Table of Contents

Last updated on August 2nd, 2024 at 07:58 pm

Understanding your company’s financial health is critical in today’s dynamic market. Having insight into the subtleties of key financial performance indicators (KPIs) and developing solid financial reporting systems are indispensable for every aspiring entrepreneur or seasoned executive.

Businesses in today’s fluid economy face diverse difficulties that necessitate strategic agility. Companies can gauge their successes, identify areas for development, and link their strategies with broader goals by generating bespoke KPIs. This not only promotes openness but also allows stakeholders to make data-driven decisions, building an accountability and growth culture.

This blog explores the basic tenets of financial management, highlighting the critical role KPIs play in assessing your organisation’s performance and how a good financial reporting system can inspire informed decision-making. With CFO training courses, you can learn to negotiate the complexity of finance, lead organisational growth through strategic thinking, and secure a profitable future in a competitive global market.

What are Financial KPIs?

Financial key performance indicators (KPIs) are quantitative metrics used to analyse a company’s financial performance and attainment of certain objectives. These indicators act as critical benchmarks for organisations, allowing them to measure their fiscal stability, make intelligent choices, and set up successfully. Financial KPIs are diverse, representing numerous areas of a company’s financial activity, and are adjusted to coincide with corporate objectives.

Financial KPIs enable firms to assess their performance, make data-driven choices, and adjust their plans to shifting market circumstances. Organisations can optimise their financial operations, increase profitability, and achieve long-term growth by regularly monitoring these metrics. Implementing a thorough financial KPI framework is critical for companies looking to prosper in today’s competitive and dynamic business climate.

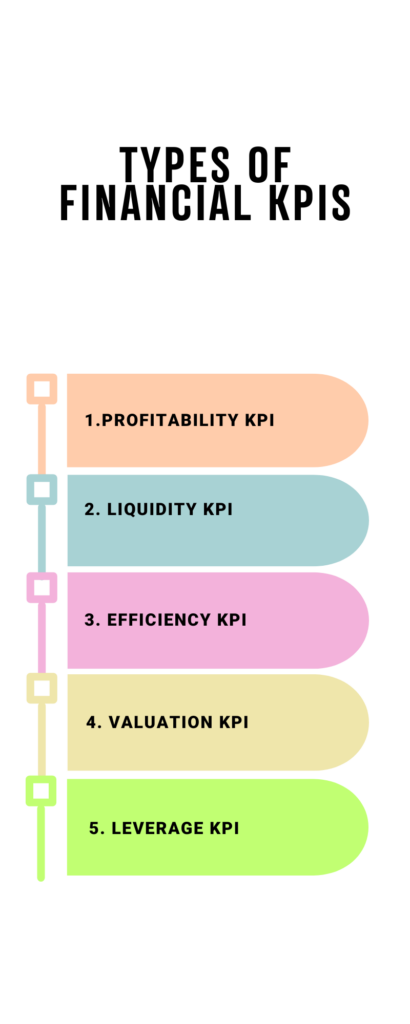

Types of Financial KPIs

Various types of financial KPIs steer the overall fiscal performance of the company. Let’s see what they are:

Profitability KPI

Profitability KPIs are important criteria for determining a company’s capacity to create profit from its operations. These metrics examine the efficacy of a business in managing expenses, pricing strategies, and investments, offering invaluable insights into the company’s overall macroeconomic well-being and long-term viability.

Liquidity KPI

Liquidity KPIs assess a company’s capacity to satisfy short-term financial obligations. The current ratio, quick ratio, and operating cash flow are all key indicators of liquidity KPIs. These measurements evaluate the availability of liquid assets for short-term obligations, ensuring that organisations can manage everyday affairs, deal with emergencies, and capitalise on opportunities without jeopardising their financial stability.

Efficiency KPI

Efficiency KPIs assess an organisation’s process and resource utilisation effectiveness. These KPIs give useful information, allowing firms to simplify processes, increase efficiency, and improve overall performance.

Valuation KPI

Valuation key performance indicators evaluate a company’s worth and investment possibilities. These measures allow investors and stakeholders to assess a company’s market value, economic viability, and financial health and can aid with investment decisions and strategic planning. Valuation KPIs are essential for proper financial assessments.

Leverage KPI

Leverage KPIs gauge a company’s financial risk by assessing its debt levels concerning equity. Key indicators include the debt-to-equity ratio and interest coverage ratio. These KPIs help businesses understand their borrowing capacity, evaluate financial stability, and make informed decisions about capital structure. Monitoring leverage KPIs is crucial for maintaining a healthy balance between debt and equity.

Why are Financial Metrics and KPIs Important to the Business?

Financial measurements and KPIs are critical for firms for numerous reasons:

- Performance evaluation: Financial measurements and KPIs give a clear picture of a company’s performance, showing areas of strength and weakness. They provide quantitative benchmarks for evaluating progress towards strategic goals, allowing firms to assess their success over time.

- Informed decision-making: By analysing financial data, firms can make well-informed decisions. Metrics such as profitability ratios, cash flow, and revenue growth assist management in determining which tactics are working and which need to be adjusted, resulting in more effective and strategic decision-making.

- Resource allocation: By showing where investments provide the highest returns, financial measures help allocate resources. Companies can direct resources towards initiatives or regions that provide favourable results, optimising operations and maximising income.

- Risk management: KPIs, including debt ratios and liquidity metrics, help identify financial risks. Businesses can proactively manage risks by knowing their financial vulnerabilities, ensuring they have the resources to withstand economic downturns or unforeseen challenges.

- Investor confidence: Financial measurements are used by investors and stakeholders to analyse a company’s stability and development prospects. Transparent and favourable financial indications boost investor trust, potentially attracting further investment and promoting corporate growth.

5 Financial Metrics and KPIs to Measure Success in 2023

Financial metrics and key performance indicators are vital tools that enable firms to measure performance, make informed decisions, manage risks, attract investment, improve efficiency, align with strategic goals, and maintain compliance. Let’s see what these metrics are:

-

Gross Profit Margin

Gross profit margin, an important financial KPI, measures a company’s profitability by calculating the percentage of revenue remaining after deducting the cost of products sold. It indicates the effectiveness of the company’s production and pricing strategies, suggesting its capacity to create profit from its primary business operations.

-

Return on Sales (ROS) Margin

ROS margin is an important financial KPI that evaluates the proportion of profit produced from each dollar of revenue to determine a company’s profitability. It evaluates operational efficiency and pricing strategies, demonstrating how successfully a company turns sales into profits and provides critical information about its financial performance.

-

Net Profit Margin

Net profit margin, a critical financial KPI, determines the proportion of profit a firm retains after subtracting all expenditures from total sales. It represents operational efficiency, reflecting how efficiently a company manages its costs. A larger net profit margin indicates increased profitability and better cost-cutting methods.

-

Operating Cash Flow Ratio

The operating cash flow ratio is a key financial performance indicator that assesses a company’s ability to produce enough cash from its primary operations to pay off its current liabilities. It assesses the effectiveness of reversing revenues into cash and guarantees that the company can satisfy its short-term obligations.

-

Current Ratio

A critical financial KPI, the current ratio assesses a company’s ability to meet its short-term commitments with its short-term assets. A ratio greater than one shows a solid liquidity situation, indicating that a corporation can pay its immediate financial commitments effectively. It is calculated by dividing current assets by current liabilities.

Conclusion

The key to attaining resilient corporate success is the development of strong financial performance indicators and the implementation of efficient financial reporting systems. These technologies enable firms to make educated decisions, enhance transparency, and confidently manage the intricacies of the financial world. By embracing these practices, organisations may drive success, develop stakeholder trust, and ensure a successful future.

If you’re looking for a CFO certification, check out Imarticus Learning’s Postgraduate Certificate Programme for Emerging CFOs. This would help you master new age financial skills and also help in work in popular organisations.

To know more, check out the website right away.