Last updated on November 18th, 2025 at 04:56 pm

If you’re planning to build a career in finance, investment banking, equity research, or portfolio management, your journey will likely start with the CFA Level 1 Exams. And it’s completely normal to feel a little overwhelmed at first – the curriculum is vast, the exam pattern is new, and everyone seems to say it’s “the toughest finance exam out there.”

But here’s the good news:

Once you understand how the CFA Exams actually work, what they test, and how to prepare for them, the entire process becomes far more manageable.

I’ll break down everything you need to know – the CFA Level 1 syllabus, what the CFA Level 1 Exams involve, what you’ll study, how difficult it really is, preparation strategy, common mistakes, and more. By the end, you’ll know exactly how to approach it smartly – not stressfully.

Let’s get started.

📊Quick CFA Facts: For the August 2025 testing window, the Level 1 pass rate was 43% globally.

What Exactly Are the CFA Level 1 Exams?

Before we go further, let’s quickly answer the big question: what is CFA?

The CFA Certification is a globally respected certification that trains you to think like an investment professional – analysing markets, evaluating companies, and making sound financial decisions.

Think of the CFA Level 1 Exams as the gateway into the world of professional investing.

Level 1 isn’t trying to turn you into a portfolio manager overnight – it’s simply building your base. It’s like learning a new language. You don’t begin with deep conversations. You begin with simple words and short phrases, and gradually, it all starts to click. Once those basics are in place, the more complex concepts no longer seem so intimidating.

Level 1 does the same:

It teaches you the core concepts in finance so you can confidently understand and later analyse how markets work, how companies perform, and how investments are evaluated.

Here’s the big picture:

- Offered by the CFA Institute (USA).

- First of three exams (Level 1 → Level 2 → Level 3).

- Globally recognised in 165+ countries.

- Ideal for individuals entering finance or transitioning into it.

Passing the CFA Level 1 exams means you’re ready for the deeper analytical work in Level 2.

Why Is Level 1 So Important?

CFA Level 1 Exams are important because they set your entire CFA journey in motion.

The CFA Level 1 syllabus builds your fundamentals in:

- Financial reporting

- Quantitative methods

- Capital markets

- Ethics

- Portfolio basics

These aren’t just exam topics – they’re skills you’ll actually use in real-world finance roles. These become the backbone of Levels 2 and 3. If Level 1 is strong, the rest of the CFA program becomes significantly easier.

CFA Level 1 Exams: Full Syllabus Breakdown (2025)

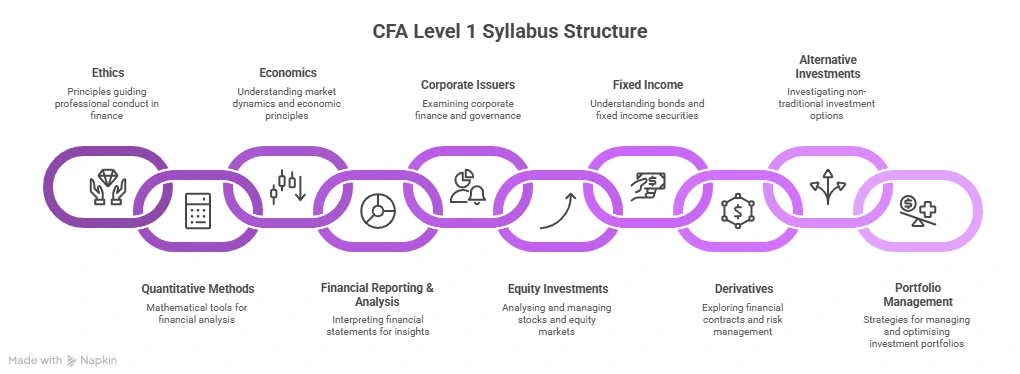

The CFA Level 1 syllabus is built around 10 core topics – each one adding a different piece to your overall finance skill set.

Here’s a simple breakdown:

1. Ethical & Professional Standards: This is the backbone of the CFA program. You learn how to act responsibly and make decisions that put investors first.

2. Quantitative Methods: All the numbers that drive finance – statistics, probability, time value of money. Basically, the maths behind smart decisions.

3. Economics: Micro and macro concepts, inflation, growth, and how entire economies function.

4. Financial Reporting & Analysis (FRA): Often considered the most important Level 1 topic. You learn how to read financial statements and truly understand what they’re saying.

5. Corporate Issuers: How companies make financial choices – capital structure, dividends, and funding decisions.

6. Equity Investments: How stock markets work, how stocks are valued, and the different strategies investors use.

7. Fixed Income: All things bonds: yields, risks, credit analysis – a huge part of real-world portfolio management.

8. Derivatives: Options, futures, swaps, and how they help manage risk or create returns.

9. Alternative Investments: Real estate, hedge funds, private equity, commodities – all the “non-traditional” assets.

10. Portfolio Management & Wealth Planning: The basics of building a solid portfolio, balancing risk and return, and thinking like a wealth manager.

Every topic builds on the others, and that’s what makes the CFA curriculum so effective. It slowly brings all the pieces together, allowing you to start seeing the bigger picture of how the finance world works.

You can also explore these CFA course details to understand how the full program strengthens your resume and boosts your long-term career profile.

📊Quick CFA Facts: CFA Level 1 exams focus on basic tools, inputs, and concepts, not advanced analytics. According to the CFA Institute, successful candidates often spend over 300 hours preparing for Level 1.

CFA Level 1 Topic Weightage (2025)

A topic’s weightage is basically the exam’s way of telling you how important that subject really is. Here’s the updated distribution:

| Topic | Weightage (%) |

| Ethics | 15-20% |

| Quantitative Methods | 8-12% |

| Economics | 8-12% |

| Financial Reporting & Analysis | 13-17% |

| Corporate Issuers | 8-12% |

| Equity Investments | 10-12% |

| Fixed Income | 10-12% |

| Derivatives | 5-8% |

| Alternative Investments | 5-8% |

| Portfolio Management | 5-8% |

Focus Areas:

Ethics, FRA, Equity, and Fixed Income carry the most weight – mastering these gives you a major advantage.

CFA Level 1 Registration Process

Registering for the CFA Level 1 exam is simple, but many students get confused about deadlines and requirements. Here’s a clear roadmap:

- Create your CFA Institute account – Visit the CFA Institute website and register using your email ID.

- Choose your exam location – Select your test centre or opt for available locations in your city.

- Pay the fees – Early registration helps you save more.

- Schedule your exam date – After paying, book your exact exam day and session slot.

Exam Windows & Registrations

The CFA Level 1 Exams are conducted 4 times a year:

- February

- May

- August

- November

Registrations usually open 10-12 months in advance. If you’re planning to attempt it. It’s smart to pick a date 6-9 months ahead so you can schedule your study time comfortably.

Registration tips:

- Always aim for early registration, as fees are much lower.

- Pick an exam window that gives you at least 6 to 8 months for preparation.

- Once registered, track the deadlines for rescheduling, deferrals, and admission tickets.

Eligibility for CFA Level 1

You can appear for the CFA Level 1 exams if you meet any of these:

- Have a bachelor’s degree (completed or in final year).

- Have 4,000 hours of work experience (any field).

- Have a combination of university + work experience totalling 4,000 hours.

CFA Level 1 Exams – Program Fee Details

Preparing for the CFA Level 1 exam is an investment in your finance career, and Imarticus Learning offers flexible modes to suit every learner – whether you prefer a classroom environment or live online learning.

The CFA Course Fees vary for every level based on the training institute, time of registration, scholarship eligibility, and a lot more. Here’s a brief overview of Imarticus Learning’s fees for CFA Level 1:

| Mode | Fee (INR) | Reg. Fee | Includes |

| Classroom | ₹75,000 | ₹10,000 | In-person classes, resources, mentorship |

| Live Online | ₹60,000 | ₹10,000 | Live online classes, resources, mentorship |

Every tough moment in your CFA Level 1 preparation is helping you grow – not just academically, but as a future finance leader. This video will guide you through a solid study plan.

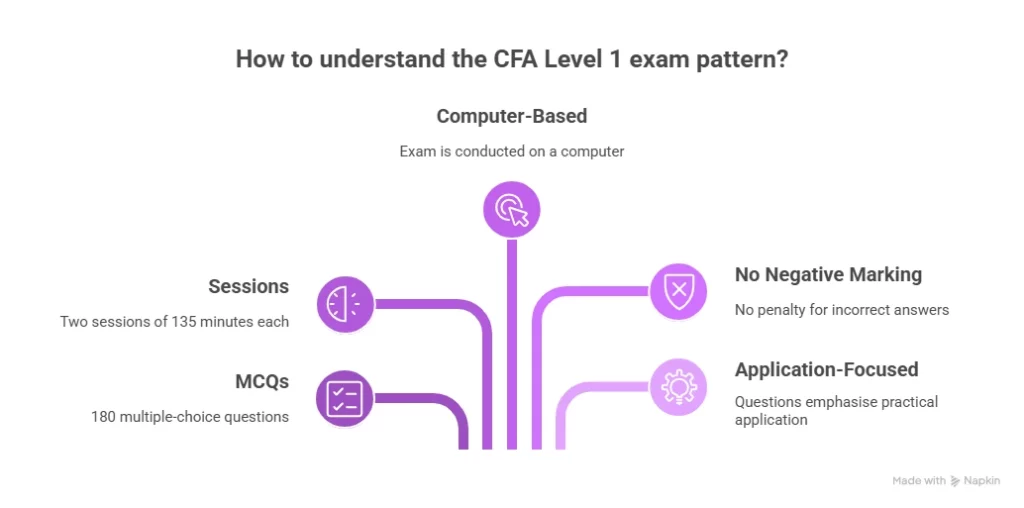

CFA Level 1 Exam Format (2025 Pattern)

Here’s what the CFA Level 1 exam pattern actually looks like:

- Computer-based testing (CBT).

- 180 multiple-choice questions.

- Divided into two sessions (135 minutes each).

- No negative marking.

- Questions are concept-based, not memory-based

To excel under the CFA exam pattern, you need a combination of:

✔ Concept clarity.

✔ Problem-solving skills.

✔ Time management.

✔ Daily practice.

✔ Rote learning won’t work here.

Understanding the CFA Passing Score (MPS)

CFA Institute does not reveal the exact cut-off or “Minimum Passing Score” (MPS), but historically:

- MPS is estimated to be around 60-70%

- Ethics adjustment can influence borderline results.

- A strong performance in heavy-weight subjects improves your chances significantly.

Aim for a minimum of 70% across topics in mocks to be safe.

If you’re still exploring whether the CFA journey aligns with your goals, this overview of the CFA course explains the qualification, structure, and career path.

CFA Study Plan: How to Prepare for CFA Level 1 Exams

To plan effectively, it’s useful to know how each subject builds on the next. This detailed look at the CFA Course Syllabus will help you understand the bigger learning roadmap. Here’s a practical CFA study plan followed by successful candidates who have cleared the CFA Level 1 Exams:

✔ Start 6-8 months early

Consistency matters more than last-minute cramming.

✔ Follow the 70/20/10 rule

70% → Learn concepts

20% → Practice questions

10% → Mocks & revision

✔ Don’t ignore Ethics

It’s weighted heavily and influences borderline outcomes.

✔ Make FRA your strongest area

Its weightage alone can boost your overall score.

✔ Solve 1,500-2,000 questions

Patterns repeat even if questions don’t.

✔ Attempt 3-5 full mock exams

Build stamina – the real exam is long.

✔ Consider joining a structured coaching program

If you’re a working professional, mentoring helps maintain discipline.

Ideal Study Hours for CFA Level 1 Exams

The recommended preparation time is around 300-350 hours spread over 6-8 months.

Here’s how most successful candidates divide it:

- Concept learning: 150-170 hours.

- Practice questions: 100-120 hours.

- Mock exams & revision: 50-60 hours.

This video gives a clear overview of how to clear CFA Level 1 while working full-time:

Best Study Materials for CFA Level 1 Exams

Your CFA preparation becomes significantly easier when you use the right resources. Here’s what most successful candidates rely on:

1. CFA Institute Official Curriculum

- Most accurate

- Directly exam-relevant

- End-of-chapter questions are extremely valuable.

Use this CFA Curriculum for concept clarity.

2. Question Banks

Great for daily practice and testing understanding.

Perfect for:

- Topic-wise questions

- Exam-style logic

- Identifying weak areas

3. Mock Exams

Mocks help you build:

- Timing discipline

- Exam stamina

- Realistic test performance

Aim for 3-5 full mocks.

4. Study Notes (Summaries)

These help revise faster and simplify difficult concepts – especially FRA, Quant, and Fixed Income.

5. Professional Training Programs (Optional but very effective)

Opting for professional training is quite useful if you are:

- A working professional.

- Struggle with discipline.

- Prefer structured learning.

- Need mentorship and doubt-solving.

How Difficult Are the CFA Level 1 Exams Really?

Let’s be honest – the CFA Level 1 difficulty level is quite challenging. But not impossible. The syllabus is huge and requires consistent effort. Recent global pass rates hover around 37-42%, emphasising that consistent preparation is essential.

What makes it tough:

- Massive syllabus across 10 subjects.

- Heavy focus on financial reporting & analysis.

- New exam format for many students.

- Ethics can make or break your result.

- FRA requires a deep understanding.

- Quantitative methods can be tricky.

- Question style emphasises application.

- Need for both conceptual clarity and speed.

In essence, the CFA Level 1 difficulty comes from covering a wide syllabus in a short period. But with a structured CFA study plan, clearing Level 1 on the first attempt is absolutely possible.

Common Mistakes CFA Level 1 Candidates Make

If you want to avoid retaking the exam, avoid these:

❌ Ignoring Ethics.

❌ Memorising formulas without understanding where to apply them.

❌ Not practising enough.

❌ Not revising regularly.

❌ Underestimating quantitative methods.

Small mistakes add up at Level 1 – so prepare smart and learn efficiently for your CFA Level 1 exam.

Month-by-Month Study Roadmap for CFA Level 1 Exams

While the roadmap and study routine differ for person-to-person, here’s a simplified guide that gives you a structured CFA study plan:

Months 1-2: Build Your Basics

- Ethics fundamentals.

- Quantitative Methods.

- Economics basics.

- Solve 20-30 questions per session.

Months 3-4: Core Technical Learning

- FRA (most important).

- Equity.

- Fixed Income.

- Corporate Issuers.

- Derivatives + Alternatives basics

Month 5: Serious Practice Phase

- Start timed practice sessions.

- Finish 1,000-1,500 questions.

- Identify weak topics and work on them.

Month 6: Mock Exam Phase

- 3-5 full mocks.

- Review mistakes deeply.

- Strengthen Ethics and FRA.

- Light revision of formulas

This roadmap ensures consistency without burnout.

Exam Day Checklist – What to Carry & Expect

Avoid last-minute stress – here’s what you must carry for CFA Level 1 exams:

Carry These:

- Valid, unexpired international passport.

- Exam confirmation email (digital copy allowed).

- Approved financial calculator

- TI BA II Plus

- HP 12C

Allowed items:

- Calculator batteries.

- Water bottle (transparent, no labels).

- Sweater/light jacket without pockets.

Not allowed:

- Mobile phones

- Smartwatches

- Bags

- Notes or study material

At the test centre:

- Arrive at least 45-60 minutes early.

- Expect security checks.

- You’ll get a small locker for personal items.

- After Session 1, you’ll have a mandatory break before Session 2.

This helps set the right expectations and reduces exam-day anxiety.

CFA Exam Tips for Exam Day

If you are wondering how to crack the CFA Level 1 and walk in confidently, follow these CFA exam tips:

Time-check from the get-go: Track your time from the start. The CFA Level 1 Exams run in two sessions. Start by scanning how many questions you have in each block and estimate how much time you can assign per question (including review).

Read carefully, answer smart: Multiple-choice doesn’t mean simple. Some questions will be wordy, with traps in the phrasing. Pause, parse the scenario, then answer – don’t rush.

Flag and move on: If you encounter a question that you’re stuck on, mark it and move. Come back later if time permits. Getting stuck on a single question for too long doesn’t just eat up your time – it throws off your entire flow. Once your momentum breaks, the pressure starts piling up.

So stay focused, stay steady: Stay calm and maintain a steady pace. Short breaks don’t help during the exam – stay present. Use your natural pause between sessions to re-centre: deep breath, quickly review your time, and press on.

Final 15 minutes = review time: Think of those last 10-15 minutes as your “calm check.” Go back to the questions you marked, skim through your formulas one last time, and look out for those tiny slip-ups or errors – especially in ethics and quant, where mistakes sneak in without you realising.

When you handle your paper this way, exam day stops feeling like a fire drill and starts feeling like something you’re genuinely in control of.

Are you aiming to clear the CFA Level 1 on your first attempt? While that’s quite aspirational, it requires a structured approach. This video equips you with the tips and tricks to achieve your goals.

Is the CFA Level 1 Exam Right for You?

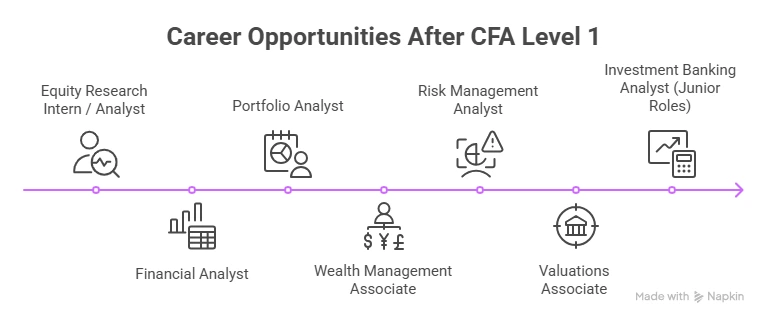

If you’re curious about the roles and pay packages you can target after clearing Level 1, you can also explore this detailed breakdown of the CFA salary in India to understand industry expectations and growth opportunities. You should consider pursuing CFA Level 1 if you want to build a career in:

- Investment banking

- Equity research

- Portfolio management

- Risk management

- Wealth management

- Asset Management

- Corporate finance

- Financial analysis

- Valuations & Financial Modelling

Clearing CFA Level 1 Exams shows commitment – a trait that finance recruiters deeply value.

It’s also ideal for:

B.Com, BBA, and MBA finance students.

Working professionals who want a global credential.

Career switchers looking to enter finance.

CFA is not ideal for a career in marketing, HR, operations, or non-finance fields.

If you want a deeper look at long-term roles across Level 1, 2, and 3, check out this guide on career opportunities after the CFA Certification for a complete roadmap.

The Imarticus Advantage for CFA Level 1 Exams

If you want structured preparation, industry guidance, and a clear CFA study plan, Imarticus Learning can make a real difference.

With Imarticus, you get:

- Live faculty-led classes

- CFA Institute-aligned curriculum

- Doubt-solving sessions

- Topic-wise quizzes & assignments

- Mock exams & exam strategies

- Revision bootcamps

This guided approach not only enhances your understanding but also significantly boosts your chances of clearing the CFA Level 1 Exams on your first attempt.

FAQs About CFA Level 1 Exams

If you still have doubts, these frequently asked questions about the CFA Level 1 Exams will clear things up.

What exactly are the CFA Level 1 Exams?

Think of the CFA Level 1 exam as your official entry point into the CFA world. It checks whether you understand the fundamental tools of finance – ethics, investment basics, financial reporting, numbers, analysis – all the stuff you need before diving into the deeper, more demanding content in Levels 2 and 3. It’s your foundation layer.

How many exams are there for CFA Level 1?

Just one. Level 1 comes as a single computer-based exam that covers all topics in the CFA Level 1 syllabus. Clear this, and you “unlock” Level 2 – literally like progressing to the next level in a game. One exam, one big milestone.

How difficult are the CFA Level 1 Exams?

CFA Level 1 exams can feel tough in the beginning, mainly because the syllabus is huge. The paper thoroughly assesses whether you understand the concepts and can apply them in different scenarios. Once you get used to that style through practice questions and mocks, the whole thing starts to feel much more manageable with the right strategy. And if you’re learning with expert guidance, mock-driven preparation, and doubt support – like at Imarticus Learning – the entire process feels even more structured and doable.

Is 60% enough to pass CFA Level 1?

There’s no fixed 60% rule for passing. The CFA Institute sets a new cut-off for every exam window. A good benchmark is to score 70% or more in your mocks, which usually puts you on safe ground.

What if I fail the CFA Level 1 Exams?

One exam result doesn’t define your CFA journey at all. If you don’t clear the CFA Level 1 Exams, don’t worry. You can register for the next exam window and retake it. The key is to learn from your experience and mistakes, focus on weaker areas, and come back stronger. Imarticus Learning’s structured CFA Level 1 program supports you every step of the way with expert mentorship, mock tests, and a clear roadmap to success.

How many Indians pass CFA Level 1?

The exact number of Indian passers isn’t published separately, but India is among the top markets for CFA – thousands attempt it each year. With good preparation, many Indian candidates clear Level 1 with flying colours.

What topics are hardest on Level 1?

It varies for everyone, but many students find Fixed Income, Derivatives, FRA, and Ethics a bit tricky. These topics require real understanding and practice – you can’t just mug up and hope for the best.

What is included in the CFA Level 1 syllabus?

The CFA Level 1 syllabus covers 10 key topics: Ethical and Professional Standards, Quantitative Methods, Economics, Financial Reporting & Analysis, Corporate Issuers, Equity Investments, Fixed Income, Derivatives, Alternative Investments, and Portfolio Management. Imarticus Learning helps break down these complex subjects into manageable parts, so you build a strong foundation from day one.

What is the exam pattern for CFA Level 1?

The CFA Level 1 exam has 180 MCQs, split into two sessions of 2 hours and 15 minutes each. Imarticus Learning offers guidance on mastering this exam pattern through timed practice sessions and real exam simulations.

How long does it take to prepare for the CFA Level 1 Exams?

Most students spend approximately 300 hours preparing for the CFA Level 1 exams, usually over 5-6 months. It’s very doable when you spread it out. At Imarticus Learning, the study plan is built to keep things balanced – a mix of concept learning, weekly practice, and regular mock tests so you’re never cramming at the last minute. Plus, having mentors check in on your progress makes it much easier to stay motivated and stick to the plan.

How many hours should I study for CFA Level 1?

The hours of study required are subjective and depend on your pace of learning, previous experience, and background. Usually, most students spend 250-350 hours preparing for the CFA Level 1 exams. Dedicating 10-12 hours per day or following a routine that suits you consistently is the key to acing your exams. Programs like Imarticus Learning make this even easier with structured plans and mentor-led guidance.

Are mock tests important for the CFA Level 1 Exams?

Yes, they are extremely essential. Mocks are basically your rehearsal for the real exam. They help you understand timing, question style, and identify your weak areas. Many candidates say mocks made the biggest difference in their final result.

What are the job opportunities after clearing CFA Level 1?

CFA Level 1 shows employers you’re serious about finance. You can work in roles like:

Research Analyst, Investment Banking support roles, Equity or Risk Analyst, Wealth Management Associate, and Corporate Finance roles. It’s a strong starting point, and the opportunities grow as you progress through Levels 2 and 3.

Your Path to Cracking the CFA Level 1 Exams

The CFA Level 1 Exams may seem challenging. Still, with the right CFA study plan, a smart approach to the CFA Level 1 syllabus, and consistent practice under the CFA exam pattern, clearing the exam becomes absolutely achievable. Whether you’re a student, working professional, or someone switching into finance, Level 1 is your gateway into a rewarding global finance career.

With structured classes, expert guidance, and mock-driven preparation, the CFA training program at Imarticus Learning can help you build confidence, stay disciplined, and improve your chances of clearing the CFA Level 1 Exams on your very first attempt.

Your CFA journey doesn’t have to be confusing or stressful. Start right, stay consistent, and let the CFA Certification become the foundation of your global finance career.