A recent study on digital lending has shown that the average borrower earns a higher income than the average credit cardholder. It is not surprising that many of these borrowers are college graduates with good jobs and high salaries. The following insights from this study will be helpful for any business looking to enter into the digital lending market or increase its share in it.

This blog post discusses essential big data in digital lending, such as how much the average borrower makes and their educational background, which can help inform future decisions regarding this industry.

What is a Big Data Analysis?

Big Data is a term that describes the large volume of data organizations collect, process, and store. The data can be in any form, including text, images, audio, or video. Big Data is the process of extracting valuable insights from this data to help organizations make better decisions.

The digital lending industry is one area where Big Data Analytics can be used to significant effect. By analyzing the data collected from borrowers and lenders, organizations can identify trends and patterns to help them make better decisions about lending money. For example, they can determine which borrowers are most likely to repay their loans on time or which lenders are most likely to offer the best interest rates.

How can lenders use big data in their day-to-day operations?

One of the most important ways is analyzing a borrower’s credit history. Using predictive analytics and machine learning techniques, lenders can use extensive data analysis to assess a potential customer. It also reduces the risk of lending money to new borrowers and shortens its time for the approval process.

Here are some other benefits: –

- Lenders can get a better understanding of customer behavior and preferences.

- They can also improve their marketing efforts by targeting specific audiences.

- Additionally, they can identify fraudulent activities and prevent them from happening.

Big data provides lenders with opportunities to increase efficiency, accuracy, and profits. Using it can make better and more informed decisions about lending money and how much.

Explore credit analyst course with Imarticus Learning

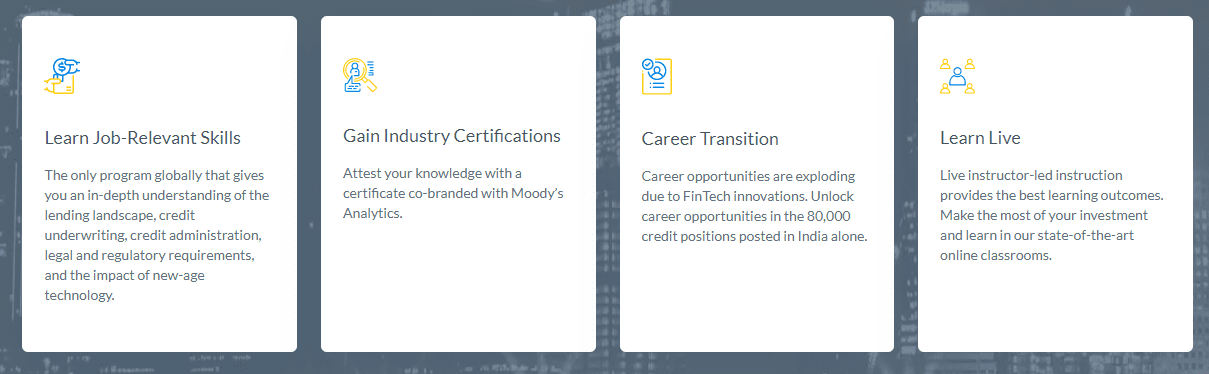

Acquire a robust toolbox that helps students grasp India’s credit environment, study the whole loan evaluation and due diligence process, and conduct financial analysis with this 145+ hour Credit Risk and Underwriting Pro degree. Students can explore five complete case studies to get a hands-on learning experience. Each case study corresponds to a particular curriculum component, allowing students to put their knowledge to use while also learning more about credit risks and underwriting.

Course Benefits for Learners

- The credit analyst course teaches students everything they need to know about lending, credit underwriting, credit administration, legal and regulatory requirements, and the influence of new-age technologies.

- Students receive a certificate in credit risk management course from Moody’s analytics that certifies their understanding.

- Impress employers & showcase skills with credit risk management courses recognized by India’s prestigious academic collaborations.

This is why banking courses in India after graduation have never lost their place in the trends.

This is why banking courses in India after graduation have never lost their place in the trends.

In this article, we discuss what an

In this article, we discuss what an  One can pursue voluntary certifications like the

One can pursue voluntary certifications like the

Imarticus Learning offers investment banking certification courses. The

Imarticus Learning offers investment banking certification courses. The

The investment banking sector also stepped in to explore the world of automation and how they can utilize it.

The investment banking sector also stepped in to explore the world of automation and how they can utilize it.

A credit analyst course or PG diploma in banking and finance may help you to achieve that.

A credit analyst course or PG diploma in banking and finance may help you to achieve that.

In this article, we’ll discuss how to get into a

In this article, we’ll discuss how to get into a