As we are well into this digital revolution, it won’t be long before we acknowledge the emerging use of AI in investment banking. The common questions now seem to be “Will AI take over investment banking?” This question evokes both excitement and dread in equal measure. The idea of AI replacing financial analysts and investment strategists is shocking, but perhaps also inevitable. But how far away are we from this conclusion? And what do these robots mean for the future of jobs in banking?

As we walk through this blog together, we will address some of these difficult questions and examine the future of AI in investment banking. We will explore some illuminating facts, industry expert findings, and potential implications for job titles in the sector. It doesn’t matter if you are an established investment banker, a financial student, or a technology enthusiast; the conclusions we reach could give fascinating insights into a future we may all be heading into.

AI in Finance – We are Rather Close to Some Job Changes

As technology marches ever forward, careers march along with it. Although technology is an entirely separate sector, the borrowings and implementations often carry across numerous sectors, including the high-stakes investment banking sector. AI is no longer a “futuristic concept”; it is reshaping the task and decision management process of the financial industry, serving as a game-changer.

To say that AI is having an impact is an understatement. We are using it to replace mundane tasks, improve the decision-making process, and provide a predictive phenomenon that could not be achieved otherwise. The following is how it will change jobs in investment banking,

- Automating Routine Processes: Artificial intelligence is transforming the investment banking industry by streamlining time-consuming, repetitive tasks. With applications ranging from daily tasks to more tedious ones, such as data entry and financial reporting, AI enables bankers to optimise their time, focusing on other critical aspects of their jobs.

- Shifting from Manual Risk Assessment to Predictive Analysis: Investment banking careers will shift focus from manual risk assessment practices to risk assessment techniques that incorporate AI analytics, allowing bankers to move with more data in less time and provide timely risk assessments and informed forecasts relative to their opportunities.

- Client Engagement: AI-driven chatbots or virtual assistants are changing the banking customer service experience. AI can automate customer service considerations by engaging with clients on behalf of bankers 24/7 while improving customer satisfaction rates through personalisation.

It should be stated that AI introductions into investment banking will not replace the human element of the profession; however, they enhance the human efforts. As banks choose to rely on AI to automate their routine tasks, this will allow investment bankers to focus their time towards additive activities such as client engagement, critical thinking, and exploratory problem-solving. This should not discourage investment banking employees from updating their skills or learning new ones for the future. Let the use of AI be an exciting opportunity and expansion, and not as a threat to the future.

Looking Ahead: The Role of AI in the Future in Investment Banking

The growth of Artificial Intelligence (AI) is expanding rapidly. Some populations are concerned that its ramifications can be seen through the lens of opportunities, as the potential for AI to disrupt many industries, and the investment banking industry is no exception. Many people are asking themselves the appropriate question: Can AI take an investment banking job?

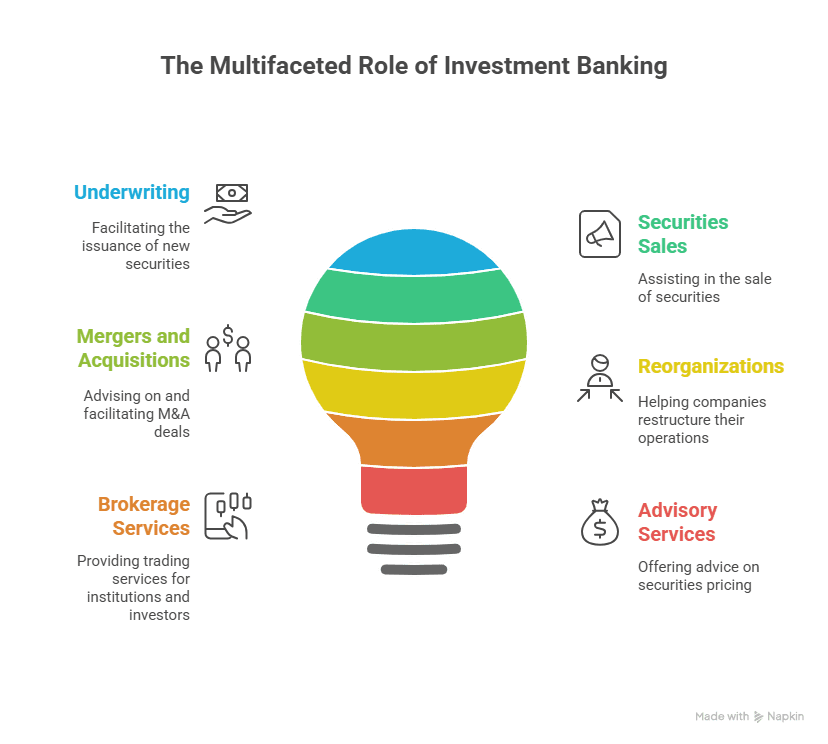

In many ways, AI will have an impact on investment banking. Here are just a few ways AI has made some advances:

- Risk Management: AI algorithms can predict various market forces, helping to reduce risk when making investments.

- Fraud Detection: AI is capable of finding irregularities in financial transactions, which will drastically reduce fraud.

- Trading: AI systems perform trades faster and more efficiently than human beings.

However, it may be a bit of an exaggeration to say that AI will entirely take away all investment banking jobs. Here is why:

- No ability to understand emotion! AI will look at a dataset faster than a human, but AI will not have the emotional intelligence to grasp what a client wants or build a client relationship, which are essential in investment banking.

- AI will need human beings to oversee AI systems to ensure ethics and legal compliance.

| AI | Human | |

|---|---|---|

| Risk Analysis | High | Moderate |

| Relationship Development | Low | High |

| Legal Oversight | Low | High |

Overall, AI has the potential to change (for the most part) the way humans complete an investment banking assignment instead of eliminating human roles. The future will have both AI and investment bankers working hand-in-hand, allowing both the direct and cognitive sides to produce the most optimal output.

Artificial Intelligence’s Impact on Jobs in Investment Banking

As we move into an era of artificial intelligence (AI), many professionals are asking, “What jobs in IB will be safe from AI?” Indeed, the move towards AI in investment banking is inevitable. Nevertheless, it is not an end-of-days scenario for IB roles as some might suggest.

AI will take over the mundane, monotonous work of processing data, data analysis, and basic risk management, making AI a complement and asset, not a replacement. While IB jobs will change, especially in areas like risk management, trading, and data processing, AI is not an elimination or replacement of those roles. Here are a few reasons why:

- Human Element: AI has limitations in replicating the human element. Roles that involve negotiations, relationship management, and understanding client needs can still have a human component and contribution.

- Complex Decision Making: Without question, senior roles involving complex decision making and strategic planning can’t be accomplished with the same level of depth and market understanding as only humans can provide.

- Regulatory Compliance: AI can provide an enhanced and efficient means to make investment banks profitable, but this will require additional human efforts to ensure compliance with regulators.

AI will be the start of new avenues for finance professionals to leverage their time towards expanding their roles, and not be lost without prison. In fact, it will be an asset that will help us work smarter. Investment banks must adapt to this trend and capitalise on it, as this will benefit their careers.

The Brave New World of AI in Investment Banking

With the rapid emergence of technology developments, people are becoming increasingly concerned with one looming question: “When will AI replace bankers?” However, the answer is not as simple to identify.

AI in investment banking is already being used and will continue to grow. Specific examples where AI is now influencing our industry include data mining, algorithmic trading, and predictive analysis. AI is capable of processing vast amounts of data to provide essential insights that could impact investment decisions. Nonetheless, will AI replace investment bankers? The chances are mixed, for several reasons:

- Human Touch: AI can process data quickly, but it lacks the human touch often necessary to build client trust and relationships, which is the most essential piece of investment banking.

- Ethics: Investment bankers’ job operations often involve ethical decisions or issues, which AI, as an algorithm, may not be able to make.

- Market Understanding: Financial markets are complex, and the unpredictable nature might require human intuition that AI may never understand.

For these reasons, investment bankers can see AI as an ally instead of a replacement. AI in investment banking is intended to complement human roles and streamline functions, leading to increased efficiency in bankers’ job functions. By embracing the AI revolution in banking, investment banks could see improved decisions, better efficiencies, and enhanced client service.

In conclusion, while AI will have a significant impact on the future of investment banking, it won’t eliminate human bankers. The integration of AI and human intelligence will ultimately shape the future of investment banking.

AI and its Consequences on Investment Banking.

The introduction of artificial intelligence (AI) has sparked considerable discussion about its future impacts on various sectors across the economy and the investment banking sector. One of the most common questions that is asked is this: ”What will investment bankers do when AI arrives?”

The answer is not simple, and the impact on investment banking will likely be multi-dimensional:

- Risk Assessment: AI will have the ability to sift through a large number of data sets and find patterns much quicker than a human could. This may drastically improve risk assessment. Despite this, investment Bankers know how to interpret these findings, and when, where, and why to take these actions.

- Portfolio Management: AI should be able to automate some parts of portfolio management. However, an investment banker also needs to understand their client’s financial goals and appetite for risk. AI can not (yet) mimic human personalisation and judgment.

- Regulatory Compliance: AI can help with compliance, but investment bankers will need to be aware of the changes as well as their implications.

Overall, AI will likely be an adaptive process for investment bankers. AI will assist them as a tool, evolving and changing the nature of their daily work, allowing them to focus on more critical work that AI cannot replicate.

So, as a follow-up on the above, one of the questions regarding “what will investment bankers do when AI arrives?” is going to be to adapt. Investment bankers will need to acquire new skills and knowledge to collaborate with AI-driven commissions effectively. They will learn not to see it as a replacement, but as a tool to improve their tasks and coordination. The future of investment banking with AI will undoubtedly be less reliant on replacement and more reliant on cooperation. Those who adapt will succeed (as per usual).

Becoming a professional in investment banking can be a scary process without the relevant guidance, skills and experience. This is where Imarticus Learning comes in with their detailed investment banking course with placement, giving a framework to anyone who dreams of working in this exciting industry. This customised course is created to match the current trends in banking, such as the role of AI in investment banking. The investment banking course combines theoretical content with practical application, ensuring learners possess the skills necessary for success in investment banking operations. The investment banking course includes modules on AI, beginning to recognise how AI transforms modern banking operations. If you take this course, you could gain a competitive advantage in this field, which could lead to various job opportunities. So, whether you have no prior experience or are a professional looking to upskill, this course could be the foundation for a career in investment banking.

Frequently Asked Questions

Will AI replace investment bankers in the future?

It is hard to say definitively if AI will replace investment bankers in the future. However, what is certain is that AI is being used more and more in investment banking. Investment banks are using AI to complete tedious tasks, analyse large amounts of data, and predict what’s next in the markets. While this may decrease demand for traditional investment banking positions, it seems likely to change the way these positions are structured, rather than eliminating them outright. Investment bankers will need to adapt to the inevitable changes in the industry by acquiring new skills and leveraging AI to support their work.

What are the potential advantages of AI in investment banking?

AI has several potential benefits when it comes to investment banking. One significant benefit is the speed and accuracy with which it can assess large swaths of data – this can help investment bankers make more informed decisions about when and where to invest. AI could also automate routine tasks, allowing investment bankers to spend more time on complex issues requiring planning. Finally, AI could enhance compliance by catching errors early and proactively flagging issues.

What are the potential disadvantages of AI in investment banking?

While there are many upsides to investment banking utilising AI, there are also potential disadvantages. For example, when tasks are automated, job loss may occur in those areas. There is also the chance that AI could be wrong or used for manipulation or slime, leading to an investor’s loss. Privacy and ethical concerns may also be raised through the use and distribution of AI, through the potential use of personal data.

How is AI currently being used in investment banking?

There are many different ways that AI can be utilised in investment banking. For example, robo-advisors are an increasingly prevalent implementation of AI in providing financial advice and managing portfolios. AI is used in evaluating financial markets and trends to assist with informed decision-making. AI systems are even being used to automate more routine tasks such as report and document creation, enabling bankers to focus on a more multifaceted range of functions.

What skills will investment bankers need to succeed in an AI-driven world?

As AI becomes commonplace in investment banking, the skills required to succeed in that area will likely evolve. Investment bankers will need to understand how AI works and how to best leverage it. This could involve learning.