The CMA after graduation path is a strategic step for high-achieving finance professionals who must differentiate themselves in an increasingly competitive market. As the world’s most recognized credential in management accounting, the CMA provides globally respected skills in financial planning, analysis, decision support and ethics—but the question on every graduate’s mind is: How long is CMA USA?

Whether you’re aiming for that 58 % salary uplift, targeting roles in Fortune 500 companies, or simply striving to master the 12 core competencies that define modern finance leadership, understanding the time commitment is crucial. Balancing work, life and study demands a clear roadmap: from initial registration through to sitting both exam parts and finally celebrating your certification.

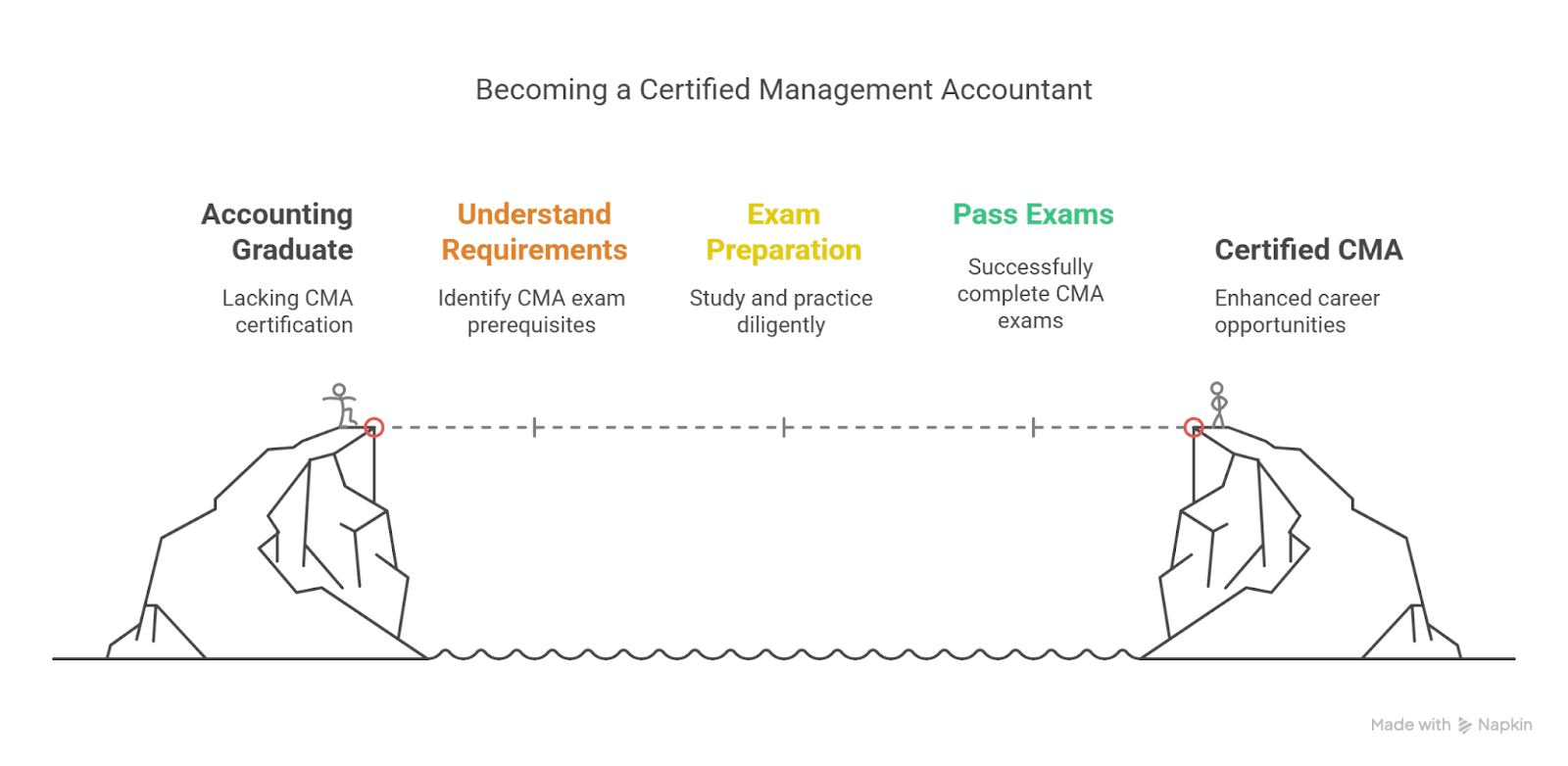

In this comprehensive guide, we’ll demystify the CMA course duration, break down the official CMA certification timeline, compare how long is CMA USA?, and reveal proven strategies to fast-track your CMA exam completion. With actionable tips on study planning, exam scheduling and leveraging expert mentorship, you’ll gain the confidence to chart a customised timeline that aligns with your career goals. Let’s map out your path to becoming a Certified Management Accountant—efficiently and effectively.

Understanding CMA and Its Significance

The Institute of Management Accountants (IMA), USA, carried out the Certified Management Accountant (CMA) certification, which is endorsed in more than 170 countries. It is the world standard in management accounting, encompassing financial planning, analysis, and strategic decision-making. Many graduates who are interested in developing their career ask themselves, “Time to complete CMA—what does that mean?”

Obtaining CMA after graduation has a number of benefits:

- Greater Credibility: Join 140,000+ CMA® members globally

- Pay Boost: See a mean salary boost of 58 % after certification

- Key Skill Mastery: Acquire 12 key competencies, from budgeting to risk management

- International Mobility: Become eligible for MNC jobs, consulting, and Fortune 500 companies

What Does “CMA Course Duration” Entail?

Where planning your CMA path, comes the CMA course duration into picture. At an average level, the candidate spends 6–8 months of rigorous learning to clear the two sections of the exam. Let’s cut this time interval:

1. Registration & Orientation (1–2 weeks)

- IMA Membership & Exam Fees: Get registered, pay fees, and arrange for exams

- Orientation Session: Make yourself familiar with exam blueprints, study guide, and mentoring support

2. Foundational Study (1–2 months)

- Part 1 Overview: Financial Reporting, Planning, Performance, and Control

- Study Goal: Get a clear grasp of important concepts through live online classes and self-study

3. Intensive Preparation (3–4 months)

- Part 1 Deep Dive: Detailed modules, practice questions, and mock test attempts

- Part 2 Coverage: Cost Management, Professional Ethics, Financial Decision Making, and Internal Controls

- CMA Exam Completion Time: Students spend 8–10 hours per week, both parts completed within 4–6 months of consistent effort

4. Revision & Mock Exams (1–2 months)

- Mock Tests: Timed full-length tests to mimic real test environment

- Doubt-Clearing Sessions: One-on-one guidance to clear out tough topics

- Final Review: Brushing up formulae, frameworks, and ethics at the last moment

Tip: Disciplined schedule is the key. This can reduce overall CMA course duration below 6 months.

The CMA Certification Timeline

Aside from study time, knowledge of the CMA certification timeline allows for planning:

| Phase | Duration | Notes |

| Registration to Part 1 booking | 1–2 weeks | Early booking secures preferred slots |

| Part 1 exam window | 2–3 months after prep | Offered three times a year |

| Part 1 result release | 4–6 weeks post-exam | Allows scheduling Part 2 immediately |

| Part 2 exam window | 2–3 months | Candidate can overlap Part 1/Part 2 prep |

| Certification granted | 4–6 weeks after Part 2 | Once both parts passed and experience met |

| Total Timeline | 6–8 months | Standard progression under normal pace |

Exam Windows & Scheduling

- Test Periods: January/February, May/June, September/October

- Booking Strategy: Book early in the window to get desirable slots

- Resits: No limit within three years—schedule reattempts in the subsequent window

Factors Influencing Your CMA Completion Time

Some factors might delay or advance your completion timeline for CMA:

- Academic Background:

- Good accounting or finance degree hastens learning basics.

- Work Responsibilities:

- Full-time courses can have longer study durations than fast-paced bootcamps.

- Study Habit:

- Routine, daily studying beats sporadic, bulk study marathons.

- Support Systems:

- Unlimited access to study material, mentorship, and uncertainty-clearing sessions optimize productivity.

- Learning Style:

- Video learners learn through video lectures; hands-on learners learn through case studies.

How Long Is CMA USA? Key Differences

Aspirants typically compare how long is CMA USA with local certifications. Main differences:

- Global Acceptance: Global acceptability of CMA USA across 170+ nations

- Exam Pattern: Divided into Two parts, 4 hours each

- Self-Paced vs Bootcamp: Self-study v/s intensive in-house bootcamp options

Overall, a self-study pathway is 8 months, but an accelerated course—with rigorous day-long training—is 4–5 months in taking both halves.

Fastest Way to Finish CMA

For entrepreneurial students who intend to finish CMA in least possible time, follow the given routes:

A. Bootcamp Intensive Model

- Live 4–6 hour classes every day for 8 weeks per part

- Total Time: Less than 4 months for both exams

B. Parallel Approach Method

- Overlapping Study Modules: Study overlapping topics of both halves (e.g., budgeting) at the same time

- Combined Mock Tests: Utilize combined simulations to build understanding

C. Money-Back Guarantee & Expert Guidance

- Free Retakes: Courses with free retakes bring an end to exam fear

- 50 % Money-Back Guarantee: You fail both halves within the specified timeframe

Pro Tip: Use digital flashcards and weekly progress tracking to catch and fill knowledge gaps early.

Benefits of Completing CMA Efficiently

Early completion of CMA saves valuable time with a great payback:

- Rapid Salary Increase: Get that 58 % salary increase sooner

- Career Progression: Get eligible for better roles like Financial Controller or Strategic CFO sooner

- International Opportunities: Take up global finance positions without hesitation

- More Expertise: Instant application of advanced financial management skills in your job

Why Choose Imarticus for Your CMA Journey?

Our Certified Management Accountant post-graduation program at Imarticus is designed to thrive:

- 6–8 Months Structured Study: Live online classes customized for working professionals

- Money-Back Guarantee: 50 % refund if you fail to clear all exams

- Top Placements: Interview commitment, resume guidance, and Fortune 500 candidates’ bootcamp

- Unlimited Study Material: CMA course books, question banks, practice papers, MCQs, flashcards, lecture recordings—powered by Surgent (95 % pass rate)

- Expert Counseling: Personalized doubt-clearing sessions with CMA, CA, CFA, and CPA faculty

- Practical Tools Training: MS Excel, advanced modelling, and financial analytics integration

Join 140,000+ CMA® Members Worldwide

FAQs About CMA After Graduation

Q1: Can I complete CMA in 4 months?

Yes—by taking an intense bootcamp, committing 20+ hours/week, and with mentor support.

Q2: How long is every segment of the CMA exam to complete?

Every one is 4 hours; study 4–6 weeks and see results.

Q3: Can I attempt several times for CMA exams?

Unlimited within your three-year registration term, pending exam window schedules.

Q4: Is CMA more challenging than CPA or ACCA?

CMA is more about management accounting and decision support, whereas CPA is more about auditing and financial reporting. Difficulty is relative to background.

Q5: What are the CMA graduation requirements?

A bachelor’s degree or equivalent professional certification is a requirement prior to issuing the certificate.

Q6: How long can I wait before I schedule my CMA Part 2 exam after passing Part 1?

Straight away—no waiting time; the majority of applicants book Part 2 within the following time period.

Q7: Is there a shorter alternative for experienced practitioners?

Yes—there are some providers that offer shorter programmes for experienced finance practitioners with experience requirements.

Conclusion

Preparing your CMA after graduation consists of learning about the CMA course duration, creating the CMA certification schedule, and adopting strategies to hasten exam completion. While 6–8 months is normal, expedited procedures can take it down to as little as 4 months.

With good study planning, expert guidance, and the proper resources—such as Imarticus offers—you can earn your CMA credential in no time, unlocking doors to high-end career prospects and whopping pay increases. Ready to change your finance future? Begin your CMA path today and become part of the top accounting professionals worldwide!