Investment banking is the profession of “très haut niveau” in finance, and it starves for smoking stars all over the place. But not nearly as much heretofore in its guise as such as a boardroom table. It begins with school classrooms, internships, seminars, and astute career choices. If you ever fantasised about opening the doors of investment banking for your foot at some point or other, then this guide takes you through each step that you have to do so you can become a star—and reign supreme.

How to Get Into Investment Banking: The Essential Guide!

hai Investment banking is not a study-and-networking game but a loyalty-and-trust game—it’s a matter of will, preparation, and determination. From the proper selection of education to the right investment banking certification, in this book are the most important milestones.

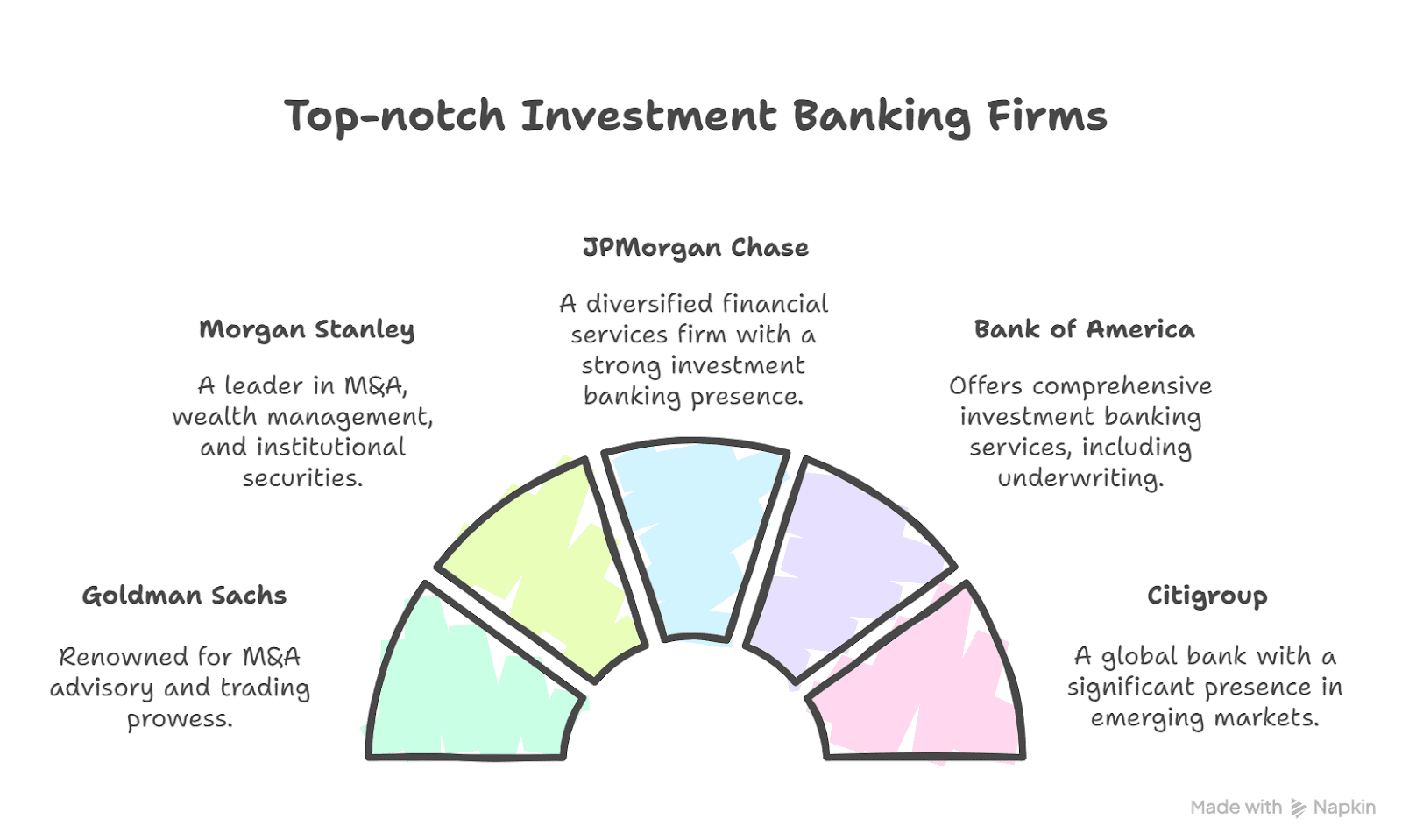

Understanding the Investment Banking Landscape

Even joining the very competitive business itself, discovering how to comprehend what investment banking is something that has to be learned. It is not mergers and acquisitions; it is cross-border advisory financial markets, issuing securities, capital raising, and trading. In this location, usually high-value transactions and high-value clients are usually serviced or handled by experts.

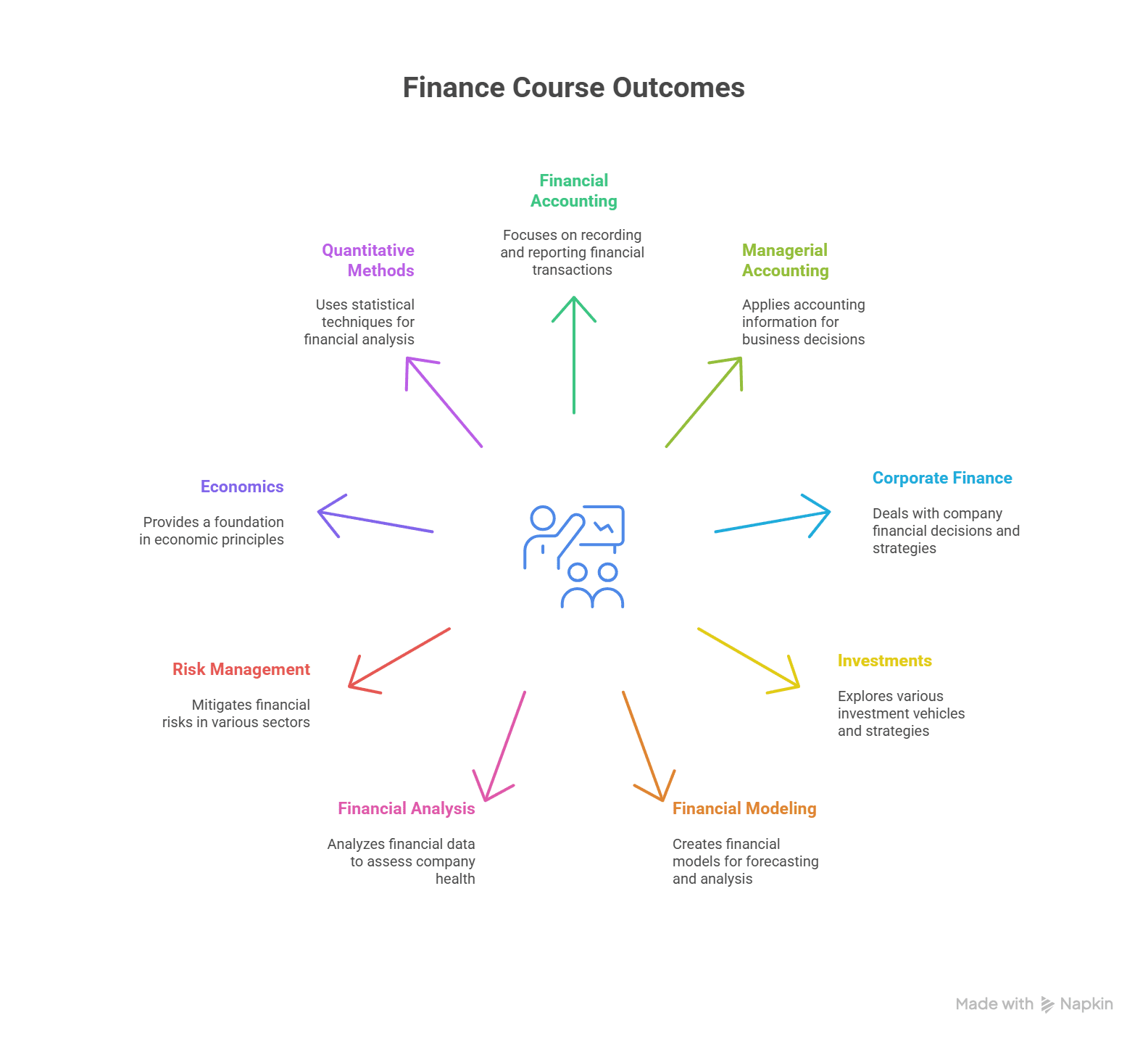

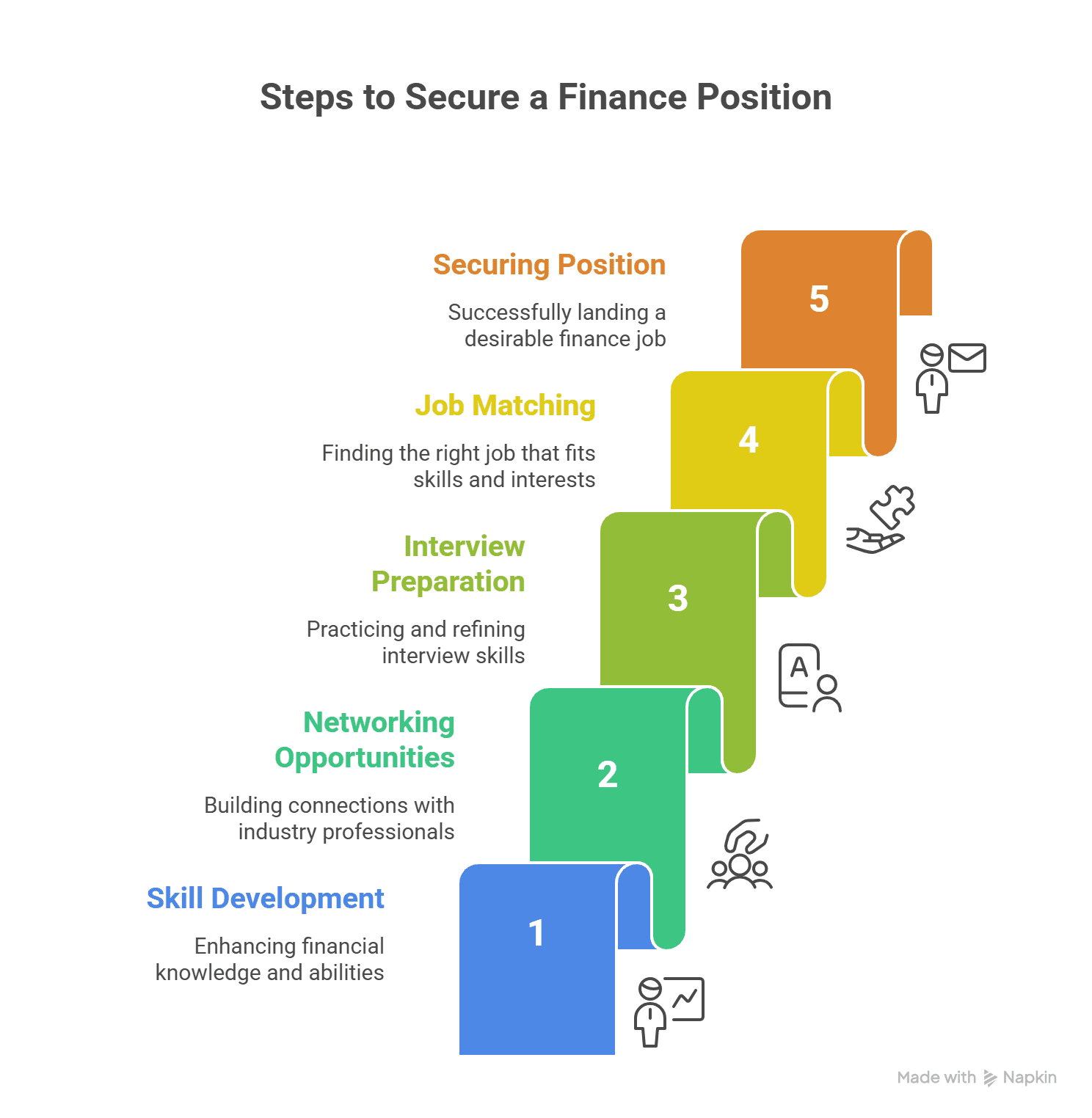

Step 1: Build a Strong Academic Foundation

Then you would have some background in economics, finance, or business. The top performers were liberal arts college and engineering school graduates. Whatever that gap is, is that you can show you do know something about financial markets and products. An investment banking operations India course will provide you with a cut and dried advantage.

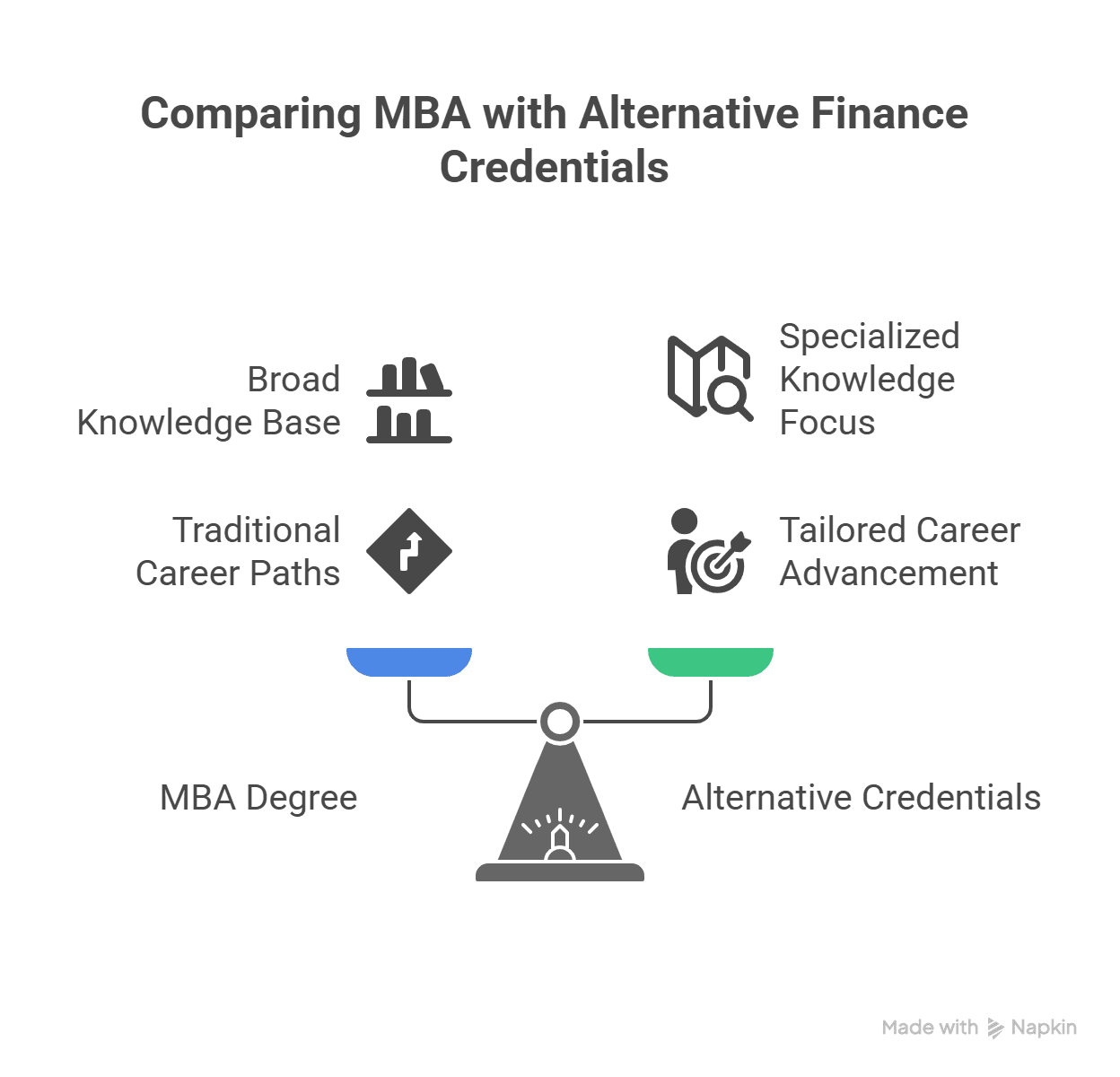

Step 2: Pursue an Investment Banking Certification

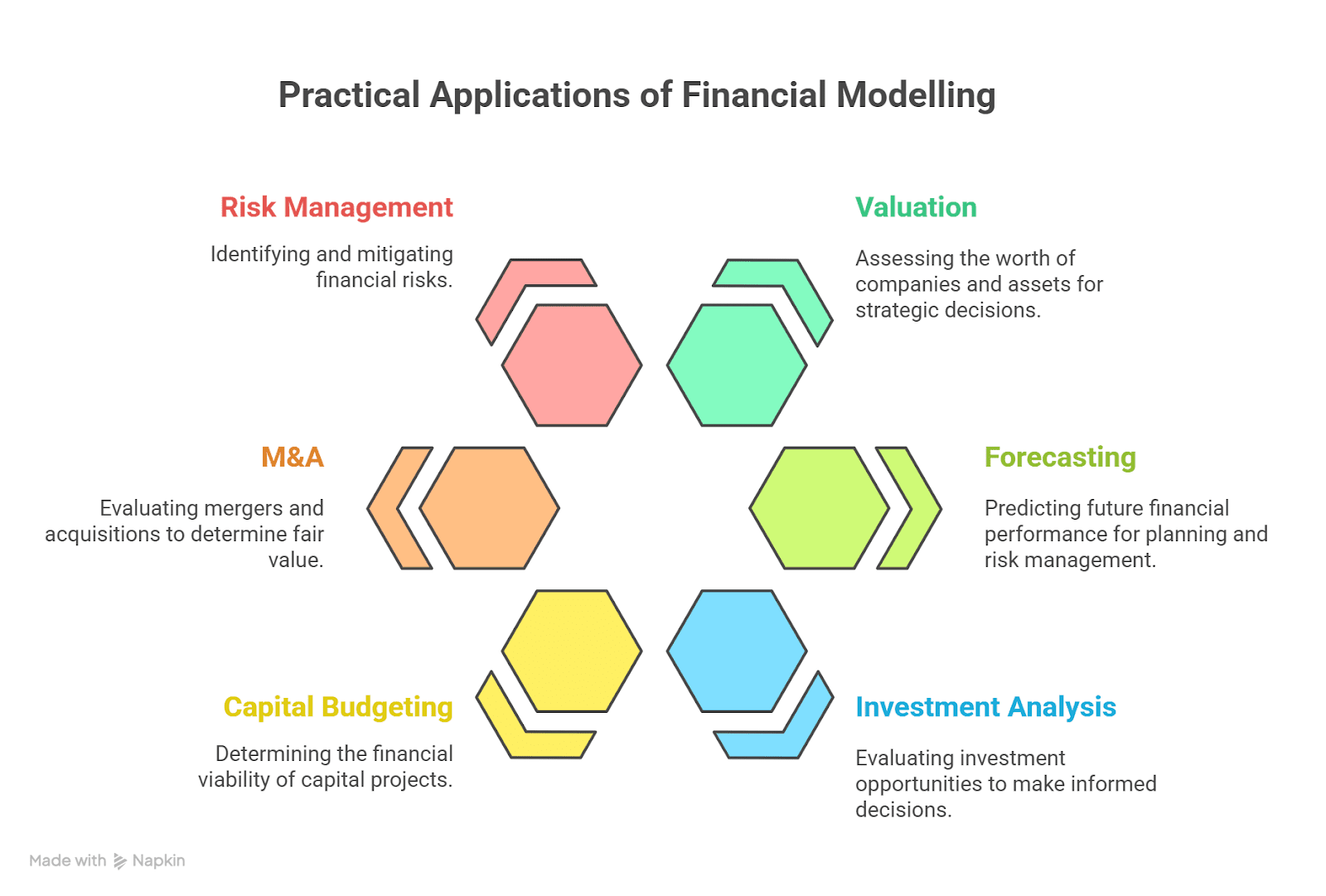

Where learning-to-learn fails, occasionally it just does. That is where a specialist investment banking certificate bridges the gap. It fills in the gap between classroom instruction of theoretical coursework and actual practice in investment banking. Passing certification prepares you for such basic topics as mergers and acquisitions, equity research, portfolio management, and risk analysis.

Step 3: Hone Investment Banking Analyst Skills

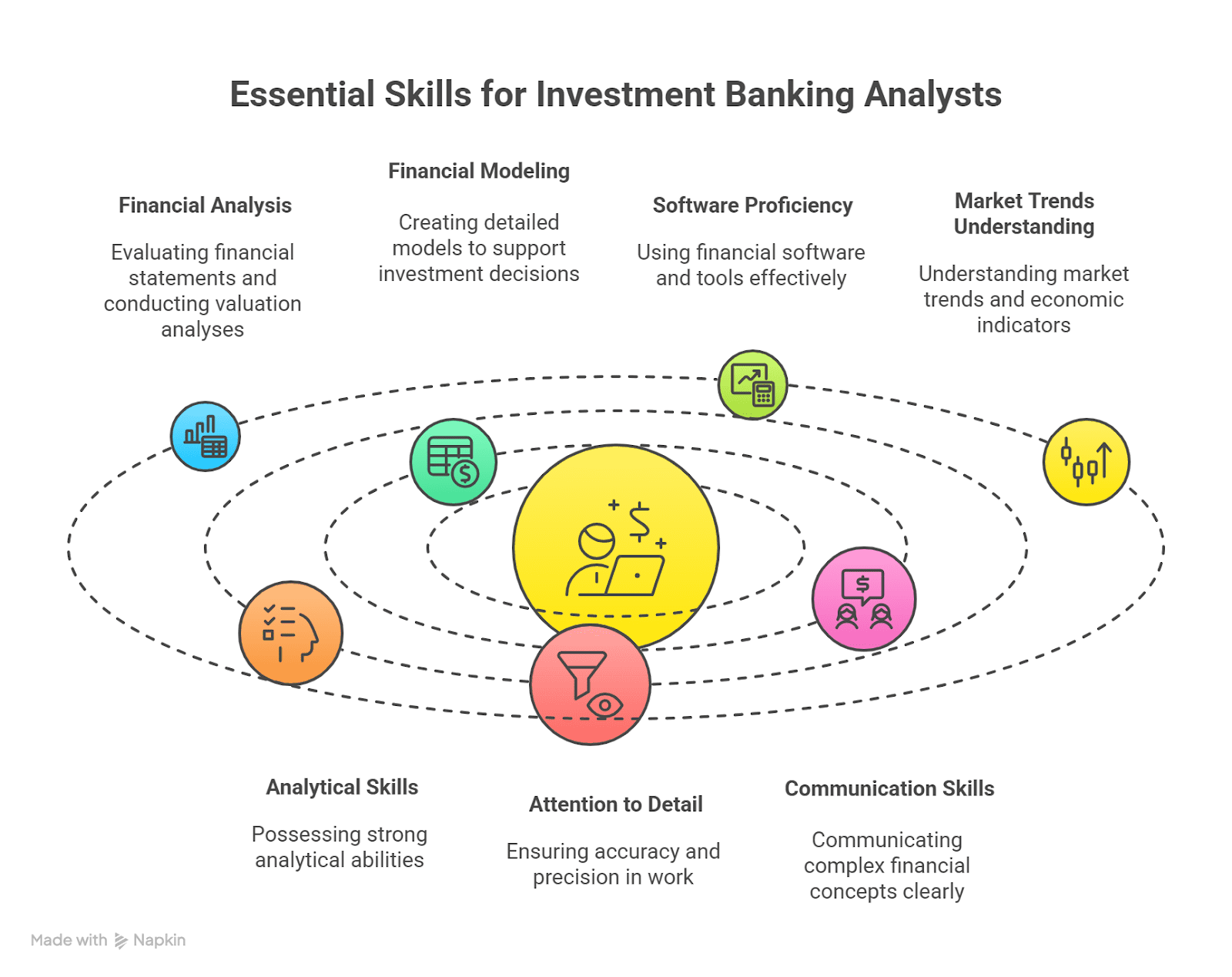

Use brains of finance, not thinking brains. Employers desire asking minds, thinking, communicating, technically producing, and not brains. Most valuable to learn as an investment banking analyst are the following:

- Financial modeling and valuation

- Excel and PowerPoint

- Knowledge of regulatory compliance

- Communication and relation with customers

These skills do not only provide jobs gates to open but will progress and be noticed.

Step 4: Secure Internships and Entry-Level Roles

Internships are alternatives to full-time career investment banking career substitutes. Internships are alternatives to actual work experience and lead to valuable contacts. Get the internship job from campus placement, alumni network, and electronic forum bulletin boards. Analyst positions, research associates, or client onboarding analysts are junior-level careers.

Step 5: Explore Global Finance Career Opportunities

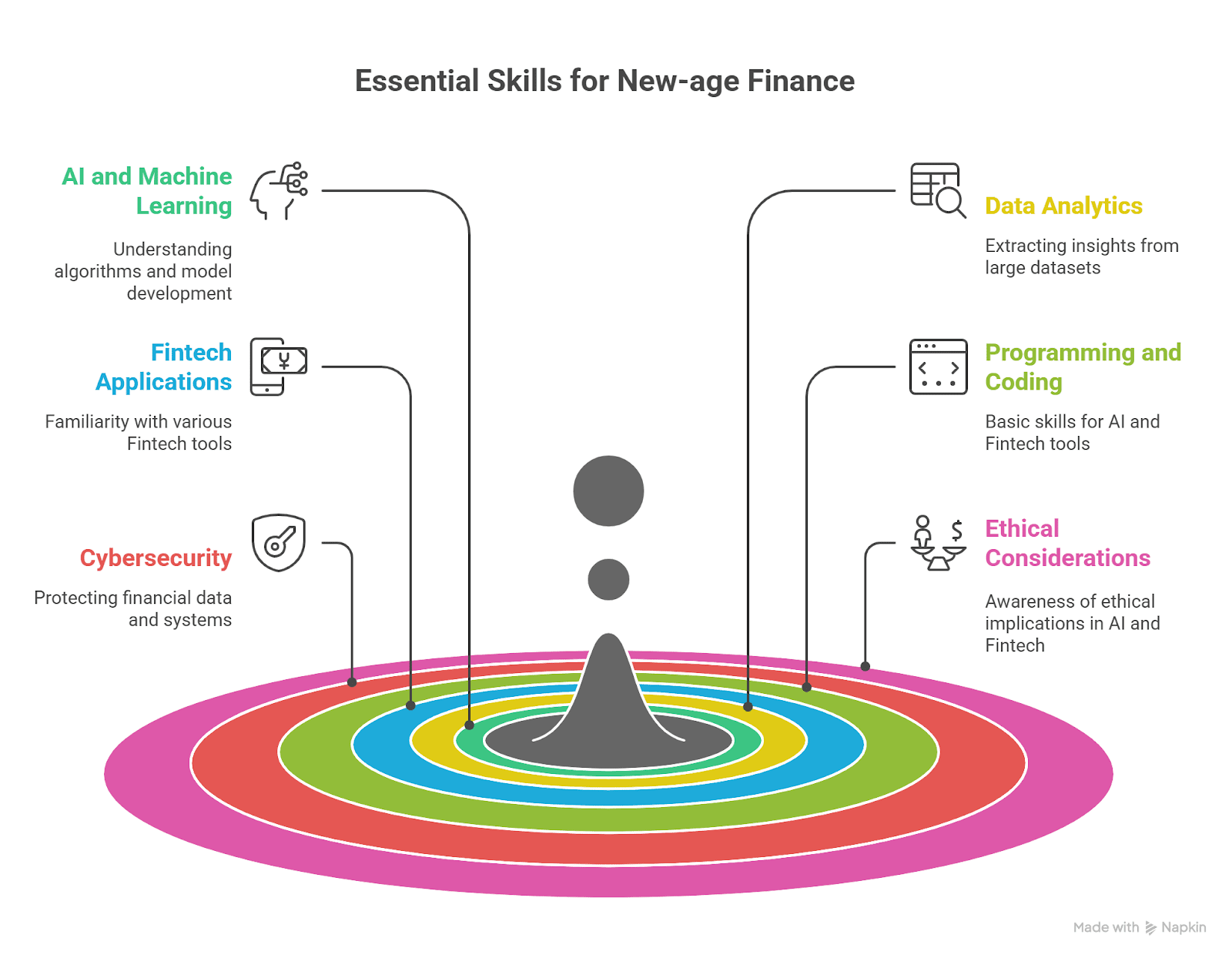

With intervals of CSSF and capital markets, the professionals are not location bound anymore. Gen-next bankers are capable of constructing international finance career by developing cross-border regimes of capability and cross-border regimes of sensitivity. Cross-border experience placements and trainings can even make your CV even more.

Step 6: Choose the Right Investment Banking Operations Course India

India is turning into the banking back and middle offices with extremely fast pace. If you undertake a specialist course in India investment bank operations, you are taught how to manage risk management, settlements, KYC, and client reporting-essential skill sets.

Step 7: Network Relentlessly

The phrase “your net worth is your network” never rings truer than it does in investment banking. Network at conferences, link up in LinkedIn groups, reach out to alumni, and network with industry workers. Sponsorship and information interviews can get their foot in the door that no resume ever could.

Step 8: Stay Updated and Keep Learning

Investment banking is a dynamic profession. Launches of new products, market trends, and new regulation continue to revolutionize the profession. Remaining current with industry magazines, webinars, and upgradation places you one step ahead.

Step 9: Nail the Interview Process

Interviewing for investment banking roles is a rigorous process. You’ll face technical rounds, case studies, behavioural interviews, and sometimes even role-play assessments. Preparation is key. Practise common questions, brush up on financial concepts, and be ready to demonstrate your passion for finance.

Why Certifications Matter: Your Ticket Into Investment Banking?

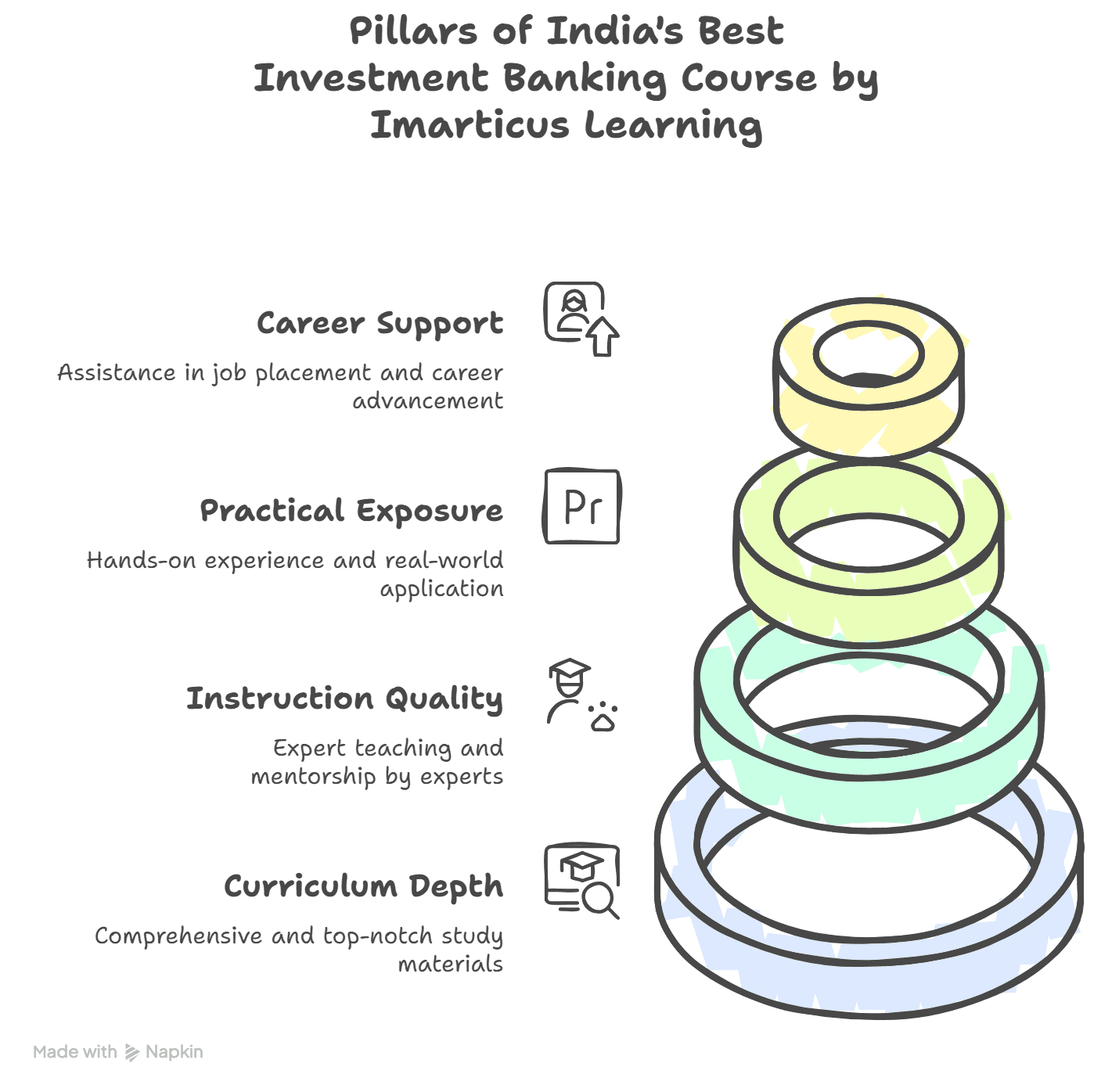

As investment banks increasingly rely on job-ready talent, certifications play a crucial role in career transformation. They bridge the gap between academic theory and practical application. The best programmes offer projects, real-world simulations, and mentorship from seasoned industry experts.

Recommended Path: Certified Investment Banking Operations Professional (CIBOP)

If you’re serious about making your mark in investment banking, the Certified Investment Banking Operations Professional (CIBOP) is your ultimate launchpad.

For finance, for experience between 0-3 years, the program provides

- 100% Job Guarantee

- 85% placement with maximum salary of 9 LPA

- Option to select program duration of 3 and 6 months

- Seven interview guaranties

- Average salary of 4 LPA

- 1000+ recruitment partner access

Winner of Best Education Provider in Finance for 30th Elets World Education Summit 2024, the certification already making its presence felt in professional life of 50,000+ with a delivery of over 1200 batches.

Programme Highlights

Scenario-based CIBOP course educates professionals with real challenges such as:

- Securities operations

- Asset and wealth management

- Risk management

- Anti-money laundering compliance

Money laundering detection, ethical banking practice, and trade-based laundering projects industry-specific to the students.

Career Outcomes

After completing the course, you could take on roles such as:

- Investment Banking Associate

- Wealth Management Associate

- Risk Management Consultant

- Collateral Management Analyst

- Trade Surveillance Analyst

- KYC Analyst

- Regulatory Reporting Analyst

Industry-Ready with a Project-First Approach

The programme ensures you’re not only job-ready but job-excellent. Additional support includes:

- Employer test clearing aptitude training

- Top-of-class profile building resumes

- Practice interviews and professional guidance

FAQs

1. How to get into investment banking after graduation?

Start with a finance qualification, internship and certification like CIBOP™ to close the gap in skills and be ready for a job.

2. Is an investment banking certification worth it?

Yes. It job-prepares you, industry-awareness you and neatly gets your career on track.

3. What are the top investment banking analyst skills employers seek?

The most in-demand skills are finance modeling, regulatory knowledge, communications, and attention to detail, in that order.

4. Can a non-finance graduate get into investment banking?

Yes, but prove your finance mettle by experience on your own projects and certification.

5. What are the best investment banking courses in India?

Imarticus Learning CIBOP is one of the best courses with career success, job guarantee, and industry recognition.

6. How long does it take to become an investment banker?

Generally, 1–3 years depending on your qualification, certification, and working condition.

7. What are global finance career opportunities in investment banking?

Career opportunities in regulatory affairs, career opportunities in risk compliance, career opportunities in international business, and career opportunities in asset management and career opportunities which are expansion high internationally.

Conclusion

The appropriate career stream of a successful investment banker is the appropriate one. From the appropriate subject to study about so that one feels to the appropriate quality certification, each and every thing matters. With such a thrilling and daunting a career as that of an investment banker, better preparation, diligent work, and professionalism is the key to success.

Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP™) is standing in your way. With serious learning, professional development, and professional certification, it is your passport to success in the boardroom and in the classroom. Launch your finance career into orbit today.

Start the journey today-and see your dreams materialise.