Last updated on April 2nd, 2024 at 09:37 am

Last Updated on 2 years ago by Imarticus Learning

A successful business is not only built by creating a sustainable flow of income. It is equally important to manage the outflows. Hence, a business often uses debt to meet its commitments. Handling debt is one of the most critical factors that impact the success of any business. Improper management of debt can prove to be fatal for the long-term success of any organization.

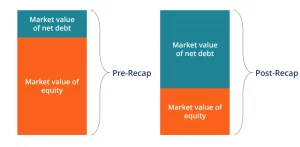

Debt recapitalisation is the process of restructuring the debt of a company to improve its financial position. One of the models used to analyze the impact of debt restructuring is the 3-statement model.

What is a 3-statement model in debt recapitalisation?

The 3-statement model helps measure the impact of changes in capital structure on a company’s financial statements. The three statements analysed are the balance sheet, income statement and cash flow statement.

The model helps to determine the impact of debt recapitalisation on various financial metrics. it can include the impact on interest expenses, debt repayment schedules and financial ratios.

The 3-statement model is often used by companies to assess the impact of debt recapitalisation. It helps to provide an overview of the current state and the situation after debt recapitalisation.

Steps in building a 3-statement model

The process of building a 3-statement model involves several steps. The steps are as follows:

Inputting data

The first step is to input data on the company’s current financial position and future projections. This data includes the relevant numbers from the balance sheet, income statement and cash flow statement.

Issuing new debt

The next step is to simulate the impact of issuing new debt. This involves estimating the amount of new debt to be issued and the associated interest rate. It helps to assess the potential exposure a business may have to the current level of debt.

Repaying existing debt

In this step, the proceeds from new debt are used to settle the existing debt. This is a critical step as the existing debt is settled using the new debt the company has acquired.

Updating financial statements

The final step is to update the financial statements to reflect the new debt structure. This involves updating the balance sheet to reflect the changes in debt and cash. It also includes updating the income statement and cash flow statement. Both these steps help to reflect the impact of the new debt on the company’s financial performance.

Key metrics and ratios analysed in the 3-statement model

The 3-statement model is used to analyse several key metrics and ratios. The key metrics and ratios analyzed in the 3-statement Model are as follows:

Interest expenses

It helps to estimate the interest expenses associated with the new debt and determine if the company can afford to service the debt. It is important because a business can decide on the future course of action.

Debt repayment schedules

The model helps to determine the repayment schedules for the new debt. It is also critical to estimate the company’s ability to repay the debt.

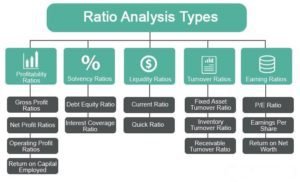

Financial ratios

The 3-Statement Model is used to analyse various financial ratios. It includes ratios like debt-to-equity, times interest earned and debt service coverage ratio.

Advantages of Using the 3-Statement Model

The 3-statement model provides several advantages. The key advantages of using the 3-statement model are as follows:

Detailed analysis of debt structure impact on financial performance

The model provides a detailed analysis of the impact of debt recapitalisation on the company’s financial performance. This allows for better decision-making.

Identification of optimal debt structure

It helps to determine the optimal debt structure that balances the company’s need for financing. The model is particularly useful to adjudge the ability to service the debt obligations of a business.

Better decision-making for companies looking to recapitalise

The model helps companies make informed decisions about debt recapitalisation. It provides a clear picture of the impact of debt restructuring on financial performance.

Conclusion

A 3-statement model is an important tool in debt recapitalisation analysis. It helps understand the impact of capital structure changes on a company’s financial statements.

The model helps to determine the optimal debt structure. It balances the company’s need for financing with its ability to service its debt obligations.

Understanding the 3-statement model is crucial for companies looking to improve their financial position through debt restructuring.

The Strategic CFO Course from IIM Indore and Imarticus Learning helps you to master new-age financial skills. The CFO Leadership Training is suitable for professionals that have over five years of experience in financial services and management.

The IIM Indore Strategic CFO Course ranks among the top Financial Markets Certification Courses that equip us with strategic, financial and tech-focused skills.

The various modules of the course include topics like Emerging CFO Roles, Capital Budgeting, Valuation, Strategic Thinking and Risk Management among others. Click here to know more.