In the high-risk, high-stakes world of finance today, it’s not just beneficial—it’s necessary—to be an expert in the most critical technical skills. Financial modeling and valuation training provides you with hands-on, no-nonsense skills that you’ll apply to analyze financial statements, estimate performance, and make sound investment decisions. Financial Modeling and Valuation Course to Build Real-World Investment Expertise Whether you want to be in investment banking, equity research, or corporate finance, this course is a career-starting launching pad.

Why Choose a Financial Modeling and Valuation Course?

A financial modeling and valuation course bridges the gap between practice and theory. The course educates professionals about how to construct solid financial models, value a company, and deliver investment-grade reports that the boardroom loves to accept.

Financial modeling allows historical information to be examined, future estimates to be given, and a firm’s fair value to be ascertained. Integrated with techniques like DCF, precedent deals, and comparables, students receive the competitive advantage required for top-level career prospects in finance.

Core Concepts Covered in Financial Modeling and Valuation Courses

Such comprehensive courses generally consist of a set of technical topics:

- Advanced Excel finance: Learn the art of flying through spreadsheets in record time with dynamic formulas and automated tools.

- Equity research training: Acquire industry research, financial modeling, and investment thesis writing skills.

- Corporate finance certification: Learn capital structuring, funding strategies, and performance measurement.

- Investment banking skills: Learn deal-making, M&A model building, and pitchbook writing.

- Financial analyst certification: Roll up your sleeves with modeling, valuation, and presentation of findings to stakeholders.

The finance model and valuation course combines all these into one practical training program.

Financial Modeling and Valuation Course – Your Key to Global Finance Mastery

From EBITDA forecasting to free cash flow prediction, the finance model and valuation course offers students an all-in-one solution to achieve success in global finance.

Along with the shift in finance career, more specifically in dynamic areas like private equity, venture capital, and consulting, hiring managers look to bring on more frequent professionals who can build interactive models, evaluate business cases, and find drivers of value.

It is noteworthy that the course is not only spreadsheets but strategic thinking, business storytelling, and validation of analysis as well. Through project-based learning and real data, students gain market-sensitive skills.

Benefits of Pursuing Financial Modeling and Valuation Training

Financial modeling and valuation training provides a competitive edge in the following manner:

- Develops good problem-solving and analytical habits

- Makes one more employable with practical implementation

- Gain exposure with industry experts through networking

- Makes one more branded with portfolio-ready models

- Breaks open career opportunities for investment banking, corporate strategy, and FP&A

Additionally, most of the finance recruiters believe that hands-on modelling skills are a key discriminator for hiring.

Who Should Take This Course?

Regardless of whether you are a new graduate, CFA candidate, or working professional looking to transition into a career in finance, this course is best for the following participants:

- Recent commerce or finance graduates

- Level 1 CFA or MBA students

- Analyst and associate in financial or consulting firm

- Entrepreneurs who need valuation skills

The course in financial model and valuation offers the fundamental and advanced level of ability, therefore ideal for a majority of students.

Tools and Techniques You Will Master

You’ll require the appropriate tools in the new finance professional environment. These are some of them you’ll likely be at ease with:

- Excel (advanced techniques, scenario modeling, VBA)

- PowerPoint (financial and storytelling presentations)

- Bloomberg and financial databases (analysis)

- Valuation models (DCF, LBO, comparables trading)

- Dashboarding and data visualization

All these won’t just make you productive, but job-ready for performance-driven scenarios.

Career Pathways After Completion

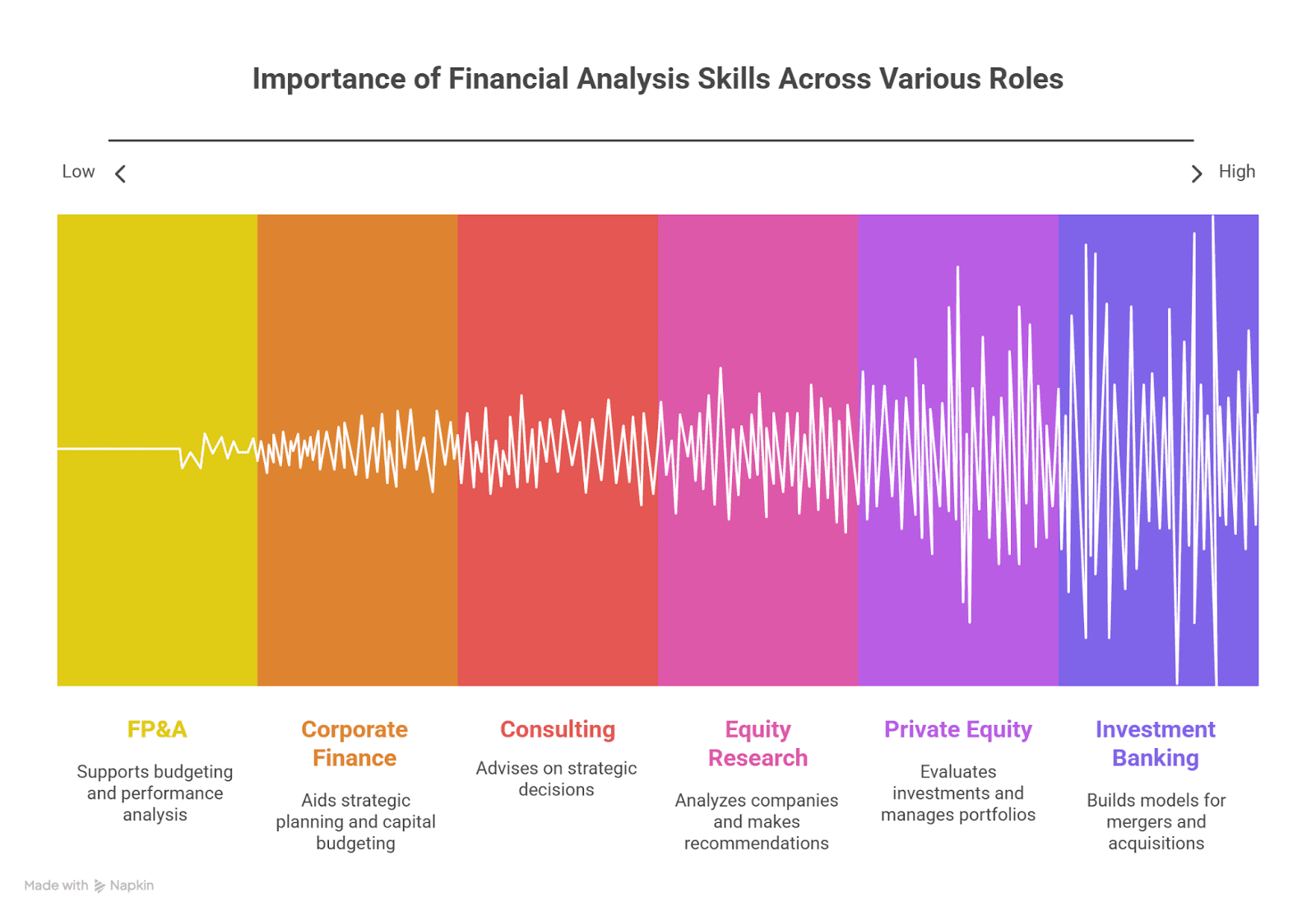

Financial modellers and valuators trained through the program are suited for challenging careers, including:

- Investment Banking Analyst

- Equity Research Associate

- Corporate Finance Manager

- Financial Planning & Analysis (FP&A) Specialist

- Private Equity or Venture Capital Analyst

With high demand from various industries, successful financial modellers have career prospects in banks, consultancy firms, start-ups, and multinationals.

The Growing Importance of Financial Modelling in India

The Indian economic landscape has developed with increasing heightened demand for valuation experts and modelling experts in metros and Tier-II cities. Corporate firms are in need of quick-thought analysts who may study markets, forecast trends, and assist with financial advice to stakeholders.

In addition, the move towards evidence-based decision making accelerated the need for analytics-capable professionals. A course in financial modeling and valuation not only addresses such market need but also promises global mobility.

Looking to Dive Deeper? Consider the Certified Investment Banking Operations Program (CIBOP)

If those finance graduates who wish to dive deeper into investment banking and finance operations, then Imarticus Learning offers a CIBOP Program to jumpstart your career.

The program is best suited for fresh graduates with 0-3 years of experience, with a healthy mix of hands-on training and also placement assistance.

What Makes the CIBOP Course Stand Out?

- 100% Job Guarantee with 7 sure-shot interviews

- Study plan: Weekday class plan (4 months) or weekend blended plan (8 months)plan

- Excellent placement rate: Way-beyond 56,000 successful placements and 500+ firms recruiting through us

- Improved ROI: Average pay of 5.5 LPA and salary growth of as much as 60%

Real-World Training for Real Finance Jobs

The CIBOP program is not just theory. Students learn through live simulations of deal execution, equity research, valuation, and financial modelling. Excel and PowerPoint are mastered and strategic communication is established.

You will also have a personal branding project and LinkedIn challenge to promote your professional presence in an ever-growing competitive jobs market.

Learn from the Best

Guided by seasoned finance professionals and strategists, this course immerses you in real industry practice, and you’ll be confident and raring to go when you leave.

Your Goldman Sachs, JPMorgan, UBS, or BNP Paribas career goal within touching distance – this course is the ideal catapult.

FAQs on Financial Modeling and Valuation Courses

1. What is the duration of a typical financial modeling and valuation course?

The majority of the courses take 2-6 months and differ in depth of content and mode of study (full-time, part-time, online, or hybrid).

2. What are the prerequisites for enrolling?

The prerequisite to take is usually a finance, commerce, or introduction to accounting fundamentals course. All the courses provide the groundwork such that most of the students are able to comprehend.

3. How does this course differ from an MBA in Finance?

While MBA is theoretical and strategic in nature in general, financial modeling and valuation is a very professional, practical, and special nature course.

4. Can this course help me transition to investment banking?

Yes, it is quite common that people take this course as a stepping stone to IB, equity research, or financial advisory positions.

5. What is the cost of enrolling in such a course?

Course price varies with institute, course duration, and course mode and ranges from INR 30,000 to INR 1.5 lakh.

6. Will I get certification post completion?

Yes, everyone offers a certificate of completion. Excellent courses offer industry-recognized financial analyst certification too.

7. What roles can I apply for after finishing this course?

You can get employed as financial analyst, equity research associate, investment banking analyst, business valuation consultant, etc.

Conclusion

A finance modelling and valuation course is not just another finance qualification—another career beginning. In a year where India will be one of the world’s financial hubs, there has never been a time when so many hands-on valuation and modelling skills have been in such demand from master professionals.

Pair this course with a program like the Certified Investment Banking Operations Professional (CIBOP) certified by Imarticus Learning, and your career gets taken a notch higher.

With strategic skills, hands-on experience, and industry-recognised certifications under your belt, you’ll be fully equipped to master the world of finance and valuations.

Ready to invest in yourself? The journey starts here.