As a powerful force with an estimated $1 trillion valuation, the data science industry is now an unstoppable force that is attracting passionate professionals from all over the globe. While a great deal of the appeal for data science and analytics jobs pertain to the high-paying nature of the industry, the industry itself offers an amount of career growth that is somewhat hard to image. This high-paying industry has experienced blistering growth among the population of data scientists, with a surge in the number of people wanting to research, develop, and create insights from big data.

But what is driving this growth? Additionally, what, specifically, are employers looking for? The blog will take a deeper dive into the world of data science growth, how this industry will change our career landscape, how growth looks, and what skills will be in demand. Join us as we explore the reality of data science and analytics, and prepare yourself to navigate the fascinating and complex space of the $1 trillion industry.

The Journey of Big Data: Your Pathway to a Successful Career

The destination of a rewarding career in data science and analytics presents a clear step-by-step journey that has its challenges but also its high rewards. A robust space in the $1 trillion data industry umbrella presents a promising path, offering an exciting, stable, and rewarding future for those with the right skills.

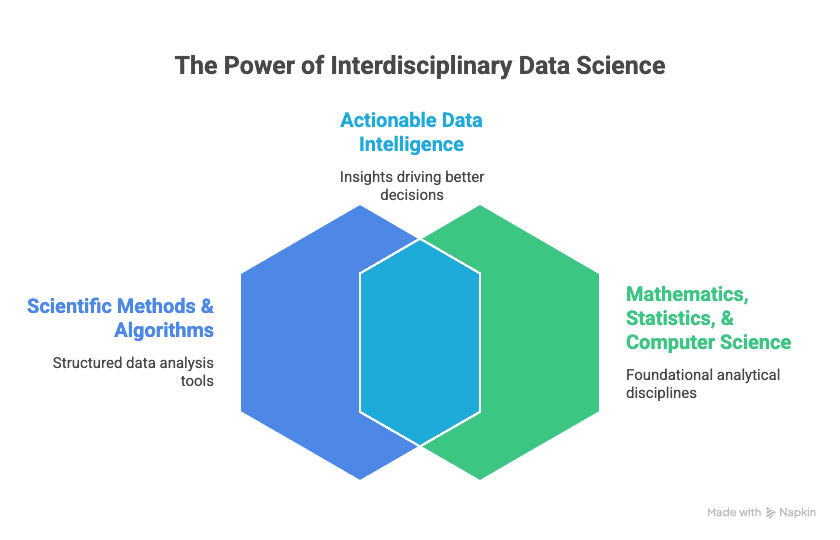

Most data science career ladders begin with even the most rudimentary skills in mathematics, statistics, and computer science, either being taught or self-taught with whatever resources are available. This allows future data scientists to develop the critical skills needed to analyse complex data sets.

- Bachelor: Mathematics, Statistics, Computer Science, or other related fields.

As one climbs the ladder, additional qualifications namely a Master’s or PhD (especially if in data science) gives candidates a competitive advantage. In addition, having a specialisation in machine learning or artificial intelligence will also be advantageous.

- Masters/PhD: Data Science, Machine Learning, AI.

In combination with academic qualifications, practical experience is extremely valuable. This can be achieved through internships, real-world projects, or even data science competitions.

- Practical Experience: Internships, Projects, Competitions.

Lastly, proficiency in key data science tools and programming languages is essential. At the very minimum, it is advantageous to have familiarity with tools like Python, R, SQL, or Hadoop, among others.

- Needed Tools: Python, R, SQL, Hadoop.

As this is a developing field, keeping up to date with trends and new tools is vital, thus creating opportunities for upward mobility on the data science career path (i.e. Data Analyst, Data Scientist, and eventually Chief Data Officer). Data science and analytics careers offer a rewarding path that leverages technical and innovative skillsets, as well as creative and strategic thinking, to create a significant impact in big data.

Discovering Possibilities with Data Science and Analytics

A career in the fast-growing field of data science and analytics is certainly a rewarding career path and opens a world of opportunity in various sectors. With demand for data analytics skills at an all-time high, there are many opportunities for promising careers and significant growth:

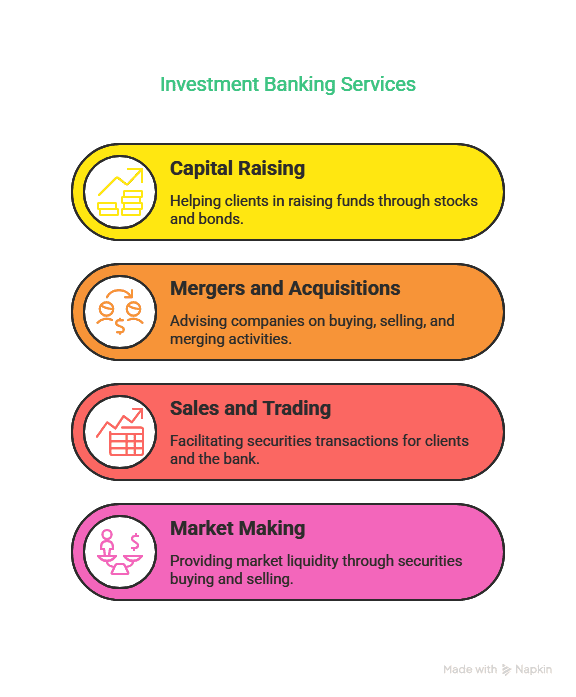

- Sector variety: Data analytics professionals are not restricted to one industry. They can work in a variety of industries such as healthcare, finance, retail, and technology, and help with developing data-driven decision-making and strategy.

- Job variety: Data science and analytics jobs come in all sorts of shapes and sizes, literally. Data Analyst, Data Scientist, Business Intelligence Analyst, and Data Engineer vary greatly in focus and expertise. The job market can satisfy a wide array of analytics needs for a business.

- Growth opportunities: Starting as a data analyst, with the proper experience and education, you would be qualified for promotions to senior professional positions like Data Architect or Analytics Manager. These positions involve higher levels of responsibility and ultimately greater pay.

- Higher than average salaries: Due to skill shortages and high demand, data analytics career options typically pay very well, making data analytics positions highly desirable career choices. In conclusion, data analytics career paths are numerous and diverse, with significant opportunities for professional development. Whether you are an experienced data practitioner or a new enthusiast, data science and the data analytics space can offer an extremely rewarding and lucrative career.

The Data Science Landscape Keeps Expanding

As we enter the 21st century, the field of data science and analytics continues to grow rapidly, ensuring a positive outlook. The existing digital transformation will see to it that the field of data analytics quickly expands, provided skilled people pursue the opportunities available.

- Untangling Unique Data Structures: One of the primary factors driving data analytics is the vast amount of data generated daily. It’s no secret that unique data structures are becoming more common. As you probably guessed, the need for data science and analytics work is increasing. The future will also demand more people who can unravel or unscramble complex data structures to discover meaningful knowledge.

- Predictive Analytics: Another area that is expected to receive prominence is the growth of predictive analytics. Organisations are starting to consider predictive models to drive their decision-making process. The role of data scientists enables them to build predictive models for organisations in this process.

- Data-Driven Operations and Decision Making: Organisations are becoming more data-driven and utilising analytics to drive their operations and strategy. This has shown there is an increasing acceptance of using knowledge from analytics to drive business operations and decision-making. This trend will lead to a greater demand for data science and analytics personnel.

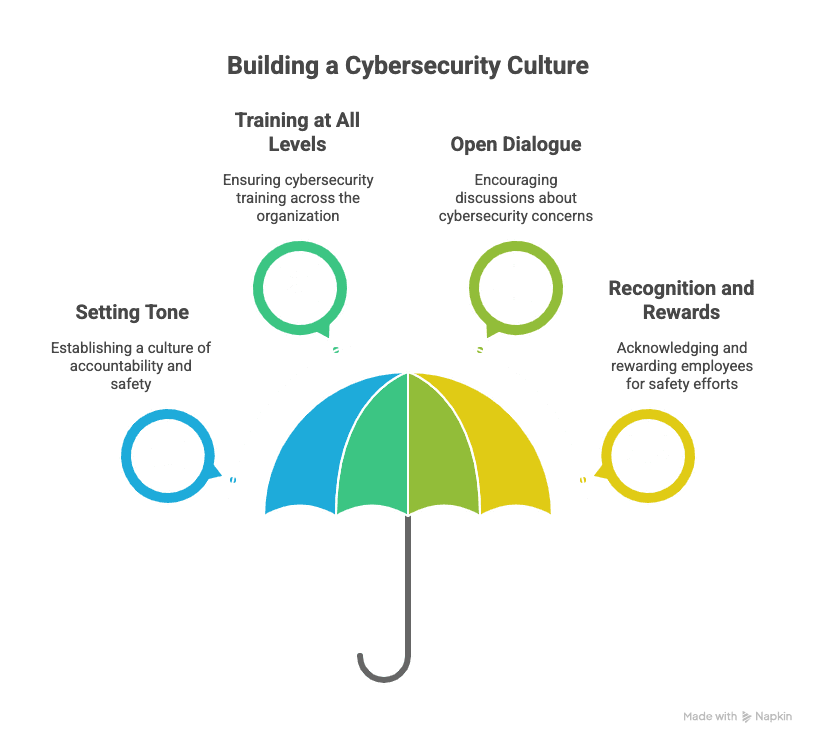

- Emphasis on Data Privacy: As data analytics continues to advance, so must the attention paid to privacy and security. Future practitioners will face the challenge of protecting data while at the same time providing value from it.

To sum up, the future of data analytics is expansive and diverse. With the increasing demand for professionals in data science and analytics jobs, numerous career options are available in this industry for those willing to evolve and adapt to changes. From predictive analytics to data-informed decision making, the future of data science has unlimited promise.

A Rapidly Growing Demand for Data Science Professionals

As the digital revolution has exploded in the amount of data being created, the need for data science jobs has also exploded. Companies worldwide are increasingly relying on data-driven insights to stay competitive, leading to a significant surge in data science and analytics jobs.

The ability to extract useful information from massive amounts of data is a highly sought-after skill. For this reason, there has been a dramatic increase in the number of individuals wanting to pursue data science careers. There are two primary reasons behind this:

- A desire for data-driven decision making is on the rise: Companies are becoming increasingly data-conscious, as well as needing to hire more data science professionals.

- There is overwhelming growth in data creation: Exponential worldwide data creation is sparking demand for specialists who can make sense of this data explosion. – Earnings potential: Data science roles usually come with high salaries because of high demand and a lack of skills available in the market.

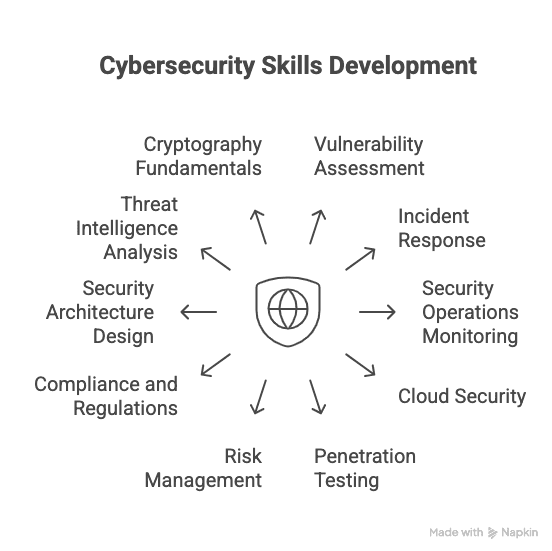

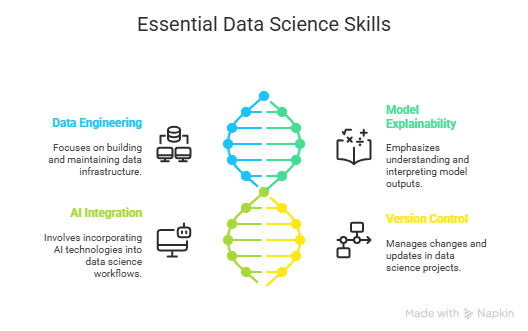

As for the specific skills that are in high demand, data scientists are usually expected to show proficiency in:

- Programming languages such as R or Python

- Statistics

- Machine learning models

- Visualisation and presentation

In conclusion, demand for data science jobs is a result of the digital revolution and is unlikely to reverse. As businesses continue to leverage data to improve their decision-making, the demand for data science and analytics jobs will remain high.

How to know if you have what is needed for success in Data Analysis?

In the fast-growing area of data science and analytics jobs, if you have the correct skill set, you can completely outshine the competition. The most in-demand skills in Analytics are a key part of success in this data-driven environment.

First and foremost, understanding and manipulating large data sets is the first skill you need to be a data scientist. You then need to have programming experience, primarily using R and Python, because these are usually the two primary programming languages for most data analytics.

Another skill is the ability to build predictive models and machine learning algorithms. Predictive models allow businesses to make data-based predictions, forecasts and data-driven decisions, providing a competitive advantage in the marketplace. Here is a summary of the primary required data analytics skills:

- Data management and data manipulation

- Python and R expertise

- Predictive modelling

- Machine Learning algorithms

- Statistical analysis and Mathematics

- Data visualization

Nevertheless, technical skills are not the only things that matter. Critical soft skills such as analytical thinking, decision-making, and communication are equally important. These skills assist individuals in interpreting raw data and articulating the outcome in relatable terms.

In conclusion, no matter how complicated, labelled, and structured the data may be, the real skill is how you interpret that data and make data-driven decisions. This requires both technical skills and soft skills, making you an asset in the job market in data science and analytics jobs.

In summary, the primary required skills for data analytics provide a guide to success in the examples we’ve explored in this growing field. By enhancing your learning of the primary skills needed for data analytics, you will increase your opportunities and make a difference when working in this growing field valued at 1 trillion dollars in data science.

Take full advantage of your data with our specially selected best data science course. This course is designed to be informative and relevant, teaching you how to interpret the complexities of data science and apply data analytics skills. The course is appropriate whether you are a beginner wanting to begin your career path to data science, or an expert seeking to upskill your current skills. The course aligns with industry trends and needs, making it perfect for those looking to enter a data science and analytics role. It focuses on both theoretical and practical aspects of the data science and analytics job. The course delivery is by working professionals who offer a great range of knowledge and experience. Why not learn what you want to be and study and build a career in a highly sought-after industry?

Join us, and see how data can benefit you!

FAQ

What is the current state of the jobs for data science and analytics?

The jobs for data science and analytics are currently thriving! The digital age is in full swing, and businesses of all shapes and sizes are realising the need to develop insights from the vast amount of data created in their everyday operations. Due to this realisation, the number of data scientists and analysts continues to balloon. Data science has evolved into one of the most in-demand professions around the globe. With the industry now worth over $1 trillion!

What skills are currently in demand for the data science space?

Data science is constantly looking for a plethora of unique skill sets. The first essential skill would be a solid mathematical and statistical base. This is important for data scientists because they often use complex mathematical models and algorithms. Demand for programming skills is growing, particularly about the use of languages such as Python and R. Demand also exists in the area of machine learning, data visualisation and the use of big data platforms – including Hadoop and Spark, and also soft skills in the area of non-technical skills, such as communication and problem solving.

What does the career growth look like in data science and analytics jobs?

The career growth in data science and analytics jobs is incredible. Data Scientists and Data Analysts start as junior data scientists or analysts, and then, with experience, continue to progress into senior positions, ranging from Senior Data Scientist or Data Architect to Chief Data Officer. The pace of progression is rapid, and in many cases, people are in senior positions within 3-5 years. Due to the increasing use of data science in all industries, the growth trajectory in this field is abundant, and there are unlimited opportunities to progress and diversify your career.

What types of roles are in the data science industry?

The data science industry encompasses a wide range of roles. For example, a Data Analyst is an entry-level role that involves analysing data to assist the business in making informed decisions. A Data Engineer works on the infrastructure of a data platform, preparing and cleansing data to ensure it is in a format ready for data scientists to analyse. A Data Scientist is a primary role in the data science industry and requires many skills to extract insights and create predictions from data. A role of Machine Learning Engineer will involve building machines/systems that learn from the data and base decisions on the data. The role of Data Visualisation Expert will translate data into a visual format that can be easily viewed and understood by the business.

What is the average salary of data science and analytics jobs?

The average salaries of data science and analytics jobs vary depending on the role, experience and location. Still, these roles are generally well-paid due to the high demand and skills acquired through work experience.