Last updated on May 28th, 2025 at 02:46 pm

Throughout your life, you would have seen countless advertisements for insurances (of all sorts.) However, if you have ever decided to fill one and go through the entire process, you would have faced the risk assessment.

Risk assessment is the insurance company’s way of determining whether insuring you would be a profitable deal or not, since each year, these companies are risking billions of dollars. Comprehensive risk management thus becomes more important.

A Credit Underwriting career is a career in which you do a risk assessment. Yes, a credit underwriter’s job description is to go through all the applicants and determine their risk coefficient. A credit underwriter’s job is both demanding and challenging, yet at the same time entertaining and lucrative.

Let us understand why credit underwriting is such a fascinating career option.

Let us understand why credit underwriting is such a fascinating career option.

Credit Underwriting: Job Description

As an underwriter, you would be the person accepting any understated liability, thus making you the person who will be held responsible for the potential losses incurred by the client. A credit underwriter does the same thing in an economic context.

So, when you accept this highly analytical, 40-hours-a-week desk job, you will be expected to review the application for insurance coverage for people and organizations. You are supposed to extract all the valuable information from their applications and then use your computer to develop a risk factor coefficient.

You, as a Credit Underwriting Career, have a pivotal role in the company’s profits (and losses). Since a lenient underwriter would open up the company to unprecedented losses, a very strict underwriter would run the company into the ground by losing its business. Thus, striking the right balance is critical for any Credit Underwriting Career.

What makes credit underwriting fun?

From the description of Credit underwriting thus far, it seems more daunting than fun. However, there are many apparent benefits, and we have listed some of them below:

You get to work with the latest technology:

You get to work with the latest technology:

Traditional means of risk assessment have been invalidated by advancements in technology like Machine Learning, Artificial Intelligence, and Deep Learning. You, as a credit underwriter of the 21st century, would be working mostly with such tech stacks. You would be using exciting and cutting-edge statistical modeling from day today.

Insurance and other benefits:

Since you will be working with insurance agencies, and you will be bestowed upon the best plans for yourself without going through any painful process, you also have a high chance of having other benefits like retirement plans, etc.

Paycheck:

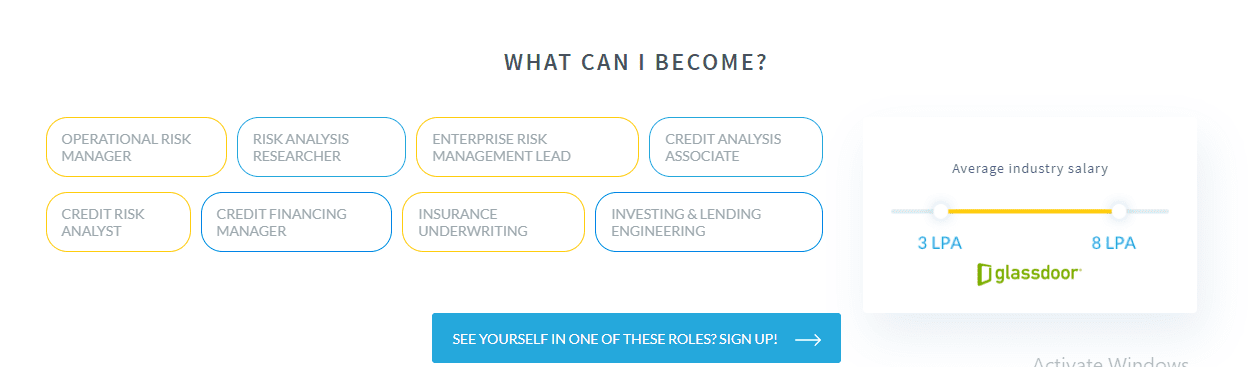

It is estimated that a Credit Underwriting Career would earn you about $69,380, which translates to about a whopping fifty-one lakh rupees an annum. That is a very lucrative reason to pick up underwriting as a career.

Conclusion:

Conclusion:

Credit Underwriting as a Career has its pros and cons like any other career. We hope to have provided you with enough information to make an informed choice on your own.