Gone are the days when visiting a bank was the only way to make a financial transaction. At present, people can easily make financial transactions with just a few taps on their smartphones. The rise of fintech has helped people make financial transactions while sitting on their couches.

Have you ever wondered what technology stack makes fintech possible? Well, blockchain is one of the primary technologies used by the fintech industry. Many young enthusiasts go for a blockchain certification to enhance their skill set. Read on to know how blockchain in fintech is prompting digitization in the commodity industry.

Role of blockchain for financial technology

Blockchain is among the new-age technologies that are decentralized. Financial transactions in the commodity industry have become more secure with blockchain. The costs incurred by companies in the commodity industry for financial transactions are also reduced with blockchain.

Companies in the commodity industry have started to realize the worth of blockchain experts. They are proactively hiring individuals that have blockchain certification. Some of the use cases of blockchain for fintech are as follows:

Companies in the commodity industry have started to realize the worth of blockchain experts. They are proactively hiring individuals that have blockchain certification. Some of the use cases of blockchain for fintech are as follows:

- Since blockchain is a distributed technology, single points of failure that disrupt the entire system do not occur. There is no work for any intermediatory in a blockchain-powered transaction. The need for transfer agents is reduced since the introduction of blockchain. Blockchain-powered transactions are nearly impossible to be hacked or manipulated.

- Blockchain is a shared platform that enhances the transparency of network participants. The best part of a blockchain network is that participants can only see the financial transactions. Under no circumstances, a participant can change the financial transaction on a blockchain network.

- Due to its transparency, blockchain helps network participants to collaborate and access financial/transaction data. Opposite parties can come to an agreement quickly due to the transparency of a blockchain network.

- You can create tamper-proof software to support your business logic as blockchain offers high programmability. Blockchain also allows businesses to share data selectively to maintain privacy. According to stats, blockchain offers around ten times more cost benefits than other technologies for making financial transactions.

- Blockchain is a scalable technology and can adapt if the number of fintech transaction increase considerably. Each company in the commodity industry gets a global reach with blockchain and fintech. If there are periodic surges in the transaction activity, blockchain is capable of handling them.

A company in any commodity industry can go global and indulge in cross-border transactions with blockchain. Products offered by different companies in the commodity market are more or less the same. Different companies in the commodity industry compete for price with each other. When a company reduces costs incurred in making/managing financial transactions with blockchain, it can provide discounts to buyers.

If you are working in the commodity industry, a fintech course with blockchain can help you upgrade your career. Companies in the commodity industry are also focusing on hiring employees that have done a fintech course. Blockchain and fintech experts can help companies in safeguarding their financial transactions.

Why choose Imarticus’s fintech course?

Why choose Imarticus’s fintech course?

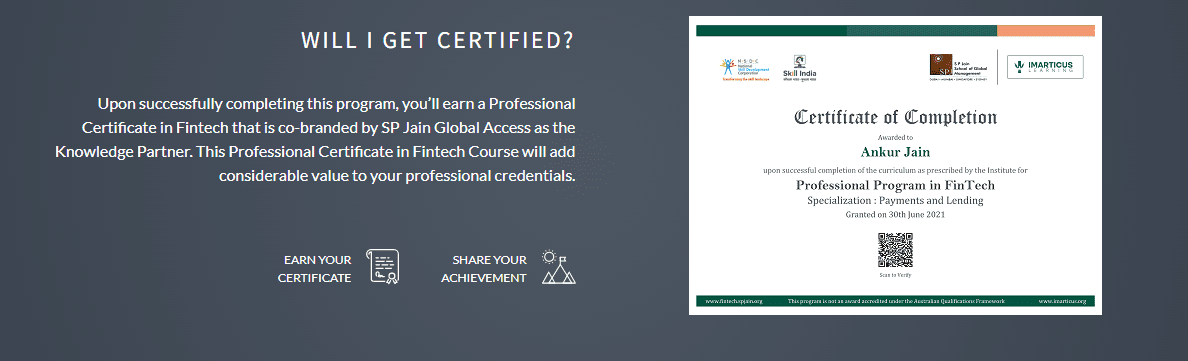

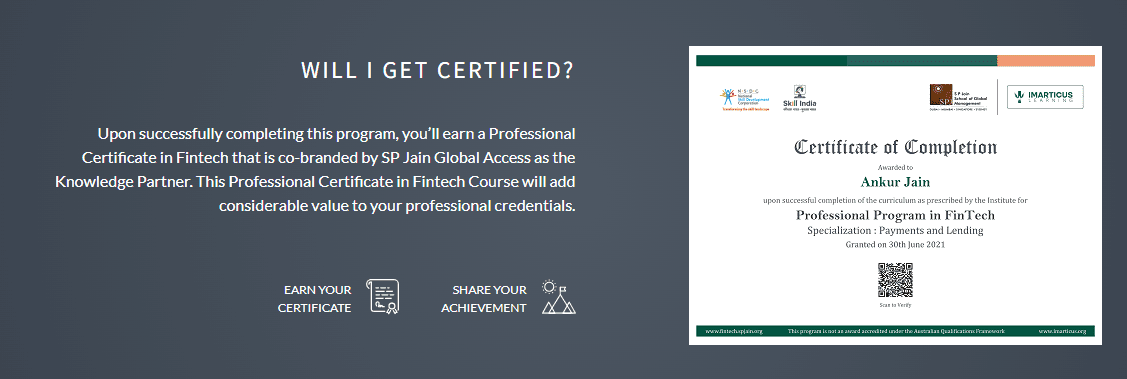

We offer a PGDM, MBA, and certification course for financial technology. Fintech courses will help you in learning the tools and technologies used in the industry. Among all the technologies used in the fintech industry, there will be a focus on blockchain. We also offer placement support to students who choose our financial technology courses.

You will work on several real-life projects during your fintech course. Not only you will learn industry practices, but also learn job-relevant skills with a financial technology course. Start your fintech course to make financial transactions in the commodity industry secure!