Thinking of building a serious career in finance in 2025?

Here’s a fact: just having a degree won’t cut it anymore. If you’re aiming for roles in corporate finance, investment banking, or financial analytics, you need more than qualifications. You need proof that you can handle real-world financial tasks. That’s where the FMVA certification becomes a game-changer.

This blog breaks down how the Financial Modelling and Valuation Analyst (FMVA) path can help you stand out and how Imarticus Learning’s Postgraduate Financial Analysis Programme gives you the tools, training, and support to get there.

Why FMVA Certification is a Must in 2025

The finance industry is changing. Recruiters today want professionals who know how to apply theory in practice. The FMVA certification is globally recognised as a practical, skills-first credential designed for today’s fast-paced financial world.

CFI provides the Financial Modelling and Valuation Analyst (FMVA) certification. Learners may also opt for individual courses tailored to their needs, without enrolling in the full certification programme.

The analyst path includes seven optional prerequisites to revisit core concepts, eleven core modules to establish a strong base in financial modelling and valuation, and at least three elective courses to explore specialised areas, making up a total of fourteen required courses. To earn the certificate, students must achieve a minimum score of 80% in each course assessment and pass the final exam.

It teaches you to:

- Build professional financial models

- Perform real-world valuations

- Analyse company performance in Excel

- Prepare investment reports and pitch books

Unlike general courses, FMVA prepares you for a career advancement in finance by focusing on what you’ll actually do on the job.

FMVA Certification vs Traditional Corporate Finance Certification

Most traditional corporate finance certification programmes focus on theory and academic concepts. That’s great for exams, not for interviews.

In India, professionals with Financial Modelling and Valuation Analyst (FMVA) certification typically earn a base salary ranging between ₹96,000 and ₹1,00,000 per month.

FMVA flips the script:

- Emphasis on Excel and financial modelling skills

- Assignments based on live market data

- Real-world case studies and decision-making simulations

This blend of practicality and credibility makes FMVA the better choice in today’s job market.

Develop Financial Modelling and Valuation Analyst Expertise

Want to become a strong financial modelling and valuation analyst?

Start with real tools and techniques.

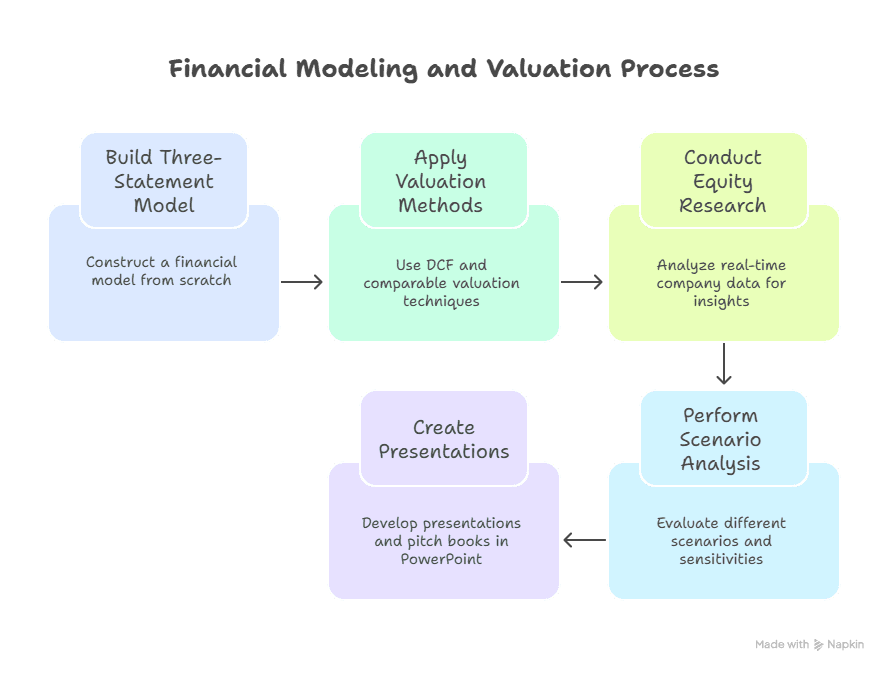

Here’s what the FMVA course will teach you:

- How to build a three-statement model from scratch

- Use DCF and comparable valuation methods

- Conduct equity research using real-time company data

- Apply scenario and sensitivity analysis

- Build presentations and pitch books in PowerPoint

These are the exact tasks that analysts perform in investment banks and private equity firms.

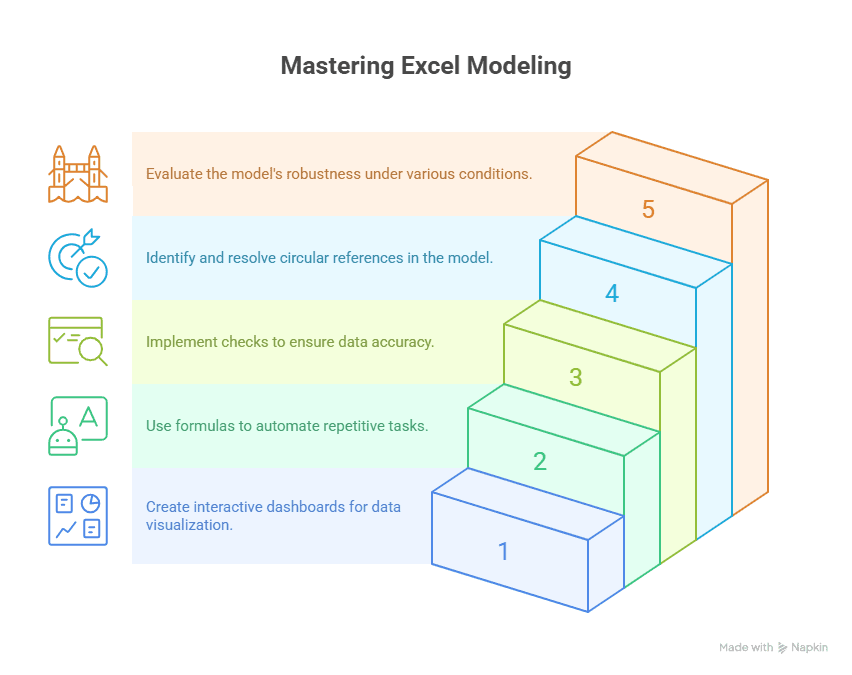

Excel and Financial Modelling Skills That Matter

Every recruiter in finance checks two things: your Excel and financial modelling skills.

The FMVA programme covers:

- Advanced Excel functions

- Dynamic financial models

- Data visualisation techniques

- Error checking and model auditing

Career Opportunities After FMVA Certification

Once you complete your FMVA and aligned training, you become eligible for roles like:

- Financial Analyst

- Investment Banking Analyst

- Equity Research Associate

- Corporate Finance Associate

- Valuation Consultant

All these jobs require hands-on financial modelling and valuation analyst skills, which is exactly what FMVA delivers.

How FMVA Helps with Finance Career Advancement

If you’re stuck in a low-growth job or trying to break into finance, FMVA can give you the edge.

You’ll gain:

- Strong knowledge of Excel and valuation

- Real work samples to show in interviews

- Greater confidence in handling complex data

- Recognition from hiring managers who trust FMVA

Many ask: How does FMVA compare to other investment banking certifications?

Here’s a simple breakdown:

| Feature | FMVA Certification | Traditional IB Certification |

| Focus | Valuation + Modelling + Excel | Deal structure + Regulations |

| Suitable For | Finance jobs across verticals | Pure investment banking roles |

| Flexibility | Self-paced or blended | Usually rigid schedules |

| Practical Application | High | Moderate |

| Career Support | Yes – Job Assurance & Mentorship | Rare or limited |

In short, FMVA has broader utility, which is perfect for freshers or professionals seeking flexible entry into finance.

Why Choose Imarticus Learning for FMVA-Aligned Training

Imarticus Learning has already helped over 45,000 learners transition into top finance roles. Imarticus Learning goes further; it guarantees interviews.

This corporate finance certification is for fresh graduates and professionals with 0–3 years of experience. You can choose:

- 4 months (weekday classroom)

- 8 months (weekend classroom or online)

And it includes:

- 7 guaranteed interviews

- 100% job assurance for eligible learners

- Personal branding and LinkedIn profile coaching

- Mentorship from real finance leaders

This is not theory. This is training that ends in employment.

Here’s what makes their Postgraduate Financial Analysis Programme a perfect FMVA-aligned choice:

- Structured learning: 200+ hours of guided content

- In-class simulations and real-world exercises

- PowerPoint and Excel mastery

- Networking opportunities through events and sessions

- Recognition: Best Finance Education Provider, Elets 2024

Register now to start your FMVA-level journey with job assurance included.

FAQ

1. What is FMVA certification?

FMVA stands for Financial Modelling and Valuation Analyst. It proves you’re skilled in real-world financial tasks like valuation, Excel modelling, and forecasting.

2. Does FMVA help with finance career advancement?

Yes, especially in 2025, where employers demand practical, job-ready skills beyond just theory.

3. What are the core Excel and financial modelling skills covered?

You’ll learn to build three-statement models, perform DCF analysis, and use Excel for data-driven decisions.

4. Is FMVA certification valid in India?

Absolutely. Indian finance firms, banks, and consulting companies value FMVA, especially when paired with local training like Imarticus Learning.

5. How does FMVA compare with investment banking certifications?

FMVA covers broader skills, applicable to IB, corporate finance, and analytics, while IB certifications are more niche.

6. How long does the FMVA-aligned course at Imarticus Learning take?

Depending on your mode, it runs for either 4 months (weekdays) or 8 months (weekends). Both formats include job assurance.

7. What makes Imarticus Learning a strong choice for FMVA preparation?

Imarticus Learning combines real-time simulations, 7 guaranteed interviews, and expert mentorship, exactly what finance employers want today.

Conclusion

If you’re serious about breaking into finance or moving up quickly, the FMVA certification is no longer optional. It is the intelligent, systematic process to develop the Excel and financial modelling skills required by employers and demonstrate that you can do more than just give them a degree next time.

No matter where you direct your focus career-wise, including the fields of investment banking, equity research, or corporate finance, you can have a head start in the competition with this certification because it proves to someone that you are ready to work and not just on theory.

Pair that with the job-assured Postgraduate Financial Analysis Programme from Imarticus Learning, and you don’t just learn, you get hired. You’ll build deep practical knowledge, grow your personal brand, and gain insider support from mentors who’ve been there.

Register for the Imarticus Learning Postgraduate Financial Analysis Programme and fast-track your finance career in 2025 with the confidence of FMVA-aligned training and 100% job assurance.

Don’t wait for the perfect opportunity; upskill, certify, and create it for yourself.