Last updated on December 29th, 2025 at 02:17 pm

The CPA exam is often described as rigorous, but the real challenge does not come from the syllabus alone. It comes from how the syllabus is tested. Every section of the exam blends technical knowledge with professional judgment, and that combination changes how preparation must be approached.

Most candidates begin with the same assumption. If the content is covered once, it should be enough. That assumption rarely holds for the CPA certification. Understanding concepts is only one part of the preparation process. Applying them under exam conditions is where outcomes begin to differ.

The structure of the CPA exam plays a quiet but decisive role. It consists of four sections, each four hours long, tested separately but connected by skill. Multiple-choice questions are combined with simulations that require analysis, interpretation, and decision-making.

This is where CPA study material becomes more than a collection of books or question banks. The material chosen and the way it is used directly influence how effectively preparation time is spent over several months.

→ Some topics respond well to surface reading.

→ Others only settle through repeated practice.

That distinction is not always obvious at the start. This guide explores how CPA study material fits into the exam structure, how different subjects demand different depths of preparation, and how study decisions influence outcomes over time. The aim is not to rush conclusions, but to build clarity step by step, so preparation becomes deliberate rather than reactive.

What Is CPA, and Why Does the Right CPA Study Material Matter?

Before I decide how to prepare, it is important to understand what is CPA and what the qualification is designed to test. CPA stands for Certified Public Accountant, offered by the AICPA, is a globally recognised professional credential issued in the United States for accounting and finance professionals who meet specific education, examination, and experience requirements.

The CPA designation signals competence in accounting, auditing, tax planning, regulation, and business decision-making. Because the exam evaluates both technical accuracy and application skills, the choice of CPA Study Material directly affects how well a candidate is prepared.

To understand preparation properly, I first look at what the CPA qualification represents.

What Is CPA at a Glance

| Aspect | Details |

| Full Form | Certified Public Accountant |

| Conducted By | American Institute of Certified Public Accountants (AICPA) |

| Exam Format | Four-section computer-based exam |

| Global Recognition | Widely accepted across audit, accounting, and finance roles |

| Core Skill Focus | Accounting standards, audit judgment, taxation, and regulation |

This structure explains why CPA preparation is not limited to reading textbooks. It requires structured CPA study material that supports learning, practice, and revision.

What the CPA Exam Tests

The CPA exam is designed to test how well a candidate can apply knowledge in real-world scenarios. Each section combines conceptual understanding with practical judgment.

The exam evaluates:

- Understanding of accounting and reporting standards.

- Ability to apply audit procedures and professional judgment.

- Knowledge of taxation rules and regulatory frameworks.

- Decision-making skills in business and advisory contexts.

Because of this design, CPA Study Material and top resources for CPA must go beyond theory and include application-based practice.

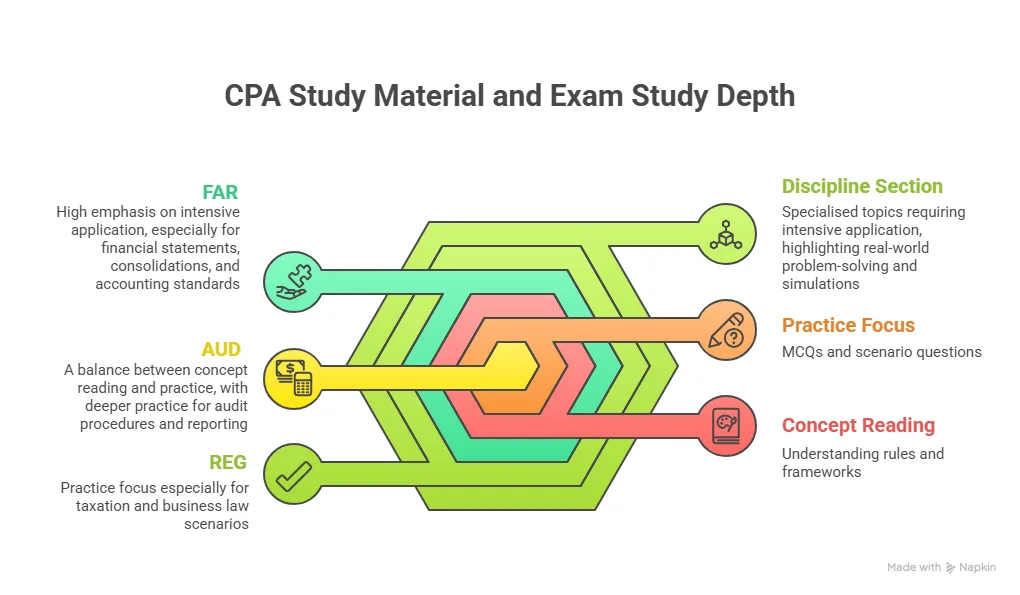

CPA exam preparation often requires different levels of study intensity across subjects. Understanding where surface learning is sufficient and where deeper practice is essential helps candidates use CPA study material more effectively throughout their preparation journey:

CPA Exam Sections and Subject Coverage

To understand how preparation works, I’ll break the CPA exam into its core components:

| CPA Exam Section | What It Focuses On |

| FAR | Financial accounting, reporting, and standards |

| AUD | Auditing procedures, ethics, and assurance |

| REG | Taxation, business law, and regulation |

| Discipline | Business analysis, systems, or tax planning |

Each section demands a different approach to study. This is why CPA preparation cannot rely on a single method or resource. The answers lie in the exam’s objective. The CPA exam tests readiness for professional responsibility, not short-term memorisation. As a result, effective CPA Study Material is structured to mirror this expectation.

What Makes Good CPA Study Material?

Understanding the CPA exam format helps you choose the type of CPA preparation materials. When I talk about quality CPA Study Material, I look at these elements first:

- Alignment with the Exam Blueprint – The material must cover what is actually tested. It should map directly to the CPA course subjects and the AICPA exam structure.

- Rich Practice Questions – The more practice items I have, the more I can understand actual testing patterns.

- Explanatory Depth and Concept Focus – Memorising rules is not sufficient. I gravitate toward sources that explain “why” as well as “how.”

- Simulations and Application Practice – A strong suite of task-based simulations elevates preparation from theory into exam readiness.

When I recommend CPA preparation materials, these criteria become my baseline.

Mapping CPA Course Subjects to Study Material

To make sure no topic is left uncovered, I segment my CPA Study Plan like this:

| Section | Key Topics |

| AUD | Internal controls, evidence, and audit reports |

| FAR | GAAP, financial statements, consolidations |

| REG | Taxation, business law, and ethics |

| Discipline | IT audit, planning, or advanced tax topics |

This table helps me track progress and select resources accordingly. There is no single resource that covers all areas equally well, so part of my planning process involves mixing and matching:

- A primary textbook that covers fundamentals.

- A secondary set of practice simulations.

- A question bank for drilling MCQs.

This mix gives both breadth and depth to my CPA preparation materials. You also get to understand the true cost and benefits of pursuing CPA.

Most Widely Used CPA Study Materials and Resources

CPA candidates across the world tend to rely on a small set of well-established study resources. These tools have become widely used because they align closely with the CPA exam structure, offer depth where required, and support long-term preparation for different types of candidates, whether working professionals or students doing the CPA after post-graduation.

Most candidates do not use a single resource. They combine materials across formats to cover learning, practice, and revision effectively.

1. Comprehensive CPA Review Programs

These are full-spectrum resources that cover all CPA course subjects and provide structured preparation. Commonly used comprehensive programs include:

- Becker CPA Review

- Gleim CPA Review

- UWorld CPA Review

- Roger CPA Review

- Wiley CPAexcel

These programs typically include:

- Complete syllabus coverage

- Video lessons

- Extensive MCQ banks

- Task-based simulations

- Mock exams and analytics

They are often used as the primary CPA study material around which a full CPA study plan is built.

2. CPA Exam Preparation Books

Printed and digital books remain essential, especially for concept-heavy sections. Most used CPA exam preparation books include:

- Becker CPA textbooks

- Gleim CPA textbooks

- Wiley CPA review books

These books are valued for:

- Structured explanations

- Detailed examples

- Clear presentation of accounting standards and tax rules

They are especially relied upon for FAR and REG preparation.

3. CPA Question Banks for MCQ Practice

Question banks are one of the most critical CPA preparation materials. Widely used question banks include:

- Becker MCQ banks

- Gleim test banks

- UWorld MCQ systems

- Wiley CPAexcel question banks

These resources help candidates:

- Learn exam-style questioning

- Improve speed and accuracy

- Identify weak areas early

High-quality explanations are a major reason these banks are preferred.

4. Task-Based Simulation Practice Resources

Simulations play a major role in CPA exam scoring, especially in FAR and AUD. Most candidates practice simulations using:

- Simulation sets included in Becker, Gleim, and UWorld

- AICPA-released sample test simulations

Simulation practice helps candidates develop:

- Document analysis skills

- Multi-step problem solving

- Exam stamina and pacing

This type of CPA study material becomes increasingly important in later preparation stages.

5. Official AICPA Resources

Official resources are used primarily for alignment and familiarity. Most used AICPA materials include:

- AICPA exam blueprints

- AICPA sample tests

- AICPA practice questions

These resources:

- Reflect the actual exam structure

- Show question formatting and navigation

- Help candidates calibrate readiness

They are usually used alongside commercial CPA study material rather than alone.

6. Supplementary Revision and Notes Resources

Many candidates create or use condensed revision aids toward the end of preparation. Common forms include:

- Personal summary notes

- Formula sheets

- Error logs

- Condensed topic checklists

These are not standalone CPA preparation materials but are essential for:

- Final review

- Confidence building

- Reducing cognitive overload before exams

How Candidates Typically Combine These Resources

Most CPA candidates follow a blended approach.

| Preparation Stage | Most Used Resources |

| Early learning | Textbooks and video lectures |

| Skill building | MCQ question banks |

| Exam conditioning | Task-based simulations |

| Final review | Notes and summary materials |

This combination ensures that CPA study material evolves with preparation needs rather than remaining static.

Why Resource Choice Matters

The CPA exam does not reward familiarity alone. It rewards readiness. If you’re contemplating how to become a us certified public accountant, the answer is that using widely adopted, exam-aligned CPA study material reduces uncertainty and helps candidates focus their effort where it matters most.

The next sections of the blog build on this foundation by explaining how to use these materials strategically, not just which ones exist.

Effective CPA exam preparation depends on using study resources in the right sequence. Moving from concept building to application and then to focused revision helps CPA study material support understanding, practice, and long-term retention throughout the preparation process:

Building a CPA Study Plan Around Quality Study Material

Choosing the right CPA Study Material has to be tied directly to the planning of my study hours, the complexity of each topic, and the time I can realistically dedicate every week.

Most candidates studying for the CPA exam prepare between 320 and 420 total hours, with roughly 80 to 120 hours per section.

Every CPA exam section has a different mix of topics and question types. For example:

- AUD leans more on professional standards and audit procedures.

- FAR includes deep financial accounting detail.

- REG covers tax law, ethics and regulation.

This means my choice of CPA exam preparation books and CPA exam preparation course materials should align closely with the focus and demands of each subject, for example, financial planning for CPAs.

Weekly Study Hours Example

Here is how a balanced weekly schedule might look for someone studying while working:

- Weekdays: 2 hours of conceptual reading and practice

- Saturday: 4 hours of problem-solving exercises

- Sunday: 5 hours of mock exams and review cycles

This block approach ensures continuity and helps build a habit. Consistency beats cramming every time.

A Realistic Timeline for CPA Preparation Time

Many candidates ask how much CPA preparation time they need. A clear plan must accommodate life, work, and study. Recommendations from prominent review sources suggest in total:

- 320-420 hours of preparation for all four sections

- Typically spread over 9-12 months for full-time working candidates

This adds up to roughly 30-40 hours per month if spread evenly.

Some candidates aim to complete the entire exam in shorter time frames, such as three months. While this is possible, it requires a disciplined schedule with at least 80-100 hours dedicated to each section at a minimum.

The key takeaway is that I do not rush through material. Instead, I build CPA Study Material into a clear calendar of study commitments and stick to it.

Preparing for the CPA exam does not always require long study hours. With a focused approach, the right CPA study material, and a disciplined study plan, even a consistent two-hour daily routine can support steady progress toward exam readiness over time.

Milestone Checklist

I recommend using a milestone checklist for progress tracking:

- Complete the first pass of all core reading

- Drill at least 2,000 practice questions per section

- Simulate full-length practice exams

- Analyse performance gaps and revise weak areas

These checkpoints help ensure that your CPA study schedule is not just about hours, but about quality progress toward mastery.

Common Bottlenecks in CPA Preparation

Even with good material, many candidates struggle with certain bottlenecks:

- Spending too much time on one section and falling behind on others

- Relying too heavily on passive reading without sufficient practice questions

- Poor time management in daily study schedules

- Underestimating the depth and volume of CPA course subjects

Addressing these bottlenecks directly in my planning phase helps maintain momentum and makes preparing for CPA exam more manageable. Students also often wonder if they can earn CPA certification with zero experience, especially when they are still early in their academic or professional journey. The CPA exam can be attempted without prior work experience, but the certification is awarded only after the required professional experience is completed.

Did you know? Candidates who space their CPA exams over 9 to 12 months report higher completion rates than those who attempt compressed timelines.

How CPA Pass Rate Connects With Study Strategy

The CPA Exam pass rate is a widely discussed metric among candidates and mentors. Historically, individual section pass rates hover between 45% and 55%, indicating that many do not pass on their first attempt.

Whereas the overall numerical score to pass a section is 75, studies have shown that consistent preparation plans and tailored study materials boost confidence and performance.

Here is a simple view of how pass rates influence preparation planning:

- A lower pass rate suggests intense content or topic clustering.

- Higher pass rates in US CPA preparation often come when candidates use high-quality practice sets and adaptive review tools.

Designing your CPA study plan to address the harder areas first and revisiting them with fresh practice sets often yields better results and strengthens your CPA skills.

Using CPA Study Material the Right Way in Daily Preparation

Once the structure of the CPA exam is clear, the real work begins at the desk. This is where CPA Study Material and tools & resources for CPA exam prep become important instruments. I always look at study material as something that should guide decisions each day. It tells me what to read, what to practice, and what to revisit.

Most candidates collect resources but struggle to convert them into progress. That gap usually comes from unclear sequencing. Every chapter, question bank, and simulation needs a place in the CPA study schedule.

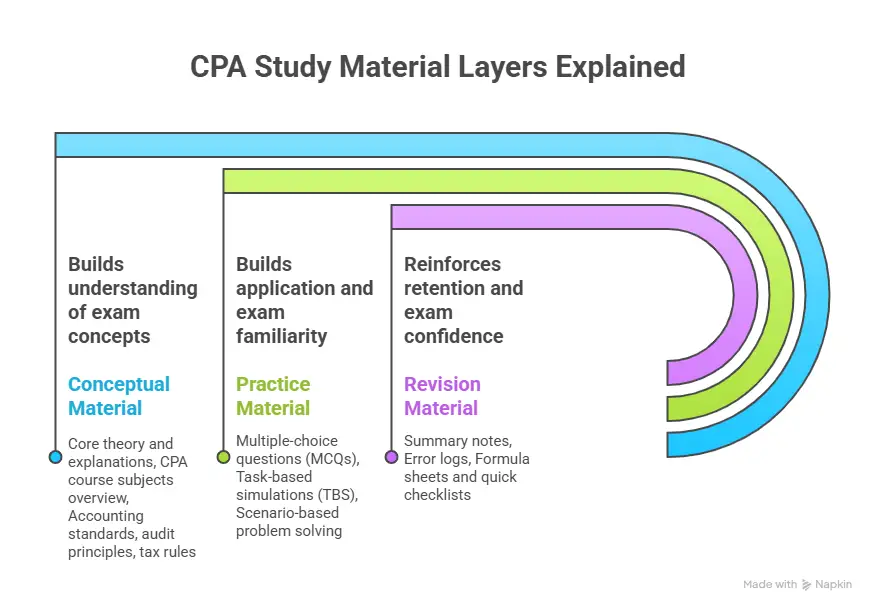

The Three-Layer Method I Follow

I organise CPA preparation materials into three layers. This approach keeps preparation focused and avoids overload.

Layer 1: Core Learning

This includes structured lessons that explain concepts clearly. These may come from:

- Textbooks

- Recorded video lectures

- Structured online modules

This layer builds understanding of CPA course subjects.

Layer 2: Practice and Application

Here I spend the bulk of my time:

- Multiple-choice questions

- Task-based simulations

- Scenario-based problems

Practice exposes how concepts are tested in the exam. According to the AICPA, candidates who practice simulations regularly adapt faster to exam formats.

Layer 3: Review and Reinforcement

This layer closes gaps:

- Error logs

- Formula sheets

- Short concept refreshers

Together, these layers turn CPA Study Material into a repeatable daily system rather than a one-time read.

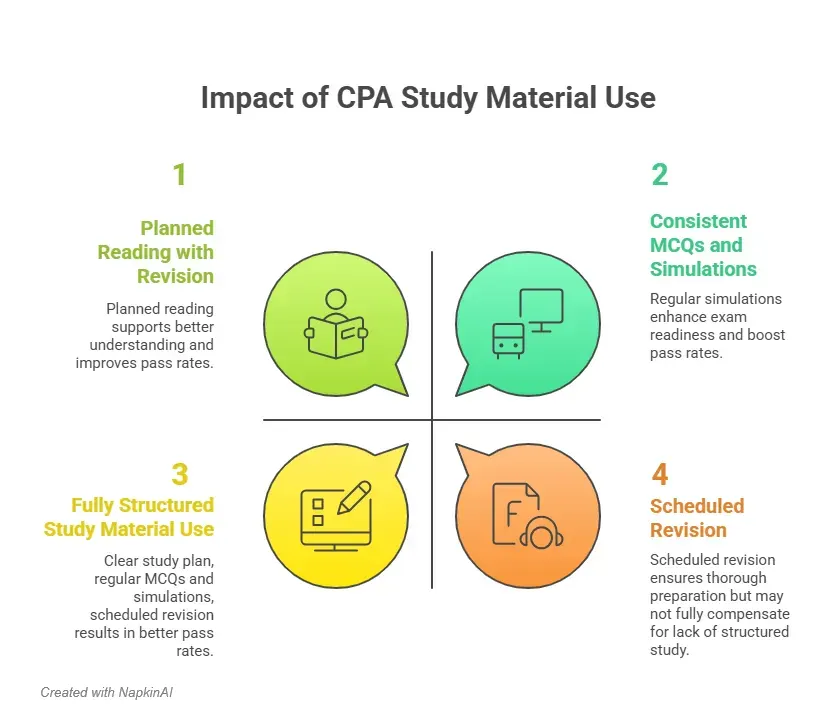

The way CPA study material is used over time often influences preparation quality and exam confidence. Structured and consistent use of resources supports better coverage, clearer understanding, and steadier progress throughout the CPA exam journey:

How CPA Exam Preparation Books Fit Into the Plan

Books remain a core part of CPA exam preparation books even in digital-first study setups. The reason is simple. Books slow the pace and encourage deeper reading. I recommend using the CPA books primarily for:

- FAR accounting standards

- REG tax rules

- Audit theory in AUD

Books provide structure and act as reference points when revisiting weak topics.

How I Read CPA Books Without Burning Time

I avoid linear reading. Instead, I suggest:

- Skim headings first

- Identify formulas, standards, or rules

- Read examples before definitions

- Flag pages for later revision

This method keeps reading active and improves recall. Books support learning best when paired with questions. That pairing turns theory into readiness.

Creating a Flexible CPA Study Schedule

A CPA study schedule should adapt to life without collapsing under pressure. Fixed daily targets often fail when workdays stretch longer than expected. Instead, I plan by weekly outcomes, knowing that CPA is a lucrative career choice that rewards steady and consistent preparation over time.

Sample Weekly Structure

Here is a practical example for a working candidate:

| Day | Focus |

| Monday | New concept learning |

| Tuesday | MCQ practice |

| Wednesday | Simulation practice |

| Thursday | Mixed review |

| Friday | Light revision |

| Saturday | Full practice block |

| Sunday | Weak area focus |

This structure gives each type of CPA Study Material a defined role. No single resource dominates the schedule.

How to Prepare for the CPA Exam for Free

Free resources can support preparation when used wisely. While they may not replace paid material fully, they add value in the early stages.

Reliable Free CPA Preparation Materials

Some useful free options include:

- AICPA sample tests

- Free trials from review providers

- Open educational accounting content from universities

I use free material mainly for:

- Familiarising myself with exam style

- Testing readiness before committing to paid resources

- Supplementing paid question banks

When exploring how to prepare for the CPA exam for free, I remain realistic about limitations. Free material often lacks adaptive feedback and full simulation coverage.

Did you know? Task-based simulations can account for up to 50% of the total score in certain sections of the CPA exam. This makes simulation-heavy CPA Study Material essential rather than optional.

Career Value and CPA Relevance

The CPA credential continues to hold strong value across top job roles like audit, accounting, tax, consulting, and advisory. According to the U.S. Bureau of Labour Statistics, demand for accountants and auditors is expected to grow steadily through the decade.

What keeps CPA relevant is not tradition, but adaptability. The integration of technology, analytics, and advisory work into exam content reflects how the profession evolves.

Effective US CPA preparation ensures that candidates are ready not just to pass exams, but to operate confidently in modern finance roles.

The CPA qualification often lays the foundation for broader leadership roles in finance. With the right exposure, strategic thinking, and continuous skill development, many professionals use their CPA background as a stepping stone toward senior positions such as CFO over the course of their careers.

Preparing for the CPA Exam While Working Full Time

Balancing work and study requires prioritisation. When I am short on time, I focus on materials that give the highest return per hour. High-impact study activities include:

- Timed MCQ sets

- Simulation walkthroughs

- Error analysis sessions

Passive activities like long reading sessions move to weekends. This balance keeps daily study manageable.

Studies show that consistent shorter study sessions outperform occasional long sessions for professional exams.

This approach ensures steady progress during preparation for the CPA exam without burnout.

FAQs on CPA Study Material

This section addresses the most frequently asked questions around CPA study material, covering how candidates choose resources, structure their preparation, and approach the CPA exam with clarity and confidence based on practical preparation needs.

Which study material is best for the CPA?

The best CPA Study Material is the one that aligns closely with the CPA exam blueprint, offers extensive practice questions, and supports simulations. I look for material that balances conceptual explanation with application. Strong CPA study material usually includes textbooks, digital question banks, and mock exams working together. Many candidates benefit from Imarticus Learning because their CPA study material integrates planning, progress tracking, and exam-focused practice into one system.

How can I prepare for the CPA?

You should approach the CPA exam by building a clear CPA study plan that breaks preparation into learning, practice, and revision phases. I rely on CPA study material that covers all CPA course subjects and includes simulations. Preparing for the CPA exam success depends on consistency rather than intensity. Daily progress, even in small blocks, builds confidence and exam readiness over time.

Can I do CPA in 3 months?

Completing the CPA exam in three months is possible but rare. It requires full-time focus and highly efficient CPA Study Material. Each exam section typically needs 80 to 120 hours of preparation. Candidates attempting a three-month timeline must already have strong accounting foundations and access to focused CPA preparation materials that minimise wasted effort.

Can I study CPA by myself?

Yes, self-study is possible with disciplined planning and the right CPA Study Material. Self-study works best when candidates follow a structured CPA study schedule and use high-quality question banks. Many self-study candidates also supplement with mentorship or guided programs offered by Imarticus Learning to maintain accountability and clarity during long preparation phases.

Is a CPA harder than a bar?

The CPA exam and the bar exam test different skills. CPA difficulty comes from volume, technical depth, and sustained preparation across sections, whereas the bar evaluates how well candidates can recall and apply legal rules under strict time pressure. With the right CPA study material and preparation time, CPA difficulty becomes manageable. Hardness depends more on planning quality than on inherent exam complexity.

Is CPA still worth it in 2025?

Yes, CPA remains valuable in 2025 due to its recognition across audit, accounting, advisory, and finance roles. CPA study material now includes analytics, systems, and advisory content, reflecting industry needs. This evolution keeps the credential aligned with modern career paths and long-term relevance. Many candidates preparing through structured learning ecosystems at Imarticus Learning benefit from this updated approach, as it aligns exam preparation with practical skill development.

Are CPA jobs stressful?

Stress levels in CPA jobs vary by role and employer. Public accounting roles may be demanding during peak seasons, while corporate and advisory roles often offer more balanced schedules. Strong CPA study material reduces exam-related stress, allowing candidates to focus on career choices with confidence after qualification.

What is the CPA exam pass rate?

The CPA exam pass rate typically ranges between 45% and 55% per section. This reflects exam rigour rather than unattainability. Candidates using structured CPA study material, consistent practice, and realistic preparation time often perform better. Pass rates improve significantly with disciplined preparation strategies.

What are the disadvantages of CPA?

The disadvantages of CPA include time commitment, exam costs, and sustained mental effort. These challenges are reduced significantly when the CPA study material is well organised and aligned with a clear study schedule. Most difficulties arise from underestimating preparation time or relying on fragmented resources.

Turning CPA Study Material Into Exam Readiness

Preparing for the CPA exam is less about chasing the perfect resource and more about building a preparation system that actually works. Throughout this guide, the focus has stayed on understanding how CPA course subjects translate into study effort, how different layers of CPA study material support learning at different stages, and how structure plays a quiet but decisive role in exam outcomes.

What becomes clear by the end is that effective preparation is intentional. It respects time constraints, acknowledges the exam’s applied nature, and relies on study material that encourages practice, reflection, and revision in equal measure. When preparation is organised this way, progress feels steady rather than overwhelming, and exam readiness develops naturally over time.For learners who are navigating professional qualifications alongside work or academics, the value of guided structure becomes even more evident, and this is where Imarticus Learning quietly fits into the preparation journey. The approach to professional education emphasises clarity, structured learning paths, and practical exposure, elements that matter in preparation for the CPA Course.