Last updated on October 31st, 2025 at 10:55 pm

When a company reports record profits or nails a major acquisition, the headlines usually celebrate the CEO or investors. Rarely does anyone mention the quiet professionals who shaped those financial strategies behind the scenes.

Those people are often CMAs. They’re the invisible architects of corporate decision-making. Professionals who don’t just record what happened, but help define what should happen next.

That’s exactly where the CMA Certification (Certified Management Accountant) steps in.

In 2025, the global demand for CMAs hit a new record, especially across India, the UAE, and Singapore, where multinational firms are scaling finance operations post-AI disruption. According to the IMA’s 2023 Global Salary Survey, CMA-certified professionals earned 58% higher salaries than their non-certified peers.

So, if you’ve been wondering things like:

Is the CMA certification really worth it in India?

What are its actual benefits and downsides?

Should I choose the US CMA or the Indian CMA?

You’re asking the right questions. And that’s exactly what we’ll unpack in this article – what the CMA Certification really is, how it compares with other qualifications like CA and CPA, how much it costs, the career paths it opens, and yes, whether it’s genuinely worth your time, money, and effort.

What Is the CMA Certification?

The CMA Certification is awarded by the Institute of Management Accountants (IMA), USA, a globally recognised body with over 150,000 members in 150+ countries.

Unlike CPA or CA, which focus heavily on accounting compliance, CMA focuses on strategic financial management, budgeting, analytics, cost management, and decision-making.

Here’s a Simple Example:

Imagine two professionals working in a company –

- Rahul, a CA, prepares the company’s financial statements and ensures they meet all legal and tax requirements.

- Sneha, a CMA, takes those statements and says,

“Our operating costs are 12% higher this quarter because our logistics expenses spiked in the north zone. If we shift part of our distribution to a third-party partner, we could save ₹80 lakh annually.”

Rahul ensures compliance, while Sneha drives profitability.

That’s the essence of what is CMA and what they do; they don’t just crunch numbers, they shift one’s mindset from compliance to profitability and strategy that move a business forward.

| Aspect | CMA USA | CA (India) | CPA (US) |

| Focus | Management & Strategy | Auditing & Taxation | Accounting & Regulation |

| Duration | 6-12 months (flexible) | 3-5 years | 1.5-2 years |

| Exam Parts | 2 parts | 3 levels | 4 parts |

| Global Recognition | 🌎 High | 🇮🇳 National | 🌎 High |

| Ideal Career Path | Corporate Finance, FP&A, CFO roles | Accounting, Audit, Tax | Audit, Compliance |

Watch this video that breaks down the real benefits of the CMA-US certification: what job roles it opens up and whether it’s the right career move for you.

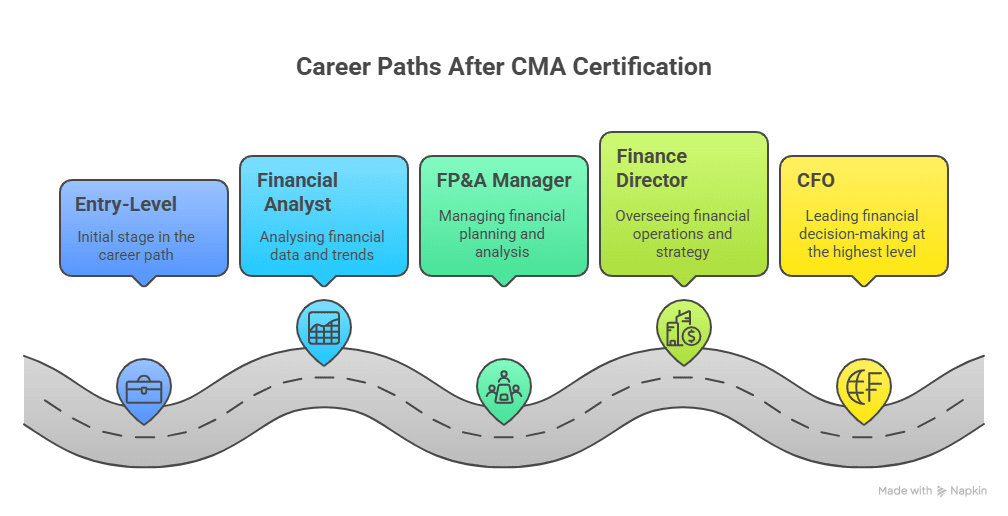

A Brief Look at Tangible Returns: Career & Global Mobility

When you invest your time and effort into a certification, the real question isn’t just “what’s the salary?” – it’s “how far can this take me?”

The CMA certification answers that in clear, measurable ways. On average, professionals with the US CMA credential earn 35–50% higher salaries than their non-certified peers in India, and up to $100,000+ globally, according to the IMA Global Salary Survey.

But beyond the paycheque, it’s the quality of roles that changes. CMAs move from routine accounting to decision-making positions in

- FP&A

- Corporate Finance

- Business Strategy

Within five years, many transition from analyst roles to managerial or controller-level positions, a leap that usually takes others nearly twice as long.

But the real magic of the CMA lies in what it unlocks beyond borders. Think of it as a global passport for finance careers. While Indian CMAs largely work within domestic regulations, the US CMA gives you mobility – recognition in 100+ countries, and access to roles across MNCs, Big Four firms, and tech-driven startups worldwide.

Employers value CMAs because they think like business partners, as professionals who understand numbers and the narrative behind them. In short, CMA doesn’t just grow your income; it expands your map.

CMA in India: Is It Worth It?

If you’re in India, here’s the truth: the CMA US credential is gaining massive traction.

In 2025, companies like Accenture, Deloitte, and Amazon actively hired CMA-certified analysts for FP&A, cost control, and business partnering roles.

Why It Works in India:

- Indian companies are now more global. They need people trained in US GAAP, IFRS, and analytics.

- CMA brings international credibility, unlike CMA India, which has more local recognition.

- With India’s CFO market expanding by 22% YoY, CMAs are preferred for strategy-aligned finance roles.

In this video, get an honest rundown of the challenge level of the CMA (US) exam, real-talk on how much effort it takes, and why it’s entirely achievable if you’re committed.

CMA Advantages and Disadvantages

Like any qualification, the CMA has its pros and cons. It’s not a golden ticket that guarantees success, but if your goals align with what the CMA certification benefits, it can really speed up your career growth.

There is more than one reason to get your CMA certification. The good part? It can open doors to global opportunities, better pay, and roles where you’re part of real business decisions, not just managing numbers. But it’s also demanding. You’ll need to put in serious study hours, stay consistent, and build a solid understanding of finance to get through the two exams.

Before jumping in, it’s worth taking a balanced look at what makes the CMA such a strong career move, and where it might not be the perfect fit for everyone.

Advantages of CMA Certification

✅ Global Recognition: Accepted in over 100 countries.

✅ Career Mobility: Move from accounting to management roles easily.

✅ Faster Completion: Can be done in under a year.

✅ Salary Uplift: Significant jump in compensation and leadership exposure.

✅ Future-Proof Skills: Aligns with data-driven finance and automation trends.

Disadvantages of CMA Certification

❌ Costly: Average total cost can reach ₹3 lakh with coaching.

❌ Challenging Exam: Global pass rate hovers around 45-50%.

❌ Less Relevance for Non-Finance Roles: If you’re shifting to marketing, tech, or HR, CMA adds little value.

The CMA Journey: Course Structure and Fees

The CMA Certification is built for professionals who want to move from accounting to strategic finance. It’s a two-part program that tests how well you can apply financial data to real-world business decisions.

What’s interesting is how compact yet globally rigorous it is: most candidates complete it within 12–18 months, while balancing full-time jobs. The standout factor is the return on learning: the CMA syllabus builds the bridge between accounting and management, a combination that directly translates into higher-value roles like FP&A, business finance, and strategy.

CMA Course Overview

The CMA exam is divided into two parts, testing both operational and strategic expertise.

| Part | Topics Covered | Weightage |

| Part 1: Financial Planning, Performance, and Analytics | Cost management, budgeting, variance analysis, data analytics | 50% |

| Part 2: Strategic Financial Management | Corporate finance, risk management, decision analysis, ethics | 50% |

To qualify, you’ll need:

- A bachelor’s degree (in any stream)

- Two years of relevant work experience

- IMA membership

CMA Course Fees (2025 Estimate)

The CMA certification course fees range from $1,000 to 2,000 in 2025. That’s around ₹85,000 to ₹1.6 lakh, depending on exchange rates. You’re paying for IMA membership, entrance fees, and the two exam registrations. They don’t take it all at once. You pay in stages as you register for different parts.

| Component | Fee (USD) | Equivalent (INR) |

| IMA Membership (Annual) | $145 | ₹12,000 |

| Entrance Fee | $280 | ₹23,000 |

| Exam Registration (2 parts) | $830 | ₹69,000 |

| Study Materials & Coaching | $1,000–$2,000 | ₹80,000–₹1.6 lakh |

| Total Estimated Cost | $2,000–$3,500 | ₹1.7–2.9 lakh |

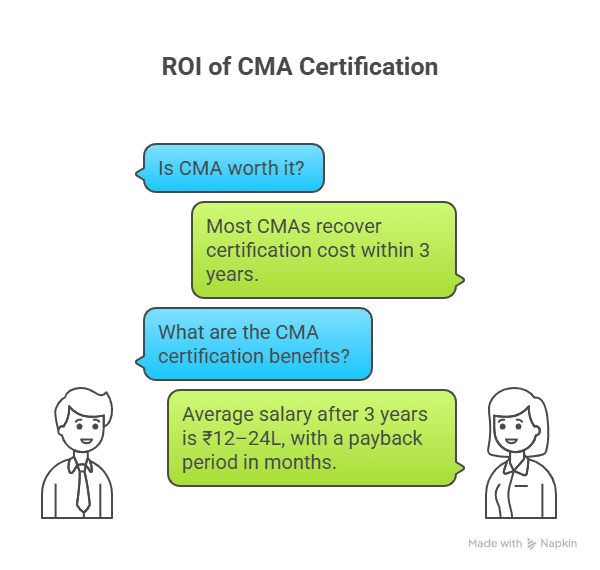

CMA Salary in India and Abroad: What’s the ROI?

You really start to see the benefits of a CMA certification once you enter the job market. In India, CMAs are partaking in key business discussions and shaping strategy. From multinational companies to consulting firms and startups, employers are looking for professionals who can read the story behind the numbers and turn it into action. This is reflected in the CMA salary in India.

The difference shows up in the pay, too. As per the IMA Global Salary Survey, CMAs in India earn around 58% more than those without the certification. Mid-level professionals usually make between ₹12–20 lakhs a year, while senior positions can cross ₹30 lakhs. The global picture is just as strong. CMAs in the US typically earn between $90,000 and $120,000, and in the UAE, salaries often fall in the AED 250,000–300,000 range.

| Region | Average Annual Salary (2025) | Source |

| India | ₹14-24 LPA | IMA Salary Survey 2025 |

| USA | $90,000-$110,000 | Glassdoor |

| Middle East | $60,000-$80,000 | PwC Gulf Salary Guide |

| Singapore | SGD 120,000 | Michael Page Salary Report |

📈 A CMA in India typically earns 35–50% higher than a non-certified finance professional in the same role.

US CMA vs Indian CMA: Which One Should You Choose?

The US CMA prepares you for global roles where strategy, performance, and decision-making take centre stage. The Indian CMA, on the other hand, is rooted in cost control, compliance, and financial accuracy within Indian regulations.

Think of it like this. The US CMA helps you understand why a company performs the way it does, while the Indian CMA focuses on how to make that performance more efficient. Both paths lead to respected careers, but they cater to very different goals.

Here’s a simple breakdown to help you see the difference clearly:

| Parameter | US CMA | CMA India |

| Governing Body | IMA (USA) | ICMAI (India) |

| Recognition | Global | National |

| Exam Parts | 2 | 3 |

| Focus | Management & Analytics | Cost Accounting |

| Duration | 6-12 months | 2-3 years |

| Ideal Career | MNCs, Corporate Strategy, FP&A | Indian PSUs, Cost Audit |

🎯 If your career goal is to work in MNCs, startups, or abroad, choose the US CMA. If your interest lies in Indian public enterprises or domestic accounting, CMA India may fit better.

Is CMA Worth It After CPA, CA, or MBA?

If you already hold a CA, CPA, or MBA, CMA adds strategic and global depth.

- After CA: CMA brings management orientation and analytics capability.

- After MBA: Strengthens your financial decision-making credibility.

- After CPA: Adds the strategic finance layer to an accounting background.

💬 As a mentor, I often tell my students that CA gives you the foundation, but CMA gives you the direction.

CMA Certification: Exam Pattern and Difficulty Level

Each exam part has 100 MCQs + 2 essay scenarios, testing your ability to think, not memorise.

Passing Rate: ~50% globally.

Exam Windows: January/February, May/June, September/October.

Quick Study Tips:

- Study 10-12 hours weekly for 6 months.

- Use practice mocks and question banks.

- Focus on decision analysis and ethics; most overlooked but high-weightage areas.

Real-World Career Examples: Where CMAs Work

CMA professionals are found in diverse sectors like tech, manufacturing, BFSI, and consulting.

| Industry | Roles for CMAs | Top Employers |

| IT & Tech | FP&A Analyst, Business Controller | Amazon, Microsoft, TCS |

| Manufacturing | Cost Controller, Plant Finance Head | Larsen & Toubro, Siemens |

| Consulting | Financial Strategist, Risk Consultant | Deloitte, PwC, EY |

| Banking & FinTech | Treasury Analyst, Product Finance | HDFC, Razorpay, Paytm |

CMA Salary Growth Over Time

The true value of the CMA Certification unfolds over time, not in the first payslip, but in the career trajectory it builds. Most CMAs don’t start at sky-high salaries; they grow into them. The certification acts like a career multiplier. The deeper you go into management decision-making, the steeper your salary curve becomes.

| Experience Level | Average Salary (India) |

| 0–2 years | ₹8–12 LPA |

| 3–5 years | ₹14–20 LPA |

| 6–10 years | ₹25–35 LPA |

| 10+ years | ₹40 LPA+ (CFO/Controller roles) |

👉 CMAs often move into senior finance roles within 4–5 years, compared to 7–8 years for non-certified peers.

Why Choose Imarticus Learning for the US CMA Course?

When you decide to pursue the US CMA certification, who you learn with matters just as much as what you learn. At Imarticus Learning, you’re not just signing up for exam preparation; you’re entering a full‐fledged launchpad built for global finance roles. Here’s what you will get from this course:

- Industry-Aligned Curriculum: Imarticus has partnered with KPMG in India and uses globally recognised content (via Surgent) with an 83 % pass-rate backing.

- Money-Back Guarantee: They stand behind their program. If you don’t clear both CMA exam parts under their terms, you’re eligible for a 50 % refund of the course fee.

- Placement & Career Support: Beyond the exam, there’s a pre-placement boot camp, resume/interview prep, and assured interview opportunities with global firms, giving you hands-on career launch support.

- High-Impact Modules: Real-world case studies (23 curated by KPMG), live expert sessions, tailored materials aligned with global roles, not just exam “drill”.

- Global Recognition, Local Relevance: Imarticus is India’s first & only authorised prep provider for top finance credentials (US CMA, US CPA, ACCA, etc.).

- Clear Career Outcomes: Salary ranges and job roles are laid out (e.g. ₹8 LPA–₹18 LPA for entry‐level CMA roles in India) so you have realistic expectations.

FAQs on CMA Certification

When it comes to the CMA Certification, it’s natural to have practical questions. How long does it take to complete? What are the costs involved? What kind of jobs and salaries can you expect? And how does it compare to other finance qualifications?

This section answers these questions clearly and directly. It’s designed to give you real insight into the certification, its benefits, and challenges, so you can decide if it aligns with your career goals without any confusion or guesswork.

What is a CMA Certification?

CMA is a Certified Management Accountant. It’s from the Institute of Management Accountants in the US. Covers financial planning, cost management, performance tracking, and business strategy. You’re not just doing bookkeeping, you’re helping companies make decisions using financial data.

For Indians in finance, a US CMA gets you into international jobs. Corporate finance, FP&A, strategy roles. Two exams total. Amazon, Deloitte, and Accenture hire CMAs because they connect finance to business outcomes.

Is CMA higher than CA?

Different things. CA is tax, audit, and compliance. Statutory stuff. CMA is management accounting, planning, and strategic decisions. Depends on what you’re after.

Globally, CMAs do strategy. CAs do technical accounting and tax. Some Indians do both. If you want CFO roles or international finance leadership, CMA has more management weight.

Which is higher, CPA or CMA?

Neither’s higher. CPA is external auditing, tax, and financial reporting. Compliance focus. CMA is internal – cost control, performance, and financial analysis. They work together in companies. CPA makes sure things are legal and accurate. CMA focuses on making money and strategy.

Corporate finance or FP&A? CMA’s better. Public accounting in the US? Need a CPA. Lots of CFOs have both.

What is CMA in salary?

India: ₹8–24 lakhs depending on experience and company. Senior CMAs in MNCs can hit ₹30+ lakhs. Globally, it averages $100k, often with 20% bonuses.

IMA data shows CMAs earn 58% more than people without it. Pretty good ROI.

Is CMA hard to pass?

Yeah, it’s hard. Two exams. Financial reporting, performance management, cost control, and strategy. Pass rate around 45–50%. Same ballpark as CPA or CFA. It tests how you think, not what you memorise.

With Imarticus Learning’s expert-led CMA prep, students get structured study plans, practice mocks, and guided mentoring, making the journey smoother and far more achievable within 6–9 months per part.

Is CMA a government job?

No. It’s a credential. But it helps you get finance jobs in the government or private sector. Some PSUs like BHEL, ONGC, Railways, hire CMAs for cost accounting, budgeting, and audit.

CMA India (ICMAI) is separate. US CMA mostly gets you private sector work in multinationals. Not a government job itself, but it opens doors in both sectors.

How many years to complete CMA?

12–18 months usually. Two exams, so it depends on how hard you work. Working people often finish in a year, doing 10–12 hours weekly. Exam windows are flexible, so you can work around your schedule.

IMA gives you three years max. Structured programs help people finish faster.

Who is eligible to do CMA?

Anyone with a bachelor’s degree (in any stream) can pursue the US CMA certification. You can even start the exams before graduating and complete the two years of relevant work experience later.

For Indian students, this flexibility is a big plus — especially with the CMA program in collaboration with KPMG in India offered by Imarticus Learning. The structured guidance helps you meet eligibility requirements, prepare effectively, and build real-world finance skills along the way.

Which degree is best for CMA?

No specific requirement, but commerce, accounting, finance, and economics help. B.Com, BBA Finance, MBA give you a base. Engineers do fine if they’re decent with numbers and willing to learn.

Experience matters more than the degree. BBA Finance plus CMA gets you into FP&A or business analysis. CA plus CMA is a CFO track.

How many exams are in CMA?

There are two parts.

Part 1: Financial Planning, Performance, Analytics

Part 2: Strategic Financial Management

100 multiple choice plus two essays each. Take them in any order. Three windows yearly: Jan–Feb, May–Jun, Sep–Oct. Most finish both in a year.

A quick way to get a global credential without years of study.

Is CMA in demand?

Yes. India’s seen a 25% demand increase. Companies want data-driven decisions, so they need CMAs for FP&A, cost control, finance management, and CFO positions.

EY, KPMG, Deloitte, Genpact, and Amazon all hire US CMAs. They want people who link accounting to strategy. Financial planning keeps showing up as a critical skill. Demand’s growing.

Is CMA tougher than MBA?

Different. CMA is technical, finance, analytics, and strategy-heavy. For people good with numbers. MBA is broader. Marketing, HR, operations, plus finance.

Lots of people do both. MBA for leadership, CMA for finance depth. CMA is two exams versus two years, but more concentrated. CMA’s harder on finance specifics, MBA’s wider. Both together can get you to senior management or the CFO faster.

Bringing It All Together

Here’s the honest mentor take:

CMA isn’t for everyone, but if you love strategic thinking, want to lead business decisions, and are ready to invest a few months of effort, it’s absolutely worth it.

It bridges the gap between accounting and strategy, data and decision, and India and the world.

💡 So, whether you’re a fresh graduate or mid-level finance professional, 2025 might be your best time to pursue the CMA certification.

Ready to take the next step?

Explore the CMA Certification Program at Imarticus Learning and get mentorship from seasoned finance experts.