Last updated on May 9th, 2024 at 12:14 pm

What is trade?

Trade is the process of buying and selling any financial instrument.

The lifecycle of a trade is the fundamental activity of investment banks, hedge funds, pension funds, and many other financial companies. There is no better way to understand the workings of a financial institution than to follow the progress of a trade through all of its various stages and all the activities performed upon it. In the financial market, “trade” means to buy and/or sell securities/financial products.

To explain it further, a trade is the conversion of an order placed on the exchange which results in pay-in and pay-out of funds and securities. The trade ends with the settlement of the order placed.

All the steps involved in a trade, from the point of order receipt and trade execution through to settlement of the trade, are commonly referred to as the ‘trade lifecycle’.

Trading has evolved from a humble apple grower wanting a stable price for his produce come harvest time, to a complex and exciting industry comprising a significant share of the global economy, and more recently, taking a hand in saving it.

It is the fundamental activity of investment banks, hedge funds, pension funds, and many other financial companies. There is no better way to understand the workings of a financial institution than to follow the progress of a trade through all of its various stages and all the activities performed upon it.

Just like any other product, even trade has its life cycle involving several steps, as those with a career in Capital Markets know.

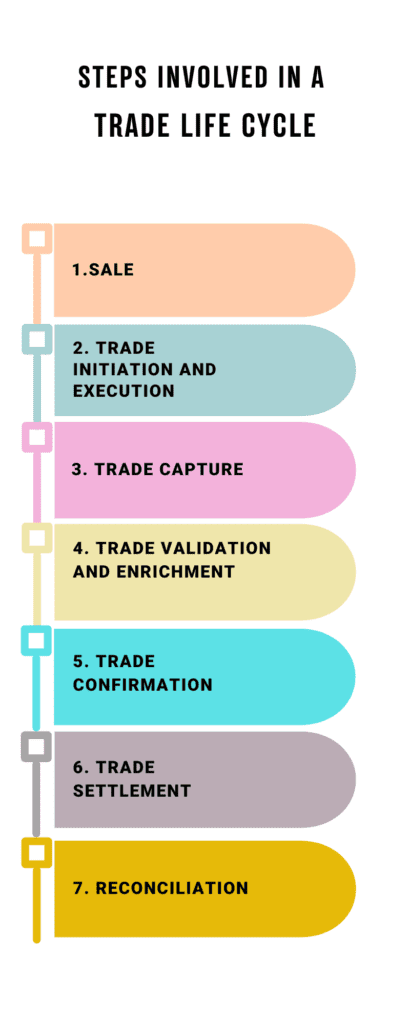

All the steps involved in a trade, from the point of pre-negotiations and trade execution through to settlement of the trade, are commonly referred to as the trade life cycle. The Trade life cycle consists of a series of logical stages and steps.

What are the Steps Involved in a Trade Life Cycle?

1. Sale

- This is a process of client acquisition in which HNIs or Institutional clients are introduced to various investment products or vehicles.

- These vehicles or products are available with an Investment Manager or Bank by whom the client’s investments are managed.

- The investments are collectively called Mutual or Hedge funds.

2. Trade Initiation and Execution

- This is the process of placing an order in the market.

- Trade Initiation and Execution can be done both in Order and Quote-driven markets.

- This depends on the choice of a marketplace and the external platform.

- Once the order is placed and it gets matched, the trade is said to be executed.

3. Trade Capture

- Trades are then booked internally in an FO system for it to flow down to the operating systems.

- It is booked in a Risk Management System (RMS)

4. Trade Validation and Enrichment

The reference data team set up the static and dynamic details which help middle office teams to validate the trade, before releasing instructions into the market.

5. Trade Confirmation

- This is an extremely critical step for the trade settlement.

- Trade details and SSIs are agreed with the counterparty at bachelor schreiben lassen least a day before the settlement date.

- Confirmation via depositories like Euro clear/DTCC

6. Trade Settlement

This is the process of simultaneous exchange of cash versus securities for a security trade or cash versus cash for a Derivatives trade.

7. Reconciliation

Reconciliation involves matching ledgers against statements to ensure correct accounting of all trade books.

The beauty of Investment Banking Operations, as taught in any school of investment banking, is the trade life cycle and its mechanisms akademisches ghostwriting. It has always fascinated me to think how innovative and creative a financial institution can work to get a job done.

Whilst working through the life cycle, one must keep in mind the reason for its existence, the end result and the factors that surround it.

Pointers to remember:

- The reason the market and its participants trade securities and financial instruments hausarbeit schnell schreiben, the current drivers and trends in modern securities markets.

- The methods the trades are executed, that any financial analyst course can teach you.

- It is very important for an organization to identify, describe and create a clear picture of the events scheduled for a trade.

- The operations team needs to be familiar with the key terms used in the fields of trade processing and its administration

- Understand the interaction and dependability of each department through which the trade flows.

- Understand the role of IT, identify the gaps which IT can resolve especially Straight Through Processing techniques

- Most importantly, what can go wrong where and what are the risks involved in every step of the trade life cycle ghostwriter bachelorarbeit kosten, be it credit, market, liquidity or operational risk.

The main reasons for the failure of a trade life cycle could be due to controls not adhered to or failure by any department of any of the people involved in the trade life cycle.

If you are looking for a Capital Markets course, or want to explore an Investment Banking Career, get to know more about the trade lifecycle through focused training and this blog could be a good starting point ghostwriting preise.

To know more about this, you can also visit – Imarticus Learning Also can contact us through the Live Chat Support system or can even visit one of our training centers based in – Mumbai, Thane, Pune, Chennai, Bangalore, Hyderabad, Delhi, and Gurgaon.

Its helpful but need more clarity