Introduction

Equity research analysis is a crucial aspect of the financial world that involves evaluating and analyzing various investment opportunities. Equity research analysts play a vital role in helping investors make informed decisions about buying or selling stocks. If you aspire to become a successful equity research analyst, acquiring the right skills and knowledge is essential.

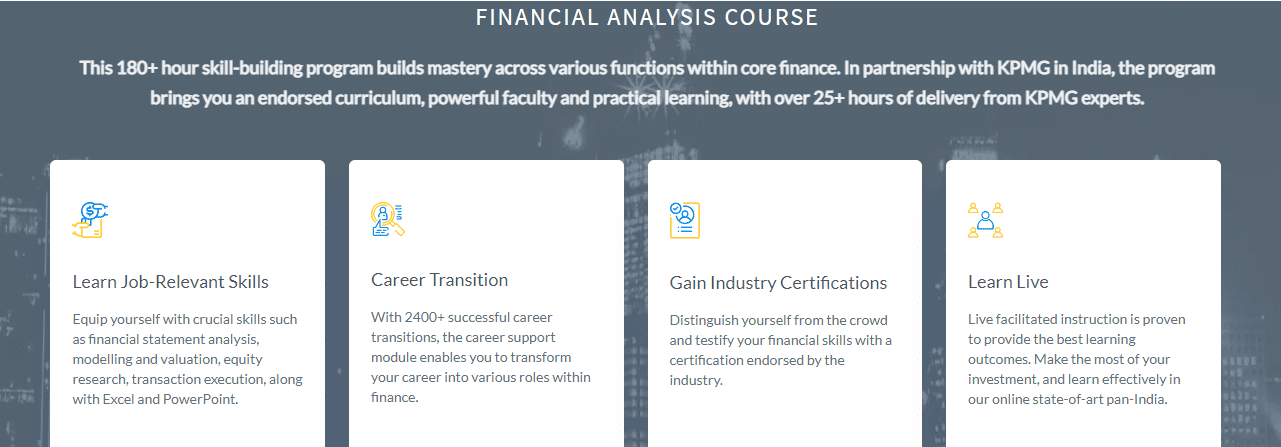

Imarticus Learning, in collaboration with KPMG, offers a comprehensive financial analysis course that equips you with the necessary expertise. In this article, we will discuss some insider tips to excel in equity research analysis and how the Financial Analysis Pro Degree from Imarticus Learning can help you achieve your career goals.

Insider Tips For Equity Research Analysis

1. Develop a Solid Foundation in Financial Analysis

To excel as an equity research analyst, it is crucial to have a strong foundation in financial analysis. This involves understanding key financial statements, such as balance sheets, income statements, and cash flow statements.

The Equity Research Analyst course by Imarticus Learning provides a comprehensive curriculum that covers these essential financial concepts. By enrolling in this course, you will gain a thorough understanding of financial analysis techniques and learn how to interpret financial statements effectively.

2. Stay Updated with Market Trends

Successful equity research analysts keep a close eye on market trends and industry developments. It is vital to stay informed about economic indicators, regulatory changes, and industry-specific news that may impact the stock market. Imarticus Learning’s Financial Analysis Pro Degree emphasizes the importance of staying updated with market trends and provides insights into effective methods for monitoring and analyzing the market.

3. Master Excel and Financial Modeling

Proficiency in Excel and financial modeling is a must for any equity research analyst. These tools enable you to organize and analyze large amounts of financial data efficiently. Imarticus Learning’s Equity Research Analyst course includes hands-on training in Excel and financial modeling. You will learn how to build comprehensive financial models, perform sensitivity analysis, and create meaningful reports and presentations.

4. Develop Strong Analytical Skills

Analytical skills are the backbone of equity research analysis. As an equity research analyst, you need to evaluate a company’s financial health, assess its growth prospects, and determine its fair value. Imarticus Learning’s Financial Analysis Pro Degree hones your analytical skills by teaching you various analytical techniques, valuation methodologies, and investment strategies. These skills are essential for making informed investment recommendations.

5. Conduct In-depth Company and Industry Research

To provide valuable insights to investors, equity research analysts must conduct thorough company and industry research. Imarticus Learning’s Equity Research Analyst course trains you in conducting in-depth research by leveraging various data sources and analytical tools. You will learn how to analyze a company’s competitive position, industry dynamics, and macroeconomic factors that may impact its performance.

6. Develop Effective Communication Skills

Communication skills are crucial for equity research analysts as they need to articulate their research findings and investment recommendations to clients and stakeholders. Imarticus Learning’s Financial Analysis Pro Degree emphasizes the development of effective communication skills through presentation training, report writing, and client interaction sessions. These skills will enable you to convey complex financial concepts clearly and concisely.

Financial Analysis Pro Degree By Imarticus Learning And KPMG

The Financial Analysis Pro Degree offered by Imarticus Learning in collaboration with KPMG is a comprehensive program designed to equip aspiring equity research analysts with the necessary skills and knowledge. This 4-months program provides a structured curriculum that covers essential financial analysis concepts, including financial statement analysis, industry research, valuation methodologies, and investment strategies.

Through hands-on training in Excel and financial modeling, students gain proficiency in analyzing and interpreting complex financial data. The Financial Analysis Pro Degree also emphasizes the development of effective communication skills, enabling students to present their research findings and investment recommendations confidently. With an industry-relevant curriculum and practical learning experiences, the Financial Analysis Pro Degree prepares students for a successful career in equity research analysis.

Final Thoughts

Becoming a successful equity research analyst requires a combination of knowledge, skills, and practical experience. Imarticus Learning’s Equity Research Analyst course, in collaboration with KPMG, provides you with the necessary expertise to thrive in this field. From mastering financial analysis to staying updated with market trends, the course equips you with insider tips for successful equity research analysis.

The Financial Analysis Pro Degree also provides extensive career support and industry certification, which is accepted by top companies around the world. The students of the Equity Research Analyst course are currently working with companies like Wipro, Infosys, Accenture, JP Morgan, TCS and more.

By enrolling in the Financial Analysis Pro Degree, you can take a step towards a rewarding career as an equity research analyst.

A lot of institutions offer a solid

A lot of institutions offer a solid  Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Here, we are going to talk about what

Here, we are going to talk about what