The finance industry is on the brink of a significant transformation. By 2030, one in three traditional finance jobs is expected to decline. This shift is driven by automation and technological advancements.

Automation is reshaping the landscape of finance jobs. AI and machine learning are at the forefront of this change. They are streamlining processes and increasing efficiency.

Finance career trends are evolving rapidly. The demand for advanced analytical and technological skills is rising. Professionals must adapt to these changes to remain competitive.

Job market changes are inevitable. Digital transformation is altering the skills required in the financial sector. New opportunities are emerging for those who are prepared.

The CIBOP course is a valuable resource. It equips professionals with the skills needed for future finance jobs. Staying relevant in this evolving landscape is crucial.

Traditional finance jobs decline due to the need for cost efficiency. Automation offers improved accuracy in financial operations. This trend is reshaping the industry.

Financial sector jobs are not disappearing entirely. They are evolving to meet new demands. Data analysis, cybersecurity, and fintech expertise are increasingly important.

The skills required for future finance jobs are evolving. Proficiency in data analytics and programming is essential. Understanding blockchain technology is also becoming crucial.

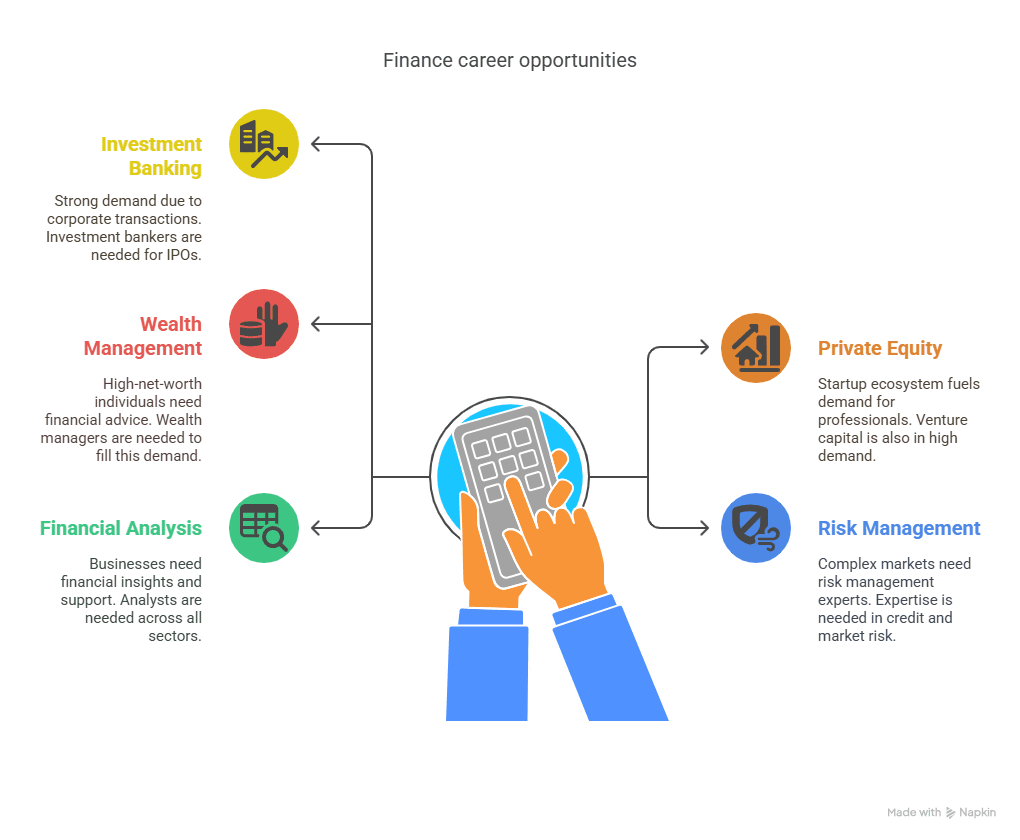

Investment banking careers are evolving to meet the demands of the digital age. Digital tools and client-centric services are now a focus. Professionals must embrace these changes.

Imarticus’ Investment Banking Course provides practical knowledge and helps professionals adapt to the changing job market. It emphasises real-world applications and industry insights.

The future of finance jobs will blend human expertise with automation. Upskilling and continuous learning are vital. Staying competitive requires a proactive approach.

The decline in traditional finance jobs is not uniform. Some sectors may grow due to technological integration. Understanding these trends is key to career success.

Professionals must acquire new skills to navigate this landscape. The CIBOP course bridges the gap between current skills and future demands. Embracing change is essential for a resilient finance career.

The Looming Decline: Why 1 in 3 Traditional Finance Jobs Will Disappear by 2030

The finance industry is no stranger to change. Yet, the next decade promises unprecedented shifts. By 2030, a significant decline in traditional finance jobs is predicted.

Automation is a key driver behind this transformation. Technology is advancing at a rapid pace. It’s creating efficiency but also leading to job losses.

Artificial intelligence and machine learning are revolutionising financial tasks. These technologies perform tasks more quickly and accurately than humans. This efficiency threatens traditional finance roles.

Cost efficiency is another major factor. Companies are constantly seeking ways to reduce expenses. Automation and digital solutions offer substantial savings.

Manual processes are becoming obsolete. Tasks that once needed human input are now automated. This shift has widespread implications for traditional finance positions.

Industries worldwide are embracing digital transformation. Businesses are investing in technology to stay competitive. Finance is not immune to this trend.

The shift to digital affects jobs across the board. Routine roles are especially vulnerable. Workers in these positions must adapt quickly.

The job market is evolving in response to these changes. New roles are emerging to meet the demand for digital skills. However, traditional roles face decline.

A skills gap is widening as technology continues to advance. Professionals must bridge this gap to remain employable. Training and education are crucial.

Understanding the reasons behind this decline is essential. It helps professionals anticipate and respond to changes. Preparation is key to navigating this evolving landscape.

The list of roles affected includes:

- Bank tellers

- Data entry clerks

- Insurance underwriters

- Financial advisors in traditional settings

The future may seem daunting, but opportunities abound. Those willing to upskill can tap into new roles. Embracing technological literacy is a step towards security.

Industries are redefining what value means in the workforce. Human skills, such as problem-solving and creativity, are gaining importance. Despite automation, there’s a place for human expertise.

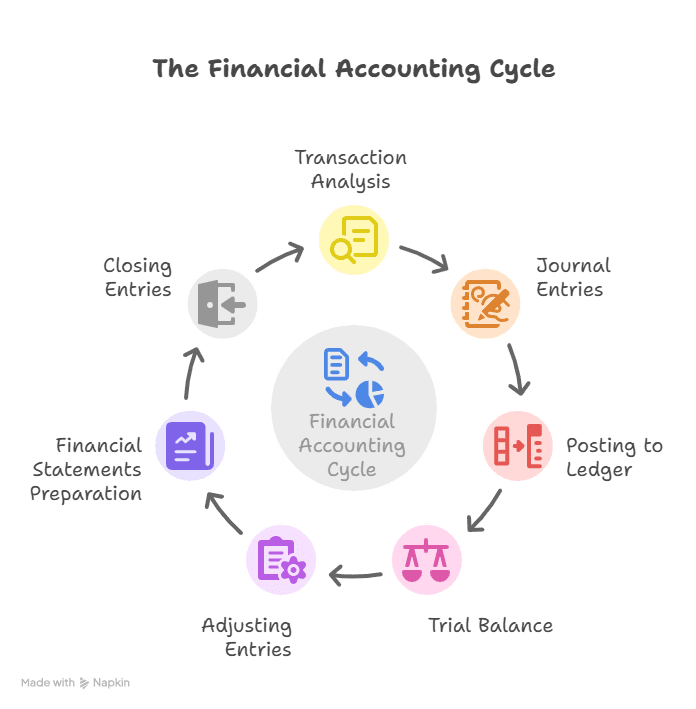

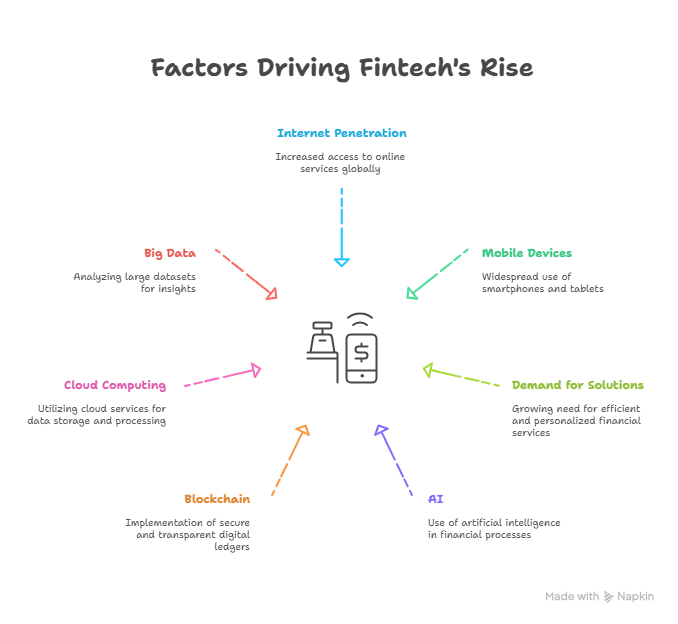

The Forces Driving Change: Automation, AI, and Digital Transformation in Finance

The finance world is on the brink of a revolution. Automation is at the heart of this change. It reshapes how businesses operate.

Artificial intelligence isn’t just a buzzword. It’s transforming financial services. AI systems manage tasks previously handled by people.

This includes data analysis and predictive modelling. AI does these quickly and accurately. Human error is minimised.

Predictive analytics enhances decision-making. Firms leverage significant data insights. This boosts accuracy and efficiency in operations.

The rise of chatbots is significant. They streamline customer interactions. Chatbots handle queries 24/7, offering swift assistance.

Robotic Process Automation (RPA) is another game changer. It automates mundane tasks. Employees can focus on more complex duties.

RPA mimics human actions. It processes transactions, manages data, and responds to queries. The finance industry benefits from this reduction in manual labour.

Blockchain technology is also pivotal. It ensures secure, transparent transactions. Finance is reaping these benefits across various domains.

Blockchain cuts out intermediaries. Transactions become more efficient. This changes the banking and investment landscapes.

Digital transformation integrates these technologies seamlessly. The shift is not just technological. It’s a fundamental business evolution.

Firms must rethink their core processes. Traditional methods evolve. Businesses adopt agile practices for success.

The impact of these changes extends beyond the realm of technology. Financial institutions now prioritise agility. Flexibility becomes a strategic asset.

This transformation requires a skilled workforce. New roles demand technical expertise. Employers seek digital proficiency in their teams.

The evolving landscape rewards adaptability. Professionals must stay updated. Continuous learning becomes a necessity.

Traditional finance roles may decline. However, innovation creates new opportunities. The future favours those who embrace change.

Key technologies driving change:

- AI and machine learning

- Robotic Process Automation (RPA)

- Blockchain technology

- Predictive analytics

- Chatbots and virtual assistants

Understanding these elements is crucial. Future finance jobs will revolve around tech. Professionals need to master new tools.

Organisations must support their workforce. Training programs are essential. Upskilling ensures competitiveness in this evolving field.

Adapting to digital transformation is a journey. It’s ongoing and requires commitment. The finance sector is at the forefront in this digital age.

The role of finance professionals is expanding. Their impact grows with new technologies. They must harness these tools for progress.

Finance Career Trends: What the Data Says About the Future of Finance Jobs

The financial job market is undergoing rapid transformation. Insights and data reveal fascinating trends. Professionals need to understand these shifts.

Job landscape data highlights critical changes. Automation and digital tools redefine the workplace. Roles are evolving to meet new demands.

Finance jobs are becoming more tech-driven. Data analysis and digital literacy are crucial. These skills are now highly sought after.

The demand for data scientists is surging. They play a pivotal role. Companies rely on them to interpret vast datasets.

Financial technology, or fintech, is disrupting traditional roles and responsibilities. It’s creating new career opportunities. Professionals must navigate this innovation landscape.

Financial planners face changing expectations. Clients demand personalised, tech-enhanced services. This necessitates staying current with the latest tools.

Investment roles are also shifting. It’s no longer only about numbers. Strategy and technology integration are now key areas of focus.

Sustainability in finance is gaining traction. Environmental, social, and governance (ESG) factors are more important. Professionals must adapt to this trend.

Remote work is another significant trend. It offers flexibility but requires digital skills. The ability to work effectively remotely is a must.

Emerging finance career trends:

- Increased demand for data scientists

- Growth of fintech roles

- Focus on ESG factors

- Rise of remote work opportunities

- Need for personalised financial planning services

Understanding these trends is vital. They impact career choices and development. Finance professionals must adopt a proactive approach.

Continuous learning remains essential. Updating skills aligns professionals with market needs. Lifelong education is crucial in this rapidly evolving field.

Networking is more important than ever. It’s vital to stay connected with industry updates. Building a broad network can open up career opportunities.

Professionals should attend industry seminars. They provide insights into emerging trends. This knowledge is invaluable for career planning.

The financial sector will continue to evolve. Adapting to these changes is necessary. Those who do will thrive in the future landscape.

The Impact on Financial Sector Jobs: Winners, Losers, and New Opportunities

The financial sector is undergoing significant transformations, leading to a reevaluation of traditional roles and responsibilities. Some positions face declines while others thrive amidst change.

Finance jobs are adapting to technological advances. Automation is streamlining processes, affecting numerous traditional roles. Routine tasks are now primarily software-driven.

This shift offers both challenges and possibilities. Job roles focusing solely on manual tasks are shrinking. Adaptable positions that integrate technology are flourishing.

The reliance on technology creates demand for tech-savvy professionals. Data analysts and cybersecurity experts are essential. They ensure data security and interpret complex datasets.

Financial advisory roles are also evolving. Advisors must integrate digital tools to enhance client experiences. Providing personalised advice is now more crucial than ever.

Investment management is increasingly reliant on AI. Predictive analytics are guiding investment strategies. Roles incorporating these techniques are expanding.

Winners in this transformation include:

- Data analysts

- Cybersecurity specialists

- Fintech innovators

- Investment strategists with AI expertise

Losers in this shift face obsolescence. Roles that are repetitive and don’t evolve with technology will decline. Job transformation is essential for survival.

Emerging roles offer exciting prospects. Professionals need to identify and adapt to these areas. Those embracing change will find rewarding opportunities.

Education and upskilling are pivotal. Attaining new skills ensures career resilience in this dynamic sector. Courses focusing on technology and finance are increasingly valuable.

Networking and mentorship provide added advantages. They give insights into market shifts and new opportunities. Staying informed is critical in navigating changes.

The future of financial sector jobs holds promise. Innovation is driving significant transformations. Individuals embracing these changes will successfully navigate the future landscape.

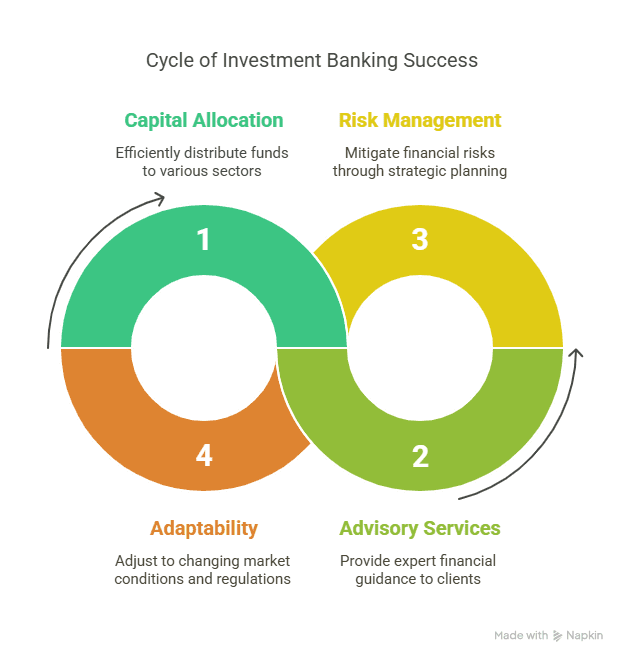

The Evolution of Investment Banking Careers in the Digital Age

Investment banking is undergoing a radical transformation, driven by digital advances. Traditional workflows are being disrupted by technology and client demands.

The role of investment bankers is evolving to meet these new challenges. They must now merge expertise with digital tools. Advanced software and analytics are paramount.

Client expectations are shifting significantly. The demand for real-time insights and efficiency is high. Banks are exploring new methods to meet these needs swiftly.

Digital platforms are transforming the way bankers interact with clients. Online interfaces simplify complex transactions. This evolution streamlines services and enhances client satisfaction.

Emerging trends emphasise the importance of adaptability. Investment bankers must fully embrace these changes. Skills in digital and financial technologies are critical.

Key trends in investment banking careers include:

- Increasing use of AI for predictive analytics

- Adoption of blockchain for secure transactions

- Integration of digital tools for client interaction

- Emphasis on strategic and analytical skills

The competitive landscape is intensifying. Banks seek professionals adept in both finance and technology. This dual skill set is increasingly crucial for success.

Technological proficiency is now a baseline requirement. New hires must understand and use digital platforms effectively. Those with advanced tech skills often rise quickly.

Continuous learning is essential to stay relevant. The pace of change demands ongoing education. Professional growth hinges on staying ahead of industry trends.

Networking offers additional benefits. Engaging with peers can provide fresh insights and opportunities. Staying connected helps professionals adapt to industry shifts.

The digital age opens doors to expansive opportunities in investment banking. Embracing new tools and practices ensures career longevity. As the industry advances, those who adapt will find themselves thriving.

Skills for Future Finance Jobs: What Employers Will Demand in 2030

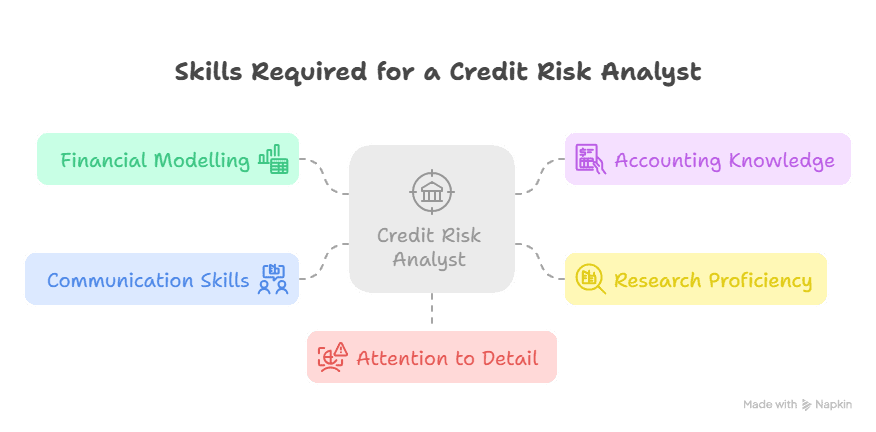

As the finance industry transforms, the skills required are also evolving. Employers seek candidates with both technical and soft skills. The right blend of these skills is crucial for future finance roles.

Understanding data is increasingly vital. Proficiency in data analytics can set candidates apart from others. Analysing large datasets helps derive actionable insights and drive decisions.

Programming skills are no longer just for tech jobs. Knowledge of programming languages such as Python and R is essential. These skills help automate tasks and optimise operations.

Here are some key technical skills in demand:

- Data analysis and interpretation

- Programming in languages like Python, SQL, and R

- Blockchain technology comprehension

- Understanding AI and machine learning frameworks

Cybersecurity remains a critical area. Protecting financial data is paramount in digital transactions. Knowledge of security protocols is therefore essential.

Employers also value adaptability. The ability to learn new tools quickly benefits individuals and organisations. Adapting to market changes is crucial for staying competitive.

Soft skills cannot be overlooked. Communication, teamwork, and problem-solving are highly valued. These skills facilitate better workplace relationships and leadership.

Necessary soft skills include:

- Effective communication

- Critical thinking and problem-solving

- Team collaboration

- Adaptability and continuous learning

Financial roles increasingly demand strategic thinking. Employees who understand the larger business implications stand out. Their insights can guide long-term planning and performance.

Customer-centric approaches are reshaping finance roles. Understanding client needs enhances service delivery. Building strong client relationships is beneficial for sustained growth.

Employers are seeking professionals who take the initiative. Proactiveness in proposing solutions and implementing changes is sought after. This mindset drives innovation and improves practices.

Being technologically adept is no longer optional; it is essential. As technology continues to accelerate, it will redefine future finance roles. Staying updated with the latest tools is crucial to success.

The Human Edge: Soft Skills and Adaptability in a Tech-Driven Finance World

In a world increasingly dominated by technology, the human touch remains invaluable. As automation reshapes the finance industry, soft skills have become increasingly significant. These skills drive effective collaboration and problem-solving, areas where machines fall short.

Effective communication is a cornerstone of success. Clear communication ensures ideas are understood, fostering teamwork. It also enhances client interactions, a crucial aspect in the finance industry.

Empathy plays a vital role in understanding client needs. Financial advisors who connect emotionally with clients deliver tailored services. This skill builds trust and long-term relationships.

Critical thinking is essential in the finance sector. Analytical skills are necessary for making informed decisions. Critical thinkers can identify and effectively solve complex problems.

Adaptability is crucial in the face of constant change. The finance sector evolves rapidly, and adapting quickly is essential for survival. This skill allows professionals to embrace new technologies and methods.

Here’s a list of key soft skills that matter:

- Clear and effective communication

- Emotional intelligence and empathy

- Critical thinking and analytical skills

- Adaptability and flexibility

Leadership qualities are becoming increasingly important. Finance professionals who can lead teams drive innovation. Effective leaders inspire and motivate others to achieve common goals.

Resilience cannot be overlooked. Navigating financial uncertainties demands a resilient mindset. Resilient individuals are better equipped to handle setbacks and challenges.

Creativity is essential for innovation. Novel solutions to problems can set companies apart. Finance professionals who think creatively can uncover new opportunities.

As technology advances, the need for a personal touch becomes increasingly important. Machines may crunch numbers, but humans provide context and nuance. The ability to connect and inspire remains a uniquely human trait.

In this tech-driven era, striking a balance between technology and human insight is crucial. Excelling in this balance ensures relevance and success. As the finance industry morphs, humans still hold a critical edge.

How to Stay Relevant: Upskilling, Lifelong Learning, and Career Adaptation

The finance industry is undergoing rapid transformation. To stay relevant, continuous learning is essential. Constant change demands a proactive approach to skill development.

Upskilling is not a one-time affair. It’s an ongoing process. Professionals must continually update and refine their skills.

Lifelong learning keeps finance professionals ahead of the curve. It involves embracing new ideas and methodologies. Being open to learning ensures you’re always in demand.

Career adaptation requires flexibility and a growth mindset. As industries evolve, so do job roles. Being adaptable means you’re ready for any shift.

Engaging in courses and seminars can expand your skill set. Formal education is critical, but informal learning is equally important. Learning from peers and mentors adds real-world insights.

Here’s a list of actions for staying relevant:

- Enrol in online courses and certifications

- Attend industry conferences and workshops

- Network with professionals and join finance forums

Embrace technology to enhance your learning. Online platforms offer a wealth of courses. These resources can help bridge skills gaps efficiently.

Adapting to new roles may require stepping out of comfort zones. This courage leads to new opportunities and personal growth. Challenge yourself by taking on unfamiliar projects.

Employers value employees who are eager to learn and grow. Showing initiative demonstrates commitment. This attitude can lead to career advancement.

In this ever-changing landscape, readiness to evolve is paramount. Seizing opportunities for growth keeps you at the forefront of innovation. Lifelong learning and adaptation are essential for a sustainable career.

By investing in your skills and embracing change, you’ll remain vital in the future of finance. Stay curious, stay motivated, and your career will surely thrive.

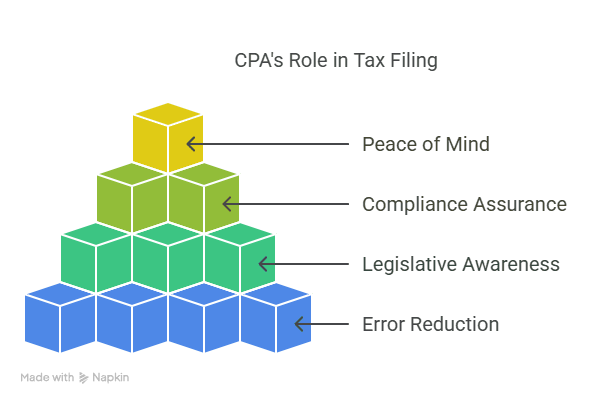

Imarticus’ Investment Banking Course: Bridging the Finance Skills Gap

The finance industry is evolving fast, and it demands updated, job-ready skills. Imarticus’ Investment Banking Course is designed to bridge this growing gap by equipping learners with the practical knowledge and tools needed to thrive in today’s financial landscape.

Certified Investment Banking Operations Professional offers specialised training. It covers essential skills for investment banking operations. This course is a gateway to future finance job readiness.

Imarticus’ course focuses on practical applications and equips students with industry-relevant skills. Real-world exposure is a core component of the training.

Both programs address the current demands of the finance industry. They emphasise technological proficiency. Embracing digital tools is vital for modern finance roles.

The curriculum of these courses is comprehensive. It includes the following areas:

- Financial Markets and Instruments

- Risk Management and Compliance

- Strategic Analysis and Problem Solving

These subjects are critical for a successful finance career. They ensure that professionals are well-equipped for industry challenges. Participants gain insights that go beyond theoretical knowledge.

The courses also offer immersive experiences. They provide simulations of real-world financial scenarios. These exercises hone decision-making skills, preparing candidates for complex roles.

Networking is another key benefit. The programs connect you with industry leaders. Building such networks is beneficial for long-term career growth.

Here are additional skills fostered by the courses:

- Advanced Data Analysis Techniques

- Understanding and Implementing FinTech Innovations

Achieving proficiency in these areas is crucial. It enhances employability and job security. This is particularly important in an industry impacted by automation.

Success in finance today requires a blend of skills. Technical expertise combined with practical application is necessary. These courses are designed to provide that blend effectively.

In essence, Imarticus’ Investment Banking Course offers a pathway to adapt and thrive. It empowers professionals to meet the dynamic demands of finance jobs in 2030 and beyond. By bridging the skills gap, you are prepared to seize new opportunities in the ever-evolving financial landscape.

Real-World Success Stories: Professionals Who Future-Proofed Their Finance Careers

Real-world stories inspire change. Let’s explore how finance professionals navigated the evolving landscape. These individuals faced the challenge of the decline of traditional finance jobs head-on.

Take Reena, for instance. She worked in a traditional banking role for years. As she saw automation take over, she embraced new skills. Reena enrolled in the CIBOP course. The specialised training enhanced her capabilities. Now, she excels in a dynamic fintech position.

Ramesh offers another success story. Initially sceptical of change, he was comfortable in his investment banking career. However, witnessing changes in the job market prompted him to adapt. Ramesh pursued the Imarticus Investment Banking Course. This decision revitalised his career path.

Both professionals benefited from upskilling. They understood the importance of finance jobs automation and acted accordingly. Embracing digital transformation, they positioned themselves for future opportunities.

These stories highlight a common theme: adaptation. In the face of finance career trends, adaptability emerges as a key differentiator. Professionals who embraced change now lead in their fields.

The courses offered invaluable insights and practical knowledge. They prepared candidates to tackle new challenges with confidence. Success demanded more than just technical skills. Networking and mentorship played significant roles.

Reena and Ramesh each leveraged industry connections. These networks provided guidance and opened doors to new ventures. Continuous learning and networking fostered these success stories.

Such narratives remind us that the future of finance jobs is promising for those who proactively prepare for them. By learning and adapting, these professionals secured their careers in an uncertain future. They serve as motivation for all finance professionals to take strategic action today.

Action Plan: Steps to Future-Proof Your Finance Career Today

Creating a future-proof finance career requires strategic planning and foresight. Begin by evaluating your current skills and understanding market trends. A proactive approach can help you stand out.

First, identify the skill gaps that need to be bridged. Consider skills like data analytics, AI, and programming. A personal skills audit is a valuable first step.

Skills to Acquire:

- Technical Skills: Data analytics

- Soft Skills: Communication, adaptability, problem-solving.

Next, embrace continuous learning. Courses like CIBOP can enhance your expertise. They ensure you stay relevant in an evolving job market.

Networking also plays a crucial role. Attend industry events and seminars. Engaging with peers can provide fresh perspectives and opportunities.

Actions to Take:

- Enrol in Relevant Courses: Prioritise those offering practical skills.

- Expand Your Professional Network: Engage with Industry Leaders.

Furthermore, seek mentorship. Guidance from experienced professionals can be invaluable. A mentor can provide insights and advice tailored to your unique goals.

Regularly review industry reports and trends. Being informed helps anticipate changes. Stay updated on finance career trends to adapt promptly.

Taking these steps can help safeguard your financial future. By being proactive, you not only remain competitive but also open doors to new opportunities. Embrace change as an ally. Your preparation today will ensure you thrive tomorrow.

Conclusion: Embracing Change and Building a Resilient Finance Career

The financial job market is undergoing rapid transformation. Embracing these changes is not only wise but also essential. By understanding the forces at play, you can strategically navigate your career path.

Automation and digital transformation are redefining the roles of finance professionals. While this creates challenges, it also presents new opportunities. Forward-thinking professionals capitalise on these shifts and prepare for a dynamic future.

Continuous learning and upskilling are your best allies. Engaging in courses like CIBOP ensures that your skills remain sharp and relevant. With the proper knowledge, you can turn potential threats into opportunities.

Ultimately, resilience in your finance career depends on adaptability. By embracing new technologies and methodologies, you’re not only surviving but thriving. The future belongs to those ready to learn, grow, and innovate.