- What is CMA Course and Why is it Special?

- CMA Syllabus: The Backbone of Global Finance

- CMA Course Duration: A Fast-Track to Success

- CMA Study Plan: How to Crack the Exams

- CMA Training Program: Why It Matters

- CMA Course Fees: Investment vs Return

- CMA Course vs Other Finance Certifications

- Career Opportunities After CMA Course

- Why Imarticus Learning for CMA Course?

- FAQs

For a finance professional, the career growth is very much linear in nature—accounting roles, financial reporting, may be a transition to management. But what if there is a possibility to break open a career turn that would lead your career into global roles and leadership positions? That is exactly what the CMA course (Certified Management Accountant) offers.

In a span of just 6–8 months of study period in the CMA courses, you can gain a program that gives you international credibility, exposure to higher salaries, and business mobility. CMA courses assure you of financial reporting, planning, analytics, corporate finance, and ethics skills—multinational in-demand skills. Mix this with quality CMA study material and quality CMA course, and you have a recipe to rewrite your career narrative.

This blog demystifies CMA course, syllabus, cost, modes of training, and international advantages—letting you in on the secret why it may just be the turn-around good luck you have been waiting for.

What is CMA Course and Why is it Special?

CMA course is globally recognised professional qualification awarded by the Institute of Management Accountants (IMA), USA. CMA is different from any other accountancy courses in that it transcends bookkeeping. It equips you with decision-making, strategy, and analytical strength that makes you invaluable to the business administration.

- Duration: 6–8 months

- CMA course cost: ₹1.5–₹2 lakh (approx., including study materials and training)

- Salary Range in India: ₹8 LPA to ₹18 LPA (lower overseas)

- Scope: International career in MNCs, Big 4, consultancy, and finance leadership

The three areas of CMA’s uniqueness are speed, recognition, and professional applicability. You don’t simply study accounting—you study leading.

CMA Syllabus: The Backbone of Global Finance

The CMA syllabus is divided into two segments of exams, each of them covering vital areas of finance and management.

Part 1: Financial Planning, Performance, and Analytics

- External Financial Reporting

- Cost Management

- Internal Controls

- Technology and Analytics

- Budgeting and Forecasting

- Performance Management

Part 2: Strategic Financial Management

- Corporate Finance

- Risk Management

- Investment Decisions

- Professional Ethics

- Decision Analysis

- Financial Statement Analysis

Together, these parts cover everything from technical finance to strategic decision-making, ensuring you’re not just a number cruncher but a business partner.

CMA Course Duration: A Fast-Track to Success

Strongest feature of CMA is the fact that it takes only a short period of courses. Unlike other finance certifications that require 2–3 years of your life, CMA gets completed in a single year.

- Average duration for which CMA courses are conducted: 6–8 months

- Flexible formats: Full-day classes for full-time students; weekend batches for professionals working

- Self-study flexibility: Candidates have a choice to give exams as per their own convenience.

Systematic CMA study schedule is the secret of success. Professionals in employment and students with genuine commitment can simultaneously study and work.

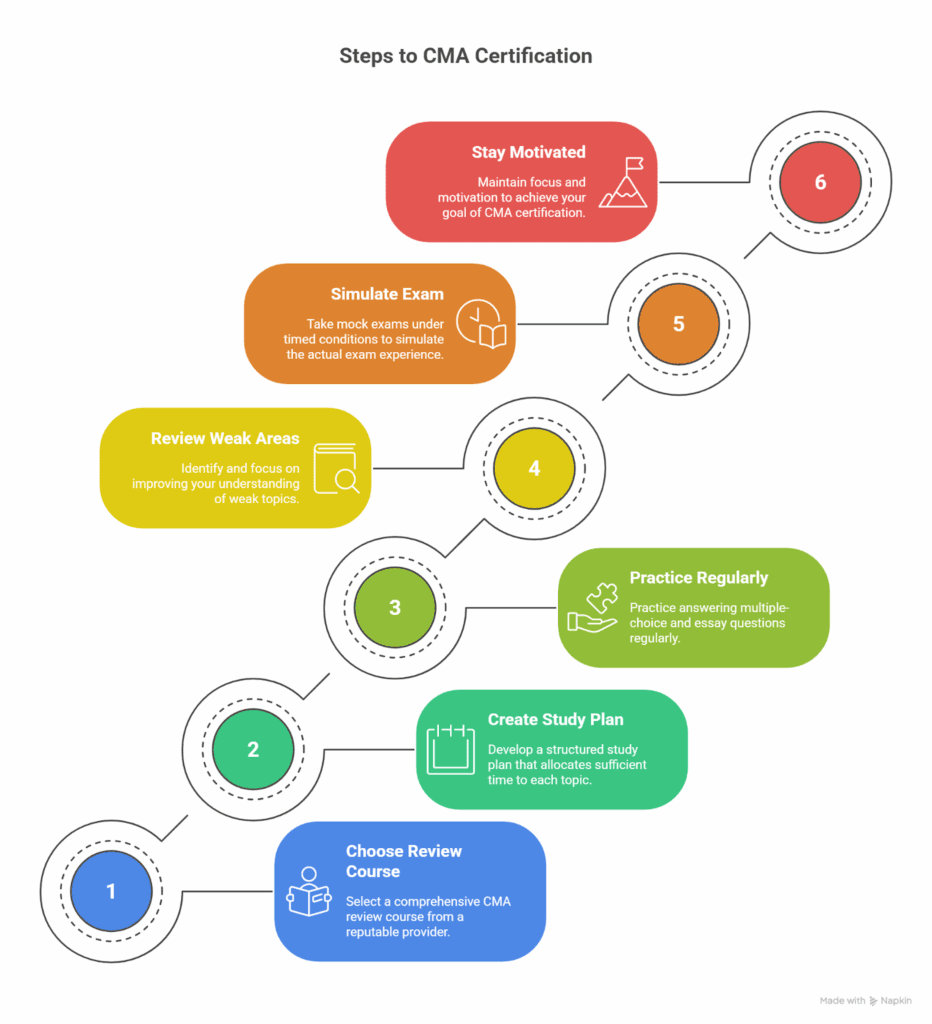

CMA Study Plan: How to Crack the Exams

Example Study Schedule:

- Month 1–2: Conceptualising Part 1 (costing, reporting, budgeting)

- Month 3–4: Part 2 emphasis (corporate finance, decision-making, risk)

- Month 5–6: Practice question, mock tests, time management

- Month 7–8: Final revision, exam simulations, attempt at the exam

Consistency is the key. Best CMA training program enables the candidates to gain exam confidence and true job skills simultaneously.

CMA Training Program: Why It Matters

Even though some like CMA from self-study, appearing for a formal CMA training program enhances pass rates by leaps and bounds. Education platforms such as Imarticus Learning (Gold Learning Partner of IMA, USA) provide the candidate with something more than books.

Features of a Strong CMA Training Program:

- Study Material: Surgent CMA content access (83% pass rate)

- Expert Faculty: Counseling by experienced CMA professionals and KPMG practitioners

- Live Webinars: Finance trends updates and exam strategies monthly

- Case Studies: Actual case studies for practice

- Placement Support: Pre-placement bootcamps and interview practice

With study preparation augmented by industry awareness, such programs facilitate the candidate to build both exam confidence and employability.

CMA Course Fees: Investment vs Return

While paying for the CMA course fees, all candidates with an opinion view it as an investment.

Indian CMA Course Fees: ₹1.5 lakh – ₹2 lakh (training and exam fees)

Details:

- IMA Membership Fee: $245

- CMA Entrance Fee: $300

- Exam Fee (each part): $460

- Training & Study Material Cost: Vary depending on provider (Surgent, Becker, etc.)

While the cost of initial investment seems to be high, ROI for CMA certification is incredible with 60% average salary hikes for certified members and global opportunities through certification.

CMA Course vs Other Finance Certifications

How is CMA different from the rest?

- CMA vs ACCA: CMA is faster (6–8 months vs 2–3 years) and management-focused

- CMA vs CPA: CMA is worldwide; CPA is US-centric

- CMA vs CFA: FCA is concerned with investments; CMA is concerned with strategy, finance, and management

This makes CMA the most appropriate certification for finance professionals aspiring to become leadership-level strategic professionals.

Career Opportunities After CMA Course

Passing the CMA course unlocks a vast universe of career opportunities in India and worldwide.

Top Most Popular Titles for CMA Professionals:

- FP&A Analyst (Financial Planning & Analysis)

- Treasury Analyst

- Corporate Finance Manager

- Business Consultant

- Equity Research Analyst

- Risk Manager

- CFO (with experience)

Industries Hiring CMA Professionals:

- Big 4 Consulting Firms

- Investment Banking

- MNC Corporations

- IT/Tech Companies (finance functions)

- Manufacturing and FMCG

By proper CMA training program, professionals are placed in companies like Deloitte, EY, PwC, KPMG, Accenture, Amazon, and international investment houses.

Why Imarticus Learning for CMA Course?

Imarticus Learning, in association with KPMG India, offers one of the best CMA training programs in India.

Highlights:

- Joint Certification with KPMG in India

- Usage of Surgent CMA Study Material (IMA-approved, 83% pass rate)

- Internships: Live corporate experience before placements

- Pre-Placement Bootcamp: Resume preparation, mock interviews, and interview fixing

- Money-Back Guarantee: 50% refund of failing exams

- India’s First Approved Provider: For finance certifications top 5 (CFA, CPA, CMA, FRM, ACCA)

This combination of corporate and academic ensures that the candidates are employable after the CMA course.

Watch this video to know how you can grab a career opportunity in multinational companies with US CMA course degree

FAQs

1. What is the duration of the CMA course?

The CMA course is usually 6–8 months, which is less than other finance certifications.

2. Where does the CMA syllabus belong?

The CMA syllabus includes financial reporting, cost management, corporate finance, decision analysis, ethics, and risk management.

3. How much are the CMA courses in India?

The costs of CMA courses usually range from ₹1.5 lakh to ₹2 lakh including training, study material, and examination fee.

4. Do I need to go through a CMA training program?

Yes. Self-study is acceptable but formal training significantly increases pass rates as a result of professional training and practice material.

5. How do I create a study timetable for CMA?

Work 10–15 hours a week, piece by piece. Make the most of mock tests, past papers, and guided reviews.

6. What are the career opportunities after CMA?

FP&A Analyst, Corporate Finance Manager, Consultant, Risk Analyst, and even CFO with experience.

7. Why choose Imarticus Learning for CMA course preparation?

Because it offers industry-specific case studies, Surgent-supported study resources, internships, and a money-back guarantee for added confidence.

Conclusion

CMA course is not another finance certification—it’s a career builder. With short tenure, globally recognised syllabus, scheduled study plan, encouraging training programs, and awesome ROI, CMA is literally the passport for finance vagabonds.

For Indian aspirants, organisations like Imarticus Learning and KPMG India provide an unparalleled combination of academics and professional learning. From Surgent-sponsored study material to placement boot camps, every step leads to success.

In case your career in finance is simply too vanilla, then taking the CMA course can be the twist of fate that turns your life into one of international acclaim, strategic advice, and economic prosperity.