If you’ve been exploring a General Management Course in Dubai, you’ve probably noticed how many options are out there. It can feel overwhelming, right? But there’s one name that consistently comes up in conversations about serious leadership training: IIM Ahmedabad’s General Management Programme (GMP).

And there’s a reason for that. This Dubai leadership course isn’t just about adding a new line to your CV — it’s about transforming the way you think, lead, and make decisions.

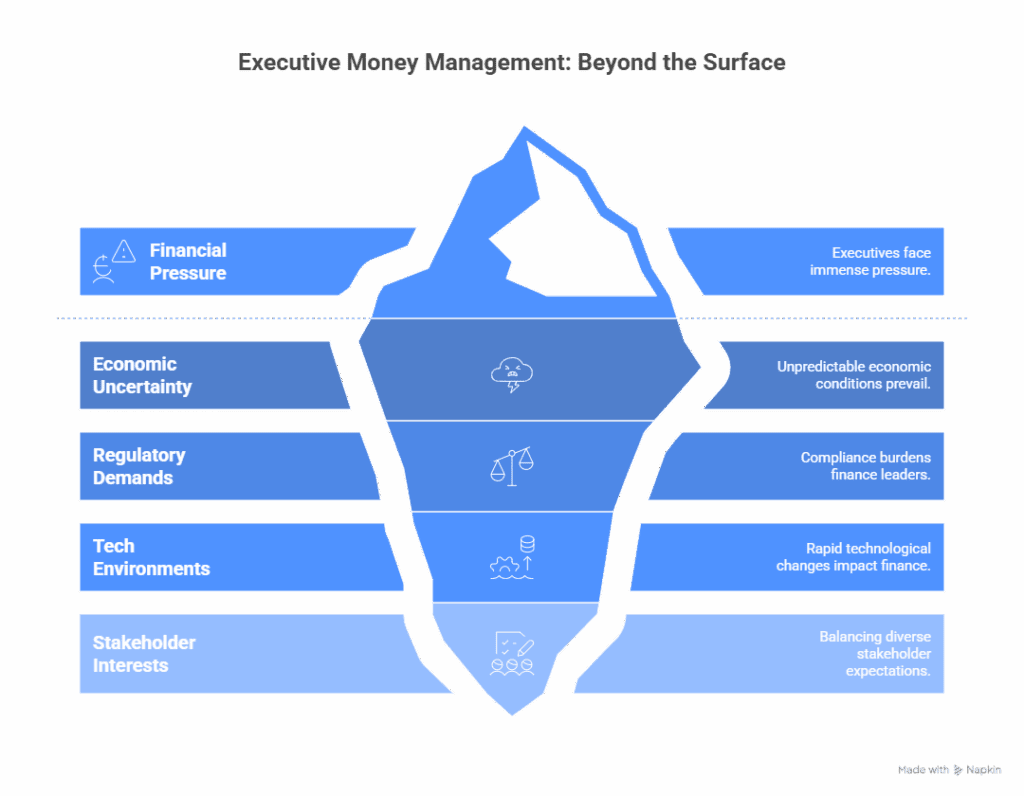

In today’s fast-moving business world, employers don’t just want functional managers; they want leaders who can connect the dots across finance, operations, people, and strategy. That’s exactly the kind of leader this programme is designed to build.

Why IIM Ahmedabad’s GMP Catches Attention

When I looked closely at what makes this programme different, a few things stood out immediately. First, the blend of old-school rigour and future-facing content. You’re not just memorising theories — you’re pushed to solve problems the way top executives do, using real business cases and frameworks that actually work under pressure.

Second, the global recognition. Say “IIM Ahmedabad” in a business conversation, and people listen. That credibility matters — whether you’re trying to break into the Middle East market, scale your own company, or step into a global leadership role.

And finally, the location itself. Dubai is buzzing with opportunities, with foreign investment growing year after year. Studying here means you’re not learning in isolation — you’re surrounded by a live lab of multinational companies, startups, and cross-border business deals happening in real time.

This snapshot of the only IIM with a direct presence in Dubai would be quite insightful.

What the Course Actually Looks Like

Here’s what I like most about the way the GMP is structured: it’s practical, intense, and manageable for working professionals. It is the perfect management training for professionals.

- Cross-functional focus: You cover finance, marketing, HR, operations, and strategy — not in silos, but as interconnected levers of business.

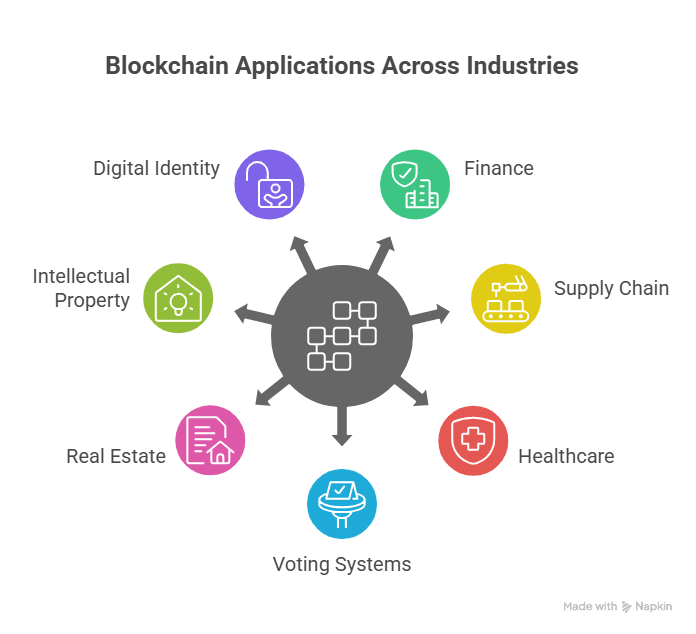

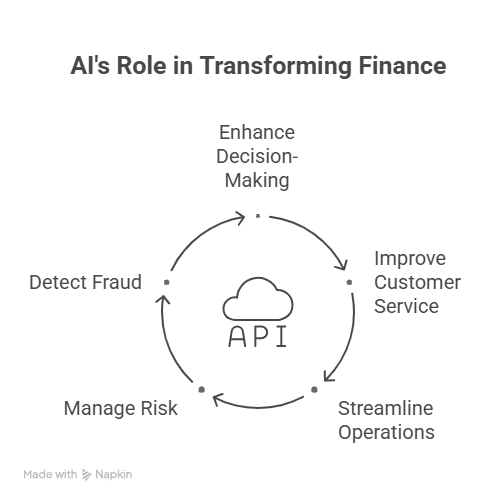

- Future-ready content: Sessions on Digital Transformation, Platform Business Models, and AI Adoption make sure you’re not left behind in a tech-driven world.

- Blended learning: Roughly two-thirds of the sessions happen in Dubai, while the rest take place on IIM Ahmedabad’s campus. That mix gives you both international exposure and the full IIM-A experience.

- Case study method: Instead of passively listening, you’re dissecting real company challenges. Each case forces you to think critically, debate with peers, and defend your point of view.

It’s not classroom theory. It’s preparation for the kind of high-stakes decisions you’ll actually face in leadership roles.

Why Dubai Adds Extra Value

Here’s the part many people underestimate: the networking advantage. Dubai isn’t just a glamorous backdrop; it’s a melting pot of talent from across the world. In one classroom, you’ll find leaders from the UAE, India, Europe, and beyond — each bringing unique insights from their industries.

That diversity isn’t just nice to have. It changes the way you think. Suddenly, you’re not just solving a supply chain problem from one perspective — you’re hearing how it plays out in logistics, tech, and retail across three continents. Those conversations become as valuable as the lectures themselves.

And given that Dubai’s foreign investments have been rising by over 15% year-on-year, the opportunities for collaboration, partnerships, and career growth only get stronger when you study here.

The Big Picture: Career Growth

Here’s the honest truth: the reason most professionals consider a General Management Programme is career growth. And IIM Ahmedabad’s GMP delivers exactly that.

- Skills that matter: Strategic thinking, digital literacy, and people leadership.

- Credibility that opens doors: A credential that global recruiters instantly respect.

- Opportunities across industries: From consulting and banking to tech and healthcare, the skills transfer everywhere.

For mid-level managers who feel “stuck,” this programme acts like a reset button. It shifts your perspective from functional expertise to enterprise-wide leadership. That’s what makes the difference between staying in middle management and stepping into the C-suite.

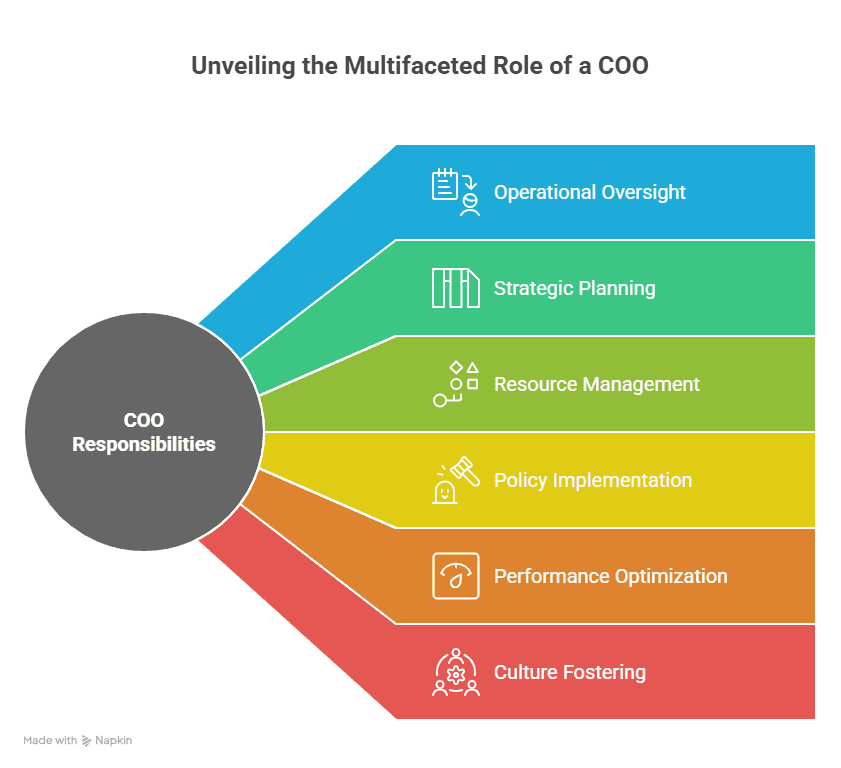

You can visualise your growth in a form of this simple pyramid:

Why the General Management Programme Matters in Today’s Business Environment

When I think about what sets great leaders apart, it’s not just technical know-how — it’s the ability to see the whole business environment and make strategic decisions that balance people, processes, and performance.

That’s exactly what a general management programme is designed to do. It’s not about memorising frameworks; it’s about learning to connect dots across finance, marketing, operations, and HR, and driving results in complex situations.

At the Indian Institute of Management Ahmedabad, the approach is immersive. You’re not sitting through lectures all day. Instead, you’re analysing real-world case studies, debating tough scenarios in group discussions, and learning from industry experts who’ve led companies through change. This makes the learning experience incredibly practical — you’re preparing for real challenges, not just exams.

For working professionals with a few years of managerial experience, this format is a game-changer. You don’t have to quit your job to pursue growth. Instead, the programme is designed to run alongside your career, building your leadership skills while you continue to deliver results at work.

And because the course takes place in a global hub like Dubai, you’re not just studying business management in theory — you’re living it, surrounded by peers from across industries and geographies.

This combination of academic rigour, practical insights, and diverse networking creates the perfect launchpad for stepping into leadership roles that demand adaptability, confidence, and a global outlook.

Building Leadership Skills Through General Management

Becoming a general manager isn’t about mastering one department — it’s about being able to lead across all of them. That’s where the true power of a general management programme lies. It equips you with the leadership skills to handle uncertainty, build high-performance teams, and shape winning business strategies.

At the Indian Institute of Management Ahmedabad, the teaching philosophy is unique. Every session is designed to challenge how you think. Through case studies and group discussions, you’re constantly putting theory into practice — whether it’s restructuring a failing company, creating a digital strategy, or handling cultural clashes in cross-border teams. The learning experience is intense, but it’s also what helps you grow into a leader who can thrive in the fast-changing global business environment.

Another aspect that stands out is the faculty. These aren’t just academics — they’re industry experts who’ve seen firsthand what it takes to succeed in leadership roles. That blend of classroom teaching and practical exposure makes all the difference.

For working professionals, especially those with 5–15 years of managerial experience, this programme is more than an academic pursuit — it’s a career transformation. Whether you’re aiming to move into strategy, expand your responsibilities, or take on regional/global mandates, the general management course gives you the toolkit to make it happen.

At its core, the programme is designed to move you from being a functional specialist to a business leader who can shape outcomes. And in a world where adaptability, foresight, and ethical leadership matter more than ever, that’s exactly the edge companies are looking for.

FAQs on General Management

What is the study of general management?

When I talk about the study of general management, I like to describe it as learning how the entire business environment works, not just one piece of it. A good general management programme, something like a good IIM management course abroad, gives you a full view of finance, marketing, HR, and operations, showing how they fit together to drive results.

Through case studies, group discussions, and insights from industry experts, the programme is designed to sharpen your leadership skills and your ability to make strategic decisions that impact the whole organisation.

What is general management work?

In practice, general managers are the ones connecting the dots. While functional managers might focus on sales or HR alone, a general manager looks at the big picture: aligning business strategies, leading teams, and responding to shifts in the global business environment.

It’s a role that demands both analytical skills and people skills, because you’re constantly balancing profit goals with team motivation and client expectations. Simply put, general management work means being accountable for outcomes, not just processes.

What is the general management in MBA salary?

If you’re wondering about salaries, here’s what’s exciting: the career potential after a general management programme is strong. Graduates from top schools like the Indian Institute of Management (IIM Ahmedabad) often see packages starting around ₹25–35 LPA in India, while global salaries for leadership roles can go well above USD 150,000 annually.

The actual figure depends on your years of managerial experience and the industry, but one thing is clear — a credential from a respected institute of management, Ahmedabad, carries serious weight in the job market.

What is the duration of the general management course?

For working professionals, one of the best things about this course is its flexibility. Unlike a traditional full-time MBA, the general management programme is structured to fit around work schedules. At IIM Ahmedabad General Management Programme Dubai, for example, you’re looking at around 9–12 months with blended learning — sessions both in Dubai and at the Indian Institute of Management Ahmedabad campus. This format ensures you get an intensive learning experience without having to pause your career.

How to get a job in general management?

Landing a role in general management isn’t about applying blindly to job boards. It’s about showing you have the ability to lead, strategise, and drive high-performance teams. That’s why structured training matters.

By completing a general management course with strong placement support, you position yourself for leadership roles across industries — from consulting and banking to tech and healthcare. Add in case studies, networking, and mentorship from industry experts, and you’ll have both the skills and the confidence to stand out in a competitive hiring market.

Is general management an MBA?

This is a question I hear often. The short answer: not always. While general management in MBA is a popular track in many schools, an executive course in Dubai, something like the General Management Programme at IIM Ahmedabad, is tailored for working professionals with years of managerial experience who want to step into broader leadership roles.

So, while the content overlaps with an MBA — covering business management, business strategies, and strategic decision-making — the focus is sharper on transforming managers into leaders ready for complex, real-world challenges.

Final Thought

The way I see it, the General Management Programme in Dubai by IIM Ahmedabad isn’t just another course. It’s a turning point. It prepares you for leadership in a world that’s unpredictable, digital-first, and globally connected.

If you’re looking to sharpen your skills, expand your worldview, and accelerate your career — this is one of the smartest ways to do it. Not because it gives you answers, but because it trains you to ask the right questions and lead with clarity.

The IIM Ahmedabad General Management Programme in Dubai isn’t just another course — it’s your opportunity to sharpen leadership skills with real case studies, work alongside industry experts, and experience a learning journey that’s built for working professionals. If you’re a seasoned manager eager to assume significant general management roles and make strategic decisions in a global business setting, this is the moment to act.