In today’s competitive finance world, standing out isn’t just about ambition—it’s about credentials. Among all the prestigious certifications, the CFA designation holds a special place. Whether you’re just stepping into finance or aiming for leadership in investment firms, this qualification opens doors.

Let’s explore the top 10 reasons why you should pursue the CFA designation and how it can truly transform your career path.

1. Globally Recognised Credential

One of the biggest CFA benefits is its global recognition. The CFA charter is respected across more than 165 countries… It’s often referred to as the “gold standard” in finance. This recognition means that whether you’re in India, New York, London or Singapore, your skills are acknowledged and valued.

| Region | Recognition Level |

| North America | High |

| Europe | High |

| Asia-Pacific | High |

| Middle East | Moderate to High |

So, if you’re planning a career that spans continents, the value of CFA charter cannot be overstated.

2. Strong Foundation in Finance

The financial analyst certification provides in-depth knowledge across areas such as:

- Equity investments

- Fixed income

- Derivatives

- Corporate finance

- Portfolio management

- Financial reporting & analysis

This structured knowledge equips professionals with a real-world understanding of finance that goes way beyond textbooks.

Want to see how the curriculum works? Watch this explainer video… it breaks down the syllabus beautifully.

3. Career Mobility & Flexibility

Let’s talk about real CFA career opportunities. A CFA charter opens up roles like:

| Job Role | Industry |

| Investment Analyst | Asset Management |

| Portfolio Manager | Wealth Management |

| Equity Research Analyst | Capital Markets |

| Risk Manager | Corporate Finance |

| Financial Consultant | Consulting/Advisory |

These roles aren’t limited to just investment banks. From startups to MNCs, career advantages of CFA spread far & wide.

You can dive deeper into CFA course details here to understand how each level builds toward these career paths.

4. Higher Earning Potential

If you’re wondering why choose CFA certification, here’s one simple reason—better pay.

According to industry reports, CFA charterholders earn significantly more than non-chartered professionals. The increased compensation isn’t just about base salary… it includes performance bonuses, stock options & leadership incentives.

| Level | Average Salary (INR) |

| Level I | ₹6–8 LPA |

| Level II | ₹10–14 LPA |

| CFA Charter | ₹18–35 LPA+ |

This clearly illustrates the value of CFA charter in real monetary terms.

5. Builds Discipline & Commitment

Let’s be honest—it’s not easy. The CFA exams require nearly 300–350 hours of preparation per level. But that’s the beauty of it. Earning the CFA charter demonstrates that you are disciplined, committed & serious about your career… and that speaks volumes to employers.

For those who want structured help, the Imarticus CFA Certification Program provides expert-led coaching, doubt-clearing sessions & exam strategies to stay on track.

6. Ethical Standards Set You Apart

The first topic in every level of the CFA exam is Ethics. Why? Because integrity is the foundation of finance.

The CFA designation places strong emphasis on ethical decision-making, transparency & professionalism. You’ll be trained to evaluate grey areas in real-world scenarios… making you not just skilled, but trustworthy.

It’s one of those soft advantages that turn into big promotions later.

7. High ROI for Career Changers

If you’re someone switching from IT, engineering, accounting or other domains into finance, this is a game-changer.

The financial analyst certification offers a focused path without spending lakhs on an MBA. Plus, it’s respected by top employers across industries.

That’s one major reason why many ask—why choose CFA certification over other expensive options? Because it delivers high return on investment (ROI), especially when guided by expert-led institutes like Imarticus.

8. Career Resilience in Uncertain Times

Markets may go up & down… but finance professionals with solid credentials stay relevant.

During layoffs or downturns, firms look for professionals with niche expertise & trusted credentials. The career advantages of CFA stand out because they signal value, even when hiring is slow.

As seen in recent trends, CFA charterholders were among the last to be affected by global economic slowdowns.

9. Community & Networking Opportunities

CFA isn’t just a course—it’s a lifelong network. You become part of a 190,000+ global community of charterholders.

There are regular:

- CFA society meetups

- Webinars & masterclasses

- LinkedIn & alumni groups

These events provide mentorship, job referrals… & sometimes, even partnerships for businesses.

For an aspirant seeking CFA career opportunities, this kind of access is gold.

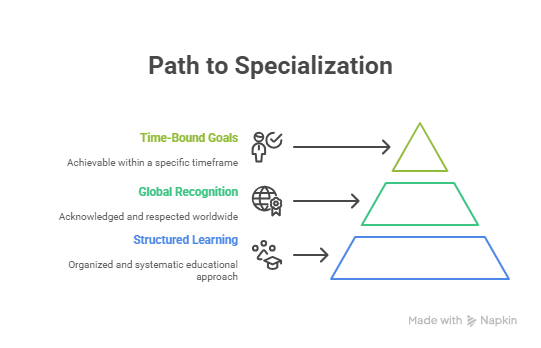

10. Clear Roadmap to Become a Specialist

If your goal is long-term leadership in finance, the CFA path gives you a roadmap that’s:

- Structured

- Recognised globally

- Time-bound

You’re not just doing random certifications. You’re building your profile brick by brick… with each CFA level taking you closer to the top.

Curious about how this journey unfolds? Check out this step-by-step guide to becoming a CFA charterholder—it gives you a complete game plan.

Summary Table: Quick Look at the Top 10 Reasons

| Reason | Why It Matters |

| Global Recognition | Career opportunities across countries |

| Strong Financial Foundation | Covers all major domains of finance |

| Flexibility in Career Choices | Roles in equity, risk, consulting, wealth management |

| Better Salary | Higher average earnings & bonus potential |

| Shows Dedication | Sets you apart from peers during recruitment |

| Ethics & Integrity | Builds trust with clients & employers |

| Perfect for Career Changers | Low-cost route into finance with great ROI |

| Market-Proof Credential | Job security in uncertain times |

| Network & Alumni | Career-building connections worldwide |

| Roadmap to Leadership | Planned growth over 2–3 years |

FAQs

1. What are the main CFA benefits?

CFA benefits include global recognition, deep finance knowledge & better career growth… all in one program.

2. How does the CFA help with career advantages of CFA?

It boosts your credibility… opens doors to top roles & gives you an edge in competitive markets.

3. Why choose CFA certification over an MBA?

It’s focused, flexible & more affordable… perfect if you’re looking for a direct finance path without full-time study.

4. What kind of CFA career opportunities can I expect?

Think equity research, portfolio management, risk analysis & more… across banks, consultancies & investment firms.

5. Is there real value of CFA charter in the job market?

Yes—employers trust CFA charterholders… it shows commitment, ethics & real financial skill.

6. What does the financial analyst certification cover?

It dives deep into finance topics like investments, reporting, ethics & portfolio management… step by step.

7. Can CFA benefits help during job shifts?

Absolutely! It’s a strong credential that supports career pivots into finance… with better roles & respect.

8. How long before I see career advantages of CFA?

Even after Level I, you’ll notice the shift… more interview calls, better offers & clearer finance direction.

Final Thoughts

Choosing the CFA designation is more than just adding three letters after your name… It’s a commitment to excellence in finance. From deep financial knowledge to global networking & career resilience—CFA gives you an edge that few other certifications can offer.

If you’re still wondering about why choose CFA certification, think long-term. Think leadership. Think credibility. Think transformation.

To begin your journey with expert mentorship, doubt-clearing sessions, mock exams & career support—consider enrolling in the Imarticus CFA Certification Program. It’s one of the best ways to kick-start your CFA journey with confidence.