RPA or robotic process automation is used to provide efficient solutions to companies dealing with a high amount of data daily. The technology is of immense help to financial, insurance, and banking service providers. By helping banks in running data entry and customer service solutions regularly without disrupting the existing systems, RPA bots reduce the extra costs that come with it. The technology also helps improve the turnaround time and lessens the risk of human errors. Not just this, it lets employees focus on activities that really need human insights and manual labour.

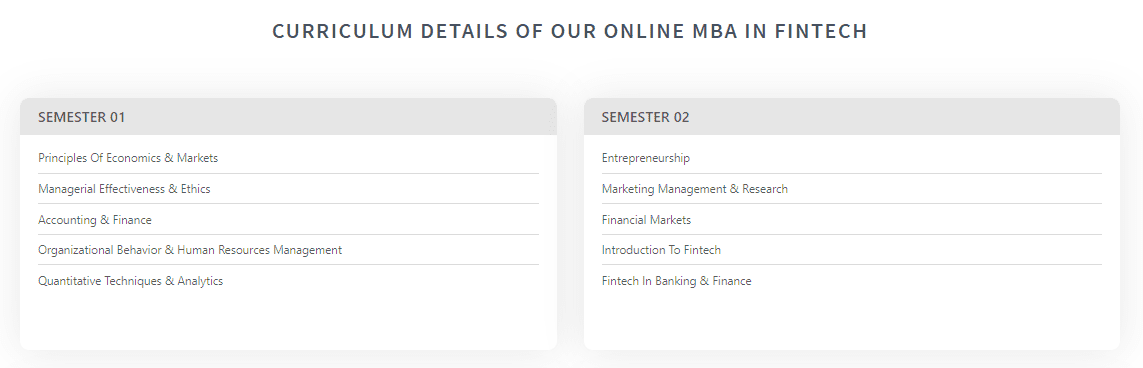

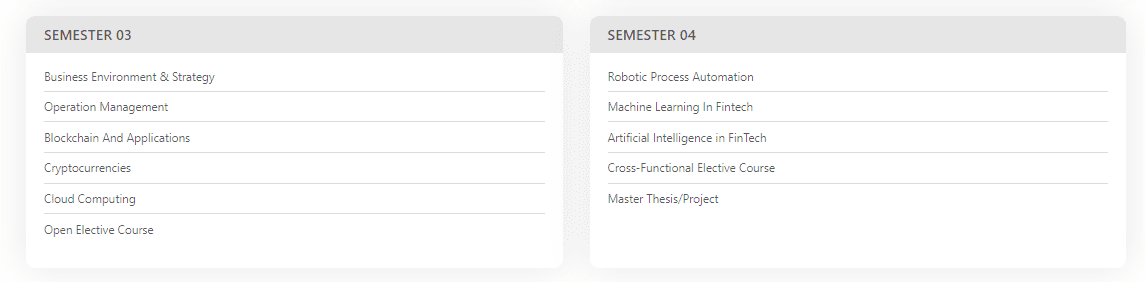

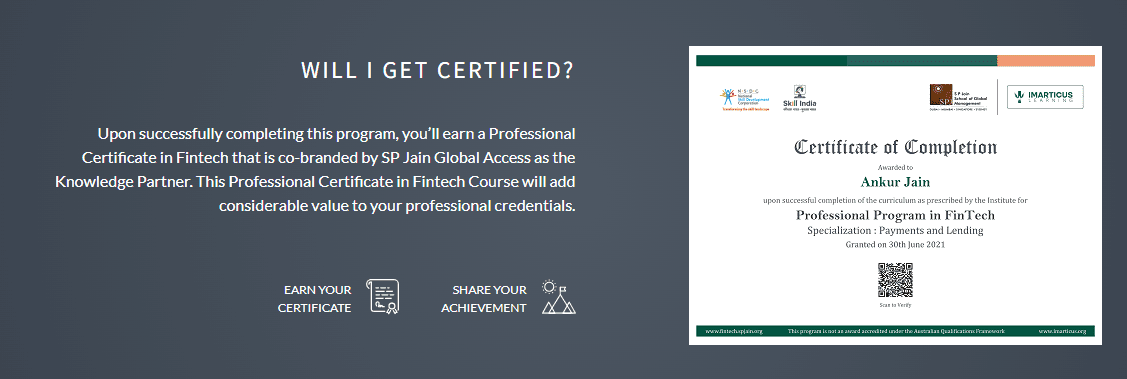

As the fintech sector is booming right now, a reinvention will create even more positions for the ones interested in it. This is why this is the golden time to pursue a fintech course that will lead to your dream career. A lot of institutions offer fintech certification in India, and Imarticus Learnings is the reputable one among them.

While pursuing the Imarticus fintech course, you get the right exposure needed to succeed in the domain. In this article, we are going to discuss what is the use of robotic process automation in finance in detail. So, read on…

Robotic Process Automation in Finance

RPA helps banks and other finance companies in a way that makes the experience smoother on both ends – the banks and the customers. With the help of UI, ML, and rules-based programming, it helps to provide the kind of solutions that currently does not have any other alternative. Notably, RPA helps in cutting down costs, increasing efficiency, and providing better customer service. It does all these without disrupting the ongoing systems and procedures at all.

Further, RPA bots help banks in more than one way. Here is a list of the major reasons for its increasing popularity:

- Financial products processing: This is one of the major areas where RPA helps a lot. From trade finance, same-day fund transfer, account closures, loan processing, and validation to card management, RPA makes all these processes run smoothly.

- Audit regulation: This too is another vertical where the impact of RPA is undeniable. Regulatory monitoring, quality assurance processing, and audits, RPA cuts down the extra costs that come with on-site monitoring and hiring extra help.

- Data management: This is the area where RPA possibly helps the most. Be it financial reconciliation, verification checks, or digitization of papers, RPA makes the processes more efficient.

- Customer satisfaction: This is a field that RPA has helped a lot with. From the faster supply of demands to predicting their needs based on past data and changing scenarios, RPA goes a long way to assure customer satisfaction.

- Operational trading: Although this is a temporary solution, RPA helps this field by storing complicated limit orders.

Fintech is a field that is ever-growing in terms of job prospects. Check out Imarticus Learnings’ fintech course to get a better idea. Imarticus offers one of the best courses providing Fintech certification in India. This will help you ace all the skills you need to drive your career and give it the much-needed boost.

Companies in the commodity industry have started to realize the worth of blockchain experts. They are proactively hiring individuals that have

Companies in the commodity industry have started to realize the worth of blockchain experts. They are proactively hiring individuals that have  Why choose Imarticus’s fintech course?

Why choose Imarticus’s fintech course?

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.