What is the US CMA Course about?

The US CMA Course (Certified Management Accountant) is a globally accepted qualification of the IMA that integrates cost accounting, financial planning, analysis and strategy. It’s for professionals ready to shift from bookkeeping to decision-making positions.

Why the US CMA Course is so important today

Companies seek finance partners who can speak numbers and drive strategy.

The IMA Salary Survey indicates CMAs make an estimated 20–25% more than non-CMAs worldwide. (Source)

There is a strong demand for CMAs in India to automate reports and advise management as a part of fast digital expansion in the nation.

US CMA Exam format

| Exam Part | Core Focus Area | Duration | Question Type | Pass Mark |

| Part 1 | Financial Planning, Performance & Analytics | 4 hours | 100 MCQs + 2 essay scenarios | 360/500 |

| Part 2 | Strategic Financial Management | 4 hours | 100 MCQs + 2 essay scenarios | 360/500 |

Dive Deep Into the US CMA Syllabus

The US CMA syllabus covers technical depth and strategic breadth:

- Financial Reporting & Planning – budgeting, forecasting, variance analysis

- Cost Management – cost-volume-profit, process costing, lean accounting

- Performance Management – KPIs, balanced scorecards, data visualisation

- Internal Controls & Tech – governance, cybersecurity basics, ERP systems

- Corporate Finance – cost of capital, capital budgeting, mergers

- Decision Analysis & Risk – sensitivity, hedging, probability

- Professional Ethics – ethical principles of IMA, conflict management

Technology and analytics are woven throughout—a testament to the transformation from “number cruncher” to “insight generator.”

Eligibility to Obtain the US CMA Credential

- Bachelor’s degree (any discipline)

- Two years’ work experience in the field of finance (can be obtained within seven years of passing exams)

- Most students complete the US CMA Course in 6–9 months with dedication.

Unique insight: The “Skill Stack Map”

Rather than “What chapters do I cram?”, plot each syllabus point to an actual business decision:

- Budgeting → Hiring plans: How many analysts can we hire next quarter?

- Risk management → Currency hedge: Do we lock in USD for a US supplier?

- Performance analytics → Pruning the product portfolio: Which SKU is bleeding margin quietly?

This “skill stack map” converts theory into boardroom-grade talking points—something that most job applicants miss.

US CMA Compensation in India: Expectations

- Freshers (0–2 years): ₹5–7 LPA

- Mid-level professionals (3–6 years): ₹8–12 LPA

- Senior managers/Controllers/CFO-track: ₹18–25 LPA+

Keep in mind that US CMA pay in India depends on the city, industry and your previous work experience. More pay is typically offered by the Big 4, shared service providers, and SaaS firms.

Scope of Certified Management Accountant in India and Globally

The Certified Management Accountant scope includes:

- Integrated reporting and ESG analytics

- Digital transformation initiatives (ERP implementations, BI dashboard)

- Strategic cost-reduction initiatives

- M&A due diligence and post-merger integration

Since the credential is recognised in 170+ nations, you can change geographies without requalifying each time.

Top 10 Reasons to Pursue US CMA Course | Why Choose US CMA? | Imarticus Learning

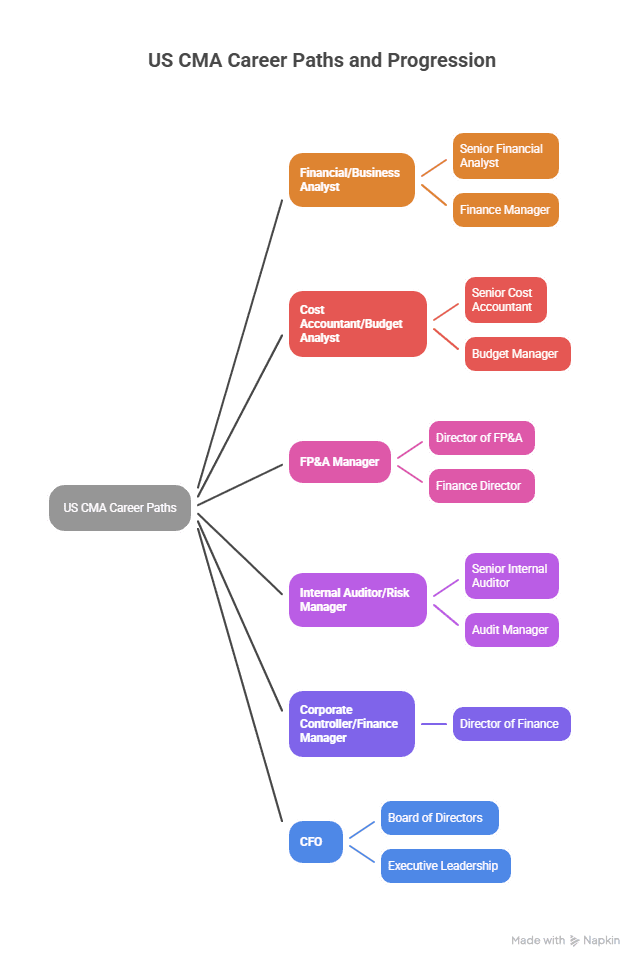

US CMA Career Paths you Can Reasonably Aim for

- Financial/Business Analyst

- Cost Accountant / Budget Analyst

- FP&A Manager

- Internal Auditor / Risk Manager

- Corporate Controller / Finance Manager

- CFO (long-term career)

The US CMA career paths get better when you combine the credential with tools such as Power BI, SQL, or Python to work with data.

How to prepare Wisely (not merely hard)

The 6–3–1 Method

- 6 months total plan (divided equally between both halves)

- 3 timed environment mock exams, each half

- 1 revision sprint (2–3 weeks) over weak areas

Daily micro-routine sample

- 45 minutes concept reading

- 30 minutes question bank

- 15 minutes flashcards/summary notes

FAQs

1. What is the US CMA Certification?

A two-part global certification proving you can turn numbers into something and influence business strategy.

2. What is the structure of the US CMA exam?

Two 4-hour sections: 100 MCQs + 2 essays, minimum passing score at least 360/500.

3. What are the fundamental subjects of the US CMA course?

Financial planning, cost management, performance analytics, corporate finance, risk, ethics and strategy.

4. What is the salary of a US CMA in India?

Typical salaries start from ₹8–12 LPA

5. How long would it take me to complete both segments?

6–9 months on a normal schedule; IMA offers up to three years to pass both the papers.

6. Do I need to have accounting experience to begin?

Commerce background preferred but not required—be prepared to learn fast.

Conclusion

The US CMA Course is a long-term investment in your financial future. You acquire technical competence, strategic mind and global mobility—abilities that every CFO team of today’s world desires.

Takeaways:

- Global Currency: The title is ahead of you—170+ nations accept it.

- Sharper Paycheque: CMAs earn 20–25% more than non-CMAs.

- Strategic Skillset: Apart from accounting, you’ll guide management on fact-based decisions.

Ready to transition from “accounts executive” to “finance strategist”?

Enrol in Imarticus Learning’s US CMA Preparation Program now and let experts guide you end to end.