Last updated on December 29th, 2025 at 02:27 pm

An investment banking career has a way of making people pause. It sounds impressive. It carries weight. And it often comes with a mix of excitement and hesitation.

On one hand, there’s the promise – high pay, global exposure, working on important deals. On the other hand, there are the long hours, pressure, and a pace that isn’t meant for everyone. You might’ve heard both and are confused about what is right; you’re not alone.

If you’re reading this, chances are you’re trying to sort through that noise. You’re not just asking whether investment banking certification looks good on paper – you’re trying to figure out whether it would actually fit your life.

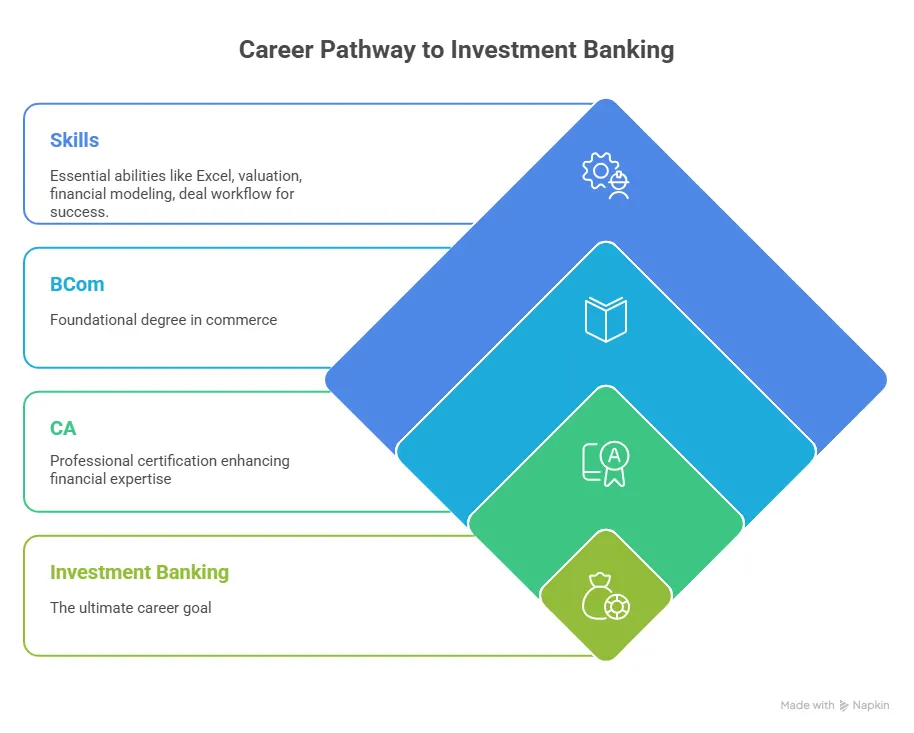

Maybe you’re a BCom student wondering if investment banking after BCom is even realistic.

Maybe you’re a CA thinking about stepping away from familiar accounting roles into something more deal-driven.

Or maybe you’re asking the simplest and most important question of all: Is investment banking a good career for me?

This guide is meant to help you think that through – calmly and honestly. I’ll talk about what the work really looks like, what the pressure feels like, how careers grow, and what people often discover once they’re inside the industry.

No hype. No selling. No assumptions.

Just a clear, human look at what an investment banking career actually involves – so you can decide if it’s something you want to commit to.

Did you know?

Most professionals who enter investment banking don’t decide overnight. They spend months – sometimes years- researching the reality of the role before committing, because early career choices here shape long-term outcomes.

What To Expect From An Investment Banking Career

Before jumping into job roles and career paths, let’s slow down for a moment and talk about what is investment banking – because it’s widely misunderstood.

At its core, investment banking is about helping companies make big, high-pressure financial decisions. The kind of decisions that don’t happen every day, but when they do, they really matter. Raising a large amount of money. Buying another company. Selling a business unit. Going public for the first time.

An investment banking career puts you right in the middle of those moments.

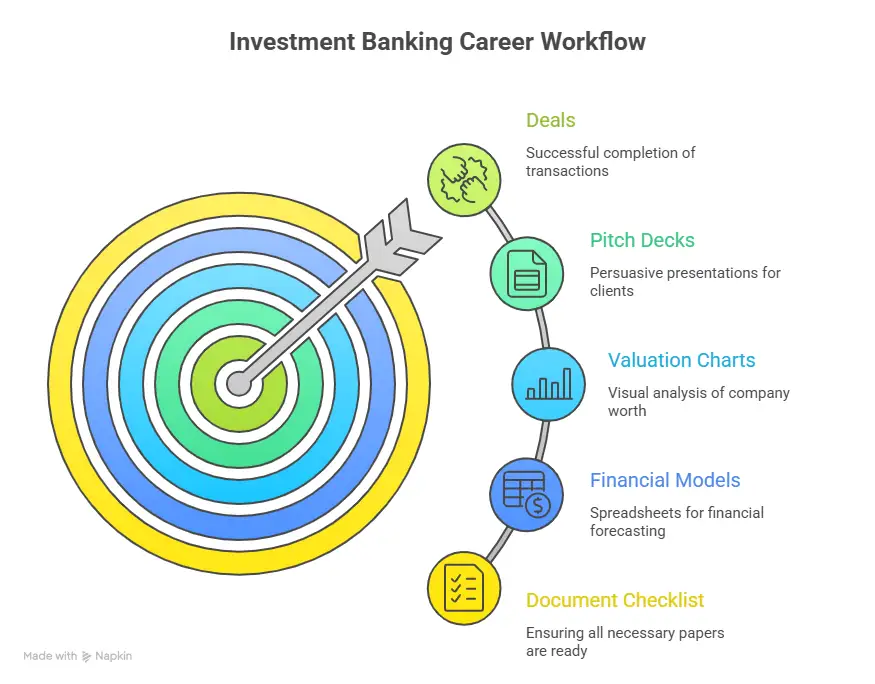

In day-to-day terms, this usually involves:

- Helping companies raise capital, either by issuing shares or borrowing money.

- Working on mergers and acquisitions (M&A) – figuring out what a business is worth and how a deal should be structured.

- Valuing companies so founders and leadership teams know what’s fair, realistic, and strategic.

- Supporting senior management during investment decisions that can change the direction of the company.

Now here’s the part most people are surprised by.

Investment bankers aren’t traders glued to the flashing stock screens all day. That’s trading – a completely different career path. An investment banking career is quieter, more structured, and a lot more detail-driven. Investment banking is far less about reacting to markets and far more about analysis, preparation, and execution.

Most of the work happens quietly, behind the scenes:

- Building financial models and double-checking them.

- Turning complex numbers into clear presentations.

- Reviewing documents line by line to make sure nothing is missed before they become expensive mistakes.

- Coordinating between clients, lawyers, and internal teams to keep deals moving.

This is why careers in investment banking have the reputation they do and are often described as demanding.

But for people who enjoy structured thinking, working with numbers, and being close to decisions that shape real businesses, an investment banking career can feel incredibly rewarding – not because it’s glamorous, but because you’re trusted with work that actually matters.

Reality check:

Less than 20% of an investment banker’s time is spent on big moments, like deal announcements. The majority is spent on preparation – models, documents, and reviews – because execution quality is what decides success.

Is Investment Banking Really a Good Career?

This is one of the most common questions people ask – and the honest answer isn’t a simple yes or no. It really depends on what you value in a career.

An investment banking career can be very good, but it’s not for everyone. The people who thrive in it usually know exactly what they’re getting into. Investment banking is a great career option if you are interested in the finance sector.

| Investment Banking Is a Good Fit If You… | Investment Banking Is Not a Good Fit If You… |

| Want fast career growth and are comfortable with a steep learning curve | Want a strict 9-5 workday |

| Can handle pressure, tight deadlines, and long hours | Prefer low-stress, predictable work |

| Enjoy analytical, detail-driven work | Dislike accuracy-heavy tasks |

| Care about high compensation and strong exit options | Prioritise work-life balance early on |

Additionally, there is a massive growth in careers in investment banking because of the boom in the finance sector of the country. So, one can stay assured that investment banking is going to stay in demand in the upcoming years.

So yes – investment banking is a good career, but only if you’re honest with yourself about what you want. If you’re excited by challenge, intensity, and responsibility, it can be incredibly rewarding.

If not, there are plenty of other finance careers that offer a better lifestyle fit – and there’s no shame in choosing those instead.

Interesting fact:

In investment banking, small errors can have large consequences. That’s why junior bankers are trained to check numbers repeatedly – accuracy is valued more than speed in the long run.

Investment Banking Career in India: Growth, Roles, and Reality

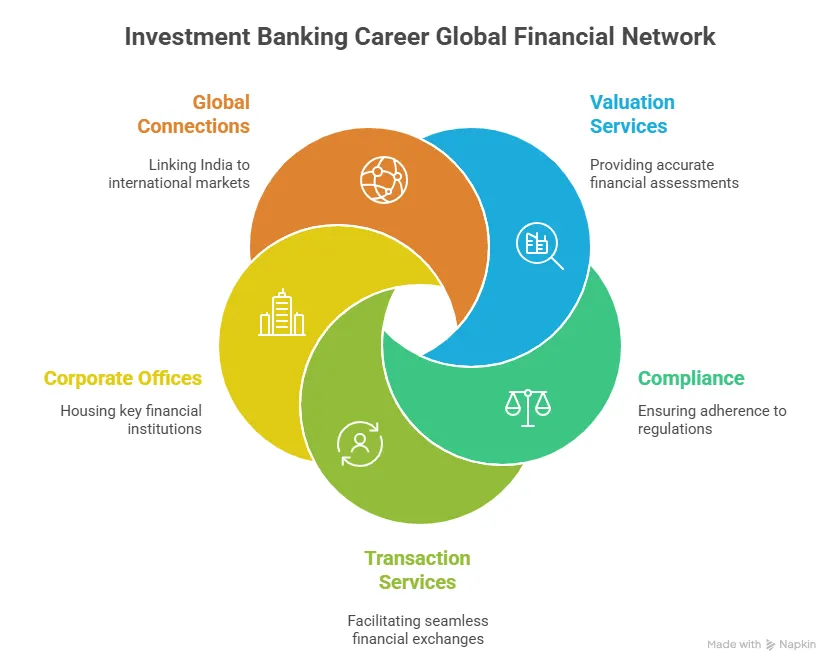

The investment banking career in India has grown rapidly over the last decade – and not just in headlines, but in real, on-the-ground hiring.

Today, India is a major global hub for investment banks. Most leading international banks run large teams here that support critical functions such as:

- Valuation and financial modelling

- Deal execution and transaction support

- Compliance, risk, and regulatory reporting

- Transaction services and middle-office operations

These teams aren’t doing support work in a superficial sense. They handle core deal processes that directly impact live transactions across the US, Europe, and Asia.

Because of this expansion, you’ll find opportunities at global institutions like Goldman Sachs, JP Morgan, Morgan Stanley, Barclays, and Citi – alongside strong domestic players such as Edelweiss, Motilal Oswal, and Axis Bank.

This growth has also changed how people enter the industry. A traditional commerce or finance background still helps, but many candidates now ask less about the right investment banking career and more about whether you can model, value, and execute real deals that actually align with what banks do day to day.

That’s because hiring has become more skill-focused – banks care less about degree names and more about whether your education has prepared you for modelling, valuation, and real deal workflows.

That’s why the question comes up more than ever: Is investment banking a good career in India?

For candidates who combine the right academic foundation or investment banking degree with practical, job-ready skills, the answer is yes. India offers strong entry points, global exposure, and long-term career growth – provided you’re prepared for the intensity and expectations of the role.

Did you know?

Many people leave investment banking not because they can’t handle the work, but because they realise their priorities around time and lifestyle are different. Self-awareness matters as much as skill here.

Can You Build an Investment Banking Career After BCom?

This is one of the most searched questions online: Can I do investment banking after BCom? The realistic answer is, Yes – but not automatically.

Investment banking after BCom is possible, but a general commerce degree alone usually doesn’t cover:

- Financial modelling

- Valuation techniques

- Real deal workflows

That’s why many students who explore IB after BCom focus on building job-ready skills alongside their degree. The degree opens the door; skills help you walk through it.

Investment Banking After CA: A Logical Transition

A chartered accountant’s career in investment banking makes logical sense.

As CAs already bring:

- Deep accounting knowledge.

- Financial statement analysis.

- Audit and compliance experience.

To move into investment banking after CA, most professionals add exposure to:

- Valuation methods

- M&A processes

- Capital markets

This is why investment banking after CA is a common and respected transition – especially into transaction advisory and corporate finance roles.

Did You Know?

Freshers who build strong fundamentals in finance, Excel, and valuation, and who target entry-level roles like analyst or transaction support positions, tend to do much better.

How to Start a Career in Investment Banking

If you’re wondering how to start a career in investment banking, you’re not alone – and you’re probably seeing a lot of confusing advice online. The truth is, most people don’t break in by chance. They do a few things really well, and they do them deliberately.

Here’s what actually works in the real world:

- First, get your finance basics clear – You don’t need to sound like a textbook, but you should genuinely understand how financial statements work, how companies are valued, and why deals happen in the first place. This clarity becomes the base for everything else.

- Next, build practical skills that banks actually use – Investment banking is very hands-on. Strong Excel, financial modelling, valuation, and basic presentation skills matter far more than memorising theory. These are the skills teams expect you to bring on day one.

- Then, aim for realistic entry-level roles – Instead of chasing senior titles, focus on analyst-level positions, transaction support, or deal execution roles. Many investment banking careers start here – not at the front office straight away.

- When it comes to applications, be selective – Randomly applying everywhere rarely works. Targeting roles that match your current skills, tailoring your resume, and applying where you actually have a fighting chance is far more effective.

- Finally, prepare properly for interviews – Investment banking interviews are less about fancy answers and more about how clearly you think. Interviewers want to see structured problem-solving, basic financial logic, and how you approach real-world situations.

So whether you’re asking how to join investment banking, how to apply for investment banking, or what it really takes to become an investment banker, the message is the same. If you focus on building the right skills early and take a realistic, targeted approach, breaking into investment banking becomes challenging – but absolutely achievable.

Quick insight:

People who succeed in investment banking often don’t see long hours as a sacrifice early on – they see them as an investment in faster learning and stronger exit opportunities.

How Much Does an Investment Banker Earn in India?

When someone asks about an investment banking career, what they’re often trying to understand is the Investment Banking salary and whether the effort is actually worth it.

Here’s what pay typically looks like in India:

| Experience Level | Investment Banking Salary in India |

| Entry-level roles | ₹8-15 LPA |

| Mid-level professionals | ₹20-40 LPA |

| Senior roles | ₹50 LPA+ (including bonuses) |

This is why so many people say investment banking is a good career financially. The earning potential of an investment banker is strong, even by financial standards.

That said, the pay doesn’t come easily. Investment banking salary levels reflect the reality of the job – long hours, high-pressure deadlines, real responsibility, and performance-driven expectations. You’re paid well because accuracy matters, timelines are tight, and the stakes are high.

For those who can handle the intensity, the financial upside can be significant. For others, the compensation may not feel worth the lifestyle trade-off – and that’s an honest decision every aspirant has to make.

An investment banking career can be very demanding as it requires many skills, abilities, and research. It not only offers enough challenges for the individuals to kick start their careers in the most interesting way, but also rewards them with attractive salary benefits.

India-specific fact:

India has become one of the largest global hubs for investment banking operations, supporting live deals across the US, UK, and Europe – making global exposure possible without relocating early in your career.

Investment Banking Career Ladder & Progression

Unlike many corporate roles where growth paths are unclear, investment banking career progression is transparent and merit-driven. You know what the next role is, what skills you need, and how performance directly affects promotions.

This clarity – combined with rising responsibility, compensation, and influence at each level – is one of the biggest reasons people actively choose investment banking jobs as a long-term career.

The investment banking career ladder is one of the most clearly defined in the corporate world. From day one, you know what the next role looks like, what’s expected of you, and how progression usually works. This transparency in investment banking career progression is a big reason many people choose banking over roles where growth paths are vague or slow.

Here’s what each stage typically involves:

| Role | Primary Focus | What Changes at This Level |

| Analyst | Execution and learning | Build models, valuations, and pitch decks while learning how deals work in real life |

| Associate | Managing execution | Review analyst work, coordinate teams, and take ownership of deal deliverables |

| Vice President (VP) | Running deals | Lead day-to-day deal execution, manage timelines, and interact directly with clients |

| Director | Client relationships | Focus on pitching, structuring deals, and expanding client coverage |

| Managing Director (MD) | Revenue and strategy | Bring in business, maintain long-term client relationships, and drive firm growth. |

Did you know?

Many global investment banks prefer India-based teams for valuation, transaction services, and compliance because of strong technical talent and cost efficiency – creating sustained hiring demand.

What People Pursue After Investment Banking Careers

One of the biggest reasons people choose an investment banking career isn’t just the job itself – it’s what it leads to afterwards.

Most bankers don’t expect to stay in investment banking forever. They put in a few intense years knowing that the experience they’re building can open doors that are otherwise very hard to access. That’s what makes careers after investment banking so attractive.

Some of the most common paths people move into include:

Private Equity

This is one of the most talked-about exits. After advising on deals in banking, many professionals want to be on the other side – actually owning businesses and helping grow them. The deal exposure and valuation skills from investment banking translate naturally here.

Venture Capital

For those drawn to startups and early-stage companies, venture capital is a popular option. Banking teaches you how to analyse businesses rigorously, which helps when evaluating young companies with big ideas but limited track records.

Corporate Strategy

Some bankers move in-house to strategy roles at large companies. Instead of advising multiple clients, you focus on one business – working on acquisitions, expansion plans, and long-term decision-making at a senior level.

CFO and Leadership Roles

Over the long run, many former bankers end up in senior finance or leadership positions. The early exposure to capital markets, fundraising, and M&A builds a strong foundation for roles like CFO, finance head, or even broader management roles.

These post-investment banking careers are a big reason people are willing to push through the early grind. The hours are long, and the pressure is real – but the experience acts like a career accelerator, giving you options and flexibility that last well beyond your time in banking.

For many, investment banking isn’t the end goal. It’s the launchpad.

Interesting fact:

Many senior leaders in finance, private equity, and corporate strategy started their careers in investment banking because of the early exposure to decision-making under pressure.

Deciding on an Investment Banking Career Path

So, by now you might have already got the answer to – Is investment banking a good career for you? If you want rapid growth, strong income potential, and exposure to high-impact financial decisions, investment banking is a good career choice.

But it’s not a shortcut – and it’s not for everyone.

If you’re willing to prepare properly, whether through investment banking after BCom, investment banking after CA, or structured upskilling. The demands are real, but so are the opportunities it creates later.

That’s the real truth behind an investment banking career. If you’re wondering how to make a career in investment banking, the table below helps you choose the right career path based on your personality traits:

| Your Natural Traits | Investment Banking Career Paths That Fit Best |

| Highly analytical, detail-oriented, patient with numbers | Valuation teams, financial modelling roles, and M&A execution |

| Comfortable with pressure and tight deadlines | Front-office investment banking, deal execution roles |

| Strong communication and coordination skills | Associate, Vice President (VP), client-facing roles |

| Strategic thinker who enjoys big-picture decisions | Corporate strategy, M&A advisory, senior banking roles |

| Relationship-driven, persuasive, commercially minded | Director, Managing Director (MD), origination roles |

| Interested in long-term ownership and business growth | Private equity, long-term post-investment banking careers |

| Curious about startups and innovation | Venture capital, growth investing |

| Leadership-oriented with finance depth | CFO track, senior finance and management roles |

Did You Know?

Investment banking rewards preparation more than ambition. The people who succeed are rarely the loudest – but often the most consistent and disciplined.

Why Learners Choose Imarticus Learning for Investment Banking

Breaking into investment banking isn’t just about ambition – it’s about being job-ready for the roles banks are actually hiring for. This is where Imarticus Learning stands out.

The Investment Banking Certification is designed specifically for candidates who want a practical, role-aligned entry into the investment banking ecosystem, rather than just academic exposure.

What makes it different:

- Role-focused curriculum aligned with real investment banking operations and transaction roles.

- Hands-on training in valuation basics, trade lifecycles, settlements, compliance, and risk processes used by global banks.

- Strong emphasis on Excel, financial workflows, and deal support skills that entry-level teams use daily.

- Built for freshers, BCom/BBA graduates, and career switchers, not just finance specialists.

- Career support and interview preparation tailored to banking hiring processes.

- Exposure to global banking standards helps candidates prepare for roles in multinational institutions.

Instead of teaching finance in theory, Imarticus focuses on how investment banking actually works inside banks – making it easier for learners to transition from education to employment.

For aspirants who want structure, clarity, and a realistic pathway into investment banking operations and support roles, this program helps bridge the gap between qualification and employability.

FAQs About Investment Banking Career

If you’re exploring an investment banking career, it’s natural to have a lot of questions. These frequently asked questions address the most common and practical queries aspirants ask, especially freshers, BCom graduates, CA professionals, and career switchers, so you can make an informed decision with clarity and confidence.

Is investment banking a good career for freshers?

Yes, investment banking can be a good career for freshers – but only if they’re prepared for a steep learning curve and long working hours. Many freshers choose structured, job-focused learning paths such as Imarticus Learning to bridge the gap between academic theory and real investment banking work, since banks value practical, role-ready skills far more than just degree titles.

Can I start an investment banking career without an MBA?

Yes. An MBA degree is not mandatory for an investment banking career, especially at the entry level. Many professionals enter through commerce degrees, CA qualifications, or focused investment banking programs that build practical, job-ready skills.

Is investment banking a stressful career?

Yes. An investment banking career involves high pressure with tight deadlines, long hours, and high expectations. The stress comes from accuracy, responsibility, and client timelines – which is also why the compensation and exit opportunities are strong.

What skills are most important for an investment banking career?

Soft skills like discipline and resilience matter just as much as technical ability. The key skills include:

- Financial modelling and valuation.

- Advanced Excel.

- Strong accounting fundamentals.

- Attention to detail.

- Clear communication and structured thinking.

Is investment banking a good career in India long-term?

Yes. With India becoming a global hub for banking operations, transaction services, and deal execution, long-term demand for skilled investment banking professionals is expected to remain strong – especially for candidates with global exposure and practical skills.

What are the best careers after investment banking?

Popular career options after investment banking include:

- Private equity

- Venture capital

- Corporate strategy

- CFO and senior leadership roles

These paths are a major reason many professionals commit to the early intensity of investment banking.

Is work-life balance possible in investment banking?

Work-life balance is limited in the early years of an investment banking career. However, many professionals move into roles with better balance later – either within banking at senior levels or through post-investment banking exits.

Final Thoughts: Should You Choose an Investment Banking Career?

An investment banking career isn’t about glamour, shortcuts, or overnight success. It’s about discipline, skill, and long-term thinking. The hours are demanding, the expectations are high, and the learning curve is steep – but for the right kind of person, the payoff goes far beyond just salary.

If you enjoy structured problem-solving, working closely with real business decisions, and pushing yourself early in your career, investment banking can open doors that few other roles can. If you’re looking for predictability or quick wins, there are better paths – and recognising that early is just as important.

The real question isn’t whether investment banking is a good career. It’s whether you’re willing to prepare properly for it.

If you’re serious about entering the field, focus on becoming job-ready, not just qualified. Build practical skills, understand how deals actually work, and choose learning paths that mirror real investment banking roles – not just classroom theory.

If you want a structured, practical pathway into investment banking operations and transaction roles, explore how Investment Banking Certification can help you bridge the gap between education and employability.

Because in investment banking, ambition matters – but preparation is what gets you hired.