If you’re planning a career in investment banking, one of the smartest things you can do early on is start reading the right investment banking books – even before enrolling in an investment banking course.

Warren Buffett once said, “The more you learn, the more you earn.” Whether you’re a student exploring finance for the first time or someone preparing for interviews at top firms, the right reading material can completely change how you understand the industry. Investment banking is competitive, fast-paced and knowledge-driven, and books remain one of the best ways to build a strong foundation.

That’s exactly where the right investment banking books come in. They help you understand how the industry works, how deals are structured, how valuation is done, and what actually happens inside investment banks.

Today, many students search for the best investment banking books and beginner-friendly guides that explain complex concepts in a simple way. The good news is that there are plenty of excellent books that cover everything from basics to advanced topics like mergers and acquisitions, valuation and financial modelling to help you in the Investment Banking Certification.

In this practical guide, I’ll cover everything from what to look for before choosing a book to how reading investment banking books helps your career. Let’s start with why these books matter so much.

Did you know?

Reading Investment Banking books helps you build commercial awareness as you start connecting news, markets and business decisions more naturally – something recruiters value highly.

Why Investment Banking Books Matter More Than You Think

Before deep diving into the books and giving you recommendations, it is important to have clarity on the most asked question: What is investment banking?

In simple terms, investment banking is a specialised area of finance where investment bankers act as financial advisors for big business moves in private equity firms, multinational corporations, financial institutions and government. They analyse data, evaluate opportunities, and guide companies on how to grow, invest or restructure.

If your goal is a career in finance, reading isn’t just about knowledge – it’s about preparation.

Many students assume they’ll start preparing when placements begin. But investment banking jobs don’t work like that. It’s a highly competitive field, and recruiters often expect candidates to already understand core concepts like valuation, financial statements and market behaviour.

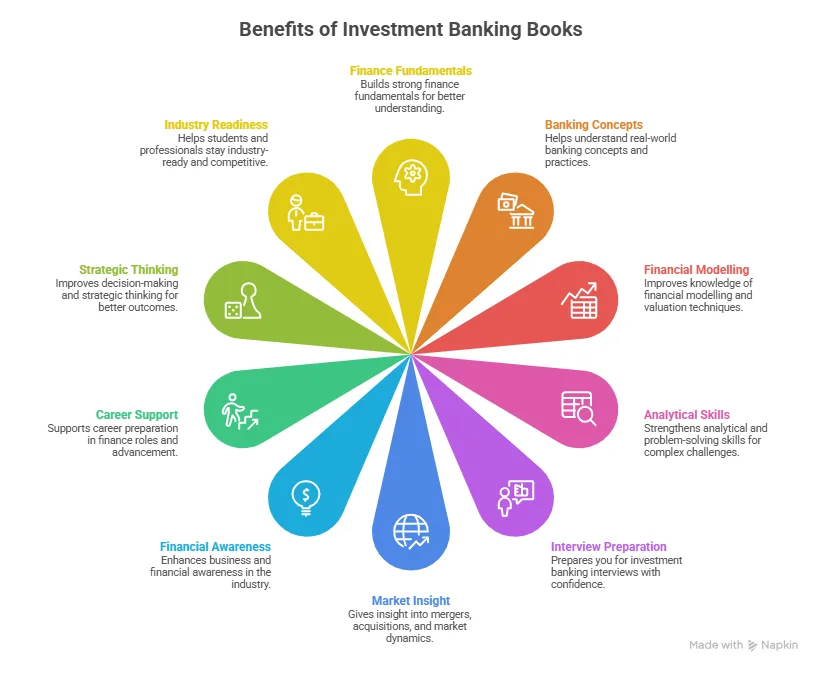

Reading good investment banking books helps you:

- Speak confidently about finance topics.

- Understand what investment bankers actually do.

- Prepare for technical interviews.

- Build strong financial awareness.

- Develop commercial thinking.

Even if you don’t land an investment banking career immediately, these skills are valuable across multiple finance careers like corporate finance, equity research, consulting and private equity. Starting early gives you a clear advantage.

If you’re new to finance, understanding what investment bankers actually do can feel a bit confusing at first. This short video breaks it down in a simple and easy-to-follow way, from the core roles of investment bankers to how they support companies in raising capital, managing mergers and making strategic financial decisions.

Top Investment Banking Books Every Student Should Read

If you’re serious about investment banking, don’t just read randomly. Start with books that professionals and analysts themselves recommend.

Here’s a carefully selected list of the most useful investment banking books for students.

Investment Banking by Joshua Rosenbaum & Joshua Pearl

This is often called the “investment banking bible”.

It explains:

- Valuation methods

- Mergers and acquisitions

- Leveraged buyouts

- Financial modelling basics

If you want to understand what analysts actually do in investment banks, this book is essential. Many IB professionals recommend starting here once your basics are clear.

The Intelligent Investor by Benjamin Graham

While not purely an investment banking book, this classic builds strong financial thinking.

You’ll learn:

- Value investing principles

- Risk understanding

- Market psychology

- Long-term financial mindset

Every finance student benefits from reading this early.

Barbarians at the Gate

This is one of the best real-world deal stories in finance.

It covers:

- A famous leveraged buyout

- How deals happen behind the scenes

- Negotiations and strategy

- Real investment banking culture

Great for understanding the human and strategic side of finance.

Monkey Business

If you want to know what life inside investment banking actually feels like, this book is eye-opening.

It gives:

- Insider perspective on Investment Banking lifestyle

- Work pressure and culture

- Real analyst experiences

Perfect for students exploring whether investment banking is the right path.

Valuation by McKinsey & Company

A must-read for deeper finance understanding.

You’ll learn:

- Company valuation techniques

- Financial analysis

- Corporate finance strategy

- Real business case insights

Best for students who already understand the basics and want to go deeper.

Liar’s Poker

A classic Wall Street book that shows the evolution of modern finance.

It helps you understand:

- Trading culture

- Investment banking environment

- Financial market behaviour

It’s engaging, insightful and surprisingly educational.

Best Investment Banking Books for Beginners

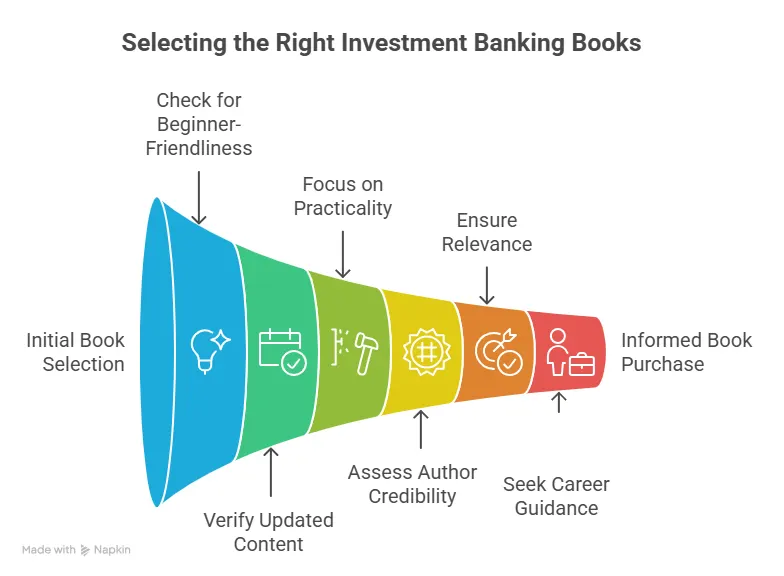

If you’re just starting, don’t jump into highly technical material immediately. Start with books that explain things clearly. The best investment banking books for beginners focus on building fundamentals first.

Here are some excellent starting points.

| Book Title | Author | Why It’s Good for Beginners | Key Topics Covered |

| Investment Banking | Joshua Rosenbaum & Joshua Pearl | Recommended by finance professionals for building strong core knowledge. | Valuation, financial modelling, leveraged buyouts, mergers & acquisitions |

| Investment Banking For Dummies | Matthew Krantz | Extremely beginner-friendly. Perfect if you have no finance background and want simple explanations. | Basics of investment banking, key concepts, industry overview |

| The Intelligent Investor | Benjamin Graham | Not strictly an investment banking basics book, but it builds strong financial thinking and market understanding. | Investing principles, market behaviour, long-term financial strategy |

| Monkey Business | John Rolfe & Peter Troob | Gives a realistic and engaging look into the life and culture of investment bankers. | Investment banking lifestyle, work culture, industry expectations |

Reading a mix of technical and real-world books gives you a balanced understanding.

Also Read: Who is eligible for a career in investment banking?

Top 10 Investment Banking Books You Should Read

If you’re looking for a solid reading list, here are the top investment banking books that students and professionals commonly recommend. This mix of technical and story-driven books gives you a complete picture of the industry.

| Book Title | Author | Why You Should Read It |

| Investment Banking | Rosenbaum & Pearl | Best overall guide to valuation, M&A and core investment banking concepts. |

| Barbarians at the Gate | Bryan Burrough & John Helyar | A famous real-life takeover story that shows how large deals happen. |

| Liar’s Poker | Michael Lewis | A classic look into Wall Street culture and trading floors. |

| The Intelligent Investor | Benjamin Graham | Builds a strong financial mindset and understanding of investing principles. |

| Monkey Business | John Rolfe & Peter Troob | Realistic insights into investment banking lifestyle and work culture. |

| Valuation | McKinsey & Company | Excellent for deeply understanding company valuation and corporate finance. |

| Financial Modeling | Simon Benninga | Helpful for students who want to build technical financial modelling skills. |

| The Accidental Investment Banker | Jonathan Knee | Offers valuable insights into career paths and the investment banking industry. |

| Den of Thieves | James B. Stewart | Explores major financial deals, scandals and Wall Street history. |

| More Money Than God | Sebastian Mallaby | Provides insights into hedge funds and global financial markets. |

Reading these investment banking books consistently will help you build strong fundamentals, understand real-world finance and prepare better for investment banking and finance careers.

This video explains what investment bankers do daily, how they help companies raise capital, manage mergers and acquisitions, and support major financial decisions. It also gives you a realistic picture of the skills required and what the career path typically looks like.

How Investment Banking Books Help Your Career

If your goal is a career in finance, reading isn’t just about knowledge – it’s about preparation. Reading consistently builds advantages that most students ignore.

Most students assume they’ll start preparing when placements begin. But investment banking doesn’t work like that. It’s a competitive field, and recruiters often expect candidates to already understand the basics.

Reading good investment banking books helps you build the essential skills required in investment banking. Even if you don’t land in investment banking immediately, these skills help in roles like:

- Corporate finance

- Equity research

- Financial analysis

- Consulting

- Private equity

So the effort you put into reading investment banking books supports your overall finance career, not just one role.

Good Books on Investment Banking for Deeper Understanding

Once you’re comfortable with the basics, you can move to more detailed material. There are many good books on investment banking subjects that go deeper into finance concepts and industry insights.

These books usually cover:

- Corporate finance strategies

- Market behaviour

- Risk analysis

- Financial modelling

- Industry case studies

At this stage, reading becomes less about “preparing for exams” and more about understanding how finance works in the real world.

Students who consistently read investment banking books over time develop a strong financial mindset. They start connecting concepts, understanding market news and thinking more analytically.

Best Books to Read for Investment Banking Careers

If you’re planning a career in finance, reading consistently can give you a strong edge. An investment banking degree is competitive, and students who prepare early often have an advantage. If your goal is getting into the industry, choose books that focus not just on theory but also on careers.

The best books to read for investment banking careers help you understand:

- What investment bankers actually do

- How the industry works

- What skills recruiters expect

- How to prepare for interviews

Some books focus on technical knowledge, while others explain real job roles and career paths. Reading both types helps you build clarity.

How to start reading books on Investment Banking?

Keep it simple. Start with:

- One beginner-friendly book

- One industry insight book

- One technical or valuation book.

- Read slowly and understand concepts rather than rushing. Investment banking isn’t about memorising – it’s about understanding.

- Even reading 15-20 minutes daily can build strong clarity over time.

Also Read: How much salary do investment bankers earn?

How Investment Banking Books Shape Your Industry Readiness

It’s easy to assume reading is just for knowledge, but the impact goes far beyond that. Consistently reading good investment banking books shapes the way you think about business, finance and decision-making.

Students who build a reading habit often notice that:

- They understand finance news better.

- They follow market trends more easily.

- Outperform candidates during interviews.

- They can contribute more during internships.

- They develop stronger analytical thinking.

During interviews, recruiters can often tell who has taken time to understand the industry. Candidates who read regularly tend to answer questions more clearly and connect concepts better.

Even during internships, having strong fundamentals helps you adapt faster. You don’t feel completely new to the environment because you already understand the basics of deals, valuation and financial analysis.

Interesting Insight!

Goldman Sachs highlights that successful investment banking candidates are expected to have a solid understanding of financial analysis, markets and valuation even before entering the industry. (Source: Goldman Sachs Careers)

Investment Banking Interview Prep Books

Once you understand the basics, the next step is interview preparation. Investment banking interviews are known for being technical and detail-oriented. This is where specialised investment banking interview books become extremely useful.

A good investment banking interview prep book usually covers:

- Accounting basics

- Valuation methods

- Financial statements

- Technical interview questions

- Case study approaches

- Behavioural questions

These books are especially helpful if you’re preparing for:

- Summer internships

- Finance roles

- Investment banking interviews

- Corporate finance positions

Some popular interview-focused investment banking books include guides from Wall Street professionals and finance educators. They break down complex technical questions into simple explanations and help you practise step by step.

Many successful candidates start interview-focused preparation at least 3 to 6 months before an investment banking placement. Students who prepare using interview-focused investment banking books often feel more confident during actual interviews because they know what to expect.

Also Read: Everything you should know about Investment Banking Salary in India.

Benefits of Reading Investment Banking Books

Students often underestimate how much reading helps. The right investment banking books can give you a clear advantage.

| Benefit | How It Helps |

| Stronger fundamentals | Helps you understand finance concepts deeply instead of just memorising them. |

| Better interview preparation | Makes technical finance and investment banking questions easier to handle during interviews. |

| Improved confidence | When you understand concepts clearly, you speak more confidently in discussions and interviews. |

| Career clarity | Provides real insights into investment banking roles, responsibilities and career paths. |

| Analytical thinking | Develops structured thinking and problem-solving skills required in finance. |

| Industry awareness | Helps you understand financial news, market trends and real-world business developments better. |

Even reading a few good books can create a strong foundation for your career.

Also Read: How to build a career in Investment Banking in Mumbai.

Common Mistakes Students Make While Choosing Investment Banking Books

Many students make similar mistakes when starting an investment banking course in India.

- Downloading too many PDFs but reading none

- Starting with very advanced technical books

- Ignoring fundamentals

- Reading passively without applying concepts

- Focusing only on theory and not interviews

Instead, focus on a few high-quality investment banking books and read them properly. Take notes, understand concepts and try to apply what you learn.

Consistency matters more than quantity.

Also Read: A Student’s Guidebook to Investment Banking Exams.

Simple Roadmap for Reading Investment Banking Books

You don’t need to read everything at once. A simple roadmap for an investment banking career path makes the process easier and more effective.

| Step | What to Do | Why It Matters |

| Step 1: Start with beginner-friendly books | Choose one or two investment banking books for beginners that explain concepts clearly. | Helps you build strong fundamentals without feeling overwhelmed. |

| Step 2: Move to practical finance concepts | Read about valuation, financial modelling and corporate finance. | Develops technical knowledge required for finance roles and internships. |

| Step 3: Add industry insight books | Explore books that explain real investment banking life and deal-making. | Gives clarity about work culture, roles and real-world finance scenarios. |

| Step 4: Prepare for interviews | Use an investment banking interview prep book once you’re comfortable with the basics. | Helps you get ready for technical questions, case studies and finance interviews. |

This step-by-step approach helps you build knowledge without feeling overwhelmed.

For anyone reading investment banking books and trying to build a strong foundation, this video adds practical career direction to your preparation by highlighting the key skills required, how to stand out during recruitment and what you can start doing now to move closer to your goal.

Investment Banking Course by Imarticus Learning

Reading investment banking books is a great starting point. But at some point, most students realise that reading alone isn’t enough for the Investment Banking program. You also need practical exposure, guidance and real-world application.

That’s where structured learning can make a big difference.

Imarticus Learning offers specialised investment banking and finance programmes designed to help students move from theory to practical industry readiness. Instead of only understanding concepts, you get the chance to apply them through case studies, financial modelling exercises and real-world simulations.

Key features of learning Investment Banking with Imarticus Learning are:

- One of the biggest advantages is the industry-focused approach aligned with current finance roles.

- You get practical training in financial modelling and valuation.

- Structured learning path from fundamentals to advanced concepts.

- Real-world case studies and deal simulations.

- Guidance from experienced finance professionals and mentors.

- Hands-on projects to build job-ready skills.

- Exposure to real market scenarios and financial tools.

- Interview preparation and career support.

- Placement assistance with leading finance companies.

- Certification that strengthens your finance profile.

When you combine consistent reading with structured practical training, your preparation becomes far stronger. And that combination is what truly helps you stand out in competitive investment banking and finance careers.

FAQs About Investment Banking Books

From beginner-friendly guides to interview preparation resources and PDFs, here are answers to some of the most frequently asked questions students have about investment banking books and how they can support your learning and career preparation.

How many investment banking books should I read as a student?

You don’t need to read too much. Start with 3 to 5 good investment banking books that cover basics, valuation and interview preparation. When it comes to preparation for investment banking exams, quality matters more than quantity.

Can I learn investment banking just by reading books?

Investment banking books give you a strong theoretical understanding, but combining reading with practical learning like financial modelling and case studies makes you job-ready. Enrolling in reputed training institutes like Imarticus Learning not only helps you in clearing exams but also showcases you as a skilled professional to recruiters.

Are investment banking books useful for interviews?

Yes. A good investment banking book offers many interview questions based on valuation, financial statements and market concepts, which help you prepare well for interviews.

Are PDFs of investment banking books good enough?

Investment banking books PDFs can be useful for convenience, but always ensure they are complete, updated and from reliable sources. Sometimes official books or e-books are easier to read and understand.

Do investment banking books help in internships?

Yes. Students who understand basic finance concepts through reading often perform better in finance internships and adapt faster to work environments. However, reading books alone won’t help you land in internships. You are required to enrol in some good investment banking courses offered by institutes like Imarticus Learning, where they bridge the gap between academic learning and real investment banking careers.

What skills can I build by reading top investment banking books?

You build financial awareness, analytical thinking, valuation knowledge, commercial understanding and confidence for interviews and discussions.

Are investment banking books useful for non-commerce students?

Absolutely. Even students from non-commerce backgrounds can build finance knowledge through beginner-friendly investment banking books and structured learning.

Where can I find an investment banking book PDF for beginners?

You can find an investment banking book PDF through official e-book platforms, publisher websites or educational resources. It can be a convenient way to begin, especially if you prefer digital reading. Many beginner-friendly finance books are available in digital format for easy access and learning.

Shape Your Career In Investment Banking

If you’re thinking about a career in investment banking, starting with the right books is honestly one of the best decisions you can make. The best books on investment banking help you to understand how the industry actually works – from valuation and financial modelling to mergers and acquisitions and deal-making.

When you read consistently and build your basics, you walk into interviews and internships with far more confidence. You’re not trying to memorise answers – you actually understand what you’re talking about.

You don’t have to read everything at once. Focus on actually understanding what you read instead of rushing through pages; you can slowly move towards advanced topics. That steady effort adds up more than you think.

And if you feel like you need more direction or practical exposure, joining a structured investment banking course can really help. The right course gives you hands-on learning, real-world case studies and guidance on how the industry works – so you’re not just learning finance, you’re preparing for a real career in it.