Are you also someone trapped in spreadsheets, trying to find a means towards a role of influencing strategic business decisions?

The US CMA Course empowers finance professionals to break free from routine accounting jobs and sit at the table in a boardroom.

What Is a CMA Course?

A Certified Management Accountant (CMA) Course is an internationally recognised certification combining financial reporting, strategic analysis and ethical governance in a single professional qualification.

Not only does it enhance technical competence, but it also develops leadership competencies required for boardroom presence.

Why the CMA Course Is a Game‑Changer

The Certified Management Accountant advantages are:

- International recognition in more than 170 countries

- Increased emphasis on strategic finance leadership capabilities

- Hands-on emphasis on risk management, analytics and ethics

- Proven track record of CMA career transformation through real‑world case studies

Completing both parts of the CMA syllabus means you’re ready to guide corporate strategy rather than merely record past results.

Accounting to Leadership: The Journey in Six Steps

| Skill Category | Before the CMA Course | After the CMA Course |

| Financial Reporting | Basic reporting knowledge | Mastery of global frameworks (IFRS, US GAAP) |

| Cost Management | Cost allocation awareness | Advanced cost‑control and performance analysis |

| Budgeting & Forecasting | Static budget creation | Rolling forecasts and scenario modelling |

| Decision Support | Limited analytics usage | Data‑driven strategic insights |

| Strategic Thinking | Short‑term planning | Integrated, long‑term business strategy |

| Leadership & Ethics | Code awareness | Ethical governance and stakeholder management |

This Accounting to leadership route demonstrates how the CMA Course accelerates you on your path from number‑cruncher to strategic advisor.

Curriculum Structure: From Numbers to Strategy

Part 1

- Financial Planning & Analysis

- Performance Management

- Cost Management

- Internal Controls

Part 2

- Strategic Financial Management

- Risk Management

- Investment Decisions

- Ethical Leadership

Every module is tailored to foster CMA career change, so you gain technical sophistication alongside boardroom confidence.

CMA Global Career Opportunities

According to the Institute of Management Accountants, over 74,000 CMAs are in practice worldwide, and demand has risen by 12% over the past two years. Typical jobs include:

- Chief Financial Officer (CFO)

- Vice President of Finance

- Corporate Treasurer

- Risk Manager

- Budget Director

CMAs in India can make an average of ₹8–12 LPA, while people working in the UK and US experts easily breach £60,000 or $90,000, the world’s premium for the qualification.

Why Businesses Value CMAs

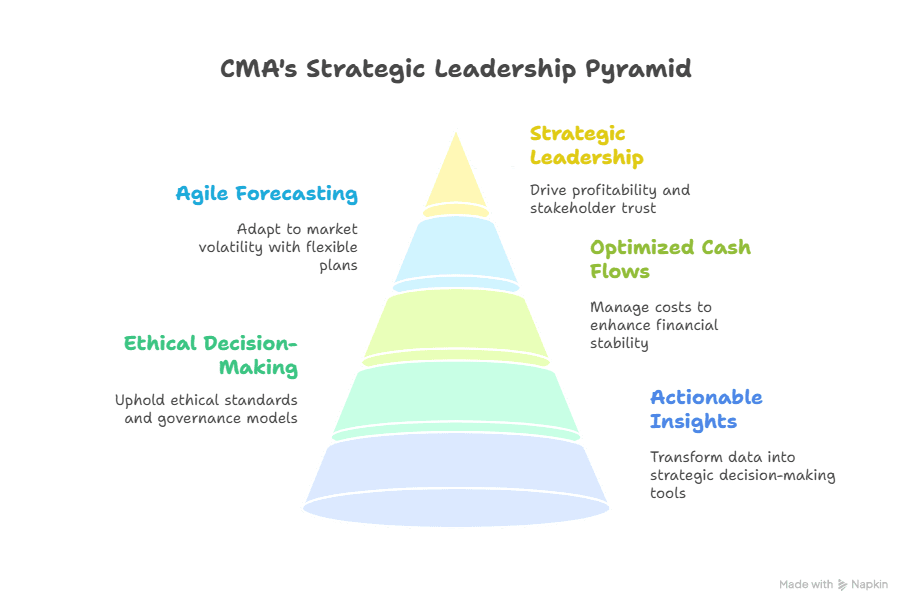

Business firms today seek more than bean-counters; they need visionary strategists. CMAs offer:

- Actionable insights through performance analytics

- Ethical decision‑making under governance models

- Optimised cash flows through state-of-the-art cost controls

- Agile forecasting to cope with market volatility

These strategic leadership skills in finance directly increase profitability and stakeholder trust, rendering CMAs indispensable.

Unique Perspective: The Next‑Gen Finance Leader

In contrast to conventional accountants, CMAs excel with digital tools (such as Power BI, Tableau) and have a consulting frame of mind. A recent Deloitte survey indicated that 85% of CFOs are convinced that next-generation finance leaders need to balance technical skills with strategic insight. The CMA Course then becomes the secret weapon for those who aspire beyond number‑crunching to genuine corporate stewardship.

Building a Professional Network through CMA

CMA certification also invites the opportunity to become a member of the IMA community, offering access to:

- World conferences and chapter meetings in your local area

- Mentor groups connecting you to seasoned CMAs

- Online forums for continuous learning and peer mentoring

This professional tribe drives your CMA global career opportunities by building relationships that often lead to leadership roles.

Continuing Professional Development and Recertification

After getting certified, CMAs need to complete 30 hours of Continuing Professional Education (CPE) annually. This keeps you current on:

- New financial regulations

- Advanced analytics techniques

- Evolving ethical expectations

Regular recertification demonstrates commitment to excellence and keeps your set of skills in line with best practices.

The Imarticus Learning Experience

Imarticus Learning provides the CMA certification preparation program through:

- Interactive virtual classrooms by former CMAs

- Case studies drawn from real-life business issues

- One-to-one mentorship programs for one-to-one coaching

This hands-on approach qualifies you for CMA global career opportunities and equips you with practical skills to become a high performer.

Watch the below video to understand better.

CMA US: Is It Worth It? | Career Benefits & Opportunities Explained

FAQs about the CMA Course

What are the CMA Course requirements?

A bachelor’s degree and two years’ experience in management accounting or financial management.

How long will it take to complete the CMA Course?

Around 6–9 months, depending on your work hours and study intensity.

Can I give CMA while working full-time?

Yes. Weekend classes and flexible learning options accommodate working professionals.

What is the pass rate of the CMA?

Approximately 45% globally

How does the US CMA build leadership ability?

By incorporating ethics into governance, risk management, and strategic decision-making modules.

What is the average salary increase post-CMA?

If you are someone working in India, you can start with ₹8-10 LPA

Is digital analytics included in the CMA Course?

Yes, students learn how to apply BI tools to strategic reporting and performance management.

Which industries hire CMAs the most?

Finance, manufacturing, IT, healthcare and consulting are at the top.

Conclusion

The CMA Course is more than a credential—it’s your key to strategic finance leadership. By bringing together rigorous analytics, ethical leadership and real-world problem solving, CMAs are admired and effective at the highest levels.

Key Takeaways

- Credential for Change: CMAs are paid 58% more and are known globally.

- Strategic Influence: Courses combine skills in analytics, ethics and strategy for boardroom influence.

- Career Advancement: Unlock opportunities from Financial Controller to CFO with confidence.

Ready to transition from number-cruncher to decision-maker? Enrol in the CMA Certification Preparation Program in collaboration at Imarticus Learning today and start driving business strategy.