Have you ever wondered how to become a financial analyst and build a future-proof career in finance?

Most of the graduates in the field of finance feel confused by the competition and do not know where to start to establish themselves in the financial world. The good news? You don’t need years of experience or an Ivy League degree to succeed.

All you require is the proper skills, certifications, and a clever plan of action, and you can go ahead.

Here, we are going to take you on a distinct path to being a successful financial analyst in India.

What Does a Financial Analyst Do?

A financial analyst carries out financial analysis as a key part of their role, serving either internal teams or external clients.

Their work is to check on their financial reports, trend analysis, and the opportunities to invest in. They also provide reports and other presentations that will enable decision-makers to appreciate financial performance and make intelligent decisions.

Still, there are various kinds of financial analysts, as each focuses on a certain area:

- Stocks, bonds, etc., are always reviewed by the investment analysts.

- Risk analysts identify potential financial risks.

- Portfolio managers deal with investment portfolios to obtain greater returns as well as control the risks.

- Equity research analysts give opinions and recommendations on specific shares or market segments.

The financial analysts operate in numerous sectors- the industry, corporate finance, consulting, and investment companies. They apply their skills to the objective of the organisation wherever they are.

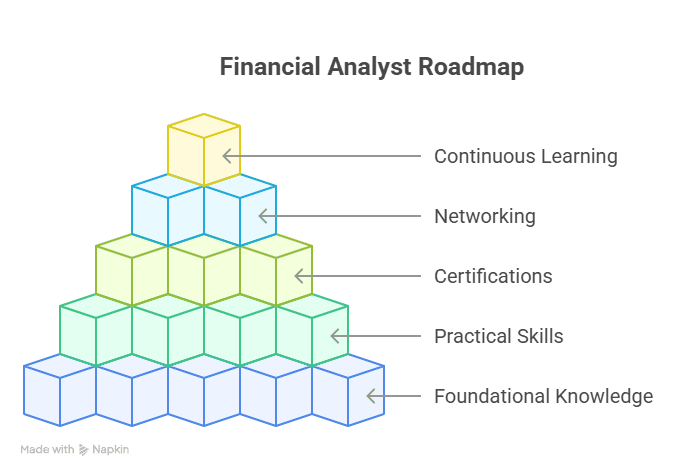

The Roadmap: How to Become a Financial Analyst

Financial analysts help businesses and individuals decide how to spend money wisely to achieve profits. You require a strategic course. This roadmap will guide you in acquiring the proper knowledge, tools, and experience to hopefully become one step ahead of the rest as a financial analyst.

Step 1: Know What a Financial Analyst Is Really Like

Have a clear understanding of the job before getting involved in courses or a job search. A capital analyst makes use of the information and dictates future projections and investment/business decisions. You can do equity research, corporate finance, M&A, or portfolio analysis.

In order to have a successful career, you will have to know the technical stuff, think smartly, and present yourself. That’s why identifying and building the right financial analyst skills is the first major step.

Step 2: Build Core Financial Analyst Skills Early

Recruiters no longer hire based only on degrees. They want financial analyst skills that show you can perform under pressure and solve real problems.

These include:

- Financial statement analysis

- Excel and PowerPoint fluency

- Equity and industry research

- Business valuation techniques

- Forecasting and budgeting

- Strong communication skills

Mastering these skills can set you apart from other applicants.

Step 3: Enrol in Financial Modelling Courses

If there’s one skill every analyst must master, it’s financial modelling. Most candidates either skip it or learn it theoretically. Big mistake.

Real-world finance roles rely heavily on modelling for decision-making, whether you’re working on valuations, market research, or investment strategy. A good course doesn’t just explain models, it lets you build them.

Step 4: Choose the Right Finance Certifications

Certifications will give you credibility and demonstrate to potential employers that you are really committed to finance.

There are certifications such as:

| Finance Certification | Focus Area | Suitability |

| CFA Level 1 | Investment analysis, portfolio management | Ideal for equity analysts and fund managers |

| CPA | Accounting and auditing | For roles in accounting-heavy finance jobs |

| Postgraduate Financial Analysis Programme (Imarticus) | Practical analysis, financial modelling, valuation | For freshers and early-career professionals |

If you’re just starting out, the Imarticus Learning programme offers one of the most industry-aligned financial modelling courses with 100% job assurance and 7 guaranteed interviews.

Step 5: Start Networking in the Finance Industry During Your Course

Many assume networking is only for senior professionals. However, networking in the finance industry should start on Day 1.

Here’s how to do it even if you’re a student:

- Create a professional LinkedIn profile

- Join finance groups and follow industry leaders

- Attend webinars and guest lectures

- Connect with peers from your training programmes

Step 6: Prepare for Interviews with a Focused Strategy

To land the job, you need to have a skill set and certifications. However, this is the twist: most applicants fail in interviews even when they have attended good courses.

That’s why interview preparation for analysts is crucial. You should be capable of discussing your models, explaining how to value the companies, and their behaviour.

Step 7: Keep Upskilling for Continuous Career Growth in Finance

Finance isn’t static. Regulations change. Tools evolve. New products emerge. To grow in your role and move up the ladder, you must keep upgrading.

Focus on these areas as you grow:

- Anti-money laundering (AML) frameworks

- Know your customer (KYC) policies

- Financial compliance and regulations

Why Interview Preparation for Analysts Matters

Receiving an interview is just halfway there. The only thing that matters is how you manage the follow-up chat. Interview preparation for analysts is often overlooked, but it can make or break your chances, especially in today’s competitive finance job market.

By seeking to become an analyst, you will have to show how you analyse data, describe the valuation models, and answer business scenarios presented in the real world.

Interviewers always demand that you take them step-by-step through your financial modelling work, read and interpret a company statement, or assess the trends in the market. You should demonstrate not only technical aptitude but also good communication.

Even in programmes such as the Postgraduate Financial Analysis Programme offered through Imarticus Learning, there is ample training on interviews, mock tests, and resume-cleaning up, so that when you go into an interview, you are confident rather than nervous.

Why Choose Imarticus Learning to Become a Financial Analyst?

Imarticus Learning has trained over 45,000 professionals and delivered thousands of job transitions across India. The Postgraduate Financial Analysis Programme is one of the most job-relevant courses available today for freshers and early professionals.

Programme Highlights:

- 100% job assurance

- 7 guaranteed interviews

- Weekend and weekday batches (classroom + online)

- Duration: 4 to 8 months

- Real-world simulations

- Placement training + personal branding support

Start your journey to becoming a financial analyst with hands-on learning, expert mentoring, and a clear path to placement.

Get hired with 100% job assurance by enrolling in the Imarticus Learning’s PGFAP Course!

FAQ

1. How do you become a financial analyst with no experience?

Get a degree that involves finance, and then enrol in a practical course such as the Imarticus Learning Postgraduate Financial Analysis Programme.

2. What are the top financial analyst skills I need to develop?

Emphasis on financial modelling, Excel, valuation, communications, and problem solving. They are in demand in high-end positions in the field of finance.

3. Do you really need to take up financial modelling courses?

Yes. They know how to construct business models and perform actual analysis, which is essential to any financial analyst. This is something that recruiters expect you to understand.

4. Which finance certifications help in career growth in finance?

Credentials such as CFA, CPA, and the Postgraduate Financial Analysis Programme enhance your profile and give you access to higher positions.

5. What can I do to prepare for financial analyst interviews?

Read case studies, brush up on your verbalisation, and practise describing models.

6. Is it possible to move to the position of a financial analyst instead of accounting?

Absolutely. Many accountants acquire the right skills and certifications to transfer. Knowledge of financial modelling and valuation is essential.

7. What is the role of networking in the finance industry for freshers?

Very. It aids in job referral, learning, and remaining in sight. Start networking while you’re still in your course.

Final Thoughts

There is no luck in becoming a financial analyst, but strategy. With proper skills, certification, and training, you can create a career that will not only be well-paying but also keep growing.

So if you’re still asking how to become a financial analyst, it’s time to stop wondering and start preparing. Select the programme that provides you with practical skills, real interviews, and practice to succeed.

Take the first step towards building your dream finance career today.

We recommend joining online finance courses, particularly those that offer financial analyst training and placement.

We recommend joining online finance courses, particularly those that offer financial analyst training and placement.