Introduction

Possibly one of the most lucrative finance career options, investment banking rewards aggressive professionals with high salaries, large bonuses, and rapid career advancement. But with this high potential for pay comes long hours, excessive stress, and intense competition.

So how much do investment bankers really earn, and how does their pay compare to other finance careers?

Here we will go deeper:

✔ Salary structure based on experience in investment banking.

✔ Bonus minus salary calculation and explanation of why bonus exceeds salary.

✔ Average investment banking salary vs. other finance professions such as corporate finance, equity research, and asset management.

✔ Salary growth in investment banking, expectation—time taken to reach ₹1 crore+ annually.

✔ Influences on investment banking compensation such as geography, bank reputation, and economic conditions.

✔ FAQs and a distinct career path for an individual who wants to enter the career.

At the completion of this guide, you will have a clear idea of whether investment banking pay is worth the hard work and long hours.

Factors That Influence Investment Banking Compensation

Unlike the majority of corporate careers whose compensation scales have a rigid framework, investment banking salaries and bonuses are allocated based on varying factors.

1. Experience & Seniority

Your level of experience in investment banking directly influences your salary.

Entry-Level (Analyst, 0-3 years experience):

- Analysts are freshly graduates hired by investment banks.

- They get a base salary with a reasonable bonus (20-50% of base salary).

- Responsibilities are financial modeling, research, preparing pitchbooks, and supporting senior bankers.

Mid-Level (Associate & VP, 4-10 years of experience):

- Associates are promoted from Analysts or directly recruited post-MBA from the top ranks of business schools.

- Vice Presidents manage deals, handle client relationships, and oversee junior bankers.

- Compensation is considerably greater, and bonuses are considerably increased (50-150%).

Senior-Level (Directors & Managing Directors, 10+ years of experience):

- Directors and MDs handle client solicitation, closing large transactions, and firm profitability.

- Their compensation is heavily commission-based, with bonuses over 200-300% of base pay.

- Top MDs at global banks easily earn ₹5 crore+ annually.

2. Type of Bank (Bulge Bracket vs. Boutique)

Your pay differs depending on whether you are employed by a Bulge Bracket bank or an Elite Boutique bank.

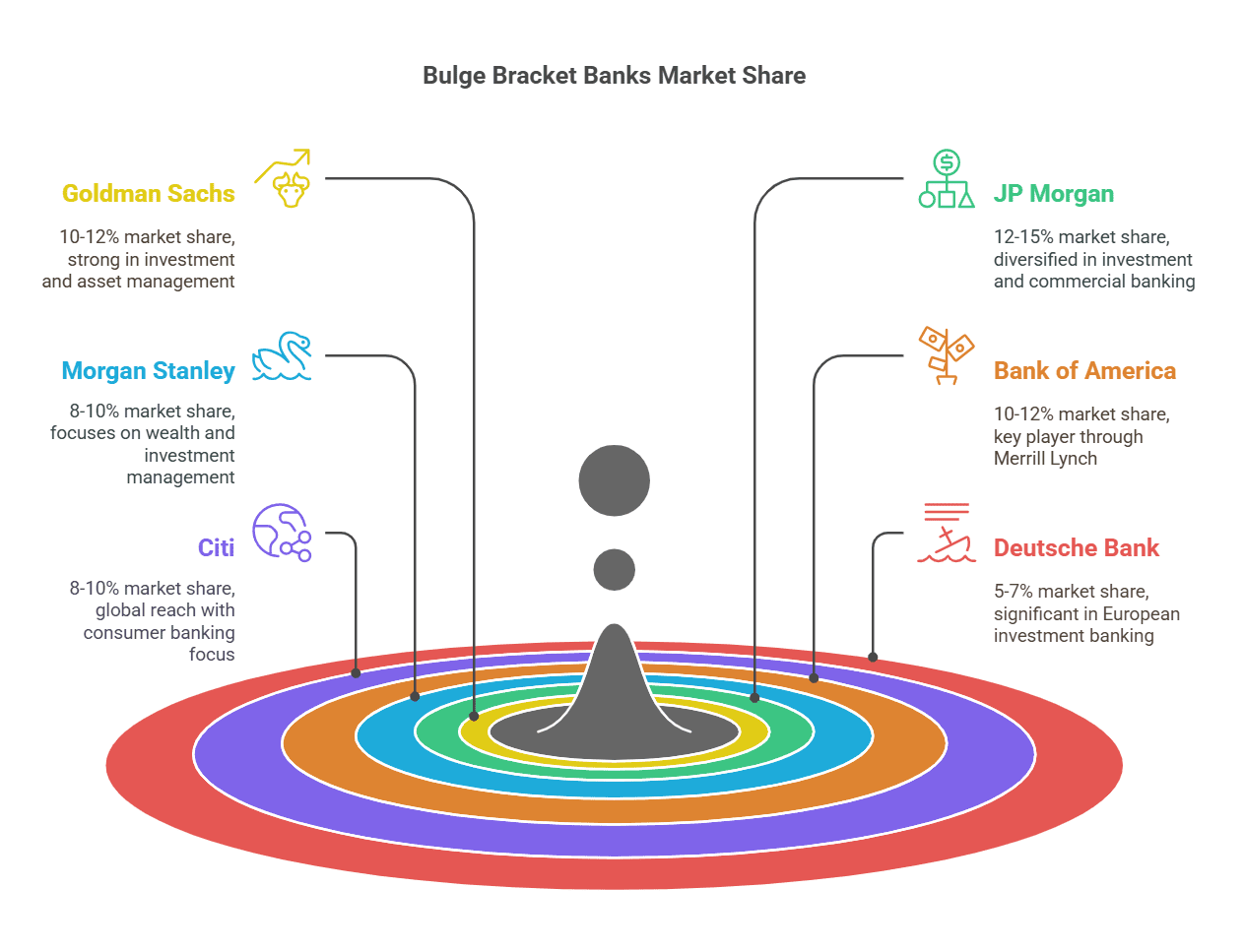

Bulge Bracket Banks (Global Top-Tier Banks)

- Includes Goldman Sachs, JP Morgan, Morgan Stanley, Bank of America, Citi, Deutsche Bank.

- Highest paying salaries, largest bonuses, and best exit opportunities are given by these companies.

Elite Boutique Banks (Specialist Investment Firms)

- Evercore, Moelis, Lazard, Greenhill, Rothschild.

- Compensation is comparable to bulge bracket banks, but with higher bonuses.

Mid-Market & Regional Boutique Banks

- Lower pay than bulge brackets, with bonuses usually 30-50% of base salary.

- These firms have less demanding work environments but fewer high-profile deals.

3. Location & Cost of Living

Investment banking salaries are highly different by location.

Highest Paying Cities:

- New York & London – Base salary of ₹1-2 crore+ for VPs & Directors.

- Hong Kong & Singapore – Similar to the US & UK but with tax advantage.

- Mumbai & Dubai – Less than NYC salary but highly competitive.

Emerging Markets (India, UAE, Southeast Asia):

- Salaries of ₹10 lakh to ₹1 crore+, depending on firm and experience.

- Less cost of living, therefore, real purchasing power is good.

4. Economic & Market Conditions

Investment banking compensation is market-sensitive.

Bull Markets (Years of High Growth)

- Good economic times are followed by record deal-making that results in greater bonuses and pay rises.

- Example: In 2021, investment banks saw record revenues, which led to 40-50% bonus rises.

Bear Markets (Recessions & Market Crashes)

- In bad times, hiring comes to a halt, wages don’t budge, and bonuses are slashed.

- Example: Investment bankers in 2008 had salary reductions of 30-50% because of the financial crisis.

Investment Banker Salary Structure: A Detailed Breakdown

Investment bankers do not get a monthly salary in the classical sense. Their compensation includes:

1️⃣ Base Salary – Fixed, regular annual salary.

2️⃣ Performance-Based Bonuses – Individual & firm performance-based.

3️⃣ Stock Options & Long-Term Incentives – Equity-based incentives for senior staff.

Salary by Job Title (India & Global Comparison)

| Position | Base Salary (INR) | Bonus (% of Salary) | Total Compensation (INR) |

| Analyst (0–3 years) | ₹10 – ₹25 lakh | 20% – 50% | ₹12 – ₹35 lakh |

| Associate (4–6 years) | ₹25 – ₹50 lakh | 50% – 100% | ₹40 – ₹80 lakh |

| Vice President (7–10 years) | ₹50 lakh – ₹1 crore | 80% – 150% | ₹90 lakh – ₹2 crore |

| Director (10–15 years) | ₹1 crore – ₹2 crore | 100% – 200% | ₹2 crore – ₹4 crore |

| Managing Director (15+ years) | ₹2 crore+ | 150% – 300% | ₹5 crore+ |

(Source: Quintedge)

Investment Banking Compensation vs. Other Finance Careers

| Career | Avg Salary (INR) | Bonus (%) | Total Compensation (INR) |

| Investment Banking | ₹25 lakh – ₹5 crore | 50% – 300% | ₹50 lakh – ₹10 crore+ |

| Corporate Finance | ₹8 – ₹30 lakh | 20% – 40% | ₹10 – ₹40 lakh |

| Equity Research | ₹8 – ₹40 lakh | 10% – 50% | ₹10 – ₹50 lakh |

| Asset Management | ₹12 – ₹40 lakh | 10% – 60% | ₹15 – ₹50 lakh |

(Source: Glassdoor)

Secure a Job in the Investment Banking Industry in 2024

FAQs on Investment Banking Compensation (H2)

1. What is the average investment banking salary in India?

The average investment banking salary for an entry-level analyst in India ranges between ₹10 to ₹25 lakh annually. Mid-level roles like Associates and Vice Presidents can earn ₹40 lakh to ₹1 crore, while Managing Directors may earn over ₹5 crore per year, including bonuses.

2. How much of an investment banker’s compensation comes from bonuses?

Bonuses play a huge role in investment banking compensation, often accounting for 50% to 300% of the base salary, especially at senior levels. High performers and dealmakers can earn multi-crore bonuses annually.

3. Which banks offer the highest-paying investment banking jobs?

The highest-paying investment banks include Goldman Sachs, JP Morgan, Morgan Stanley, Bank of America Merrill Lynch, and Citi Group. These banks offer top-tier base salaries, significant bonuses, and lucrative long-term incentives like stock options.

4. What is the salary growth in investment banking over 10 years?

Salary growth in investment banking is rapid. An analyst earning ₹15 lakh per annum can reach ₹1 crore+ as a Vice President within 7-8 years. Those who reach Director or MD positions within 10-15 years may earn ₹2–5 crore or more annually.

5. Do investment bankers in India earn as much as those abroad?

While base salaries in India are lower compared to the US or UK, the investment banking compensation in India is still among the highest in the country’s finance sector. When adjusted for cost of living, it’s highly competitive.

6. How do investment banking bonuses compare to other finance roles?

Compared to corporate finance or equity research, investment banking bonus trends are significantly more aggressive. Corporate finance bonuses usually range from 20% to 40%, while IB bonuses can exceed 100% even at mid-level roles.

7. Is investment banking worth it for the money?

Financially, yes. Investment banker salary structures are among the best in the industry. However, it comes at the cost of long hours, high pressure, and a demanding lifestyle. It suits individuals who thrive in competitive, high-stakes environments.

8. Can you negotiate your salary in investment banking?

While base salaries are typically standardised by role and firm, bonuses and performance incentives are often negotiable—especially at mid and senior levels. Negotiation can also happen during lateral moves or promotions.

9. Do investment bankers receive stock or equity as part of their pay?

Yes. Senior professionals (VPs and above) often receive long-term incentives like stock options or restricted stock units (RSUs) as part of their total compensation. This ties their financial rewards to the performance of the firm.

10. What skills increase your earning potential in investment banking?

Mastering financial modelling, deal execution, client management, and leadership can lead to faster promotions and higher bonuses. Certifications like CFA or completing programs such as the Imarticus Certified Investment Banking Operations Professional Program can also accelerate your growth.

Conclusion: Is Investment Banking Worth It?

✔ Investment banking is the best paid finance career, with salaries growing very quickly at every level.

✔ Bonuses can reach as much as 300% of base pay, so income is highly volatile.

✔ The career is incredibly demanding, with 80-100 hour workweeks.

Ready to get into investment banking? Enrol today at the Certified Investment Banking Operations Professional (CIBOP) Program today to get your dream job!