The financial world has witnessed a gargantuan transformation in the last ten years. Global investment banking is now one of the key supports of economic development and capital market expansion. This is why it’s booming:

What’s Driving Careers in International Finance?

- Cross-border M&A deals: Multinationals need money managers who know how to work with global regulation and compliance.

- Fintech adoption: Vague digitization has accelerated global investment banking but made it easier but less expert.

- Emerging markets: Southeast Asia, the Middle East, and Africa are dominating career opportunities in finance pursue.

How to Become an Investment Banker Internationally?

Becoming an international investment banker is not a straightforward process but is worth it. Below are steps to begin:

Build the Right Foundation with a Banking Certification

World-renowned banking certification gives candidates confidence. Training such as the Certified Investment Banking Operations Professional (CIBOP™) hands-on training and certifies you to work geographies.

Why CIBOP?

- 100% Job Guarantee for the candidates meeting our eligibility criteria

- 4 LPA average package; up to 9 LPA

- 1200+ batches and 50,000+ alumni

- 7 assurance interviews

- A ML, compliance, trade surveillance industry projects

Investment Banking Opportunities Abroad: Where’s the Action?

Foreign hotspots for investment banking opportunities are:

Top Global Financial Hubs

- New York City – Wall Street Leadership

- London – EU financier and fintech hub

- Singapore – Asia-Pacific finance hub

- Dubai – Emerging MENA finance hub

- Frankfurt & Hong Kong – Corporate banking hubs

These hubs provide international finance careers exposure to world market, regulatory framework, and high-value transactions.

Digital Disruption: Fintech’s Global Footprint

While fintech is revolutionizing traditional banking of the finance industry, finance professionals in the present day for global professionals need finance as well as technology professionals.

Why Finance Jobs for Global Professionals Require Tech Expertise

- Artificial intelligence and machine learning to enable predictive analytics and anti-fraud

- Blockchain for asset tokenization and settlement

- Digital onboarding and KYC technology

- Cross-border payment innovations

The finance career choices in fintech for the finance professionals are not all coding—of learning how to apply technology into banking professions globally.

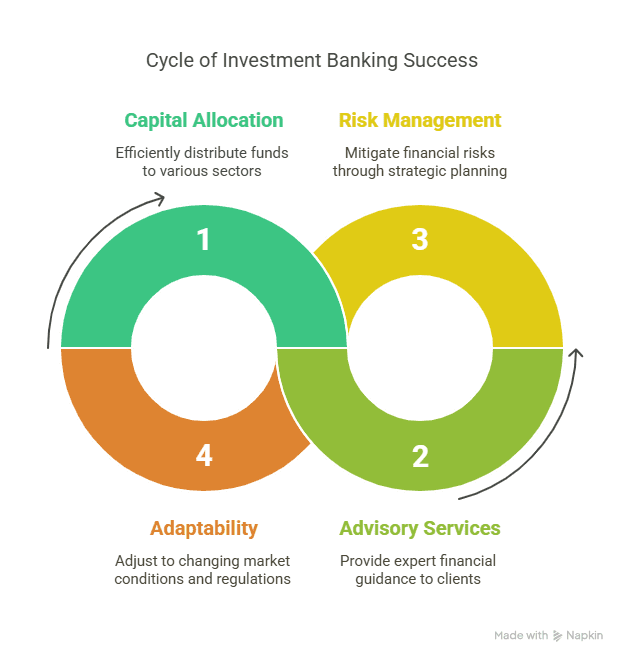

What Skills Do You Need?

International finance and international investment banking career success for international professionals is what you need to be an expert at:

Technical Skills

- Financial modeling and valuation

- Knowledge of global markets and instruments

- Risk management and regulatory systems

Soft Skills

- Cross-cultural communication

- International regulation flexibility

- Pressure decision-making

Tools You Should Know

- Bloomberg Terminal, Excel (Advanced), Python

- CRM and trade platforms

- AML and compliance software

Real Benefits of a Career in Global Finance

Why Choose a Career in International Finance?

- Greater Earning Power: Higher pay from global companies

- Introduction to Multiple Markets: Cross-system exposure to various systems

- Career Mobility: Locational adaptability

- Personal Growth: Global awareness and cultural flexibility

How does CIBOP Course Supports Your Global Journey?

Imarticus Learning’s CIBOP unlocks a global career path by:

- Practical trade-based money laundering and ethical banking training

- 1000+ recruitment partners’ career placement

- Mentorship by seasoned investment bankers

- Qualifying certification for leading world global banks

New York or Singapore could be your dream, CIBOP™ equips you to achieve world employer expectations.

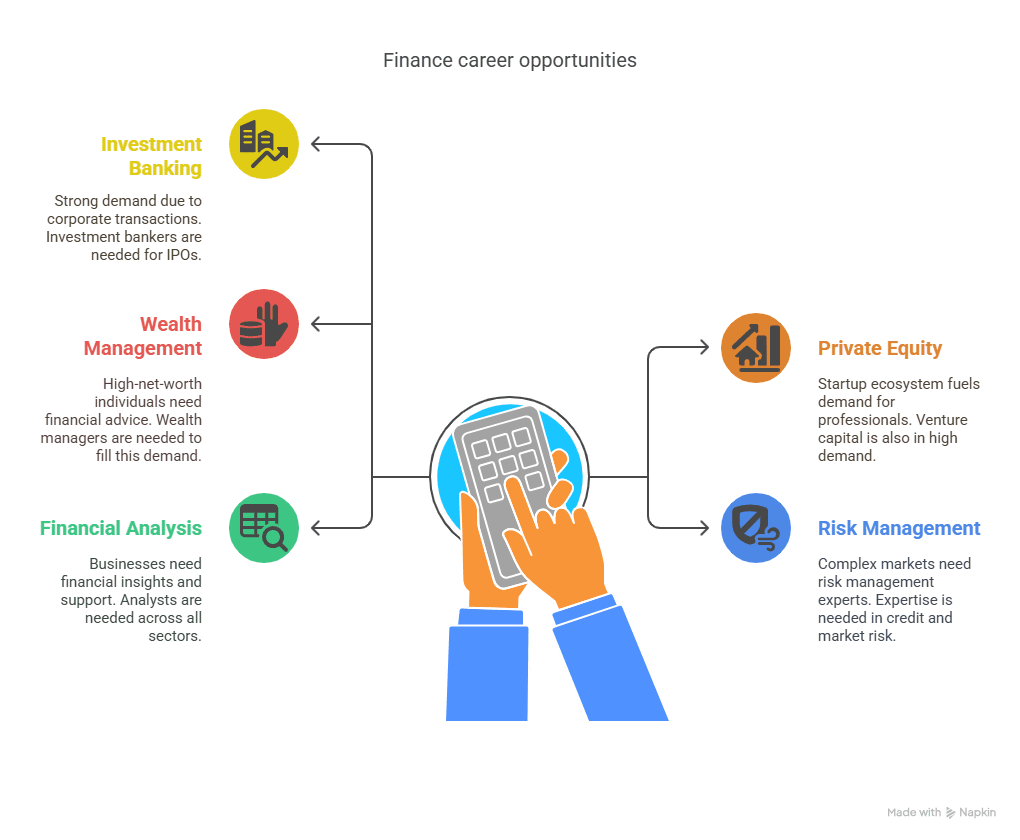

Top Roles in Global Investment Banking

Having a good investment banking course in your pocket, here are some high-paying career opportunities for you:

- Investment Banking Associate

- Job Risk Management Consultant

- Hedge Fund Associate

- Collateral Management Analyst

- Client Onboarding Specialist

- KYC & Trade Surveillance Analyst

These are all finance professions suitable for the entire world and employable for modern-day finance career prospects.

Global Finance Trends to Watch

What’s Shaping the Future of International Investment Banking?

- Decentralized Finance (DeFi) shaking up conventional models

- Green Finance and ESG regulation shaping terms of new types of compliance careers

- Artificial Intelligence in Investment Banking making decision-making easier

- Remote Banking Teams dismantling the hurdles to borderless opportunities

Tips to Launch Your International Finance Career

Step-by-Step Roadmap

- Begin with a relevant certificate like CIBOP

- Build an international network on online forums and LinkedIn

- Be current with global finance news and regulation-making

- Apply for some cross-border job postings

- Practice interview with a global goal in mind

Finance Career Statistics Worth Noting

- 1.2 million global finance positions to be created by 2030

- 60% of investment bankers now employ AI technology

- India’s BFSI industry to grow to $1.3 trillion by 2025

- 40% of global finance recruitment now is remote or hybrid

FAQs: Building a Global Finance Career

Q1. What qualifications do I need for an international finance role?

A finance qualification with a CIBOP certification is that winning edge.

Q2. Is investment banking a good international career?

Yes. It is accompanied by fat bonuses, worldwide respect, and equitable career progression.

Q3. How do I apply for jobs abroad?

Begin with research on foreign country banks and those with a good LinkedIn profile.

Q4. Are there remote finance roles available globally?

Yes. Banks are hybrids in the global professionals’ practice nowadays.

Q5. How important is a banking certification?

Yes, it is. It attests to qualified employers with preparedness in practice.

Q6. Can I switch to investment banking from another finance field?

Yes. If qualifications and skills are readily accessible, this trend is not unusual.

Q7. What are the biggest challenges in global finance careers?

Adjusting to varying rules, market fluctuations, and extended work hours.

Conclusion: Your Global Finance Career Awaits

The finance industry is no longer bound by borders. With the rise of fintech in finance, digital transformation, and evolving client expectations, finance career opportunities have become global. If you’re looking to elevate your career to an international stage, now is the time. Equip yourself with the right investment banking course, sharpen your global mindset, and dive into a future full of limitless potential.

Discover the CIBOP program and start your journey to a successful international finance career.