Reaching the top of the ladder that leads to the much-desired Chief Financial Officer (CFO) position is no simple task, but this is the dream of many finance professionals across India. If you have ever pictured yourself as a senior decision maker at the highest level impacting the future direction of an organisation with control of its finances, this blog will show you how to become a CFO.

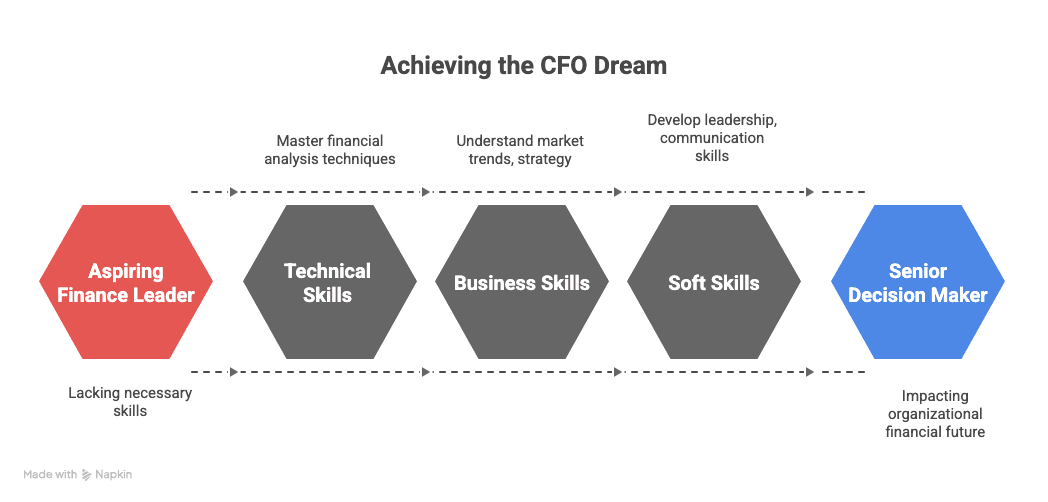

The path to the CFO role does not merely involve number crunching in today’s competitive landscape. It involves great leadership & vision, as well as the right balance of technical skills, business skills & soft skills. No matter where you are in the process, whether as an aspiring finance leader, mid-career professional or starting to plan a pathway to CFO.. it is important to understand what skills to be able to develop, what qualifications you may require and what is the quickest route to the C-suite.

Table of Contents

- What Does a CFO Do?

- CFO Career Path: The Typical Journey

- Skills Needed to Become a CFO

- CFO Qualifications and Certifications You Need

- Financial Leadership Positions Leading to the CFO Role

- Executive Finance Training: Fast-Track Your Journey

- Fastest Route to the C-Suite: Practical Advice

- Key Takeaways

- FAQs

- Conclusion

What Does a CFO Do?

Before you strategize on how to become a CFO, it is important to know the extent of this lofty position. The CFO occupies the confluence of finance, strategy, and leadership, serving as the financial guardian and strategic guide to the CEO and board.

Now, CFOs are no longer just confined to crunching numbers. Now, they lead business growth, manage investments, handle risks, and lead digital transformations. Their function stretches far beyond financial reporting to creating company vision and performance.

Chief Responsibilities of a CFO:

- Managing financial planning, budgeting, and forecasting

- Managing capital structure and financial risk

- Guiding M&A and strategic investment decisions

- Ensuring compliance with regulations

- Guiding the CEO and board on financial strategy

- Driving operational efficiency and profitability

Explore global CFO trends from PwC

CFO Career Path: The Generic Journey

It takes time, experience, and wise decision-making to plot your CFO career path. There is no such thing as a one-size-fits-all plan, yet knowledge of the generic journey can facilitate planning.

Not everyone becomes a CFO overnight. Most CFOs gain experience in finance, accounting, operations, and leadership over a period of 15-20 years. Through focused planning and the right executive financial training, talented professionals can expedite this timeframe.

Typical Career Path:

| Career Stage | Key Roles | Duration |

| Entry-Level | Financial Analyst, Accountant | 2-4 Years |

| Mid-Level | Finance Manager, FP&A, Controller | 4-7 Years |

| Senior-Level | Head of Finance, Director of Finance | 5-8 Years |

| Executive-Level (C-Suite) | CFO | – |

A few professionals can switch from audit, advisory, or corporate finance careers. Others might shift from top finance leadership jobs like Finance Director or VP of Finance.

Skills to Become a CFO

Learning how to be a CFO involves acquiring technical skills and leadership skills. Strategic thinkers, technologically savvy, and able communicators are today’s CFOs.

Technical knowledge is not enough. You will need to inspire teams, work with stakeholders, and address complicated business environments.

Key Skills for Future CFOs:

- Financial Acumen: Strong finance statement, modeling, and forecasting expertise

- Strategic Thinking: The ability to link finance with business objectives

- Leadership: Directing teams and impacting at board level

- Technology Awareness: Knowledge of digital tools, AI, and analytics

- Risk Management: Finding and addressing financial risks

- Communication: Communicating complex data to non-finance stakeholders

- Adaptability: Managing change and uncertainty

It is said that according to Deloitte’s Global CFO Signals, CFOs nowadays are more likely required to lead innovation and organisational transformation.

Qualifications and certifications you require

Your professional and academic qualifications are instrumental in deciding how to become a CFO. Experience is important, yet qualifications reflect credibility and dedication towards your CFO career.

In India, a combination of core degrees, advanced certifications, and international exposure enhances your CFO prospects.

Typical CFO Qualifications and Certifications:

- CA (Chartered Accountant): Extremely well-respected for finance skills

- MBA (Finance/Strategy): Best suited for strategic leadership development

- CFA (Chartered Financial Analyst): Enhances investment and finance knowledge

- CPA (Certified Public Accountant): Reputed for international finance expertise

- Executive Finance Training: Short-term programmes for leadership skills

Numerous successful Indian CFOs have augmented their skills through specialized executive finance training, like the Chief Financial Officer Programme by London Business School and Imarticus Learning.

Financial Leadership Positions Leading to CFO

Along the way to becoming a CFO, you will probably move through several financial leadership positions that lead you to the highest position. Each is developing your technical skills, business acumen, and leadership skills.

These jobs provide essential experience in strategic decision-making, managing teams, and communicating with stakeholders—pillars of CFO success.

Financial Leadership Positions:

- Financial Controller

- Head of FP&A (Financial Planning & Analysis)

- Director of Finance

- VP of Finance

- Finance Business Partner

- Head of Treasury or Risk Management

Numerous Indian CFOs also acquire global exposure or cross-functional experience in ops or strategy positions prior to arriving at the C-suite.

Executive Finance Training: Speeding Up Your Career

While a traditional CFO career path can be decades long, the right executive finance education can condense and expedite your career. These programs develops leadership capability, knowledge of global business, and strategic decision-making.

For Indian finance professionals seeking to speed up their career, such training offers:

- Exposure to global finance trends

- Access to world-class faculty and industry specialists

- Leadership development in live business scenarios

- Networking with senior finance colleagues

One such initiative is the exclusive Chief Financial Officer Programme by London Business School and Imarticus Learning, which helps prepare finance leaders for the C-suite.

Fastest Path to the C-Suite: Practical Tips

Face it—the CFO race is cutthroat. But with intentional decisions, ongoing learning, and conscious career strategies, you can speed your way to the top.

Here’s a pragmatic guide to speed-up becoming a CFO:

Guidelines to Make it to the C-Suite:

- Secure recognized CFO certifications and qualifications early

- Develop cross-functional skills (strategy, operations, technology)

- Establish networks with mentors and senior executives

- Stay current with new financial technologies

- Enhance leadership, communication, and negotiation skills

- Engage in high-impact projects that showcase strategic thinking

- Consider executive finance training to enhance credibility

For insights on evolving CFO expectations, check out EY’s CFO Imperative Report.

Key Takeaways

- The path to CFO requires technical expertise, leadership, and vision.

- Mapping your CFO career path early boosts your chances.

- Focus on building the skills required to be a CFO, including strategic thinking and technology awareness.

- Acquiring respected CFO qualifications and certifications enhances credibility.

- Strategic financial leadership roles build readiness for the C-suite.

- Executive finance training accelerates your leadership journey.

- With planning, ambition, and continuous learning, Indian professionals can reach CFO faster.

FAQs

1. How long to become a CFO?

Generally.. it takes 15-20 years of progressive experience, in finance & leadership positions to become a CFO. However -that timeline can move faster with the right qualifications and executive programs.

2. Do I need to be CA, or MBA to become a CFO?

While 99% of CFOs have a CA or MBA, it is possible become a CFO, without a CA or MBA, but with some other finance-related certifications, and extensive leadership experience, as long as global certifications and executive training are obtained.

3. Do I need to be CFA to be a CFO?

A CFA is not required but greatly appreciated for investment strategy, capital markets, and financial leadership positions at multinational corporations.

4. In which industries do CFOs get hired most frequently?

CFOs are recruited in all industries such as -BFSI, technology, manufacturing, healthcare & startups, where strategic growth is fueled by financial leadership.

5. Must I have international experience to be a CFO?

Though not necessary, international exposure greatly enhances your CFO opportunities, particularly in multinational firms or MNCs.

6. How significant is tech savvy for CFOs?

Very significant—today’s CFOs need to be familiar with financial technologies, data analysis, AI, and digitalization to guide successfully.

7. Can Indian professionals indulge in global CFO vacancies?

Yes. With good credentials, international experience and leadership potential, Indian professionals very often are offered CFO roles at multinational corporations.

8. What is the fastest route to becoming a CFO in India?

The fastest route being through pursuing the best CFO qualifications and investments, accumulating cross functional experience, engaging in strategy projects and studying top executive finance programs.

9. Is CFO a finance-only role?

No. Finance is a core role but the modern CFO is a strategic business partner who has influence over operations, technology, risk and the performance of the organisation as a whole.

10. What can I do today to start preparing for a CFO position?

Focus on technical knowledge and expertise, develop your leadership skills, develop your network, stay up to date with global finance developments and consider taking special programs such as the Chief Financial Officer Programme by London Business School and Imarticus Learning.

Conclusion

For aspiring finance professionals in India, learning how to become a CFO is the first step to a respected and influential leadership role. Becoming a CFO means not only developing technical skills, but also developing strategic thinking, and a serious commitment to learning.

By thoughtfully developing the skills to act as a CFO, earning reputable CFO qualifications and certifications, obtaining experience in necessary finance leadership roles along with a commitment to executive finance education, you can accelerate your journey to the C-Suite.

If you have invested time and effort into creating your CFO career pathway, you should consider applying the Chief Financial Officer Programme by London Business School and Imarticus Learning, an internationally-recognised hiring programme for finance leaders transitioning to the top spot.

The path may be challenging, but if you stay the course, the C-Suite is closer than you think.