Lending institutions conduct credit risk analyses before approving credit. For most lenders, credit risk analysis usually depends on several years of experience. Such credit risk management is a combination of astute loan portfolio analysis and an intuitive knowledge regarding borrowing risks.

However, owing to increasing competition and significant regulatory changes in the backdrop of economic uncertainty, creditors are focusing on automating credit risk workflow automation.

Credit risk management is a popular part of the banking sector today. You can undertake credit risk management courses to implement the knowledge in today’s evolving lending market.

Credit risk management is a popular part of the banking sector today. You can undertake credit risk management courses to implement the knowledge in today’s evolving lending market.

A credit analyst certification will help you to conduct credit assessments using modern automation techniques.

Impacts of Automating Credit Risk Management

With a massive jump in credit requests, the lenders’ ability to analyze credit risk efficiently has declined. This has potentially led to a rise in loan default. However, with the automation of credit risk assessment, creditors can swiftly process loan requests in bulk without credit risk or increased expenses.

By including artificial intelligence and machine learning in credit risk management, credit institutions can enjoy a host of benefits. As a creditor, you can use modern technologies in various circumstances, which will allow you to draw crucial insights about borrowers from a large set of data.

Here are some of the ways in which automation impacts credit risk analysis, thereby benefiting creditors:

Increased Fraud Detection – Credit card and loan fraud is a massive business throughout the globe, which has been costing billions to lending institutions. However, such frauds can be efficiently reduced by automating the credit risk assessment process. Through predictive analytics, automation processes can be used to detect fraud risks associated with certain borrowers.

- Scalability

It can be challenging for financial institutions to achieve scalability under conventional credit risk analysis systems. This is usually because creditors need much understanding about the lending sector so as to be able to process a vast number of documents for stacking, analysis, categorization, extraction, and more. With automation, institutions can easily manage the entire process without having to assess each case of credit risk individually. This can enable creditors to concentrate on offering additional services.

- Compliance with Regulations

One of the significant benefits of automation is that it provides lenders with the flexibility to alter rules and implement them according to the basis of the criteria that you provide. Therefore, with automation, you can easily automate several processes that are prone to errors.

- Enhanced Underwriting

Through credit risk management automation, a lender can carry out document creation, credit request approval, and granting with increased personalization. This can happen while still being within the regulations of the institutions. Moreover, automated credit risk assessment processes come with all loan-risk factors that can be otherwise neglected during conventional credit risk assessment.

Available Automated Solutions for Credit Risk Management

Automating the credit risk management process helps lenders to eliminate high-risk customers while conducting a more accurate analysis of customers. Here are some of the most commonly-used automated credit risk assessment techniques:

- General process automation

- Low-code application platform

- Cognitive and robotic automatic solutions

Bottom Line

Automation of credit risk assessment is widely applied off late. As a credit analyst, you need to be equipped with the knowledge of recent automation techniques predominant in the lending sector. With a credit analyst certification following a credit analyst course, you can enhance your decision-making abilities regarding credit risk assessment.

Credit risk management courses allow individuals to gain major insights into the crucial elements of the credit analysis process employed by banks. A credit analyst certification will also enable you to learn about various challenges that one can face during portfolio analysis.

Comfort with Financial/Statistical software: Credit analysis requires risk analysis using statistical software. Knowledge & comfort working on such platforms is an advantage.

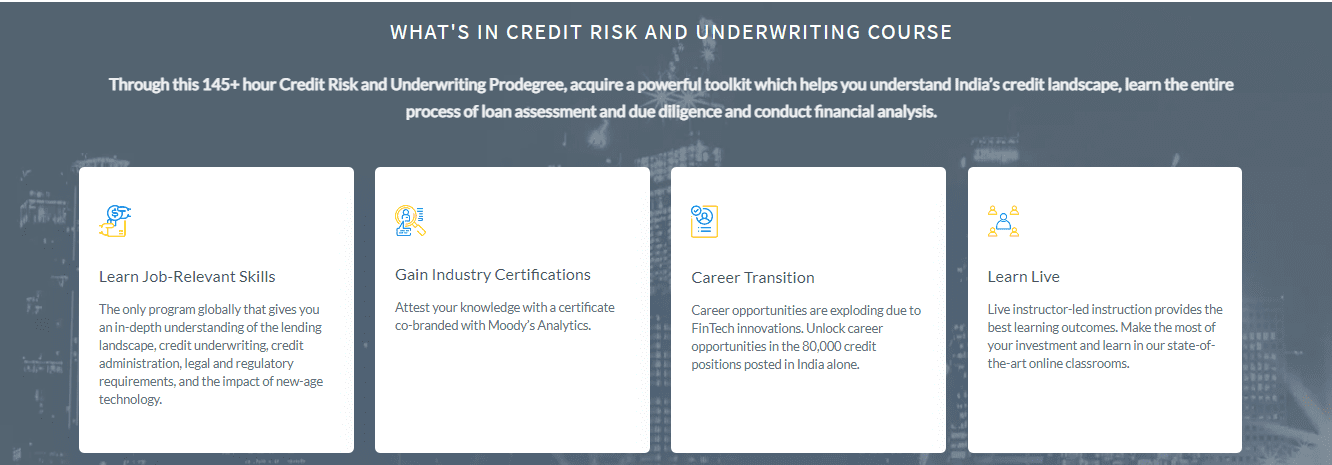

Comfort with Financial/Statistical software: Credit analysis requires risk analysis using statistical software. Knowledge & comfort working on such platforms is an advantage. Through this Credit Risk and Underwriting Prodegree, students acquire a powerful toolkit that helps them understand the credit landscape, learn the entire process of loan assessment and due diligence and conduct financial analysis. The students get hands-on learning experience and explore five comprehensive case studies linked to different aspects of the curriculum.

Through this Credit Risk and Underwriting Prodegree, students acquire a powerful toolkit that helps them understand the credit landscape, learn the entire process of loan assessment and due diligence and conduct financial analysis. The students get hands-on learning experience and explore five comprehensive case studies linked to different aspects of the curriculum.