In today’s business world, simply knowing Excel isn’t enough.

Yes, you can use formulas… yes, you can build spreadsheets—but if you really want to drive decisions, influence strategy & stand out in finance—you need to go beyond the basics. That’s where a Financial Modeling Certification steps in.

It’s more than a course—it’s a career accelerator that arms you with the ability to interpret financial data, create dynamic models, evaluate businesses & present insights with clarity.

Let’s explore what it really means to master financial modeling… why it’s a must-have in 2025… & how it compares to other finance paths like the CFA.

Why Financial Modeling Matters Now (More Than Ever)

With businesses becoming more data-driven, the demand for professionals who can build financial models to simulate performance, test business scenarios & predict future outcomes is at an all-time high.

Here’s why this skill is a game-changer:

| Reason | Impact |

| Better Decision Making | Forecasts help managers reduce risk & plan ahead |

| Increased Job Relevance | Analysts with modeling skills are in high demand across industries |

| Bridge Between Data & Strategy | Translating numbers into actionable insights is a valuable superpower |

| More Informed Investments | Use models to assess business value, growth potential & risk |

And unlike theoretical finance degrees, a Financial Modeling Certification teaches you how to use these tools in the real world.

What You’ll Actually Learn in a Certification Program

A quality course will take you from Excel beginner to pro—and give you the ability to build financial models from scratch.

Here’s a quick breakdown of what a certification program typically covers:

| Module | You’ll Learn |

| Excel for Finance | Advanced formulas, data visualisation & shortcuts |

| Income Statement & Balance Sheet | How to project revenues, costs, assets & liabilities |

| Cash Flow Modelling | Forecast cash positions… manage liquidity scenarios |

| Scenario & Sensitivity Analysis | “What if” situations using dynamic inputs |

| Valuation Techniques | Apply DCF, comparables & other models to determine business value |

| Dashboarding & Presentation | Convert data into investor-grade presentations & insights |

You won’t just learn Excel—you’ll build financial models that companies can actually use.

For an overview of this in action, check out this video that shows how financial modeling powers real decisions.

Financial Modeling Course Online: Learning with Flexibility

Gone are the days when you had to attend in-person finance classes. Today’s top programs let you learn from anywhere.

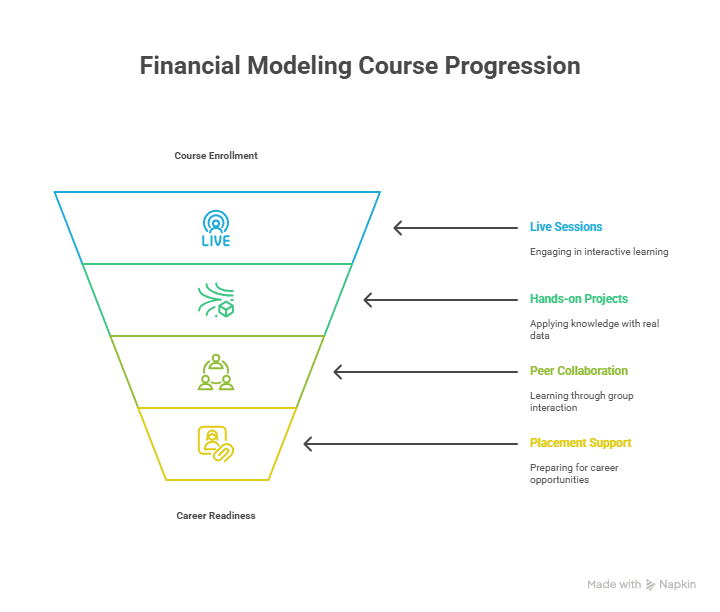

An effective financial modeling course online will:

- Offer live mentor-led sessions

- Include hands-on projects with real company data

- Provide peer collaboration & doubt clearing

- Give you placement support or interview prep

The Postgraduate Financial Analysis Program by Imarticus Learning is a perfect example. It blends online learning with job assurance… & covers everything from core concepts to real-world case studies.

So if you’re balancing work, studies… or life, this is the smarter route.

CFA vs Financial Modeling: Which One Should You Pick?

It’s a question finance aspirants ask all the time—CFA vs financial modeling, what’s the difference?

Here’s a quick snapshot to help you decide:

| Parameter | CFA | Financial Modeling Certification |

| Duration | 2–4 years | 3–6 months |

| Focus | Ethics, portfolio theory, macro/micro economics | Excel, projections, valuation, financial analysis |

| Recognition | High in asset management & research | High in corporate finance, FP&A, investment banking |

| Practical Exposure | Limited | Strong hands-on approach with tools & case studies |

| Career Fit | Ideal for fund managers, analysts | Best for analysts, CFO teams, finance strategists |

If you’re more interested in hands-on decision-making, creating models, & delivering insights—certification wins.

Still unsure? Read this helpful blog on career scope in financial analysis for a broader view.

Valuation Techniques You’ll Actually Use

Knowing how to price a business, investment, or deal? That’s a must-have skill.

Your Financial Modeling Certification will teach you at least four major valuation techniques used in the industry:

| Valuation Technique | Used For | How It Works |

| Discounted Cash Flow (DCF) | Predicting future value | Projects future cash flows, discounted to today’s value |

| Comparable Company Analysis | Benchmarking business value | Compares company metrics to peers |

| Precedent Transaction Method | M&A valuation | Looks at past similar deals to estimate fair value |

| Asset-based Valuation | For asset-heavy companies like real estate | Total asset value minus liabilities |

These tools let you assess risk, return & potential… in any business scenario.

Why Real-World Finance Skills Are a Career Booster

Most finance jobs in 2025 demand more than just theory.

Whether you want to work in equity research, financial planning, or M&A—you’ll need real-world finance skills like:

- Reading statements like a CFO

- Creating 3-statement models with confidence

- Valuing companies for investment decisions

- Communicating insights clearly to stakeholders

With this certification, you learn by doing—not just listening. You walk away with confidence… and a solid portfolio.

To see how this translates into roles, here’s a useful read on M&A careers for CA graduates.

Can a Financial Modeling Course Help Career Starters?

Absolutely.

In fact, if you’re an MCom graduate or fresh finance student wondering where to begin, a certification can open doors. It builds skills quickly & gets you noticed by recruiters.

Curious about salaries or how to maximise your MCom? This blog has useful insights.

Whether you’re from a small town or switching careers later, the right financial modeling course online gives you global access & practical experience.

Job Roles After Financial Modeling Certification

Once certified, you can apply for roles such as:

| Job Title | What You’ll Do |

| Financial Analyst | Forecasts, models, performance reporting |

| Equity Research Analyst | Evaluate stocks, sectors & create investment recommendations |

| FP&A Specialist | Budgeting, scenario planning, internal financial advice |

| M&A Analyst | Deal evaluation, due diligence, target modeling |

| Treasury Associate | Cash flow management… working capital strategy |

These are roles that demand brains, tools… & confidence.

Final Thoughts: Build, Analyse & Influence

In 2025, the most valuable professionals in finance won’t just understand numbers—they’ll shape them.

A Financial Modeling Certification gives you more than a certificate—it builds the skills that matter most:

- Ability to build financial models that influence strategy

- Mastery of valuation techniques used across industries

- Understanding of CFA vs financial modeling differences so you make smarter career choices

- Development of real-world finance skills that help you thrive in interviews… & on the job

- Freedom to upskill anytime with flexible financial modeling course online options

FAQs

1. What’s covered in a financial modeling course online?

Excel, forecasting, valuation… all hands-on stuff.

2. Can I build financial models without work experience?

Yes, just start with templates & real-world examples.

3. What’s the difference between CFA vs financial modeling?

CFA is theory-heavy… modeling is more job-focused.

4. Why are valuation techniques important?

They help you find out what a business is really worth.

5. Are real-world finance skills useful for interviews?

Absolutely—they show you can do the job from day one.

6. Which tool is best to build financial models?

Excel still rules… but learning shortcuts is key.

7. Do valuation techniques vary across industries?

Yes—tech, retail & real estate use different ones.

8. What makes real-world finance skills stand out?

They turn your resume into proof—not just promises.

Ready to Start?

If you’re ready to go beyond Excel & into business-impacting skills, check out the Postgraduate Financial Analysis Program from Imarticus.

It’s designed to help you get job-ready in just a few months—with a structured curriculum, project-based learning… & strong career support.