The financial modeling certification will increase your skills and help you focus your knowledge on the genuine needs of the business. Financial projections simulate the behavior of a business over time through the evolution of its financial statements, depending on how changes in key business variables and its immediate environment are predicted. Thus, advanced modeling provides dynamic tools to study the effects of different scenarios.

A financial model is a tool that allows a company’s financial statements to be projected over time (into the future). It can also project the effect of independent business lines, specific investments, or isolated projects. The most useful aspect of the model is that, once it has been built and reflects (through the calculations incorporated) a representative behavior of the key variables of the business, we can analyze the estimated effect that certain changes in these variables may have on the ratios that have been defined as a priority.

This is one of the most comprehensive and powerful enterprise risk management tools and is an important part of the financial modeling course.

A solid financial model, with credible data and which allows a dynamic understanding of the effect that certain events in the market could have in the future, has become a fundamental tool in the debt refinancing processes that have been experienced during the worst years of crisis. This is only one of the applications of financial modeling. Their contribution to strategic planning is fundamental to discriminate on the major decisions to be taken in companies:

- new investments

- internationalization

- remuneration policies

- decisions between “make or buy”

- outsourcing of work, etc.

These require an in-depth qualitative and quantitative study that ends up being translated into a financial model. This way of acting generates a series of different options or paths that we call “scenarios” and which comprise certain parameters that are estimated to occur (or not to occur) at a time. This set of events ends up generating a value for our study ratios and tells us which of these paths brings us closer to the objectives of the business and/or its shareholders.

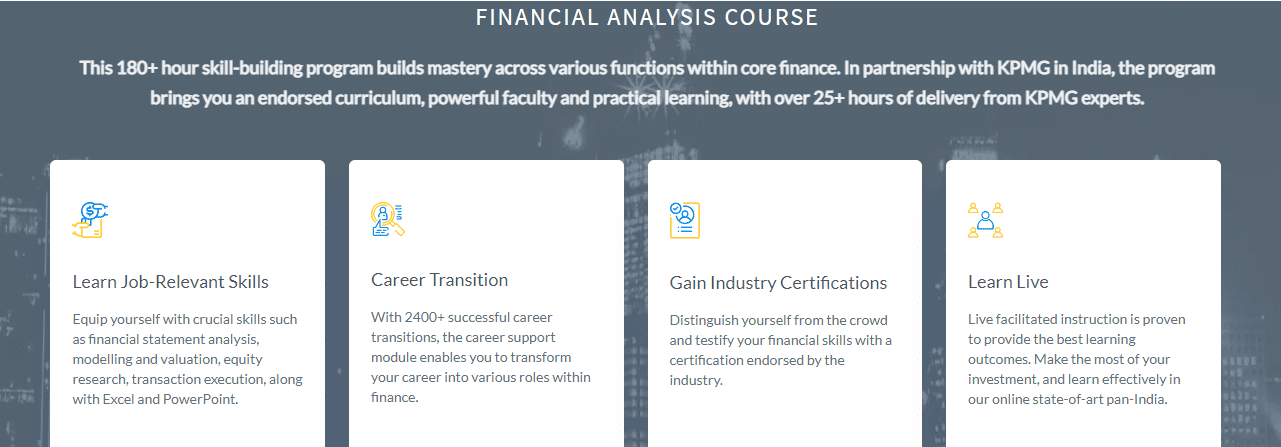

The structure of a financial model should always be fairly similar. Another thing is that each modeler has his or her own way of ordering the information within the model, and each business is unique and requires that certain types of data or calculations gain (or lose) relevance depending on the activity and/or the specific stage of the business. The Financial Analysis Prodegree (FAP) is a program that builds your skills so that you can build your own models in the right way.

The best way to know if a financial model is well thought out is to look at the performance requirements that the model must meet and you can learn this in the financial analyst course:

- Financial statements must be projected under accounting, tax, and commercial regulations. Balance sheets must balance, depreciation must correspond to each period according to the nature of the assets, loans must be depreciated according to the specific conditions of each line, reserves must be appropriated when appropriate, and so on.

- The entrepreneur must be able to recognize his business. If, after the model has been created, the entrepreneur who knows his business does not recognize the data, nor does it fit his business model, it should be reviewed from the outset to ensure that certain variables have not been oversimplified, nor that erroneous behavior of parameters that may be key has been assumed.

A lot of institutions offer a solid

A lot of institutions offer a solid  Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Here, we are going to talk about what

Here, we are going to talk about what

The best option is to go for an online course to learn and become a chartered financial analyst. Imarticus Learning offers reliable

The best option is to go for an online course to learn and become a chartered financial analyst. Imarticus Learning offers reliable