Passing the CFA exam is like climbing a mountain for all of those aspiring Investment Analysts. Whether analysing an equity market, or managing a very complex portfolio, there is nothing that can elevate your professional position like passing the CFA exam. But let’s face it – this isn’t your average exam. It demands intense discipline, clarity of concept, and a preparation strategy that works for you. If you’re a student or a finance professional balancing job responsibilities with CFA studies, this post is for you. Let us help you feel a little less overwhelmed and a lot more achievable in your CFA experience.

Table of Contents

- CFA Exam Preparation: Understand What You’re Up Against

- CFA Study Tips: Build Your Ideal Routine

- Investment Analyst CFA Tips: What the Pros Recommend

- CFA for Portfolio Managers: Special Considerations

- How to Pass CFA Exam: A Step-by-Step Breakdown

- CFA Exam Strategy: What Actually Works

- CFA Success Tips: Avoid These Common Pitfalls

- Key Takeaways

- FAQs

- Conclusion

CFA Exam Preparation: Understand What You’re Up Against

Before you dive into the textbooks, it’s essential to grasp what lies ahead. Each level of the CFA exam is different – from curriculum complexity to question patterns. Investment Analysts often underestimate the volume and depth of content, particularly when transitioning from Level I to Level II. Recognising the exam’s design helps align your study approach accordingly.

Here’s a quick breakdown of CFA Levels:

| Level | Focus Area | Pass Rate (2023) | Exam Duration |

| I | Basic Financial Knowledge | 37% | 4.5 hours |

| II | Asset Valuation & Analysis | 44% | 4.5 hours |

| III | Portfolio Management & Ethics | 48% | 4.5 hours |

Key CFA exam preparation insights:

- The exam requires around 300 hours of study per level.

- Questions are application-heavy, especially from Level II onward.

- Ethics and Portfolio Management are critical scoring areas.

Check out CFA Institute’s official curriculum updates here

CFA Study Tips: Build Your Ideal Routine

Consistency is key, but so is flexibility. As an Investment Analyst or someone aspiring to be one, you might already have a demanding schedule. Building an adaptable yet efficient study routine can be your game-changer.

Structure your week smartly:

- Weekdays: 1.5 to 2 hours of focused study post-work

- Weekends: 6-8 hours of dedicated prep

- Monthly Mock Tests: Simulate exam conditions

- Daily Review: Revise older material alongside new concepts

Recommended CFA study tips:

- Use a spaced repetition method for formulas

- Create summary flashcards for quick revision

- Group study once a week for doubt clearing

- Block out distraction-free zones during study time

Read more: CFA Exam Tips

Investment Analyst CFA Tips: What the Pros Recommend

Experienced Investment Analysts who’ve passed the CFA share recurring advice: it’s not about studying more, but studying smart. Focus on areas that truly reflect your job role or expected career goals.

What top Investment Analysts suggest:

- Relate concepts to real-world financial scenarios

- Focus on Equity Valuation, Ethics, and Portfolio Management

- Don’t neglect Corporate Finance – often a tie-breaker

Tools that help:

| Tool/Resource | Purpose |

| CFAI Learning Ecosystem | Conceptual clarity & practice |

| AnalystPrep | Practice questions |

| FinQuiz | Notes & summaries |

| Schweser | Mock tests & drills |

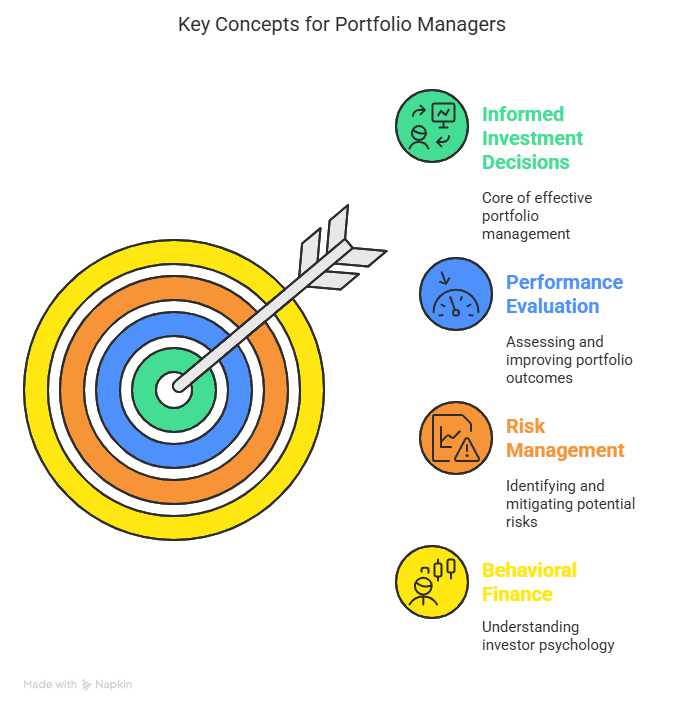

CFA for Portfolio Managers: Special Considerations

As a Portfolio Manager, your day-to-day decision-making overlaps deeply with CFA Level III topics. This allows you to intuitively grasp several subjects, but also exposes your blind spots.

Section focus for Portfolio Managers:

- Behavioral Finance

- Risk Management

- Performance Evaluation

Tips specifically for Portfolio Managers:

- Use client case studies to apply concepts and deepen your understanding of how theoretical knowledge translates into real-world client solutions.

- Create a real-portfolio case study as a revision tool so you can test your practical thinking while reviewing core topics like asset allocation and performance attribution.

- Prioritise essay-type practice questions early in your prep to become more comfortable with structuring written responses that mimic the Level III exam format.

How to Pass CFA Exam: A Step-by-Step Breakdown

There isn’t one formula for success, but there is a pattern. Thousands of Investment Analysts follow this proven approach.

Step-by-step CFA exam strategy:

- Assess your baseline – Start with a diagnostic mock test to gauge where you currently stand and identify areas requiring immediate attention.

- Create a study plan – Break the syllabus into weekly chunks that are manageable, realistic, and take your work schedule into account.

- Concept mastery first – Don’t rush into solving mocks without first establishing a strong conceptual foundation, especially in ethics and financial reporting.

- Practice, practice, practice – Aim to solve over 2,000 practice questions in total, focusing on a mix of topic-wise and full-length formats.

- Mock & review – Attempt at least 5 full-length mock exams under timed conditions, and spend time reviewing your errors and adjusting strategy.

- Exam-day readiness – Simulate 3-4 full exam sessions in the final month to fine-tune your time management and reduce exam anxiety.

CFA Exam Strategy: What Actually Works

Not all study strategies are created equal. The CFA exam is about application, not memorisation. Adopting smart tactics gives you a clear edge.

Here are proven CFA exam strategies for Investment Analysts:

- Master topic weightages: Allocate time proportionally

- Follow the 80/20 rule: Focus on the 20% that gets 80% of the marks

- Be brutally honest about your weak spots

- Track your performance trend using Excel

Weightage Breakdown:

| Topic Area | Level I | Level II | Level III |

| Ethics & Professionalism | 15% | 10-15% | 10-15% |

| Portfolio Management | 6% | 10-15% | 35-40% |

| Financial Reporting | 13% | 10-15% | – |

| Quantitative Methods | 10% | 5-10% | – |

CFA Success Tips: Avoid These Common Pitfalls

Even smart candidates fall into common traps. Awareness of what not to do is half the battle won.

Mistakes CFA candidates often make:

- Ignoring Ethics thinking it’s common sense

- Starting mock tests too late

- Focusing too much on one topic

- Not reviewing incorrect answers

- Studying passively (just reading without solving)

Bonus CFA success tips:

- Use Pomodoro Technique for better concentration

- Maintain a study journal to track doubts

- Don’t skip post-exam analysis of mocks

Key Takeaways

- Investment Analysts need tailored strategies for CFA success.

- Build a consistent study routine and use reliable prep tools.

- Apply CFA concepts to real-world scenarios.

- Portfolio Managers must focus on essay questions and application-based areas.

- Avoid common preparation pitfalls by staying self-aware and proactive.

FAQs

1. How much time should Investment Analysts dedicate daily to CFA prep?

Ideally, 1.5 to 2 hours on weekdays and 6-8 hours over the weekend works best for full-time professionals. Adjust based on work pressure and level of the exam.

2. What are the best CFA prep providers for students?

Schweser, AnalystPrep, and FinQuiz are popular among CFA candidates for their high-quality mock tests and concise notes.

3. Should I take the CFA exam while working full-time?

Yes, many professionals do. The key lies in early planning, time-blocking, and weekend deep-study sessions.

4. How can I improve retention while preparing for CFA?

Use active recall, spaced repetition techniques, and revise using flashcards or mind maps.

5. Are CFA exams different for Investment Analysts and Portfolio Managers?

No, the exams are the same, but the application and focus areas might differ depending on your role.

6. Is Ethics really that important in the CFA exam?

Absolutely. Ethics is often the tiebreaker in marginal pass/fail situations. Never neglect it.

7. How soon should I start mock testing?

Begin light mock testing after 50% of syllabus coverage. Full mocks should start 6-8 weeks before the exam.

8. Do CFA scores matter to employers?

While the pass itself is most crucial, scores can reflect consistency. However, it’s the designation that ultimately adds value.

9. What if I fail the CFA Level I?

It’s okay. Reflect on what didn’t work, change your approach, and come back stronger. Many successful CFA charterholders failed once.

10. Can CFA help me land a role as an Investment Analyst?

Yes, absolutely. It’s one of the most respected qualifications globally and is highly valued in finance job market.

Conclusion

The CFA test is difficult for sure, but it is not impossible. It will help if you see the vital advantage of being an Investment Analyst or aspiring to become one as discipline, relevance, and smart strategies. Use your experience and insight to turn theory into practice. Remember, the CFA journey is as much about mindset as it is about material. And with the right preparation, you won’t just pass the CFA – you’ll own it.