Last Updated on 2 months ago by Imarticus Learning

When you ask, “What are the skills required in investment banking?” what you’re really asking is this:

What do top firms look for when they decide who gets hired – and who gets left behind?

Because let’s be honest – investment banking isn’t just another job title you stick on your resume. It’s a fast-paced world where the right combination of financial know-how, analytical sharpness, and real-world execution separates the candidates who get offers from the ones who end up waiting for callbacks.

Some people think investment banking success depends on where you studied or an elite investment banking certification. In reality, recruiters and hiring managers care far more about whether you can think with clarity, work with numbers under pressure, and communicate confidently with teams and clients. Those are the kinds of abilities that turn a resume into an interview – and an interview into an offer.

In this blog, I’ll break down the finance skills, technical capabilities, and soft skills you need to not only prepare for a career in investment banking but also stand out in a competitive job market. We’ll unpack what hiring teams actually test for, how these skills show up in real work, and why building them early makes you visibly more employable.

Whether you’re just exploring the field or already deep into preparation, by the end of this guide, you’ll have a clear sense of the skills required in investment banking to get noticed – and get hired.

Lesser-known fact:

Most investment bankers spend far more time analysing and preparing than actually negotiating deals.

What Is Investment Banking?

Before diving into the skills required in investment banking, it’s important to pause and understand what the job actually is – because many people prepare for the idea of investment banking, not the reality.

Students, aspirants and professionals always ask me what is investment banking. I always end up explaining most simply.

At its core, investment banking is about helping companies navigate big, high-pressure financial decisions – the kind that can shape where the business goes next.

This might involve:

- Raising funds to grow.

- Deciding whether to buy or sell a company.

- Restructuring debt during a difficult phase.

- Handling complex deals where timing, accuracy, and sound judgment matter just as much as the numbers.

On a day-to-day level, investment bankers spend their time analysing financial data, building models, preparing client presentations, and supporting deals that can run into billions – or even trillions – of dollars. It’s hands-on, deadline-driven work. You’re not just studying finance; you’re using it in real time, often under pressure, where mistakes are costly, and clarity is everything.

That’s why investment banking isn’t a purely academic role. Knowing finance theory helps – but what really matters is how well you can apply it when the stakes are high. It’s a practical, execution-driven profession where your work directly influences real outcomes.

That’s why investment banking places such heavy emphasis on skills. Once you understand what the job demands, it becomes obvious why certain finance skills, technical abilities, and behavioural traits are non-negotiable.

With that context in place, let’s now look at the skills required in investment banking – and what actually gets you hired.

If you’re still trying to visualise what investment banking actually involves beyond definitions, and skills required in investment banking, this video explains the investment banker’s role, responsibilities, and purpose in a very clear way:

Why Skills Matter More Than Titles in Investment Banking

The requirements for investment banking jobs are often misunderstood. Many assume that only elite colleges or holding a prestigious title is what truly matters. While a degree may help you get noticed early, it rarely decides who actually gets hired – or who succeeds once inside the role.

In reality, once you’re in the interview room, recruiters focus on something much simpler:

Can this person do the job without slowing the team down?

Does this person have the skills required in investment banking roles?

Investment banking teams work under tight deadlines, high pressure, and real financial risk. There’s very little room for on-the-job handholding. That’s why the investment banker skills needed are highly specific and practical. You’re not paid to know finance in theory. You’re paid to apply finance accurately, quickly, and under pressure, often with incomplete information and changing assumptions.

This is also why candidates with strong execution skills often outperform those with impressive titles but weak practical ability.

Did you know?

Investment banking decisions often involve incomplete data and tight deadlines, which is why judgment matters as much as numbers.

Why Investment Banking Job Roles Are Skill-Driven

In an investment banking career, skills aren’t a nice-to-have – they’re the baseline, the non-negotiable criteria for hiring. Titles may open the door, but skills decide whether you’re trusted, promoted, and retained. That’s why successful bankers invest early in building the right mix of finance, technical, and execution-focused capabilities.

| Investment Banking Job Role | Why Skills Matter More Than Titles |

| Analyst / Associate | Requires strong financial modelling, Excel, and valuation skills to deliver error-free work under tight deadlines. |

| M&A Advisory | Demands analytical thinking, deal structuring, and communication skills to support high-stakes transactions. |

| Capital Markets | Needs market awareness, numerical accuracy, and fast decision-making as conditions change rapidly. |

| Investment Banking Operations | Relies on process knowledge, attention to detail, and risk control to ensure smooth deal execution. |

| Financial Analyst | Focuses on data analysis, forecasting, and judgment – core financial analyst requirements across banks. |

Understanding the skills is one part, but knowing how candidates actually get hired is another. This video focuses on practical steps, mindset shifts, and preparation strategies that help aspirants land investment banking roles:

Core Finance Skills Required in Investment Banking

Let’s start with the foundation. No matter which team you join – front office, middle office, or even investment banking operations – these are the finance skills required across the board. If you’re serious about meeting the requirements for investment banking, this is where your preparation must begin.

Financial Statement Understanding (Non-Negotiable)

One of the most fundamental skills required in investment banking is a deep, working understanding of financial statements. You must be comfortable with:

- Income Statement

- Balance Sheet

- Cash Flow Statement

But this goes far beyond familiarity with textbook definitions or rote learning. Recruiters and hiring managers aren’t looking for memorised theory – they want to see whether you actually understand how things work in the real world. You should be able to explain:

How does a rise in revenue impact operating cash flow?

How do debt changes affect the balance sheet and interest expense?

How does cash flow ultimately drive company valuation?

This ability to connect numbers across statements is a core investment banking required skill, and it’s where many freshers struggle. Without it, even strong Excel or modelling skills fall apart.

Valuation Knowledge

Another essential part of the investment banking skills required is valuation. You don’t need to invent new valuation models – but you must clearly understand when and why each method is used.

Key valuation techniques every aspiring banker must know include:

- Discounted Cash Flow (DCF)

- Comparable Company Analysis

- Precedent Transactions

- Valuation multiples such as EV/EBITDA, P/E, and Price-to-Book

This is where financial skills to learn become role-defining. Valuation is central to M&A, fundraising, and advisory work, and it directly influences client investment decisions. Candidates who can interpret valuation outputs – not just calculate them – stand out quickly.

If your goal is to move beyond back-office or purely support roles, these valuation concepts are non-negotiable skills in investment banking.

In short, strong financial statement analysis and valuation knowledge form the backbone of investment banking skills. Once these finance fundamentals are in place, it becomes much easier to build advanced technical skills, handle live deals, and meet the real-world investment banker skills needed on the job.

Reality check:

Most rejections happen before interviews, simply because candidates don’t demonstrate job-ready skills – not because they lack degrees.

Technical Skills Required for Investment Banking

This is where theory finally meets execution. You can understand finance concepts perfectly, but without the strong technical skills required in investment banking, it’s very difficult to survive – or grow – in the role. These are the skills that are tested most heavily in interviews and used daily on the job.

Advanced Excel & Financial Modelling

Among all technical skills for investment banking, Excel and financial modelling are the most critical – and the most tested.

You’re expected to:

- Build clean, structured, and logical financial models from scratch.

- Work fast and accurately, without breaking formulas or links.

- Audit, troubleshoot, and fix errors under intense time pressure.

This isn’t about knowing a few shortcuts. It’s about building models that other bankers can trust. A single error in a live deal model can have serious consequences, which is why Excel proficiency is one of the most important investment banking skills required.

In many hiring decisions, candidates with similar degrees and backgrounds are separated by one thing alone: who has stronger modelling skills. That’s why these technical skills required in investment banking often become the deciding factor between two equally qualified candidates.

PowerPoint & Pitchbook Skills

Yes, presentation skills matter, and often more than people expect.

Investment bankers spend a significant portion of their time in:

- Creating pitch decks for prospective clients.

- Updating deal books and presentations for live transactions.

- Simplifying complex financial data into clear, client-ready slides.

This is a core skill, but often gets overlooked as part of the skills required in investment banking. Senior bankers and clients rely on these materials to make decisions, which means clarity is non-negotiable.

Clear, structured slides signal clear thinking.

Messy layouts, inconsistent numbers, or poorly explained charts signal risk.

That’s why PowerPoint proficiency is considered a practical, everyday investment banking skill, not just a soft add-on.

Together, Excel, financial modelling, and presentation skills form the execution backbone of investment banker skills needed. Without them, even strong financial knowledge struggles to translate into real-world banking performance.

If you want a clearer picture of how different investment banking roles and functions fit together, this video breaks it down visually and simply:

Analytical & Decision-Making Skills Required in Investment Banking

An investment banking degree isn’t just about running models or preparing slides – it’s about making sense of information when the stakes are high. Every deal involves uncertainty, imperfect data, and tight timelines. That’s why strong analytical and decision-making ability sits at the heart of the skills required in investment banking.

Banks look for professionals who can break down complex financial data, spot what actually matters, and make sound judgments quickly. Whether you’re evaluating a potential acquisition, assessing risk in a transaction, or supporting a client decision, your value comes from how well you think, not just how well you calculate.

These investment banking required skills are what turn raw numbers into insights and those insights into decisions that move deals forward.

| Skill Area | What Banks Look For | Why It Matters in Investment Banking |

| Financial Analysis & Judgment | Ability to spot inconsistencies in numbers, question assumptions, and ask “Does this make sense?” | Helps bankers evaluate deals realistically, manage risk, and support sound client decisions. |

| Risk Understanding | Seeing beyond returns to understand downside risk, volatility, and uncertainty. | Prevents overvaluation, flawed recommendations, and poor deal outcomes. |

| Attention to Detail | Accuracy in numbers, models, and presentations – down to decimals and formatting. | Even small errors can change valuations and quickly erode trust within deal teams. |

| Analyst-Level Thinking | Structured analysis and logical reasoning under pressure. | Aligns closely with financial analyst requirements, which is why many bankers start as analysts. |

Did you know?

Once hired, no one cares where you studied – only whether your work can be trusted. Top-performing bankers aren’t always the most qualified on paper, but the most reliable under pressure.

Soft Skills Required in Investment Banking

When people talk about skills required in investment banking, they often focus only on finance and technical ability. But once you’re inside a deal team, soft skills quietly decide who is trusted, who advances, and who struggles. These may not show up clearly on a resume, but they show up every single day at work.

Communication Under Pressure

In investment banking, you don’t need to be the loudest person in the room. You need to be clear, precise, and calm – especially under pressure.

Strong communicators in banking can:

- Explain complex numbers to seniors in a clear, concise way.

- Write professional, structured emails to clients and internal teams.

- Summarise large amounts of data for leadership without losing the key message.

This ability to communicate clearly is one of the most underrated investment banking skills required. Deals move fast, and misunderstandings can be costly. Clear communication signals reliability, competence, and sound thinking.

That’s why communication becomes a silent differentiator among investment banker skills needed, even when technical ability is similar.

Time & Stress Management

Let’s be realistic – long hours are part of the job. Deadlines shift, deals run late, and urgency is constant. That’s why time and stress management are essential skills in investment banking, not optional extras.

The best bankers aren’t just smart – they’re organised. They know how to:

- Prioritise tasks when everything feels urgent.

- Manage fatigue without letting accuracy slip.

- Deliver clean work even at 2 a.m.

Banks value professionals who can stay dependable under pressure. Poor stress management leads to mistakes, burnout, and lost trust – none of which fit the requirements for investment banking.

In practice, these soft skills tie everything together. Finance knowledge and technical expertise get you into the role, but communication, organisation, and resilience are what help you sustain and grow in an investment banking career.

Lesser-known fact:

Over 70% of an analyst’s first year is spent on Excel and PowerPoint – not client meetings or deal negotiations.

Skill Required for Investment Banker in India: What’s Different?

When people search for investment banker qualifications in India, they often expect a neat checklist or a specific degree, a fixed exam, or a guaranteed pathway. The reality is far more practical.

In India, there is no single mandatory qualification for investment banking. Degrees such as BCom, BBA, CA, MBA, and even Engineering are all acceptable entry points. What actually determines success is not the title on your resume, but how well your skills align with the role you’re targeting.

Indian investment banks, global banks, and captive units don’t hire based on degrees alone. They hire candidates who are job-ready people who can handle financial data, work on models, support deals, and deliver accurate output under pressure.

This focus on execution is also why investment banking salary levels tend to be higher than most traditional finance roles, especially as your deal exposure and responsibility increase. That’s why the skills required in investment banking in India closely mirror global standards, with a strong emphasis on execution.

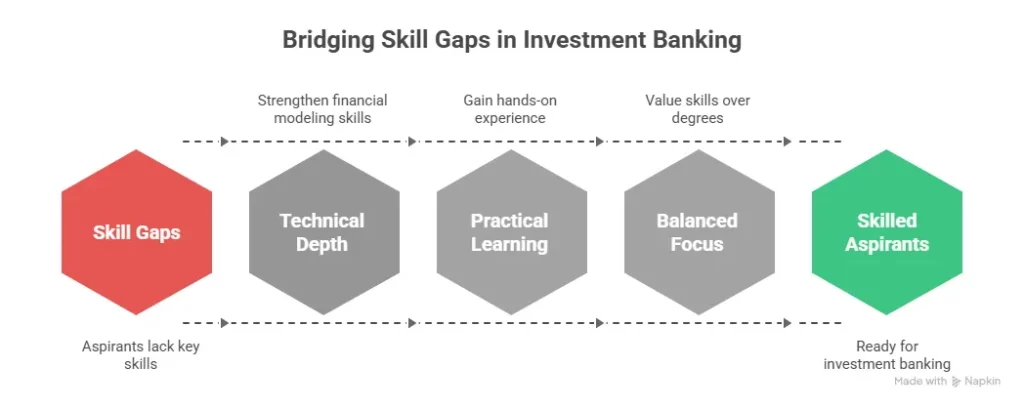

Common Skill Gaps Aspirants Don’t See Early

Most people who struggle to enter investment banking don’t fail because they lack intelligence, ambition, or effort. They fail because they misunderstand the skills required in investment banking and spend their time preparing for the wrong things.

Here are the most common gaps that quietly hold aspirants back:

Over-focusing on qualifications instead of execution

- Many candidates chase degrees, titles, or certifications, assuming these alone meet the requirements for investment banking.

- While qualifications help you get noticed, interviews and on-the-job performance are driven by investment banking skills required – your ability to analyse data, build models, and deliver accurate work under pressure.

Underestimating technical depth

- A frequent mistake is assuming basic Excel knowledge or surface-level valuation is enough. In reality, the technical skills required in investment banking are far deeper.

- Banks expect speed, accuracy, and structure – especially in financial modelling, valuation, and data analysis. This gap often becomes visible very quickly in interviews.

Delaying practical finance skill-building

- Many aspirants postpone hands-on learning, focusing only on theory. But the finance skills required in investment banking are practical by nature.

- The longer you delay building real-world financial skills, the harder it becomes to compete with candidates who start early and practice consistently.

Understanding what the skills required in investment banking are at an early stage helps you avoid these pitfalls. It allows you to focus on investment banker skills needed in real roles – saving years of confusion, misdirected effort, and missed opportunities.

Once you start building the right skills, interviews are the next hurdle. This video walks through 13 commonly asked investment banking interview questions and what recruiters are really testing:

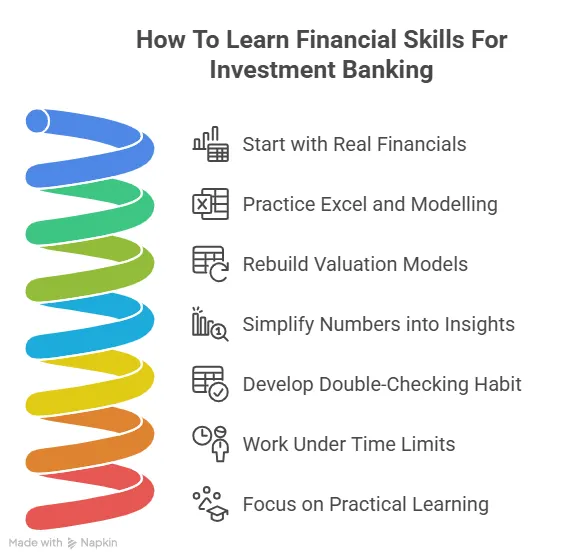

Smart Tips to Learn Investment Banking Skills Faster

By now, one thing should be clear: the skills required in investment banking are learnable – but only if you approach them the right way. Many aspirants stay stuck not because they aren’t working hard, but because they’re learning inefficiently.

If you’re serious about how to become an investment banker, this is the part that matters most. Investment banking rewards focused, practical learning – not scattered effort. Here are a few smart ways to build investment banker skills faster and more effectively:

| Skill Area | Smart Way to Learn | Why It Works |

| Finance Fundamentals | Practice analysing real company financial statements, not just examples | Builds real-world understanding of the finance skills required |

| Valuation | Recreate DCF and comparable models for listed companies | Strengthens interpretation, not just calculation |

| Excel & Modelling | Time yourself while building models from scratch | Improves speed and accuracy under pressure |

| PowerPoint | Reverse-engineer pitch decks and deal presentations | Teaches clarity and structure expected in banking |

| Analytical Thinking | Regularly ask “Does this make sense?” while reviewing numbers | Develops judgment aligned with financial analyst requirements |

| Soft Skills | Summarise complex data in 3-4 clear bullet points | Sharpens communication under pressure |

| Consistency | Practice a little every day instead of cramming | Matches how skills are built in real banking roles |

Don’t wait until you feel ready to practice. Investment banking skills are built through repetition, not perfection. The earlier you start working with real numbers, real models, and real constraints, the closer you get to meeting actual requirements for investment banking.

Small, consistent progress compounds fast in this field – and that’s what ultimately gets you hired.

Why Imarticus Learning for Investment Banking Skills?

The Investment Banking Certification by Imarticus Learning is designed for one clear purpose: to help learners build the investment banking skills required to perform confidently in real roles – especially at the entry and early-career level.

Instead of overwhelming you with broad finance theory, the program focuses on how investment banking actually works day to day. It’s built around execution – what analysts and operations teams really do inside banks – so learners aren’t left figuring things out from scratch once they’re hired.

Here’s how the program supports investment banker skills needed in practice:

- A role-aligned curriculum based on how investment banking operations actually work, not generic finance theory.

- Hands-on training in real banking processes like trade lifecycles, settlements, reconciliations, and compliance.

- Strong focus on practical finance skills – financial analysis, accurate reporting, and operational risk awareness.

- Training that mirrors day-to-day technical work, especially Excel workflows used in global banks.

- Realistic projects and case studies that show how bankers think and work.

- Career and placement support, including interview prep and employer connections.

- Ideal for freshers and career switchers from BCom, BBA, CA, MBA, and similar backgrounds.

In short, the program is built for people who don’t just want to learn about investment banking but want to develop the skills required to actually work in it. That practical, execution-first approach is what makes the difference between being qualified on paper and being ready on the job.

If your goal is to move from qualification-focused preparation to skill-driven employability, a structured investment banking course like this can significantly improve how quickly and confidently you meet the real-world investment banking required skills.

FAQs About Skills Required in Investment Banking

If you’re exploring a career in investment banking, it’s natural to have questions about the skills required in investment banking – what really matters, what’s learnable, and where to focus first. In this frequently asked questions section, I’ll answer the most common doubts in clear, so you can spend less time guessing and more time building the right skills.

What skills are required for investment banking?

The core skills required in investment banking include strong finance fundamentals, financial statement analysis, valuation knowledge, advanced Excel and financial modelling, analytical thinking, attention to detail, and clear communication under pressure. This is why many aspirants turn to hands-on, job-focused learning through institutes like Imarticus Learning, where the emphasis is on real banking workflows rather than just theory.

What are the skills required for investment banking roles?

An investment banking role requires doing the basics really well, consistently and under pressure. You need to be comfortable with numbers, confident in Excel and financial modelling, and able to make sense of financial data quickly. But skills aren’t limited to technical. The people who do well are those who can think clearly, execute accurately, and be relied on when the stakes are high.

Which technical skills are required for investment banking?

The most important technical skills for investment banking are Excel proficiency, financial modelling, valuation techniques, and PowerPoint skills for creating pitch decks and client presentations.

Are finance skills required for investment banking roles in India?

Yes. Finance skills required in investment banking in India are the same as the global standards. Banks look for job-ready candidates who can analyse financial data, build models, and support deals accurately – regardless of degree background.

Can I learn investment banking skills without a finance degree?

Yes. Many investment bankers come from non-finance backgrounds. What matters most is whether you’ve built the investment banking skills required through practical learning, hands-on projects, or a structured investment banking course.

How long does it take to build the skills required for an investment banker role?

With focused, practical learning, most candidates can build core investment banking skills in 6 to 12 months. The timeline depends on consistency, practice, and how early you focus on real-world execution skills.

How to pursue an investment banker qualification in India?

The most practical way to pursue it is to start with an eligible background like BCom, BBA, CA or related fields, build core finance fundamentals, develop technical and execution skills, take a job-focused investment banking course from reputed institutes like Imarticus Learning, and target the right entry roles.

Skills Required for Investment Banker: Final Takeaway

If there’s one thing to learn from all of this, it’s that investment banking isn’t about chasing impressive titles or collecting degrees. It’s about building the skills required for investment banker roles – the kind of skills that let you work confidently with numbers, handle pressure, communicate clearly, and deliver accurate work when it really counts.

Once you understand what the job actually demands, the confusion starts to fade. You stop asking – Do I have the right background? and start focusing on whether you’re job-ready. And that shift makes all the difference.

If you’re serious about breaking into the field, a structured investment banking course can help you develop the skills required in investment banking faster and more practically – without years of trial and error.

Start building the right skills now. The sooner you do, the closer you are to being the candidate firms actually want to hire.