The world of finance is changing with a fast pace, as is the expectation of the best employers. To stand out in today’s global economy, the professionals need to have strategic, analytical, and leadership capabilities. That is where the US CMA certification becomes the game-changer. The CMA holds the certification of the IMA, USA, which is acceptable all over the world as the best certification of a management accountant.

US CMA certification by the US is recognized across the world in over 170 nations and has picked up immense speed in India due to its quick time period (6–8 months per level), real-world application, and sound return on investment. As an employed professional or a student, this certification has the potential to unlock opportunities with Fortune 500 organizations, Big 4 accounting firms, and top MNCs.

What Is the US CMA Certification?

CMA certification is a globally recognized certification that comprises 12 skills which finance professionals in today’s times are required to possess. They are accounting, analytics, planning, budgeting, and risk management, among others.

Advantages of US CMA certification in 2025 are:

- 170+ worldwide recognition across nations

- Excellent job placement in multinational companies

- Strategic training with practical exposure

- In-depth syllabus which encompasses finance, business, and analytics

Why Choose US CMA in 2025?

1. Fast-Track Credential

Unlike other finance certifications of 3–5 years, US CMA certification is possible in 6–8 months for both levels, faster entry into the professional market.

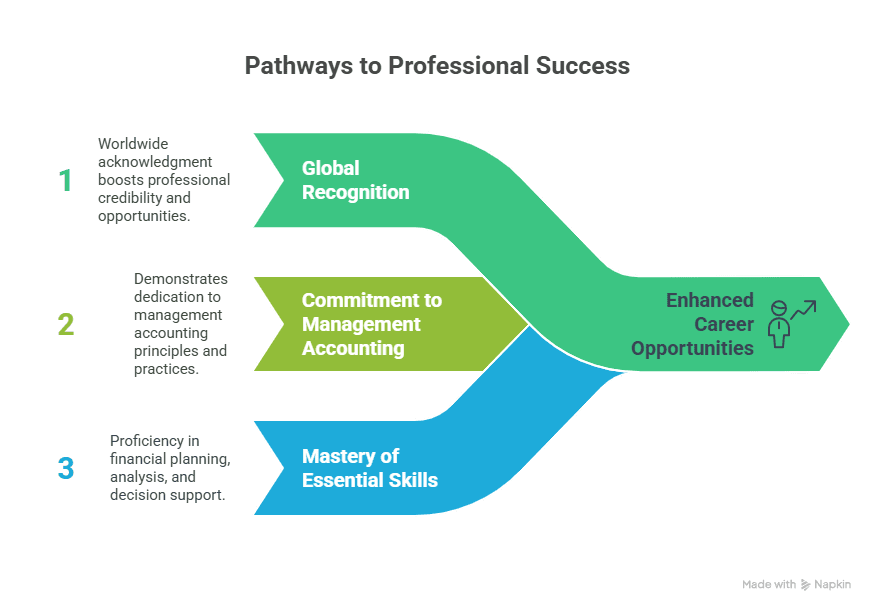

2. Global Recognition

With more than 1,40,000 members spread across the world as of 2025, CMA members confirm the increasing faith in this certification.

It’s particularly useful for foreign job seekers who are submitting their resumes for foreign jobs.

3. Industry-Driven Curriculum

It spans broad areas of core concepts relevant in actual business situations:

- Financial reporting and analysis

- Budgeting and forecasting

- Risk management

- Technology and analytics

4. High Salary Potential

US CMA certification test takers witness salary increase of 58% at the time of completion of course, from ₹7.5 LPA to ₹18 LPA and above.

5. Job-Ready Skillset

The course equips test takers for actual use in finance, accounting, analytics, and strategy—job-ready day one.

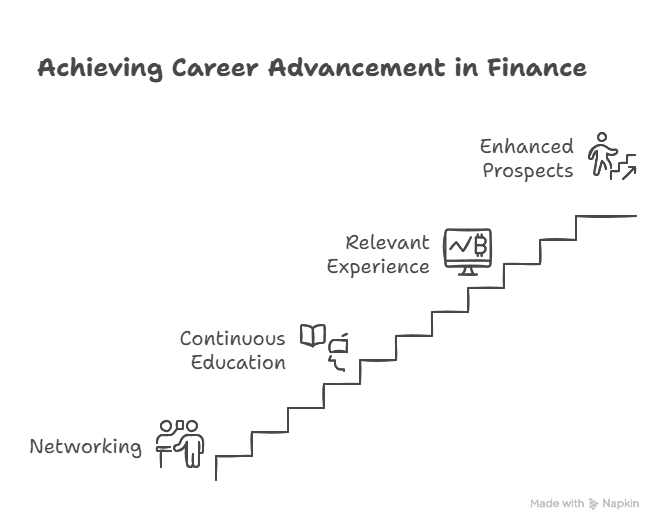

Career Growth with CMA USA: What to Expect

Rapid Promotions

CMA professionals will assume strategic positions such as Financial Controller, FP&A Manager, and Cost Analyst in 3–5 years.

International Career Opportunities

US CMA career opportunities reach US, UAE, Singapore, UK, and global top-notch companies.

Preferred by Fortune 500

Amazon, Deloitte, PwC, Capgemini, J.P. Morgan, and Wipro recruit CMA-certified individuals.

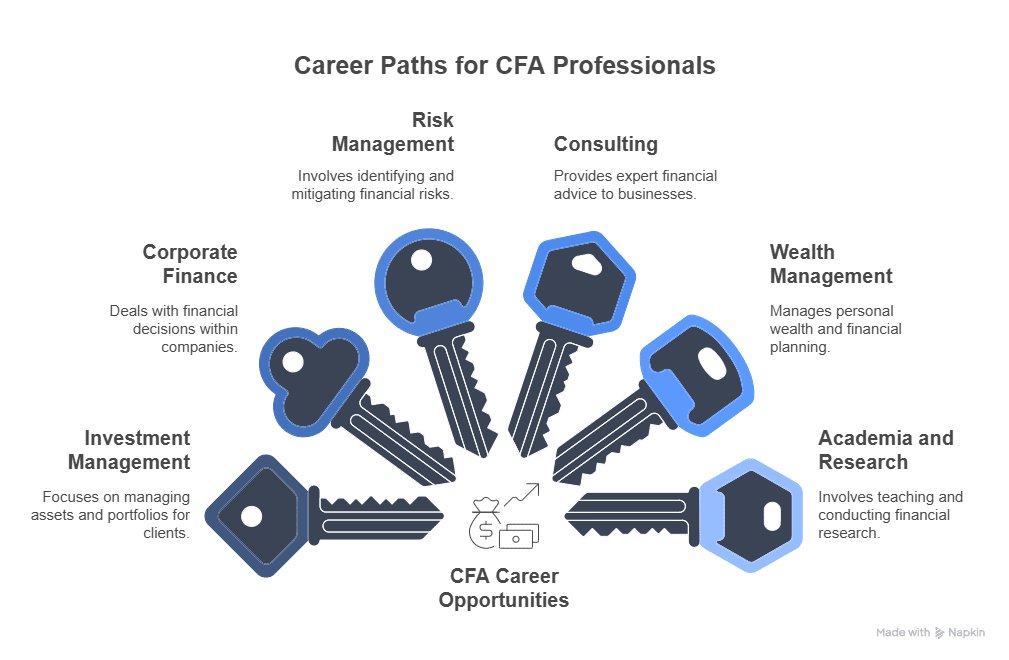

Specialised Career Paths

- Financial Analyst

- Budgeting Specialist

- Risk Analyst

- Cost Accountant

- Strategic Finance Consultant

Benefits of US CMA Certification for Indian Professionals

US CMA jurisdiction in India is expanding as a result of the growth of multinational companies and increasing financial disclosure requirements. Indian candidates will benefit as follows:

- Global Curriculum, Local Relevance: International training with India market relevance

- Global Pay Scale: International-level compensation package

- Big 4 and Indian MNCs recognition

- Chance of Fast-track positions in finance, strategy, and compliance

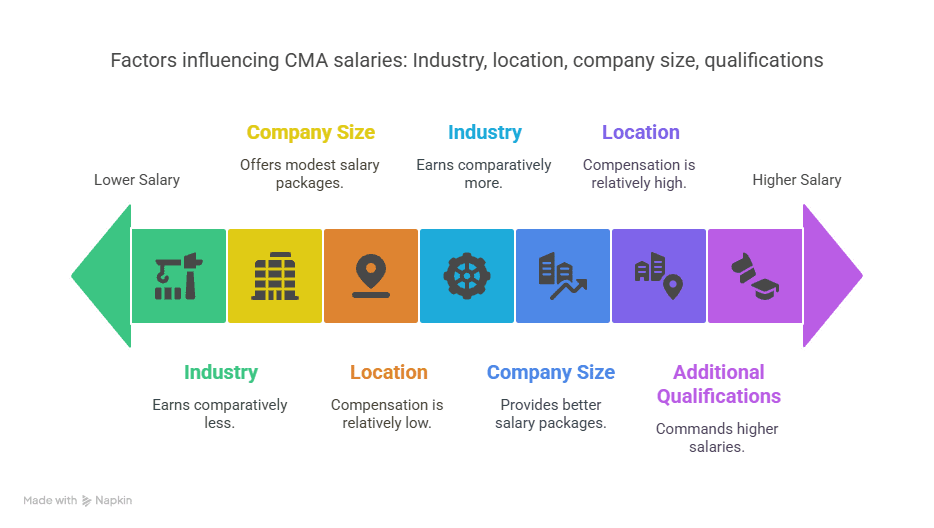

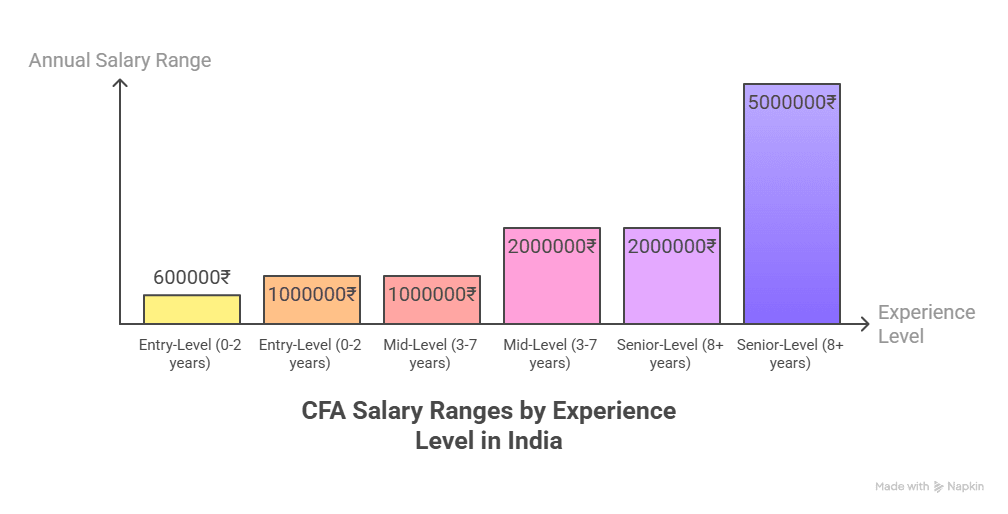

US CMA Salary Potential in 2025

The US CMA salary opportunity keeps increasing, and particularly with work experience and certification. According to industry facts:

| Experience Level | Average Salary (INR) |

| Freshers | ₹7.5 – ₹10 LPA |

| Mid-Level | ₹12 – ₹18 LPA |

| Senior-Level | ₹20 – ₹35 LPA+ |

These are a reflection of the significant career progression with CMA USA.

US CMA Job Opportunities in 2025

The US CMA profession is full of work opportunities with good compensation packages, international exposure, and leadership positions:

- Financial Analyst – Budgeting, analytical suggestions, decision-making

- FP&A Specialist – Planning budgets, predicting the future, building fiscal models

- Risk Analyst – Rule compliance and risk minimization

- Cost Accountant – Process efficiency, cost planning

- Controller – Reporting, audit, strategic planning

- Finance Manager – Fiscal operations and financial strategy overall

These US CMA career prospects are promoted in sectors such as IT, FMCG, BFSI, Consulting, and others.

Why Imarticus Learning Is the Best Choice for CMA Preparation?

Imarticus Learning, being the first and sole licensed prep partner for the global leading four accounting and finance certifications—CMA included—provides:

1. Live Online Learning

Interactive live classes with thorough treatment of all topics

2. Expert Faculty

Counselling through faculties with CMA, CA, CPA, and CFA backgrounds

3. Unlimited Learning Access

Surger-powered tools like e-books, MCQs, mocks, flashcards, and so on

4. Job Readiness

Big placement boot camps like resume creation, mock interview, and soft skills

5. Money-back Guarantee

If you fail your exams, Imarticus will reimburse 50% of course fees (T&Cs apply)

FAQs on US CMA Certification

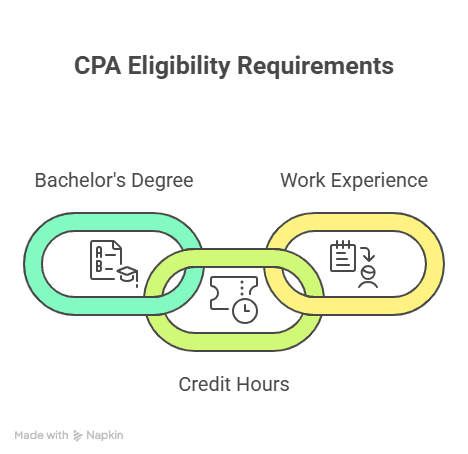

Q1: What is the eligibility for US CMA?

Graduates or final-year students in Commerce, Accounting, and Finance.

Q2: How long does it take to complete the US CMA course?

It takes 6–8 months to finish both sections of the US CMA exam.

Q3: Is US CMA worth it in 2025?

Yes. With world acceptability, excellent ROI, and quick career advancement, US CMA is even more deserving now.

Q4: What is the salary potential of a CMA in India?

It offers freshers ₹7.5–₹10 LPA, and experience holders ₹20 LPA and above.

Q5: Does CMA help in getting international jobs?

Yes. It’s accepted in 170+ countries and appreciated by multinational companies.

Q6: What are the top companies hiring CMA-certified professionals?

Amazon, Deloitte, PwC, Accenture, Genpact, and Tata Group to name a few.

Q7: Can I get placement support after US CMA?

Yes. Imarticus guarantees interviews and full placement assistance.

Q8: What are the job roles I can get after CMA?

Financial Analyst, Cost Accountant, Controller, FP&A Specialist, Risk Analyst, etc.

Q9: Is US CMA better than Indian CA?

Both are useful, but US CMA provides faster ROI, worldwide availability, and strategic emphasis.

Q10: What is the pass rate for US CMA exams?

Worldwide pass rates of approximately 45–50% for each part, and even higher with intensive training.

Conclusion: US CMA Certification—Your Global Career Catalyst

In a world where business success is driven by financial strategy, analytics, and global compliance, the US CMA credential enables professionals to take charge.

Whether your goal is to boost your pay cheque, transition to a multinational organization, or move into a strategic position—this credential is priceless.

With proper preparation, expert guidance, and placement assistance from Imarticus Learning, your journey to reaching a satisfying career after US CMA starts today.

Select the Money World of Finance by selecting Select US CMA in 2025 for Confidence.