Introduction

The fintech space is evolving, and the space is opening up for all kinds of individuals. If you want to make a career in fintech, you need to have a degree to support your credentials. A fintech course online can help you understand the basics of fintech and how space is evolving with every passing day.

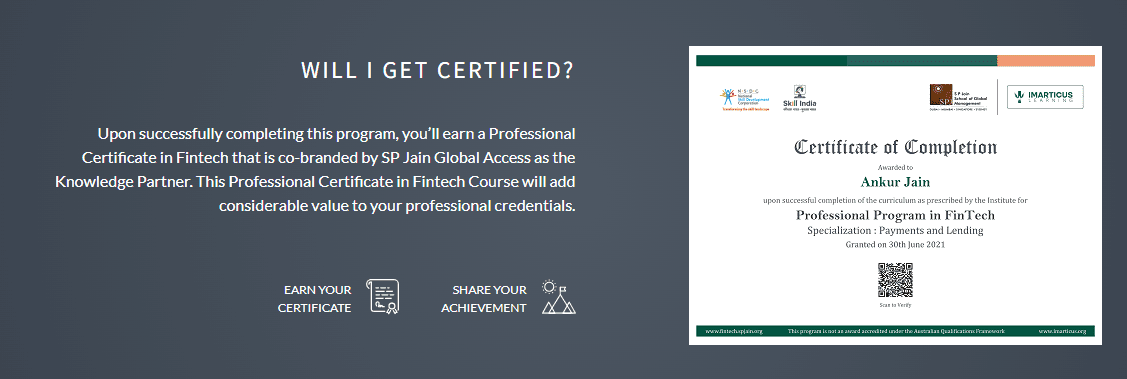

We at Imarticus have several fintech certification programs that can help individuals build a career in fintech. The fintech certifications today are changing the entire landscape as the industry evolves, and more and more individuals want to join the exciting space.

We at Imarticus have several fintech certification programs that can help individuals build a career in fintech. The fintech certifications today are changing the entire landscape as the industry evolves, and more and more individuals want to join the exciting space.

What is Fintech?

Fintech refers to the technology that enables and supports financial services and brings a level of automation. Fintech has surpassed customer expectations and is now committed to providing the best value to them. The fintech space has witnessed exponential growth, and the space is actively looking for people who can join the space and accelerate the rate at which this industry is transforming.

Key areas of fintech

Several areas are booming in the fintech space. Some of these areas are listed below:

- Cryptocurrency: Bitcoins and all the other channels of cryptocurrency are expanding. Several investors are now investing in cryptocurrencies, and the industry is expected to grow. Fintech professionals can also make a career in bitcoin trading and other related fields.

- Big Data and Analytics: Earlier, much data used to go to waste as no use was made of all the collected data. However, with big data and analytics, all consumer data is coming to use. With big data, companies create personalized experiences for all of their consumers. With the technology, companies are also building operational efficiencies that can help revenue optimization.

- Wealthtechs: Companies are now onboarding digital wealth management solutions that can help understand the assets. Investments are now growing, and investors are now investing in all kinds of assets like real estate. This opens up a massive opportunity for the fintech space.

- Cybersecurity: With the increase in the use of mobiles and computers for making transactions, the whole new world of frauds and disputes also opens up. This creates the need for individuals who can handle these issues and get into fraud management. Fintech certifications will also give you an in-depth insight into how cybersecurity is managed in the case of these transactions.

- Small and medium enterprises: The fintech space has now evolved and opened up a million opportunities for small and medium-sized enterprises that want to get into the fintech space. Several small industry players have now entered the space of payment banks, insurance, financial management, etc. These companies and enterprises can use fintech solutions to fuel their growth.

There are several opportunities for career advancement in the fintech space. Certification will give you both an overall and in-depth understanding of the subject.

Conclusion

We are known for providing the best certification programs. We have the best fintech certifications and degrees. You can get enrolled in these courses if you want to make a career in finance. You can also get a master’s degree in finance with a Master of Business Administration (MBA) specialization in fintech.

This is one of the most popular courses in the fintech space as, along with the industry knowledge, you will also get a master’s degree to justify your expertise in the subject matter.

There is another course in fintech that is popular among both students and working professionals. The course is called a Professional Certificate in Fintech. You will get a certificate if you complete this course too. All of these courses will make you employable and ready for the future.