Table of Contents

- Introduction

- Learn Financial Modeling Online: A Smart Start

- Best Financial Modeling Tutorials for Beginners

- Self-Study Financial Modeling: Your Independent Roadmap

- Investment Banking Modeling Techniques to Master

- Financial Modelling Certification: Is It Worth It?

- Excel for Financial Modeling: Tools You Need

- FAQs

- Key Takeaways

- Conclusion

Introduction

If you’ve ever been curious how analysts sift through voluminous amounts of financial data, or how investment bankers come up with future profits it is done through financial modelling. It is the pillar of strategic business decision-making in finance. The ability to learn financial modelling could alter your career goals. Whether you are planning to pursue a career in investment banking, or just want to become a better financial analyst, in this guide, we will help you figure out the best route for exploring the most helpful financial modelling approaches—from the programs to study from to the best forms of self-learning.

Learn Financial Modeling Online: A Smart Start

Online learning platforms have revolutionised professional upskilling. If you’re planning to learn financial modelling, online courses offer flexibility, real-world case studies, and instructor support. This is ideal for working professionals and students balancing multiple responsibilities.

- Top Online Platform: Imarticus Learning

- Course Name: Postgraduate Financial Analysis Program

- Duration: 3-4 months

- Highlights: Investment banking focus, placement support

This course combines foundational theory with industry exposure, ensuring a strong grasp of core concepts.

Best Financial Modeling Tutorials for Beginners

If you’re a motivated learner who prefers autonomy, self-study is a fantastic approach. It allows you to tailor your journey based on your career goals.

Self-study also builds long-term discipline, critical thinking, and problem-solving skills—all of which are invaluable in financial modelling. You’ll gain the flexibility to revisit concepts, experiment with models, and pace your learning according to your grasp. Supplement your efforts with practice cases from actual annual reports and 10-K filings to mimic real-world scenarios. Keep a journal of mistakes and learning reflections to track growth over time.

Self-Study Financial Modeling: Your Independent Roadmap

If you’re a motivated learner who prefers autonomy, self-study is a fantastic approach. It allows you to tailor your journey based on your career goals.

Self-Study Plan Checklist

- Set Clear Goals: e.g., build a 3-statement model

- Gather Resources: books, online PDFs, YouTube series

- Practice Daily: modelling requires repetition

- Join Forums: Reddit’s r/financialmodeling or AnalystForum

- Seek Feedback: upload your models for peer review

Some top-rated books for self-study financial modelling include:

- Investment Banking: Valuation, LBOs, and M&A by Rosenbaum & Pearl

- Financial Modeling by Simon Benninga

- The Wall Street MBA by Reuben Advani

Investment Banking Modeling Techniques to Master

A huge part of the financial modelling skillset involves investment banking techniques—especially when it comes to valuations and strategic transactions.

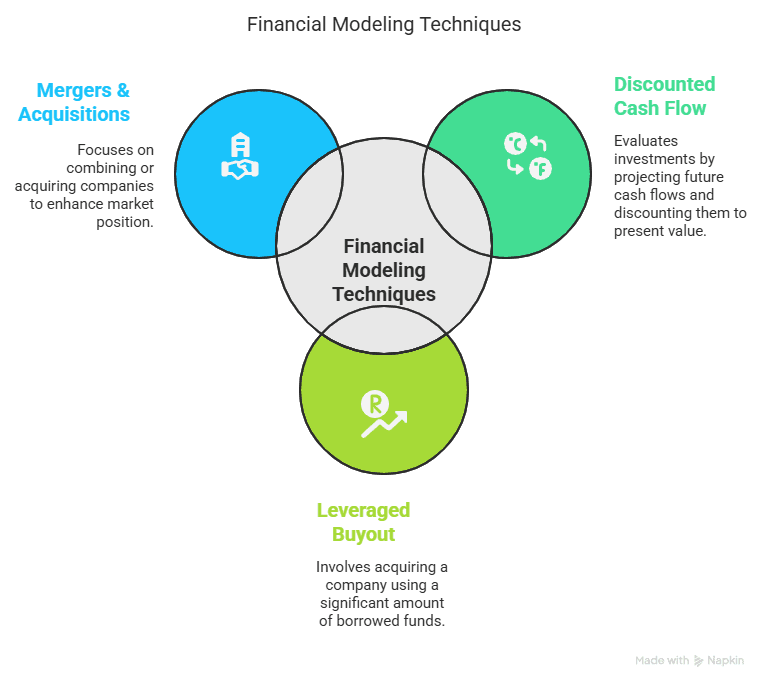

Key Modelling Techniques:

- DCF (Discounted Cash Flow): Forecasting company value based on future cash flows

- LBO (Leveraged Buyout): Used in private equity to analyze debt-fueled acquisitions

- M&A Models: Evaluating synergies, accretion/dilution analysis

| Technique | Use Case | Tools Required |

| DCF | Valuing startups or established firms | Excel, financial reports |

| LBO | Private equity investments | Excel, debt schedules |

| M&A | Strategic mergers | Excel, synergy models |

Mastering these investment banking modelling techniques prepares you for high-impact roles in IB, PE, and VC firms.

Financial Modelling Certification: Is It Worth It?

While it’s entirely possible to learn financial modelling independently, certifications add credibility. They signal to employers that you’ve been vetted by a recognised body.

Top Certifications:

- CFI Financial Modeling & Valuation Analyst (FMVA)

- Wall Street Prep Certification

- Imarticus Learning Certification in Financial Modeling

| Certification | Duration | Cost | Recognition |

| FMVA | 4-6 months | $500 | Global, job-oriented |

| Wall Street Prep | 1-2 months | $399 | Investment banks |

| Imarticus Learning | 3 months | ₹70,000 | Placement-supported in India |

Financial modelling certification enhances your resume and opens doors to high-paying jobs in finance.

Excel for Financial Modeling: Tools You Need

Spreadsheets are the foundation of all financial models. If you’re going to learn financial modelling, proficiency in Excel isn’t optional—it’s essential.

Excel isn’t just about formulas—it’s about understanding data flow, cleaning messy datasets, and creating intuitive dashboards. When you’re working on large-scale models with interdependent sheets, strong Excel fundamentals can be a game-changer. Get comfortable with keyboard shortcuts to boost speed, and explore macros to automate repetitive tasks. Learning Excel in the context of finance helps you apply logic in ways that mimic how professionals work in investment banks and corporate finance teams.

Must-Know Excel Functions:

- VLOOKUP/XLOOKUP

- IF, AND, OR

- INDEX & MATCH

- OFFSET

- Pivot Tables

- Data Validation

Excel for financial modelling also involves shortcuts, data visualization, and scenario analysis. Many platforms now offer Excel templates with embedded logic for practice.

Check out Microsoft’s Excel Training Center for guided modules and templates.

FAQs

Q1. What is the best way to learn financial modelling from scratch?

The best way to learn financial modelling from scratch is to- start with foundational courses that teach accounting and Excel basics & then move into more specialised modelling tutorials. Structured programs from reputed providers like CFI or Imarticus Learning can help streamline this journey.

Q2. How long does it take to learn financial modelling?

It usually takes 3-6 months to master financial modelling with regular practice. The duration can be shorter or longer based on your experience with finance and Excel.

Q3. Is financial modelling hard to learn if you don’t have a finance background?

Although a finance background is helpful, most successful students have non-finance backgrounds. With proper guidance and practice, you can master the skills.

Q4. What are the most valuable Excel skills for financial modelling?

The key Excel skills are: logical functions (IF, AND), lookup formulas (VLOOKUP, INDEX MATCH), data validation, pivot tables, and keyboard shortcuts to maximise efficiency.

Q5. Are free courses sufficient to learn financial modelling?

Free courses may be an excellent starting point but lack depth and personalised feedback. Paid programs involve mentorship, assignments, and industry projects that add value to learning.

Q6. What are the career positions that demand financial modelling skills?

Positions in – investment banking, equity research, corporate finance, FP&A, private equity, and management consulting often demand financial modelling skills.

Q7. Do I need to be certified to secure employment in financial modelling?

Certification is not required, but it greatly increases credibility, particularly if you are coming into the profession without work experience.

Q8. Can I learn financial modelling while employed full-time?

Yes, with effective time management, several professionals upskill while on the job. Modular-designed online courses with lifetime validity are ideal for flexible learning.

Q9. What is the distinction between financial modelling and financial analysis?

Financial modelling is developing future-oriented forecasts based on historical information, while financial analysis reads through available financial data to facilitate decision-making.

Q10. What books can be used to study financial modelling independently?

The best books recommended are “Investment Banking” by Rosenbaum & Pearl, “Financial Modelling” by Simon Benninga, and “The Wall Street MBA” by Reuben Advani.

Key Takeaways

- Learn financial modelling to unlock career opportunities in finance, IB, and consulting

- Online platforms like Imarticus offer flexible learning

- Combine self-study financial modelling with structured courses for maximum impact

- Gain edge with financial modelling certification from reputed bodies

- Excel mastery is non-negotiable—focus on automation, functions, and logic

- Start with basics, build real models, and seek continuous feedback

Conclusion

Never has it been easier – or more important – to learn financial modelling, whether you’re new to finance or looking to strengthen your skills for a new opportunity. Now there are so many options: learning through online financial modelling courses and self-study financial modelling resources right at your finger tips. Focus on what aligns best with your learning style, stay consistent, and soon, you’ll be crafting models that drive million-dollar decisions. The finance world awaits—are you ready to build your future?