Introduction: What Is a Client Servicing Manager?

A Client Servicing Manager is a pivotal figure in the success of modern businesses, particularly in industries such as banking, finance, advertising, and IT. The work involves building close relationships with clients, ensuring their satisfaction, and fostering effective communication between clients and internal teams.

In today’s highly competitive market, client servicing is both challenging and rewarding. From managing deliverables to identifying opportunities for expansion in existing accounts, client servicing staff must balance effective communication, strategic planning, and empathy.

Client Servicing Job Description

The career description of a client servicing professional differs according to the sector. There are some general tasks that are still industry-independent:

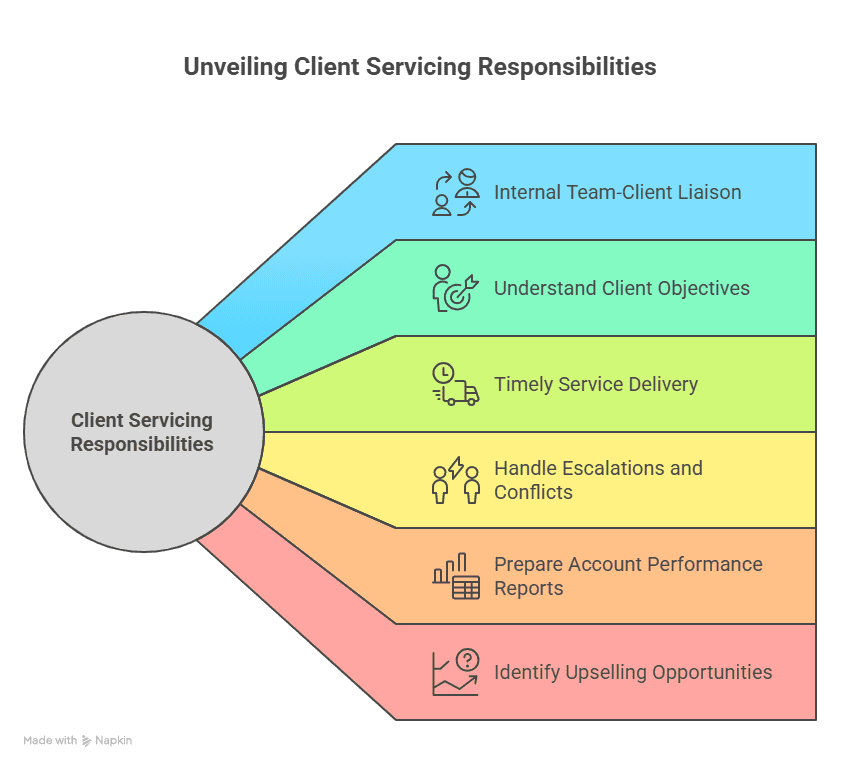

Main Client Servicing Responsibilities

- Be the internal team-client liaison.

- Understand client objectives and translate them into workable actions.

- Provide services or products on time.

- Handle escalations, customer complaints, and the resolution of conflicts.

- Prepare account performance reports and report to stakeholders.

- Identify opportunities for upselling and account growth.

What Are the Main Client Servicing Tasks?

Daily Activities and Responsibilities

- Client meeting and briefing sessions attendance

- Project updates and client reports preparation

- Internal department coordination to ensure deliverables

- Accurate records of communication and agreements are kept

- Offering solutions in advance to avoid problems from happening

Essential Client Servicing Skills

To be an effective Client Servicing Manager, one must exhibit a blend of technical, interpersonal, and analytical abilities:

- Communication: Concise and clear communication and listening

- Problem-solving: Being thoughtful under stress

- Project management: Handling several deliverables simultaneously

- CRM software knowledge: Packages like Salesforce or Zoho CRM

- Negotiation and persuasion: Handling renewals, grievances, and upsells

What are the competencies required in client servicing?

Client servicing professionals require strong communication, problem-solving, and project management skills, as well as knowledge of CRM software and negotiation skills.

Industry Focus – The Banking Client Servicing Role

In the banking and financial services sector, client servicing managers handle high-value accounts, providing clients with timely information on investments, accounts, and other financial products.

Banking Responsibilities

- Assisting with financial transactions and service inquiries

- Interacting with relationship managers and operations staff

- Guiding customers regarding new banking products and regulations

- Ensuring regulatory compliance while handling inquiries

Market Snapshot

The combined market capitalisation of the top 20 Indian financial services companies stood at $680 billion in October 2024. Over 40% of this value was held by banks. HDFC Bank, ICICI Bank, and SBI dominated the list, demonstrating how the success of this sector lies in client experience. (Source)

Client Servicing Manager Salary: What to Expect?

| Experience Level | Industry Average Salary (India) |

| Entry-level (0–2 years) | ₹3.5 – ₹5.5 LPA |

| Mid-level (3–6 years) | ₹6 – ₹10 LPA |

| Senior-level (7+ years) | ₹11 – ₹18 LPA |

The compensation of a Client Servicing Manager also varies based on the sector. For instance, those employed in banking and finance tend to earn more salaries due to the intensity and volume of client accounts.

Career in Client Servicing: What’s the Growth Path?

One of the biggest attractions of a client servicing career is its potential for vertical expansion. Many professionals transition into leadership roles or cross-functional functions, such as strategy or business development.

Typical Career Path

- Client Servicing Executive

- Assistant Manager – Client Relations

- Client Servicing Manager

- Account Director / VP – Client Experience

- Head – Customer Success / Client Strategy

How to Become a Client Servicing Manager?

Education and Training

Bachelor’s in business, finance, or marketing

PG courses in customer relationship management or finance

Industry certifications like PRINCE2 (project management), or CRM software like Salesforce

Tip: Courses like the Postgraduate Program in Banking and Finance by Imarticus Learning are built to hone industry-specific client relationship skills and gain entry into leading firms.

The Importance of Client Relationship Management

Client servicing is more than servicing—it’s about trust. In banking or advertising, your ability to service relationships has the power to grow business and clients.

Why It Matters

- Enhances client retention

- Increases account value through upselling

- Fosters referrals and positive reviews

- Reduces churn and negative word-of-mouth

Tools Used in Client Servicing

Some of the most common tools that client servicing professionals use:

- CRM platforms: Salesforce, HubSpot, Zoho

- Project management: Trello, Asana, ClickUp

- Communication: Slack, Microsoft Teams, Zoom

- Analytics & Reporting: Google Sheets, Tableau

Top Industries That Are Hiring Client Servicing Professionals

- Banking and Financial Services

- Advertising and Media

- IT and Software

- Telecom

- Insurance

10 Most Frequently Asked FAQs About Client Servicing

Q1: What does the job of a Client Servicing Manager entail?

They work as the interface between clients and the firm, ensuring deliverables are complete and satisfaction is achieved.

Q2: What industries are hiring Client Servicing Managers?

Banking, advertising, IT, telecom, and more.

Q3: What qualifications are needed?

A business, finance or marketing degree, along with experience.

Q4: Is client servicing stressful work?

It can be stressful due to deadlines, but it’s rewarding for those who love building relationships.

Q5: How does client servicing differ from sales?

Servicing is retention- and satisfaction-based, whereas sales are focused on new client acquisition.

Q6: What are essential client servicing skills?

Communication, CRM skills, time management, and problem-solving.

Q7: Are freshers welcome in this profession?

Yes, especially through formal programs like those offered by Imarticus Learning.

Q8: Is this position applicable in the digital era?

Yes, absolutely. As businesses expand digitally, client servicing guarantees human interfaces remain intact.

Q9: How much is the average salary in India?

Between ₹3.5 LPA and ₹18 LPA, depending on experience and industry.

Q10: Are there certifications to support my development?

Yes, certifications in project management and CRM tools can be beneficial.

Conclusion: Is Client Servicing the Right Option for You?

A Client Servicing Manager is the frequently unappreciated person behind most successful client relationships. With the correct balance of empathy, process discipline, and communications, the role offers ample opportunities to develop across all sectors.

Key Takeaways

- Client Servicing Managers foster client trust and loyalty through active interaction and coordination.

- Development is offered across industries like banking, advertising, and technology with fair salary ranges.

- Courses like Imarticus Learning’s PGP in Banking and Finance make you transition into this role with confidence.

Are you ready to build a Career in Client Servicing?

Find Imarticus Learning’s Post Graduate Program in Banking and Finance to create industry-related skills, mentoring, and job placements with top employers.