Last updated on July 15th, 2024 at 12:38 pm

Chief Financial Officers (CFOs) hold the highest financial leadership positions within organisations, collaborating closely with other top-level executives to enhance financial operations and steer capital management.

Becoming a CFO includes cultivating a distinctive skill set, accumulating substantial professional experience, and attaining specific educational qualifications.

What Is a CFO?

The CFO is a linchpin in financial leadership, working closely with fellow C-suite executives under the CEO’s purview. Their role as stewards of a company’s financial well-being includes long and demanding days, from financial statement scrutiny to strategic planning sessions.

The specific responsibilities of a CFO are highly adaptable, depending on the dynamic needs of the business. Some everyday core responsibilities that unite most CFOs are:

Overseeing financial planning & analysis (FP&A)

Financial Planning & Analysis is a fundamental facet of financial management. It includes meticulously analysing a company’s financial data and the crafting of predictive reports based on historical figures.

This analytical process supports critical executive decisions. The CFO directly supervises the FP&A team, instrumental in formulating the organisation’s financial strategies for the future.

Managing investor relations

The CFO wields a unique blend of financial acumen, communication pgarowess, and marketing skills to shape and uphold stakeholder expectations. Cultivating transparent and enduring relationships with investors is pivotal for the company’s brand credibility.

CFOs play an integral role in fostering connections with the investor community, ensuring a solid foundation of trust.

Heading tax and compliance

Companies operate globally in an increasingly globalised business landscape, contending with a labyrinth of tax laws and regulatory mandates across diverse markets.

Proactive management of tax and compliance issues is important for governance and future-proofing the business. Strategic consideration of compliance is essential, enabling unhindered expansion on the global stage.

Raising capital and pitching strategic M&A

The maturation of a business necessitates adept fundraising. The CFO’s role extends beyond mere fundraising; it encompasses the strategic structuring of capital acquisition, whether through equity, debt, or other means.

Furthermore, the CFO assumes a central position in advising the CEO on strategic mergers and acquisitions that align with the company’s expansion plans.

Minimising financial risks and losses

Identifying financial risks lurking within operational processes is a critical task. The CFO’s panoramic perspective across the organisation equips them with the insight to pinpoint vulnerabilities and inefficiencies.

Effective risk management may involve process optimisation, automation of compliance protocols, and other proactive measures to avert costly mishaps.

Championing automation and financial technnologies

In a world marked by constant technological disruption, finance is no exception. CFOs must harness technology to expedite growth and navigate the competitive landscape of rapidly evolving businesses.

A robust technical arsenal fosters scalability and efficiency and mitigates friction and cost overruns. It is also extremely important to embrace fintech solutions that can help companies gain an edge over competition inside dynamic business environments.

Balancing budgets and expenses

Balancing budgets and judiciously allocating resources is a cornerstone of the CFO’s role. This task transcends cost-cutting and cash flow management; it entails identifying initiatives that harmonise with the organisation’s long-term vision, assessing potential returns, and ensuring precise funding allocation.

Importance of the CFO in an Organisation

The CFO plays a critical and diverse position in every organisation, serving as a cornerstone in directing the company’s financial health and strategic direction.

For several convincing reasons, the necessity of a CFO in an organisation cannot be overstated:

Resource allocation

CFOs bear the responsibility of efficiently distributing resources. They determine how funds are directed toward projects, technology advancements, and initiatives to optimise returns and realise the organisation’s strategic goals.

Technology integration and innovation

CFOs must wholeheartedly embrace technology and data analytics. They spearhead innovation within financial processes, facilitating data-centric insights that drive informed strategic choices.

Leadership and team oversight

CFOs provide leadership to finance teams and, in some instances, other departments. Effective leadership, mentorship, and talent cultivation ensure the finance function operates at peak performance.

Strategic capital management

Securing and supervising capital for the organisation is squarely in the scope of the CFO. They assess a spectrum of funding alternatives, encompassing debt, equity, and other innovative avenues. Their focus remains aligning financial resources with the organisation’s objectives while prudently managing financial risks.

Financial transparency and regulatory adherence

CFOs guarantee the precision and openness of financial reporting. They diligently supervise compliance with accounting standards and regulations, instilling confidence in shareholders and stakeholders regarding the organisation’s financial disclosures.

Expense oversight

Vigilant cost management is fundamental to sustaining profitability. CFOs craft cost-containment strategies, fine-tune operational efficiency, and pinpoint cost reduction opportunities while preserving quality and fostering growth.

Evolving Role of the CFO in Modern Business

The ever-growing interconnectedness of organisations and rapid technological advancements necessitate a transformative role for CFOs in staying competitive.

Their evolving responsibilities include:

- Tech Integration: CFOs expand their financial expertise to integrate applications and software for in-depth data analysis.

- Platform Proficiency: CFOs become experts in cloud-hosted ERPs and oversee infrastructure changes to enable technological integration.

- Data-Driven Decisions: Data enables informed choices on cash flow, precise forecasts, and financial oversight, setting apart effective CFOs.

- Data Visualisation: The ability to harness data and visualisation becomes a distinguishing trait and eventually a standard skill.

- Competitor Analysis: CFOs research how competitors employ technology, deciding on valuable investments, even if they require substantial resources and learning curves.

- Emerging Technologies: CFOs play pivotal roles in evaluating the relevance of emerging technologies like robotic process automation (RPA), artificial intelligence (AI), and machine learning, differentiating between potential growth and costly hype.

Key Skills and Qualities of a Successful CFO

Successful CFOs have unique abilities and attributes that allow them to flourish in their diverse responsibilities.

The following are significant characteristics and abilities frequently identified in successful CFOs:

Forward-thinking strategy

A crucial quality of an exceptional CFO is their ability to craft a forward-looking strategy. Unlike accountants and controllers who primarily deal with historical records, a CFO excels in devising strategies that propel the company toward its financial goals.

It is achieved through sophisticated forecasting, utilising historical data, industry trends, competitive analysis, and strategic modelling to create a roadmap for progress. Along with financial and business modelling, CFOs must also be great at deal structuring and valuation of projects. This is essential as CFOs must be able to evaluate if certain deals or projects are viable or worth the investment and if not, they should be able to suggest alternatives or modifications.

Strategic collaboration

Great CFOs go beyond mere financial reporting; they act as strategic partners. Their comprehensive understanding of the organisation spans sales, customer service, and R&D to vendor relationships. They optimise performance across all facets of the business and make strategic adjustments to drive growth and profitability.

For instance, they may conduct in-depth product line analyses, proposing changes in vendor agreements, pricing, or sales and marketing to enhance product performance.

Operational expertise

Distinguishing themselves from traditional financial professionals, accomplished CFOs possess real-world operational experience. Whether through a previous COO role or mentorship, this experience enables them to offer pragmatic strategic advice that transcends budgeting and cost-cutting.

Financial mastery

Many CFOs ascend from Controller roles, but the transition sometimes translates to increased expertise, coaching, or mentorship. Experienced CFOs have accumulated high-level financial insight over time.

In contrast, newer entrants or those promoted directly from Controller roles may need more experience.

In such cases, mentorship from a seasoned CFO is invaluable, or opting for a highly experienced part-time CFO may be the wiser choice.

Sophisticated financial tools

In addition to conventional financial tools like balance sheets and income statements, exceptional CFOs employ advanced modelling tools.

These include short-term, mid-term, and long-term forecasts and tools such as contribution margin analysis, break even analysis, product line analysis, revenue bridge analysis, and pro forma cap table & liquidation.

These tools enable the formulation of advanced financial strategies.

Networking process

Great CFOs boast a network of high-quality relationships, which can significantly impact a company’s success, from securing funding to improving vendor relationships and contracts. Recent events have demonstrated how such relationships can expedite resource access, making it a hallmark of an experienced CFO.

Leadership acumen

A top-tier CFO possesses not only financial expertise but also exceptional leadership skills. While finance professionals may be perceived as soft-spoken, a CFO should be capable of leading their financial team and guiding the operations team.

They are adept at making data-backed strategic suggestions and implementing them effectively. CFOs must be able to lead growth for their companies and be masters of financial leadership and strategic thinking.

Industry versatility

Although industry-specific experience is beneficial, it’s not mandatory. However, it does provide valuable context for comparing analytics and often grants access to industry contacts, competitive analysis, and benchmarks. This well-rounded industry insight is advantageous.

Skilled financial support

A great CFO doesn’t perform lower-level tasks like payroll or end-of-month close. Instead, they rely on an expert financial team to produce timely and accurate financial reports.

The CFO oversees this team, using their reports as the foundation for developing financial strategies, risk assessment, and advancing the company towards its goals.

Educational and Professional Requirements

Educational Background and Degrees

You must possess a bachelor’s degree to access entry-level roles. Subjects like economics, business management, accounting, or finance are pertinent. Many aspiring CFOs choose to pursue advanced degrees, which include:

- Master of Public Administration

- Master of Business Administration

- Master of Accounting for Financial Analysts

- Master of Accounting for Financial Managers

- Master of Science in Accounting

Numerous universities extend opportunities for continuing education and workshops tailored to financial professionals. These non-degree programs span various areas, including peer networking, enhancing organisational communication skills, staying updated on market trends, navigating regulatory complexities, and implementing transparent accounting practices.

While several extension programs facilitate in-person interactions among business peers, there’s also a burgeoning array of online CFO training courses for CFO certification and MBA programs, designed to prepare individuals for certifications, providing distance learners with accessible educational pathways.

Relevant Certifications

For the role of CFO, although certification or licensure is not a strict requirement, many professionals opt to pursue these credentials to showcase their dedication and competence.

Below are several certification options to consider:

Certified Treasury Professional (CTP)

This certification, which focuses on treasury management expertise, underscores proficiency in cash processing, financial statement analysis, reconciliation, and more.

Certified Public Accountant (CPA)

Becoming a CPA involves fulfilling state-specific requirements, which includes 150 postsecondary semester hours, including graduate-level coursework. Candidates must pass a series of four exams within 18 months and maintain their CPA licence through ongoing education.

Chartered Financial Analyst (CFA) Certification

Offered by the CFA Institute, the CFA certification equips individuals with a comprehensive foundation in investment analysis and portfolio management, emphasising real-world applicability and adherence to professional standards.

These certifications exemplify a commitment to expertise and excellence in the finance field, providing CFOs with valuable skills and credentials to excel in their roles.

Experience and Career Progression

Professional experience

CFOs usually have extensive experience in finance and accounting roles. It often includes working their way up through the ranks, starting as financial analysts, accountants, or controllers. They gain valuable insights and skills in financial management, reporting, and strategic planning.

Public company experience

For CFOs of publicly traded companies, experience with regulatory compliance, financial reporting, and investor relations is vital. This experience ensures adherence to legal and reporting requirements.

Global experience (for Multinational companies)

CFOs in multinational corporations often have experience in international finance, understanding global financial markets, foreign exchange, and international tax regulations.

Proven Track Record

CFOs typically ascend to the role based on a proven track record of financial leadership, sound decision-making, and successful financial management.

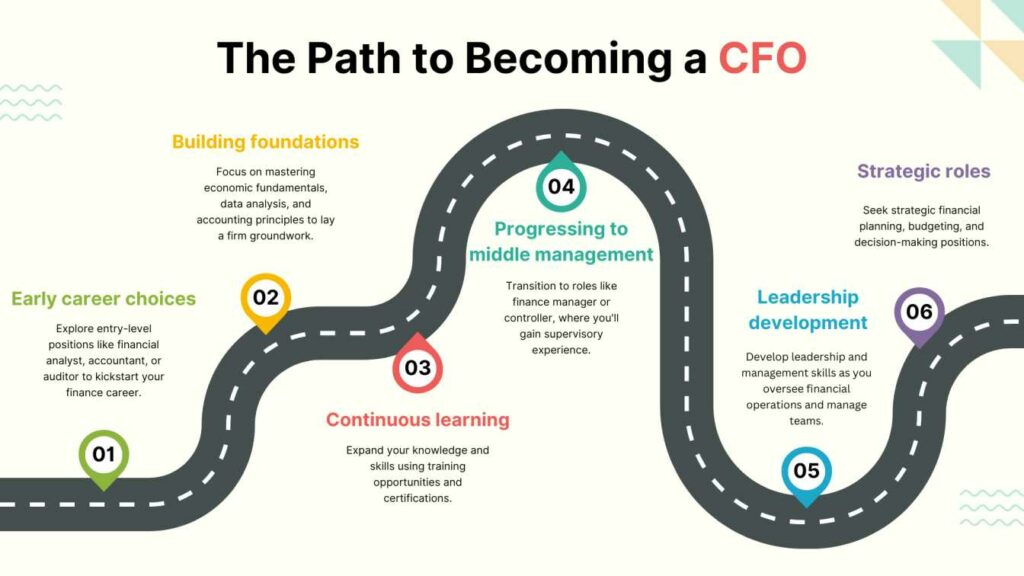

The Path to Becoming a CFO

Entry-Level Finance Positions

- Early career choices: Explore entry-level positions like financial analyst, accountant, or auditor to kickstart your finance career.

- Building foundations: Focus on mastering economic fundamentals, data analysis, and accounting principles to lay a firm groundwork.

- Continuous learning: Expand your knowledge and skills using training opportunities and certifications.

Mid-Career Advancement

- Progressing to middle management: Transition to roles like finance manager or controller, where you’ll gain supervisory experience.

- Leadership development: Develop leadership and management skills as you oversee financial operations and manage teams.

- Strategic roles: Seek strategic financial planning, budgeting, and decision-making positions.

Tips for Aspiring CFOs

Cultivate a forward-thinking approach

CFOs are increasingly expected to bring strategic skills to the forefront. Develop a strategic mindset that allows you to consider opportunities alongside risks, and be willing to invest in endeavours that drive strategic growth.

Always represent

Recognise that you represent your company around the clock as CFO. Understand the significance of this role, as it goes beyond office hours.

Lead with humility

Effective CFOs ensure they have the right talent in key roles, emphasising teamwork and humility. Seek individuals who excel and surpass your abilities to build a strong team.

Invest in talent

Talent management will be a significant part of your CFO role. Dedicate substantial time and effort to nurturing and developing talent within your team.

Be the CEO’s confidante

CEOs benefit from a trusted confidante within the management team. As a CFO, your unique vantage point enables you to provide valuable insights and engage in candid discussions.

Partner with the business

Go beyond finance and offer actionable insights to improve performance. Understand the business thoroughly and build credibility by interacting directly with its operations.

Effective communication

Tailor your communication to various stakeholders, ensuring clarity, accuracy, and consistency. Work on your communication skills, especially public speaking, as they are increasingly critical in the evolving CFO role.

Specialisation

Acknowledge that you can only be an expert in some things. Focus on understanding the principles and emerging trends in tax and technology, and hire experts in those domains.

Uphold integrity

Maintain the highest levels of integrity. As the truth-teller for your organisation, convey authority and wisdom when addressing critical issues impacting stakeholders, from employees to regulators. Your words and actions are under constant scrutiny.

Challenges and Opportunities in the CFO Role

An adaptable CFO is integral in propelling your organisation forward in the current landscape.

CFOs achieve this by harmonising strategic objectives throughout the company, harnessing technology to enhance efficiency, leveraging data for informed decision-making, and contributing to future-oriented planning.

Here’s how a strategic CFO can be instrumental in driving your organisation’s growth:

Enhancing Interdepartmental Communication: A forward-looking CFO fosters collaboration across the organisation. They facilitate alignment among senior leaders, business units, and the finance department, offering a comprehensive perspective on the organisation’s performance and potential.

Crafting, Monitoring, and Assessing Strategic Blueprints: Amidst challenges like pandemics and economic uncertainties, today’s CFOs are central in steering the organisation. An adaptable CFO provides guidance and leadership in formulating and overseeing strategic plans while proactively preparing for an uncertain future.

Adopting Digital Solutions: Finance teams are increasingly embracing digital solutions. Modern CFOs leverage these technologies to drive efficiency, engage employees, and align strategic objectives company-wide. They recognise the transformative potential of digital tools in achieving organisational goals.

Industry-Specific Considerations

CFO Roles in Different Sectors

- Healthcare sector: Exploring the unique financial challenges and opportunities in healthcare, including regulatory compliance, revenue cycle management, and healthcare finance strategies.

- Technology sector: Understanding the economic dynamics of the tech industry, including managing R&D investments, handling rapid growth, and evaluating technology investments.

- Finance sector: Exploring the CFO role within financial institutions, including banks and investment firms, focusing on risk management, asset allocation, and regulatory compliance.

- Manufacturing and industrial sectors: Learning about CFO responsibilities in manufacturing and industrial companies, including supply chain finance, cost management, and capital allocation.

- Consumer goods and retail: Understanding the financial intricacies of consumer goods and retail, such as inventory management, pricing strategies, and e-commerce finance.

Industry-Specific Skills and Knowledge

- Healthcare finance: Acquiring knowledge of healthcare reimbursement models, healthcare accounting standards (e.g., GAAP and IFRS), and healthcare-specific financial metrics.

- Tech finance: Developing expertise in managing tech company financials, understanding software revenue recognition, and evaluating technology investments and product development costs.

- Financial services: Mastering financial regulations, risk management practices, and financial product knowledge within the industry.

- Manufacturing and supply chain finance:

-

- Learning about lean financial practices.

- Inventory turnover ratios.

- Supply chain optimisation in the manufacturing sector.

- Retail and consumer finance: Gaining insights into consumer behaviour analytics, pricing strategies, and omnichannel finance in the retail industry.

- Energy and utilities finance: Understanding energy market dynamics, pricing, and sustainable finance practices in the energy and utilities sector.

Networking and Professional Development

Networking and continuous professional development are critical to a successful CFO’s career journey. These efforts help CFOs stay current, build valuable relationships, and enhance their leadership skills.

Follow these useful strategies for networking and professional development:

Building a solid finance network

Networking is a cornerstone of success in the finance industry. It involves connecting with peers, mentors, and industry leaders to foster professional relationships. Practical strategies for building a robust finance network include attending industry events, joining relevant professional organisations, and leveraging online platforms like LinkedIn.

Remember that the relationships you cultivate can provide valuable insights, career opportunities, and support throughout your finance journey.

Continuing education and skill improvement

Continuous learning and skill development are vital to achieve long-term financial success. Demonstrating a commitment to lifelong learning distinguishes you in this dynamic field. Consider earning certifications like CPA, CFA, or CMA to enhance your expertise.

Enrolling in executive education programs, attending workshops, or taking online courses helps you stay current with industry trends and best practices. Regularly reading finance journals, books, and industry publications deepens your knowledge and comprehension.

Mentoring and coaching for aspiring CFOs

Mentorship and coaching are invaluable resources for those aspiring to become CFOs. A mentor or coach can provide guidance, perspective, and support throughout your career journey. Finding the right mentor or coach involves identifying individuals with relevant experience and seeking advice.

Additionally, consider offering mentorship and guidance to those earlier in their finance careers. Peer support networks and mentorship programs can create a strong community of finance professionals who learn from and support each other.

Conclusion

Becoming a CFO is a dynamic journey combining education, experience, and ongoing professional development. Aspiring CFOs should pursue a solid educational foundation, gain diverse financial knowledge, and actively engage in networking and continuous learning opportunities.

Additionally, exploring specialised CFO certification programs and training courses, such as Imarticus Learning’s IIM Indore’s Postgraduate Certificate Programme for Emerging CFOs, can provide valuable insights and skills to excel in the CFO role.

Visit Imarticus Learning today to learn more about our CFO training courses.