Just recently, the startup ecosystem in the fintech saw RBI regulate and intervene to establish a beta-testing sandbox for fintech products. This move was to provide a controlled safe environment for the release of products. And then, the Fintech sector came across a new challenge to overcome. The crisis of liquidity in the NBFC sector! Earlier in the year, ILFS the largest NBFC player on the market defaulted on its payments causing the cash-crunch for other NBFCs as investors grew wary and the capital markets declined lending to shadow NBFC lenders. The rating experts ICRA and CRISIL were quick to downgrade Home-Financer DHFL after the interest default to investors on its NCD issues. The liquidity-starved DHFL missed its deadline for payment of investor interest on NCDs.

The question now is about the impact and whether this is a blow to the fintech space? Entrepreneurs are divided over their opinions. Funding has not stopped according to the statistics. Tiger Global Management’s funding round saw them raise USD 30 million from Fintech-Startup-Open who offer banking services for businesses and SMEs. Razorpay specializing in payment solutions could raise USD 75 million with assistance from Sequoia India led a group of financiers. However, CEO and founder of Qbera.com, Aditya Kumar, said the liquidity crunch originating from ILFS has made investors risk averse and there is a capital shortage from banks and partnering financial institutions. His company just got funded USD 3 million from lenders E-city Ventures last year.

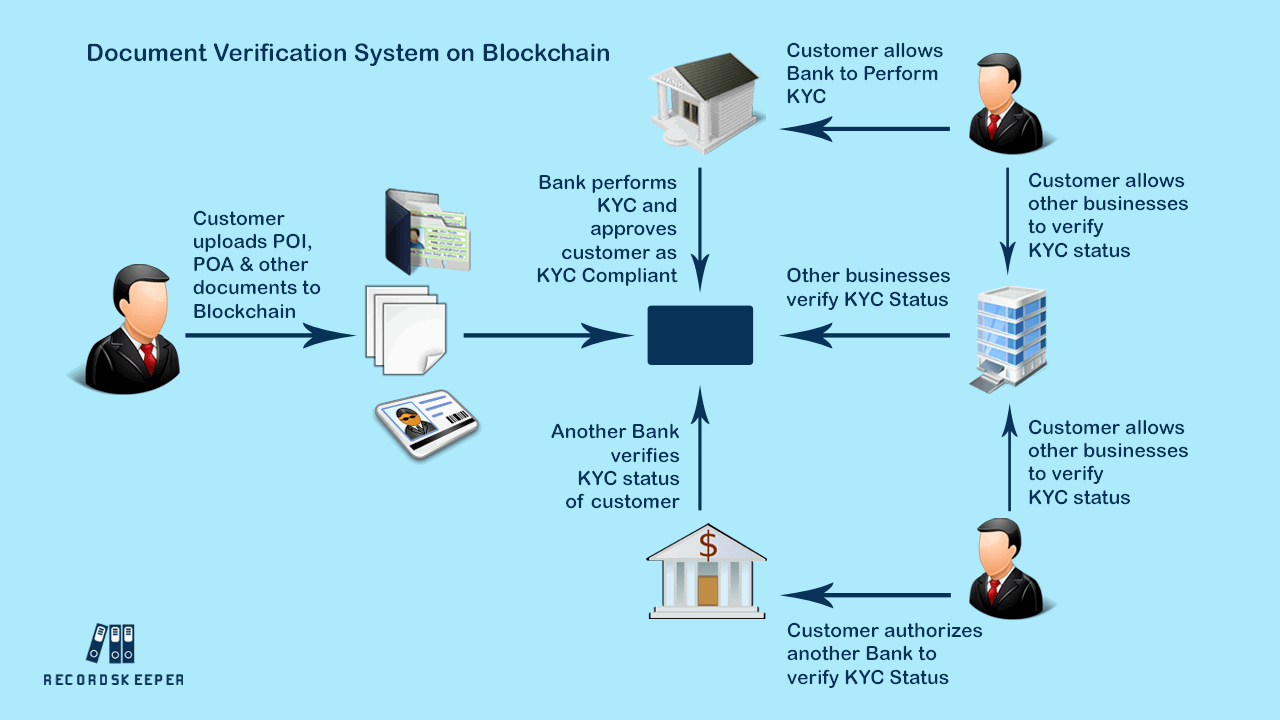

Citing data results from Medici insights oriented fintech platform and Zone Startups, between 2015 when fintech took off to 2018 a whopping 1,300 ventures cropped up in the fintech space. The P2P lending base uses funding loans of retailer investors and trust is key. But, it would be wrong to disqualify the fintech space on the count of the fund crisis in the NBFC segment. Fintech has an immense and broader scope than any other nascent industry. According to CEO and founder of LenDenClub, Bhavin Patel KYC is a challenge for the payment companies in the wallet segment and the liquidity of online lenders has definitely been impacted. Last year the LenDenClub got equity investments totaling to 3.5 crores in Rs.

CEO and founder of CoinTribe, Amit Sachdev, felt the fintech industry should be classified as focused around SMEs and focused on the retail segment. The retail players are floundering to raise debt capital and equity as they have high costs in acquiring customers, the retail loans offer low yields and the product economics is not favorable to such financial measures. On the other hand, the SMEs dependent players do have debt lines and equity capital available to them. CoinTribe received a response of USD 10 million in funding from Sanre Partners and are focused on distribution and B2B partnerships with a SMEs focus.

Though the investors in the retail segment have adopted a circumspect cautious outlook, the P2P players in lending depend on the trust factor since their funding base is reliant on investors in the retail markets, according to RupeeCircle’s Co-founder Abhishek Gandhi. RupeeCircle was funded by Mahindra Finance to the tune of 4 crore Rs last year. Systematic communication ensures investor trust. From the start, their focus was both on recovery and lending and this has helped keep their rates of loss low and ensure investors do not distance themselves from them.

Overall, the Fintech segment is seeing steady growth. The fintech segment has over 175 deals, seen a cumulative sum of USD 1.5 in billions being invested in it last year according to data from Tracxn. This means strong players with the right growth figures and a profitable potential have succeeded in raising funds in spite of the poor market conditions and the resultant financial crisis.

Entrepreneurs are now more interested in scaling efficiently and significantly as lending partners are placing their bets on the SME focused lending segment, says Sachdev.

In FY 2019 CoinTribe saw 3x growth and are confident of these levels in the current year. They are betting on a 3-lever strategic approach of new product launches driven by SME business linkages and B2B partnerships to attain significant geographic expansion. Kumar from Qbera.com said they had an impressive 300 percent every-year rate of growth enabling their book-value to grow to beyond the 130 Crore Rs mark.

A framework that is robust, the use of AI technologies and a loan process that is seamless has helped them stay abreast of the market conditions. LenDenClub’s Patel was quick to point out that being a foundling finding new markets, they are still able to hit the 40 to 50 percent quarterly rate of growth mark.

Conclusions:

The Fintech courses offer immense job scope and opportunities. One can opt for training in this sector or in financial analysis from the reputed Imarticus Learning Academy to be a part of the revolution. For more details in brief and further career counseling, you can also search for – Imarticus Learning and can drop your query by filling up a simple form on the site or can contact us through the Live Chat Support system or can even visit one of our training centers based in – Mumbai, Thane, Pune, Chennai, Banglore, Hyderabad, Delhi, Gurgaon, and Ahmedabad.