When most aspirants consider pursuing the US CPA qualification, they’re not just choosing another finance certification – they’re choosing a path that demands precision, applied reasoning, and a deeper understanding of how global accounting really works. And at the heart of that journey are the CPA subjects, each designed to shape how you think and operate as a finance professional.

But what exactly are the subjects in the CPA course?

Are CPA course subjects the same across countries like the US, Australia, and Canada?

And which CPA exam subjects are considered the toughest?

What most aspirants really want to understand is how demanding the syllabus is, how long it realistically takes to master each subject, and whether the effort invested genuinely pays off in real-world roles. That clarity matters a lot because the CPA exam focuses heavily on applied reasoning, not memorisation.

I’ll break it all down so that you don’t see CPA subjects just as exam papers, but as skill-building blocks that map directly to audit rooms, finance teams, and board-level reporting. By the end, you will have a clear sense of what to expect, how to plan your preparation, and how each subject fits into the bigger picture of a CPA career.

Understanding CPA

Whenever students come to me confused about what is CPA and whether it’s worth the effort, I tell them the basics first – because understanding the qualification frames everything else you’ll study.

The most valued accounting and finance accreditation is to be a Certified Public Accountant (CPA). Universally recognised, US CPA accreditation is an indicator of competence, ethical professionalism, and high performance.

To achieve the most sought-after title, candidates must pass the CPA examination, which comprises a full course of core subject matter areas that financial professionals must obtain.

US CPA course topics are designed to assess competency in core subjects such as auditing, taxation, financial accounting, and business law. Preparing in advance and memorising the CPA exam topics is necessary to pass.

Overview of the CPA Program Subjects

Before diving into the details of individual papers, it’s important to understand the structure of the CPA course. I’ve answered this for many students who ask me what is CPA. Is it relevant for Indian organisations or limited to US compliance roles? Whether they actually meet the CPA eligibility criteria? I get why students have these doubts, so to clear everything, let’s begin with the basics.

The CPA qualification is not designed to test rote learning. The CPA program subjects focus on judgment, application, and professional reasoning across accounting, auditing, regulation, taxation, and business analysis. That’s why candidates often find the learning curve steeper than other finance certifications.

The US CPA exams are divided into three core papers and one discipline paper, all of which must be cleared within the prescribed exam window. Together, these form the official CPA subjects and syllabus defined by the AICPA.

Across years of advising CPA aspirants, a common misconception keeps surfacing – that CPA is purely academic. In practice, each subject mirrors actual professional responsibility. Each CPA subject is built around responsibilities you’ll handle in real accounting and finance roles. This practical alignment is why CPAs are globally trusted by employers.

To make the structure easier to understand at a glance, here’s a quick snapshot of all the CPA exam subjects and how they’re grouped. This gives you the big-picture layout before we dive into the details of each paper.

| Category | CPA Exam Subjects |

| Core Paper | AUD – Auditing & Attestation |

| Core Paper | FAR – Financial Accounting & Reporting |

| Core Paper | REG – Regulation |

| Discipline Paper | BAR – Business Analysis & Reporting |

| Discipline Paper | ISC – Information Systems & Controls |

| Discipline Paper | TCP – Tax Compliance & Planning |

CPA Subjects List: What You’ll Study

Let’s start with the most commonly pursued version – the US CPA. Every section of the CPA exam covers a different topic, and one should be familiar with basic concepts as well as practical applications in depth. Below is the standard CPA subjects list, applicable for candidates aiming to work in global accounting, audit, finance, and consulting roles.

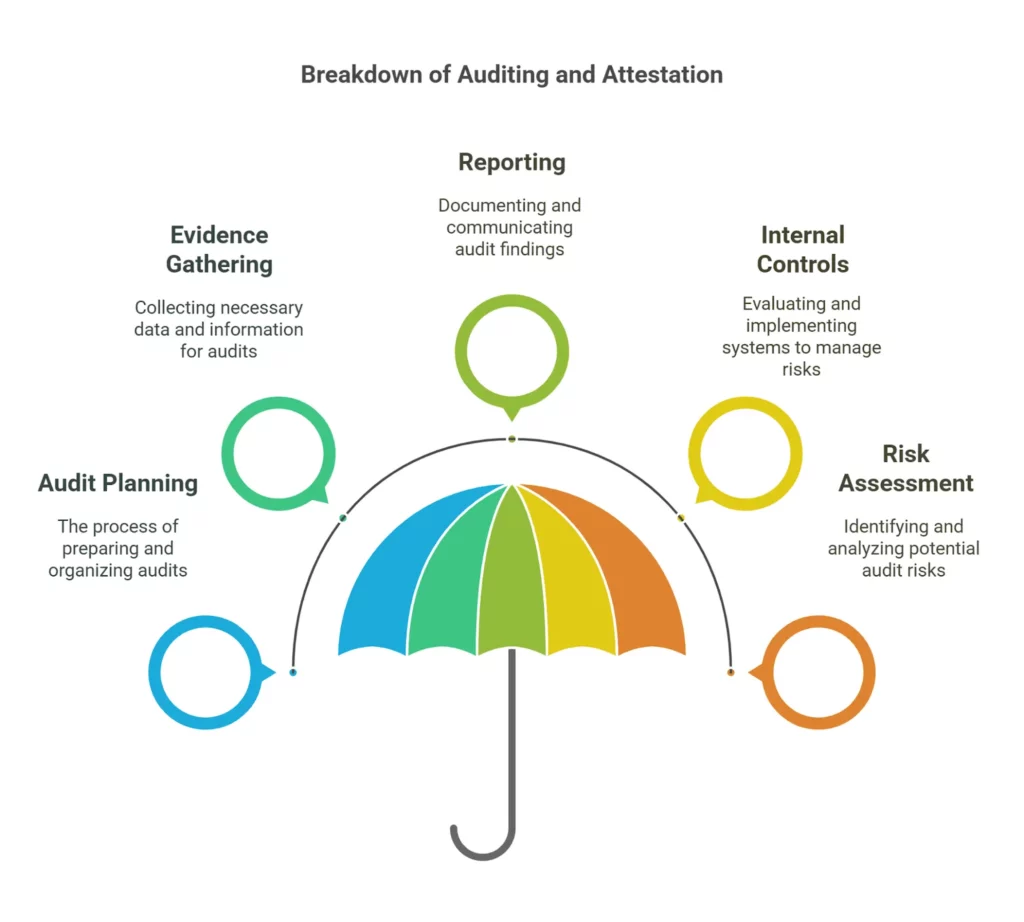

1. Auditing and Attestation (AUD)

The AUD section covers audit procedures, attestation, ethics, and risk management. You’re expected to understand financial statement audits, compliance audits, and fraud detection. Overall, AUD tests how well you can perform and evaluate audit and assurance engagements in real business environments.

Key areas covered:

- Auditing Principles & Standards – GAAS Application.

- Audit Risk & Internal Control – Audit procedure determination and risk evaluation.

- Engagement Planning & Procedures – Auditing planning, execution, and completion.

- Professional Ethics & Responsibilities – AICPA Code of Professional Conduct.

- IT & Data Analytics in Auditing – Auditing procedures impact of technology.

This subject is heavily judgment-oriented and reflects how auditors think and operate in practice.

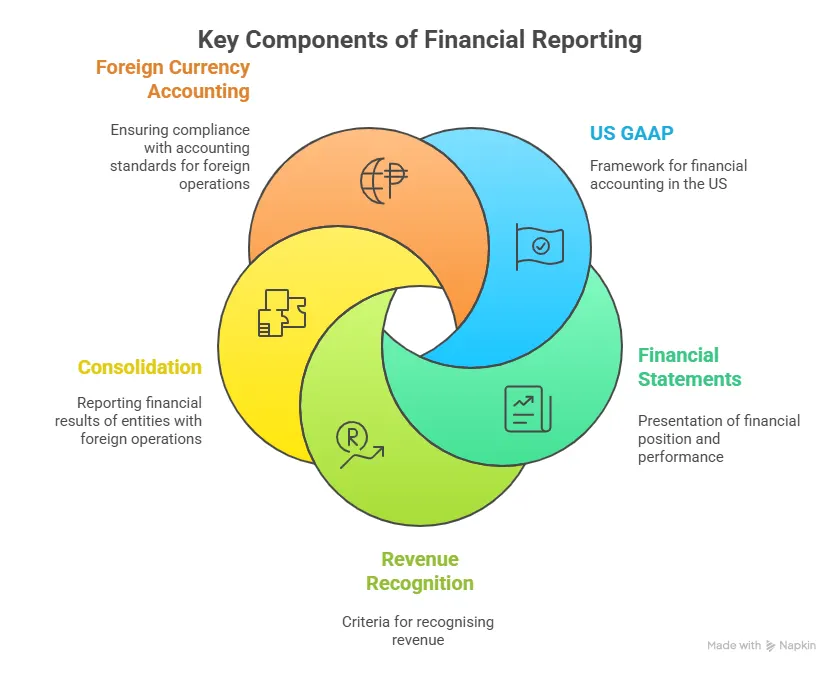

2. Financial Accounting and Reporting (FAR)

Often considered the most extensive among CPA exam subjects, FAR covers core accounting principles used by businesses, governments, and non-profits. The hardest and most technical part is FAR and deals with questions such as financial models of reporting, US GAAP, and IFRS, and intricate financial transactions.

You will study:

- Conceptual Framework & Financial Statements – Preparation of balance sheet, preparation of income statement, preparation of cash flow statement.

- Accounting for Transactions – Leasing, revenue recognition, and consolidations.

- Government & Non-Profit Accounting – Applied accounting principles by governmental agencies.

- Fair Value Measurements & Valuations – Intangible, goodwill, and impairment accounting.

- Foreign Currency Transactions & Hedging – Hedging foreign exchange risk of foreign currency.

Because of its vast syllabus, FAR strongly influences opinions around CPA subjects.

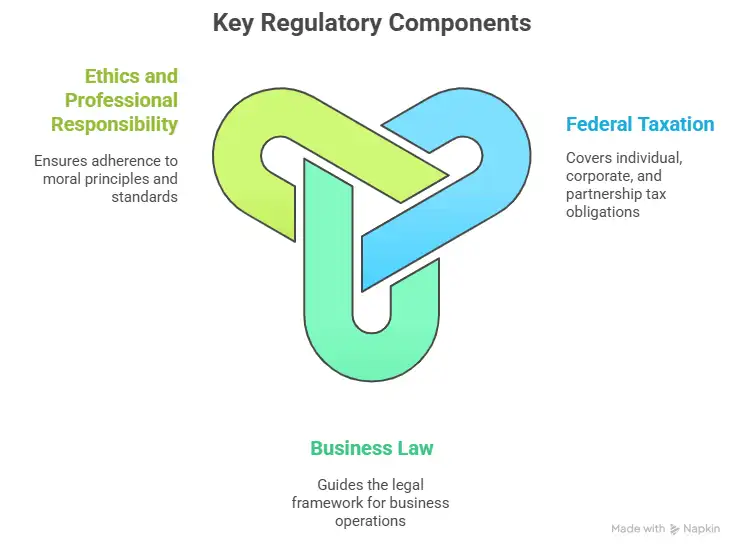

3. Regulation (REG)

The REG course covers the corporation and individual tax and legal law requirements, and business ethics information. REG focuses on the legal and tax framework within which accountants operate.

Core areas:

- Federal Taxation – Business & Individual – Income tax determination, deduction, and credit.

- Corporate & Partnership Taxation – Classification of business forms for tax purposes, determination of tax.

- Estate & Gift Taxation – Estate planning, gift planning, and valuation.

- Ethics & Professional Conduct – Professional ethics of CPAs.

- Business Law & Contracts – Contract formation, negotiable instruments, and securities regulation.

If taxation is an area you’re interested in professionally, this subject becomes especially valuable.

4. Discipline / Elective Paper (BAR, ISC, or TCP)

Previously, the BEC section (Business Environment and Concepts) assessed the candidate’s familiarity with economic theory, company governance, and business concepts.

Key Topics covered:

- Corporate Governance & Internal Control – Board roles, compliance, and risk management.

- Economic Concepts & Analysis – Macro and microeconomic features, foreign trade, and demand and supply.

- Financial Management – Planning, risk evaluation, and budgeting.

- Information Technology in Business – IT control, cloud computing, and info security.

- Business Writing & Communication – CPAs must be extra careful about the following.

BEC also tests communication skills applied in business. Now, this is replaced with the discipline or elective section. This is where CPA elective subjects come into play. Candidates choose one discipline based on their career interest:

- BAR (Business Analysis & Reporting) – For finance-heavy roles.

- ISC (Information Systems & Controls) – Ideal for tech and controls-focused profiles.

- TCP (Tax Compliance & Planning) – Best suited for tax specialists.

These electives allow the CPA course subjects to adapt to your career goals instead of forcing a one-size-fits-all approach.

If you’re juggling work, study, and life while preparing for the CPA exam, this video offers a practical study plan that outlines realistic strategies to manage time effectively without burning out on a topic every aspirant struggles with when tackling CPA subjects like FAR, AUD, REG, and the discipline papers.

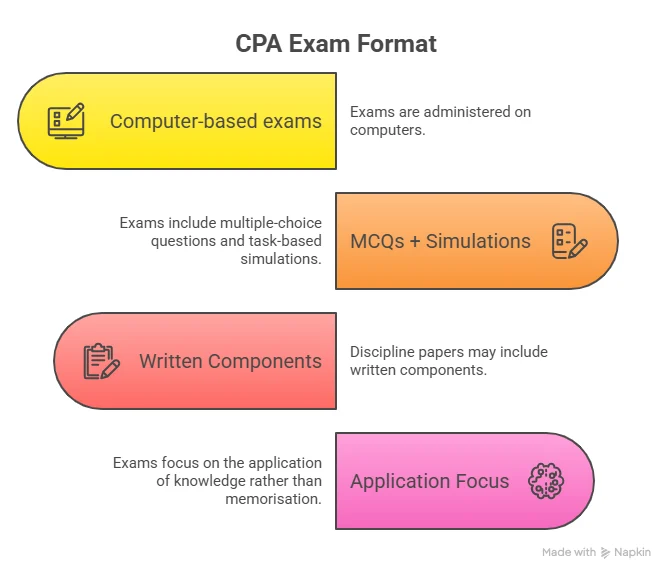

CPA Subject Details: How the Exam Is Structured

Understanding the CPA subject details goes beyond names and topics. Each CPA exam subject:

- Is computer-based.

- Includes MCQs, task-based simulations, and written responses (select papers).

- Tests application and analysis rather than memorisation.

The official CPA subject outline released by the AICPA provides weightage and topics, which many candidates refer to while planning their preparation, or when downloading a CPA subjects PDF for quick revision.

Overview of the US CPA Exam

The US CPA exam is administered and organised by the American Institute of Certified Public Accountants (AICPA). The exam consists of four sections with a sequence of CPA exam subject matter and tests various accounting, business, and regulatory abilities.

CPA Exam Structure

The exam is split into four:

- Auditing and Attestation (AUD)

- Business Environment and Concepts (BEC)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

Four of these categories are task-based simulations (TBS), multiple-choice questions (MCQs), and written communications tasks.

It is a test that occurs on a computer annually in one window.

CPA subject matter knowledge under the above four categories must be prepared for. Let us now address each of these categories separately below.

Subjects in CPA Course: US vs Australia vs Canada

One common confusion among aspirants is whether CPA subjects differ across countries. Let’s clear that up.

CPA Australia Subjects

The CPA Australia subjects list has a slightly different structure:

- 6 core subjects.

- 2 CPA elective subjects.

- 1 capstone subject.

Key CPA subjects in Australia include:

- Ethics and Governance.

- Financial Reporting.

- Contemporary Business Issues.

Many candidates refer to these collectively as CPA subjects Australia, ideal for careers in the Asia-Pacific region.

CPA Canada Subjects

CPA Canada subjects follow a modular approach:

- Core Modules 1 & 2

- Elective Modules

- Capstone Modules

- Common Final Examination (CFE)

The CPA subjects Canada framework is well-suited for candidates planning long-term careers in Canada.

Whichever region you choose, the core purpose of the qualification remains the same – building technical depth and professional readiness that translate into strong career outcomes, often reflected in competitive packages such as the CPA salary in India for globally aligned roles.

CPA Course Subjects: Difficulty Level Explained

Let’s talk honestly about CPA subjects’ difficulty – because this matters when you’re planning your preparation timeline.

- FAR is considered lengthy and concept-heavy.

- AUD requires strong analytical thinking.

- REG can be challenging for non-tax backgrounds.

- Electives depend heavily on your prior experience.

That said, difficulty is subjective. Your academic background, work exposure, and study strategy play a huge role.

CPA Subjects Difficulty Comparison

When I speak to CPA aspirants, one thing everyone wants clarity on is: which subject is the hardest? Before you start planning your study order, it helps to get a real sense of how tough each CPA subject actually is. Some sections feel dense, some are technical, and others are surprisingly manageable once the concepts click.

| CPA Exam Subject | Lengthy Syllabus | Conceptual Complexity | Calculation Heavy | Overall Difficulty |

| FAR (Financial Accounting & Reporting) | ✅ | ✅ | ✅ | High |

| AUD (Auditing & Attestation) | ❌ | ✅ | ❌ | Moderate – High |

| REG (Regulation) | ❌ | ❌ | ✅ | Moderate |

| BAR (Discipline) | ✅ | ✅ | ✅ | High |

| ISC (Discipline) | ❌ | ❌ | ❌ | Moderate |

| TCP (Discipline) | ❌ | ✅ | ✅ | Moderate |

Key Takeaways

- FAR consistently ranks as the toughest among the CPA exam subjects due to its vast syllabus and conceptual depth.

- AUD and REG are manageable with solid conceptual clarity and regular practice.

- Discipline papers depend heavily on your background and career alignment, not just syllabus size.

- Strategic subject order can significantly reduce perceived difficulty.

CPA Subjects Pass Rate: What to Expect

While pass rates vary slightly each quarter, most CPA exam subjects typically show pass rates between 45 to 60%.

Some trends candidates often notice:

- FAR has slightly lower pass rates due to syllabus volume.

- Elective disciplines may have higher pass rates if chosen strategically.

- Understanding the CPA subjects’ pass rate helps set realistic expectations, but should never discourage you.

How quickly you progress through each paper also depends on how much time you can commit to preparation, especially since the CPA course duration typically ranges from 12 to 18 months for most candidates.

Best Strategies for Preparing for CPA Exam Subjects

If you’re still comparing pathways or alternatives like CMA vs CPA, understanding these CPA subjects will help you decide which qualification aligns better with your long-term goals. Because the CPA exam has very wide coverage, the candidates have to study in a structured manner. The following are the US CPA’s study processes that they have to follow:

1. Create a Study Plan

Develop a timetable for every subject of the CPA exam based on the difficulty level.

Enrol in CPA study classes like Becker, Wiley, or Imarticus Learning’s CPA course.

2. Use Mnemonics & Memory Techniques

Use acronyms for memorising accounting principles and taxation legislation.

Flashcards for recalling pesky formulae and phraseology of laws.

3. Practice MCQs and Simulations

Set 3,000-5,000 multiple-choice questions (MCQs) at least seven days before the exam.

Take simulated mock exams under timed conditions to be well-prepared.

4. Stay Updated on Exam Changes

AICPA now and then modifies the exam pattern; study guides will need revision.

Listen to official CPA webinars and discussion forums to be updated.

5. Time Management During the Exam

Both sections are 4 hours each in duration; practice in-time answering of questions.

Start with score questions and subsequently use tougher ones.

How to Choose the Right CPA Exam Subjects

Since you can appear for CPA exam subjects in any order, smart planning goes a long way.

Here are some smart tips:

- Start with a subject closely aligned to your academic strengths.

- Pair theory-heavy papers with lighter electives.

- Plan revision cycles well in advance.

Many candidates download official outlines or a CPA subjects PDF to track progress and avoid syllabus gaps.

Preparing for the CPA exam can feel overwhelming, especially when you’re balancing work, life, and study. This video brings a candidate’s perspective on study strategy, mindset, and how to tackle the CPA subjects effectively.

CPA Syllabus Focus

Candidates often refer to the official AICPA outline or a CPA subjects PDF to understand topic-level weightage within each paper.

| CPA Exam Subject | Major Focus Areas |

| AUD | Risk assessment, audit procedures, and ethics |

| FAR | Financial reporting, GAAP, government accounting |

| REG | Taxation (60-65%), business law & ethics (35-40%) |

| BAR | Financial analysis, reporting, and advanced accounting |

| ISC | IT systems, data security, internal controls |

| TCP | Tax compliance, planning, and advisory scenarios |

CPA Exam Structure

Understanding the CPA subject details is incomplete without knowing how each subject is tested in the exams. The image below highlights the CPA Exam structure:

This video breaks down the key differences between CPA and CA, especially from an Indian career perspective. It covers how each qualification influences career growth, global recognition, salary potential, and industry demand – helpful context if you’re evaluating which path aligns better with your long-term goals.

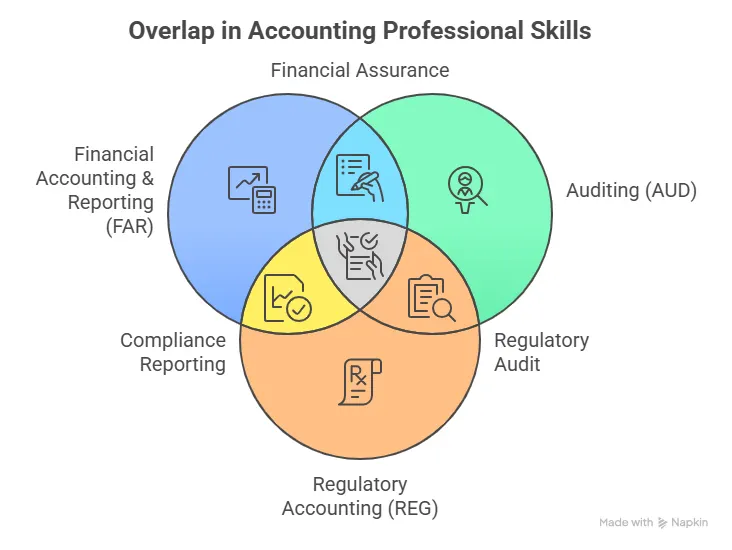

CPA Subjects: Skill Focus by Paper

CPA subjects aren’t just a paper you clear – they build a specific professional skill. Understanding what each section trains you for makes your preparation far more intentional. Think of the CPA exam as a skill map rather than four isolated subjects.

If you’ve ever wondered what these subjects translate into once you start working, here’s how each CPA paper builds a skill you’ll rely on throughout your career. Let’s break it down.

| CPA Exam Subjects | Primary Skill Tested | Professional Application |

| FAR | Financial reporting & analysis | Corporate accounting, financial reporting roles |

| AUD | Audit judgment & ethics | Audit & assurance engagements |

| REG | Taxation & regulatory compliance | Tax advisory, compliance roles |

| BAR | Financial analysis & reporting | FP&A, strategic finance |

| ISC | Systems & internal controls | IT audit, risk management |

| TCP | Tax planning & compliance | Advanced taxation roles |

Source – AICPA – Uniform CPA Examination Blueprints

Many aspirants evaluate paths such as ACCA vs CPA, but the CPA subjects give you a deeper focus on US GAAP, auditing, and taxation areas that directly translate into global accounting and assurance roles.

Why Choose Imarticus Learning for Your US CPA Preparation

When it comes to preparing for the US CPA qualification, the right support can make all the difference, and that’s where Imarticus Learning stands out. Imarticus Learning is designed to bridge the gap between exam content and real-world competence, offering aspirants structured support that goes beyond CPA books.

- Industry-Led Curriculum with KPMG in India – Imarticus partners with KPMG in India to deliver a CPA program grounded in practical scenarios, curated resources, real-world case studies, and a joint certification that adds credibility to your profile.

- Comprehensive Study Materials and Tools – You’ll get access to Surgent premium CPA study material – known for its strong pass-rate support – along with mock tests, practice questions, and structured prep content that mirrors actual exam demands.

- Dual Teacher Advantage & Mentorship – The program features a dual-teacher model with highly experienced CPA and CA instructors, personalised mentoring, and 24×7 doubt-solving support to help you stay on track throughout your preparation.

- Money-Back Assurance – Imarticus also offers a money-back guarantee – an uncommon but confidence-boosting feature – refunding part of your fee if you don’t clear all CPA exam sections under specified conditions.

- Monthly Webinars & Live Sessions – Regular webinars and live sessions with industry experts help you stay updated on current trends and deepen your understanding of core CPA subjects.

- Career & Skill Enhancement Focus – Beyond certification prep, Imarticus includes elements like real case studies and pre-placement bootcamps that help sharpen your professional skills – a key advantage when stepping into audit, finance, or advisory roles post-CPA.

With expert-led training and practical exposure, you’ll be far better equipped to not just clear the CPA course but also excel in the opportunities that follow for global finance roles.

FAQs About CPA Subjects

Over the years of guiding CPA candidates, I’ve noticed that certain questions always come up – about difficulty, timelines, CPA subject selection, and self-study. These frequently asked questions I hear almost every day can help to clear those doubts for you.

What are the CPA US subjects?

The CPA US subjects include four papers: AUD, FAR, REG, and one discipline (BAR, ISC, or TCP). These subjects collectively assess auditing, accounting, taxation, regulation, and business analysis skills.

How many subjects are in CPA?

The standard CPA subjects list includes 4 exam sections:

- AUD – Auditing & Attestation

- FAR – Financial Accounting & Reporting

- REG – Regulation

- Discipline (BAR / ISC / TCP)

These are the updated subjects under the CPA 2025 Evolution model format.

What is the syllabus for CPA?

The CPA subjects and syllabus cover: Audit procedures, ethics, attestation, internal control, US GAAP, IFRS, financial reporting, consolidations, taxation (individual + corporate), business law, and Discipline: BAR, ISC, or TCP, depending on your chosen specialisation. Each section includes MCQs, simulations, and application-based tasks.

What are the CPA subjects in Australia?

CPA Australia has a different syllabus from the US CPA.

CPA Australia subjects include:

- Ethics & Governance,

- Financial Reporting,

- Strategic Management Accounting,

- Contemporary Business Issues,

- Electives and a capstone exam.

These are not the same as the CPA US subjects.

Can I pass the CPA in 3 months?

It’s possible but intense. You would need to:

- Study 4 to 6 hours daily.

- Use structured materials like Becker or Surgent.

- Take full-length mocks.

- Focus on two sections maximum.

Most students prefer 6 to 9 months for a balanced approach. Students who train with structured programs like Imarticus Learning’s CPA course often complete the qualification faster because they get curated study plans, mock tests, and mentor support that keep preparation on track.

Is CPA full of maths?

No. CPA is not math-heavy. You only need basic numeracy, percentages, ratios, and financial calculations. The exam is more about logic, reasoning, and the application of standards.

Is CPA more difficult than CA?

CPA is shorter but more application-driven, while CA is longer and more exhaustive. Many students find CA tougher overall, but CPA still requires disciplined preparation. Imarticus Learning helps simplify this by providing structured CPA coaching, guided study plans, and industry-aligned content that make the learning curve more manageable.

Is CPA easy to crack?

CPA is not easy, but it’s very achievable with:

- Conceptual clarity

- Daily practice

- Strong revision discipline

- Good-quality preparation material

Pass rates (45-60%) show it’s challenging, but far from impossible.

Is CPA suitable for self-study?

Yes, CPA can be self-studied if you’re disciplined, but most candidates prefer coaching to get:

- Structured timelines

- Doubt support

- Mock exam training

- Updates on syllabus changes

If you lack an accounting background, guided training from institutes like Imarticus Learning is strongly recommended.

How many tests do you need to pass the CPA?

You must pass 4 separate CPA exam sections, each scored independently. You need 75 or above in each section.

Can I sit for the CPA exam in any order?

Yes, the CPA exam can be attempted in any sequence. But according to most of the experts, FAR should be attempted first because it unlocks basic knowledge that could be used for other sections.

How many study hours per section of the CPA exam are needed?

All areas of the CPA exam take 120 to 150 hours of studying. Candidates complete the entire CPA exam in 12 to 18 months, depending on their plan and study routine.

CPA Subjects: Your Roadmap Moving Forward

The CPA exam is rigorous by design, ensuring the qualification holds genuine professional value. If your goal includes global accounting roles, audit leadership, or senior finance positions, the CPA subjects you master today will directly shape the opportunities you access tomorrow.

The CPA journey isn’t easy, but it is incredibly rewarding. Once you understand the subjects, the skills they build, and how each paper connects to real-world roles, the entire path becomes clearer. With the right preparation strategy and consistent effort, you’re not just passing an exam – you’re stepping into a global professional league where your expertise truly matters.

By now, you can see that CPA subjects go far beyond theory. They’re designed to shape the way you think, analyse, and make decisions as a finance professional. If you approach each paper with clarity, planning, and a long-term mindset, the CPA course becomes completely achievable and genuinely career-transforming.