Before someone registers for the CFA exams, one quiet question sits in the back of the mind. How long will this really take? Not just the brochure answer. Not just the minimum timeline. The real-life version of the CFA course duration.

This is not like signing up for a three-month course or a weekend certification. This is a structured, multi-year professional journey that runs alongside your job, your studies, your energy levels, and your personal life. Time is the real currency here. Not just money. Not just effort.

Some people start Level 1 of the CFA certification while in college and imagine they will be charterholders in record time. Then placements begin. Internships turn into full-time roles. The calendar moves faster than expected. Others begin while working in finance and assume experience will make things quicker. It helps with understanding, yes. It does not change exam windows. The clock still follows the same global cycle set by the CFA Institute. So,

→ What is the duration of the CFA course in practical life?

→ Is it two and a half years? Is it four?

→ Why do some candidates finish smoothly while others feel stuck between levels for long stretches?

These are not small details. They shape career planning, financial planning, and even job switches. Think of the CFA course duration like training for three major competitions held at fixed times. You cannot move the event date. You can only control how ready you are when that date arrives. If preparation aligns well, you move to the next stage quickly. If life gets busy, the next attempt may be months away. That gap quietly stretches the overall timeline.

This guide looks at the timeline the way real candidates experience it. Level by level. Month by month. With space for work, delays, and recovery. The goal is not to rush the process. The goal is to see the road clearly before you start walking.

Did you know? Candidates who follow a study plan of at least 15 hours per week are more likely to feel prepared before exam day. This pattern appears often in candidate surveys shared by prep providers and summarised alongside CFA Institute candidate guidance.

What Is CFA Before You Map Your Course Duration

The length of the CFA course duration only makes sense when you understand the depth of the program itself. Many professional certifications teach a narrow skill. The CFA program builds complete investment expertise across capital markets, instruments, and decision-making.

To fully grasp the timeline ahead, it helps to understand what is CFA in practical career terms. The Chartered Financial Analyst designation is a global credential awarded by the CFA Institute. It is widely respected in asset management, equity research, portfolio management, and investment banking roles.

The program is not designed as a quick exam cycle. It is structured as a progression from knowledge to application to strategy. That structure is the core reason the CFA course duration extends across multiple years.

What the CFA Program Covers

The CFA curriculum is designed to build complete investment expertise step by step. It does not focus on just one financial skill. Instead, it covers how financial markets work, how companies are valued, how different asset classes behave, and how portfolios are managed in real conditions.

| Area | What You Learn |

| Investment Foundations | Economics, financial reporting, quantitative tools |

| Asset Valuation | Equity, fixed income, derivatives, alternatives |

| Portfolio Strategy | Risk management, allocation, wealth planning |

| Professional Ethics | Standards that guide real-world investment decisions |

Each level revisits these areas with greater complexity. Level 1 introduces concepts. Level 2 applies them in a detailed analysis. Level 3 moves toward portfolio-level decision making. This layered design naturally spreads preparation across time, shaping the total duration of the CFA course.

How the Program Structure Affects Time

The CFA program has three sequential exam levels. You must pass one to move to the next. Exams are offered only during specific windows each year. These fixed schedules create built-in gaps that influence the CFA time duration.

Alongside exams, candidates must complete relevant work experience. This requirement reflects the program’s focus on applied knowledge. It also connects directly to the overall CFA degree duration, since professional growth runs parallel to academic progress.

In a field where roles evolve quickly and competition stays high, having a qualification that signals deep investment knowledge and strong ethical grounding can make a meaningful difference. Seeing how the charter leads to long-term roles in asset management, research, and portfolio strategy makes the effort across the CFA course duration feel worthwhile.

How the Full Timeline Looks for the CFA Course Duration

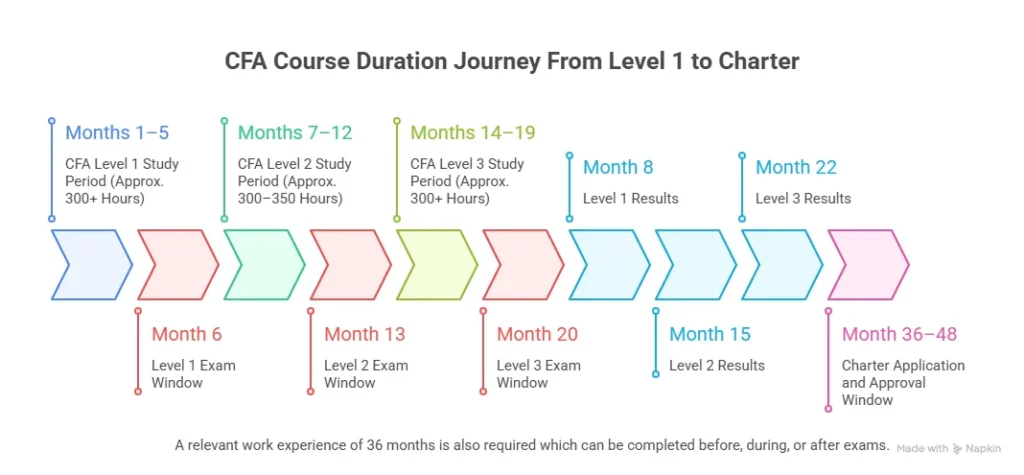

Below is a simplified view of the course duration of CFA from start to charter.

| Stage | What Happens | Typical Time Spent |

| Registration | Choose level and exam window | 1 to 2 months planning |

| Level 1 Prep | Study basic finance and ethics | 4 to 6 months |

| Level 2 Prep | Deeper valuation and analysis | 5 to 7 months |

| Level 3 Prep | Portfolio management focus | 4 to 6 months |

| Work Experience | Relevant job role | 36 months total, can overlap |

The work experience requirement does not always extend the CFA course duration. Many candidates complete it while taking exams. Think of it like earning work credit while still in college. Both can run at the same time.

Minimum vs Realistic Timelines for CFA Exam Duration

People often ask what is the duration of CFA course in the best case. Let me simply map this.

| Scenario | CFA Time Duration |

| All levels cleared on the first attempt | About 2.5 years |

| One failed attempt at any level | Around 3 years |

| Two or more gaps | 3.5 to 4+ years |

A failed attempt does not mean starting from zero. It simply adds a waiting period until the next exam window. That waiting period creates the biggest duration gap CFA candidates face.

Also Read: Why CFA is the Gold Standard for Finance Professionals?

Did you know? The average candidate globally takes about four years to complete all three levels, according to data shared by the CFA Institute. This shows that planning for flexibility is wise. Life events such as job changes or relocations often overlap with exam cycles.

Level-Wise CFA Duration in Real Life

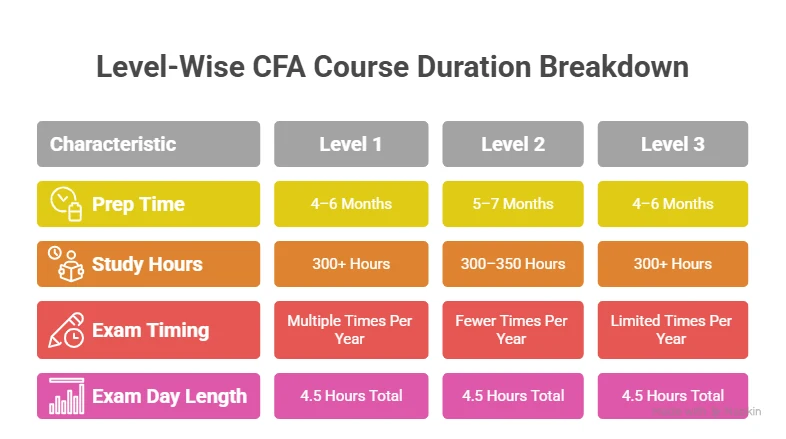

The three CFA levels build on each other, and each one has a slightly different study rhythm. While the overall CFA course duration spans years, the preparation time for each level varies based on syllabus depth, question style, and exam frequency.

CFA Level 1 Duration

The CFA Level 1 duration is usually the shortest in concept but heavy in volume. The syllabus covers many topics at a basic level. Most candidates study around 300 hours. The CFA Institute shares this number as an average guideline.

- Focuses on building a broad base across many finance topics

- The syllabus is wide, so the volume of content is high

- Most candidates prepare for around 300 hours

- The exam is about 4.5 hours long, split into two sessions

- Often, the first long computer-based exam experience for candidates

- Offered multiple times a year, allowing flexible scheduling

The CFA Level 1 course duration can be planned flexibly. A college student might prepare during their final year. A working analyst might take early morning study slots.

CFA Level 2 Duration

The CFA Level 2 duration feels more intense. Questions become case-based. Topics connect. Study time often rises to 350 hours or more. Many candidates need six months of steady prep.

- Moves from basic concepts to deeper financial analysis

- Questions are case-based and require the application of concepts

- Study time often increases to 300–350+ hours

- Preparation typically takes about six months

- Exam length remains about 4.5 hours, but complexity is higher

- Missing an attempt can extend the overall timeline by several months

Exam windows are fewer than Level 1. That increases the impact of any delay. One missed attempt can stretch the overall CFA duration by half a year or more.

Also Read: Top Online Courses That Prepare You for the CFA Program

CFA Level 3 Duration

The CFA Level 3 duration focuses on portfolio management and wealth planning. The CFA syllabus shifts toward decision-making. Written response questions appear here. Preparation often takes five to six months.

- Focus shifts to portfolio management and wealth planning

- Emphasis on decision-making and real-world application

- Includes written response style questions

- Preparation usually takes five to six months

- Exam time duration is again around 4.5 hours

- Final academic stage before meeting the work experience requirement

The CFA exam time duration for Level 3 is again around 4.5 hours. Writing structured answers under time pressure is a new skill. Practice becomes more important than just reading.

Preparing for Level 1 becomes far more manageable when the syllabus is broken into clear phases with steady revision and practice. A structured approach that balances concept building, question practice, and mock exams can help candidates build confidence early and stay on track with their broader CFA course duration without last-minute pressure.

CFA Course Duration in India

The CFA duration in India follows the same global exam calendar. The papers are identical across countries. What changes is the lifestyle pattern of candidates.

Many Indian candidates prepare during graduation or alongside full-time jobs in finance or consulting. This makes the CFA course duration in India closely tied to work schedules. Someone in investment banking may study late nights. Someone in college may use semester breaks.

| Aspect | CFA Course Duration in India | CFA Course Duration Globally |

| Exam Structure | Same three levels and format | Same three levels and format |

| Exam Calendar | Follows the global schedule set by the CFA Institute | Follows the same global schedule |

| Question Papers | Identical worldwide | Identical worldwide |

| Study Pattern | Often balanced with college or full-time jobs | Often balanced with full-time roles or dedicated study time |

| Lifestyle Impact | Study hours depend on academic workload or job demands | Study pace depends on work culture and personal schedule |

| Work Experience | Frequently overlaps with exam preparation | Also commonly overlaps with exams |

The CFA USA course duration is not shorter or longer in structure. The difference lies in the study environment and work culture. The exam timeline remains global.

Also Read: Top Roles You Can Land with a CFA Certification

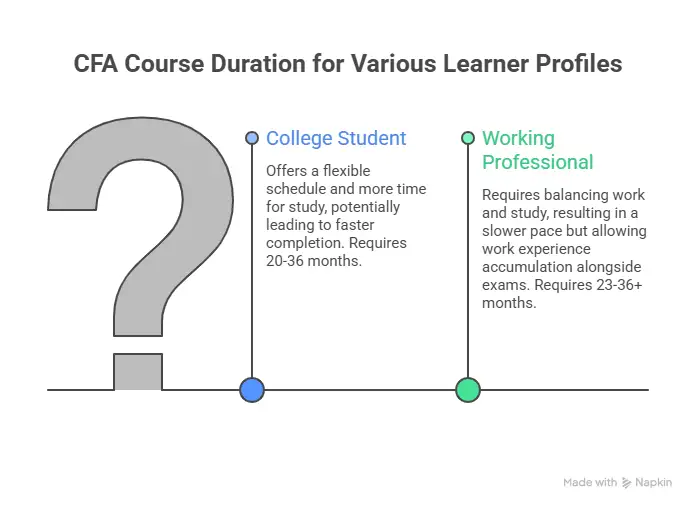

How Working Professionals Plan CFA Course Duration

A full-time job adds another layer. The CFA duration becomes a balance between work energy and study focus. Think of your week as a wallet. You only have so much time currency. You choose where to spend it. I usually break it into three realistic patterns.

Common weekly study patterns

- Weekday short sessions of 1.5 hours plus longer weekend blocks

- Early morning study before work when the mind is fresh

- Heavy study during the last two months before the exam

These patterns often stretch the CFA course time duration slightly. That is normal. Consistency matters more than speed.

Students and Early Starters

College students often assume they can finish faster. Sometimes they can. Sometimes distractions extend the course duration of CFA. Semester exams. Internships. Campus placements. All compete for attention. A student who studies two hours daily during semesters and four hours daily during holidays can complete Level 1 prep in about five months. That keeps the CFA Level 1 course duration tight and efficient.

Balancing a full-time job with CFA preparation often feels overwhelming until you see how small, consistent study slots add up. A focused two-hour daily routine can create steady progress without disrupting work commitments, helping professionals move through the syllabus in a structured and realistic way.

How Gaps Between Levels Affect CFA Program Duration

CFA exam windows create natural breaks. These breaks can help or hurt. A short break allows rest and planning. A long break increases the duration gap CFA candidates experience.

Think of this like learning a language. Regular practice builds fluency. Long gaps slow momentum.

| Gap After Level | Impact on CFA Duration |

| 2 to 3 months | Good recovery time |

| 6 months | Slight delay in momentum |

| 12 months or more | Noticeable extension of the CFA program duration |

Keeping gaps short helps maintain rhythm and reduces the total CFA course duration.

CFA Duration After MBA

Many MBA graduates ask if their degree shortens the CFA duration after MBA. The exam schedule does not change. The benefit shows up in preparation speed.

Subjects like corporate finance and portfolio theory feel familiar. This can reduce study hours slightly. That may shorten each level’s prep window by a month or so. The overall CFA course duration still depends on exam cycles.

CFA Duration After CA

Chartered Accountants often find financial reporting easier. That helps at Level 1 and Level 2. The CFA duration after CA may feel smoother in early levels. Level 3 remains new for most because of its portfolio focus. Prior knowledge saves effort. It does not remove exam gaps. So the total CFA time duration stays within the same broad range.

Also Read: How a CFA Course Can Take You From Entry Level to Executive Leadership

How to Plan CFA Course Fees and Duration Efficiently

Money planning connects closely with time planning. The CFA course fees and duration go hand in hand. Exam fees increase if you delay registration. Early planning reduces cost stress. Below is a general idea based on fee structures published by the CFA Institute.

| Stage | When You Pay | Approx. Exam Fee (USD) |

| Level 1 Registration | First entry into the program | $1,140 early / $1,490 standard |

| Level 2 Registration | After passing Level 1 | $1,140 early / $1,490 standard |

| Level 3 Registration | After passing Level 2 | $1,240 early / $1,590 standard |

| Total Exam Fees (All Levels) | Spread across 2.5-4 years | ~$3,520 – $4,570 |

In India, currency exchange rates add another factor. This is why people often search for CFA course fees and duration in India together.

CFA Exam Duration on Test Day

Understanding the CFA exam duration helps plan stamina. Each level exam lasts about 4.5 hours with a break in between sessions. The CFA exam time duration includes tutorial screens and optional breaks. Sitting focused for this long feels similar to a long flight. Mental energy must be paced. Practice mock exams under timed conditions reduce surprises.

CFA Course Duration and Eligibility

People often mix up eligibility rules with time rules. The CFA course duration and eligibility are separate ideas.

You can start Level 1 while in the final year of graduation. Work experience can come before, during, or after exams. This flexibility allows many candidates to align career growth with the CFA course duration in India or abroad.

Also Read: The Future of CFA Courses and Industry Outlook to 2027

Did you know? The CFA charter requires 36 months of relevant work experience, and this can overlap with exam years. This overlap helps prevent the CFA degree duration from becoming longer than necessary.

Why Choose Imarticus Learning for Your CFA Journey

Preparing for the CFA exams is one thing. Navigating that preparation with structured support, industry insight, and real-world relevance is another. When you are planning your cfa course duration and study strategy, choosing the right training partner can make your timeline more efficient and your preparation more purposeful. Imarticus Learning’s CFA Course prep stands out with features designed to support your progress at every stage of the journey.

Key features of Imarticus Learning’s CFA Program:

- Industry-led CFA prep developed in collaboration with KPMG in India, ensuring real-world perspectives alongside core exam preparation.

- Recognised as India’s first and only approved prep provider for top global finance certifications, including the CFA, giving you confidence in quality and global alignment.

- Comprehensive curriculum with Kaplan Schweser study materials, widely trusted for CFA exam readiness and depth of content.

- Dual-teacher model combining live online classes by expert CFA faculty and additional one-on-one guidance to help you stay on track across your planned CFA course duration.

- AI-driven mock test analytics and performance breakdowns that help you focus on weak areas and refine your strategy with data, not guesswork.

- Structured revision kits and topic-wise assignments that turn a heavy curriculum into a manageable, iterative learning process.

- Regular live sessions and webinars that connect you to industry insights, current finance trends, and practical perspectives from professionals.

- Dedicated doubt-clearing support to prevent confusion and keep momentum steady throughout your CFA preparation.

- Built-in placement support after Level 1, including resume building, mock interviews, and interview opportunities to help align your CFA success with career movement.

- A strong professional community and networking ecosystem that connects you with peers and industry professionals for ongoing motivation and opportunities.

Each of these elements is designed not just for passing exams but for aligning your CFA course duration with real career momentum. With practical support, Imarticus Learning helps ensure you stay on track and confident throughout your CFA journey.

FAQs About CFA Course Duration

When people start mapping their CFA course duration, the doubts that come up are rarely just about months and years. Let’s look at the most frequently asked questions that address those practical concerns so you can see how time, effort, and career outcomes are closely connected throughout the CFA journey.

What is the time duration to complete a CFA course?

The typical CFA course duration ranges between 2.5 and 4 years. This includes the time needed to clear all three exam levels plus the required 36 months of relevant work experience, which can be completed alongside the exams. Structured coaching programs offered by Imarticus Learning help candidates stay aligned with exam windows and avoid unnecessary delays.

Can I complete the CFA course in 1.5 years?

Finishing the CFA course in 1.5 years is not realistically possible because the exams for all three levels cannot be scheduled that close together. Even if you clear each level on the first attempt, exam windows and result timelines create built-in gaps. The fastest practical path is about 2.5 years.

How many hours do I need to prepare for CFA Level 1?

Most candidates spend about 300 hours preparing for Level 1, according to guidance from the CFA Institute. Spread over four to six months, this fits into the early stage of the CFA course duration and builds a strong base for the next levels. A structured timetable and regular mock testing, like those included in programs at Imarticus Learning, can help ensure those hours are used effectively.

How much time does the CFA course take if cleared in first attempt?

If all three levels are cleared on the first attempt, the CFA course duration is typically about 2.5 to 3 years. This includes exam preparation periods and the minimum time gaps between levels based on the global exam schedule. Work experience can run in parallel, so it does not necessarily extend the timeline. Many candidates follow a structured prep pathway with Imarticus Learning to stay consistent across levels.

Is CFA harder than CA?

The CFA course duration feels different from CA because the structure and focus differ. CFA exams test global investment knowledge and portfolio skills. CA focuses deeply on accounting, tax, and audit rules. Many people find CFA wide in scope and CA detailed in regulation. Difficulty depends on background and study style. Time planning matters in both.

Who is eligible for CFA in India?

Eligibility links to education and work stages, not nationality. For the CFA course duration in India, a candidate can register for Level 1 in the final year of a bachelor’s degree or with relevant work experience. The exam timeline remains global. Imarticus Learning guides candidates on how to align eligibility with a realistic CFA degree duration.

Is 67% enough to pass CFA?

CFA exams do not use a fixed public cutoff. The passing score changes by exam. Scoring well above average topic performance improves chances. A clear study plan helps protect the planned CFA course duration.

How many attempts are in CFA?

There is no strict lifetime limit announced for attempts, but exam windows and policies can change. Each retake adds waiting time. Planning carefully helps maintain a steady CFA course duration without unnecessary gaps.

Planning Your CFA Course Duration the Right Way

The CFA course duration stops feeling uncertain once you see the full path clearly. Three exam levels. Structured preparation phases. Fixed exam windows. Work experience that can run alongside your studies. Each part fits together like stages in a long professional journey rather than a short academic sprint.

Some candidates move quickly through the levels because their schedule allows steady study. Others take longer because careers, relocations, or personal commitments shape their pace. Both paths are valid. What matters most is entering the process with a realistic understanding of how the timeline works and how your daily routine will support it.

If you are ready to move from planning to preparation, structured guidance can make a real difference in how smoothly your CFA course duration unfolds. Many candidates choose to learn within a disciplined framework that keeps study plans aligned with exam windows and career demands. The CFA program prep offered by Imarticus Learning is designed around this balance, helping candidates stay consistent while managing work or college alongside their CFA journey.