The fast-paced universe of mergers and acquisitions, international equity, and capital markets demands specialists with scalpel-sharp analytical ability and adequate knowledge of the financial universe. With India emerging as a global financial player, selecting the best investment banking course in India is no longer a perk—it’s a necessary tool for anyone who wants to play the high-stakes game of investment banking.

Why Choosing the Best Investment Banking Course in India Matters?

Investment banking is a ruthless business where talent, expertise, and reputation seal your fate. As investment banks remain a key participant in M&A transactions, raising equity, IPOs, and cross-border transactions, trained professionals from the top investment banking course in India have an excellent chance of success.

Whether your career goals are to be working with global financial behemoths or modest investment houses, the appropriate qualification opens doors, hones your analytical powers, and places you head and shoulders above others in the finance job market.

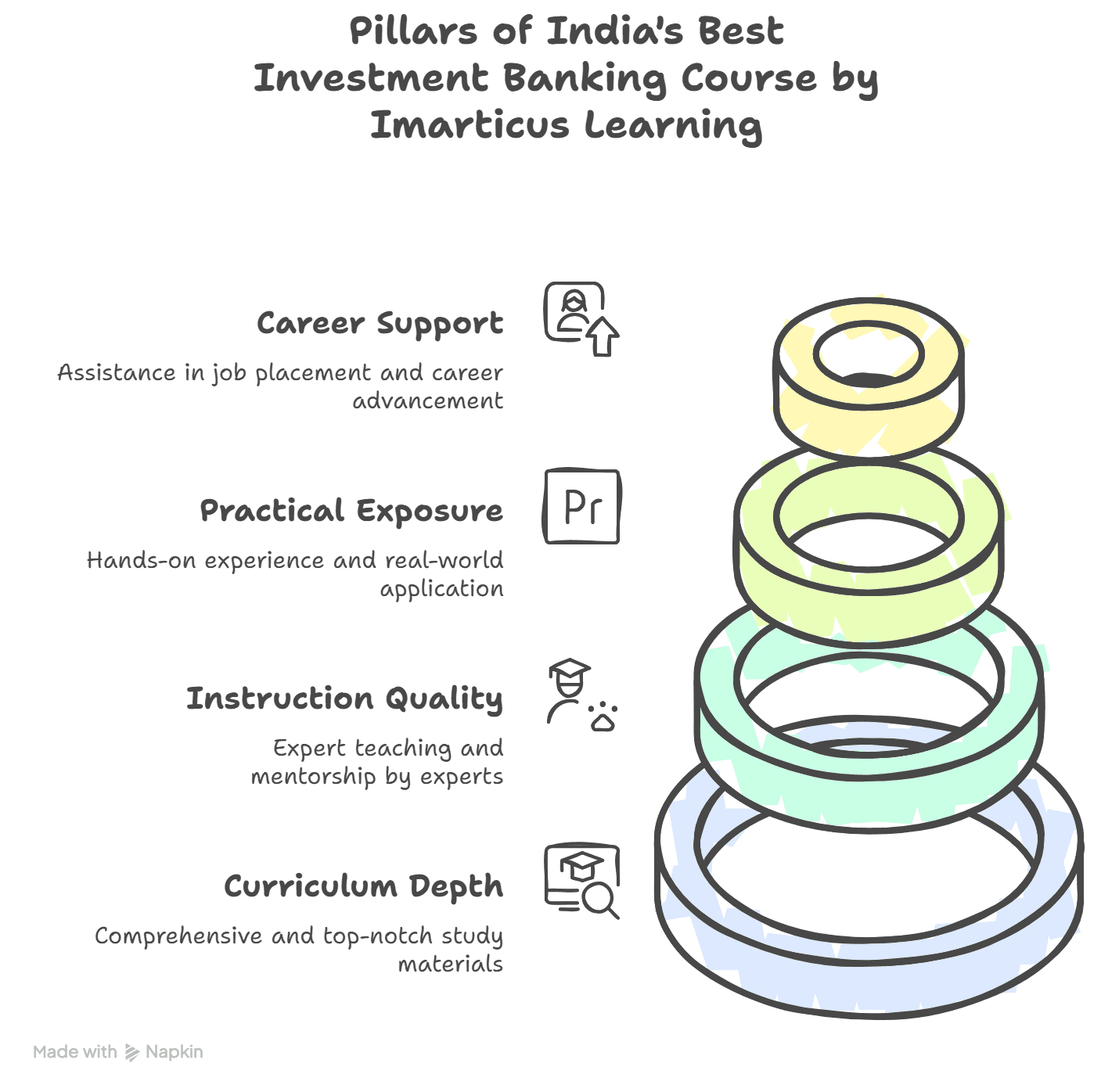

Features of a Top Investment Banking Course

In evaluating the best-ranked investment banking course in India, it is worthwhile to look at a number of distinguishing features that define quality programs:

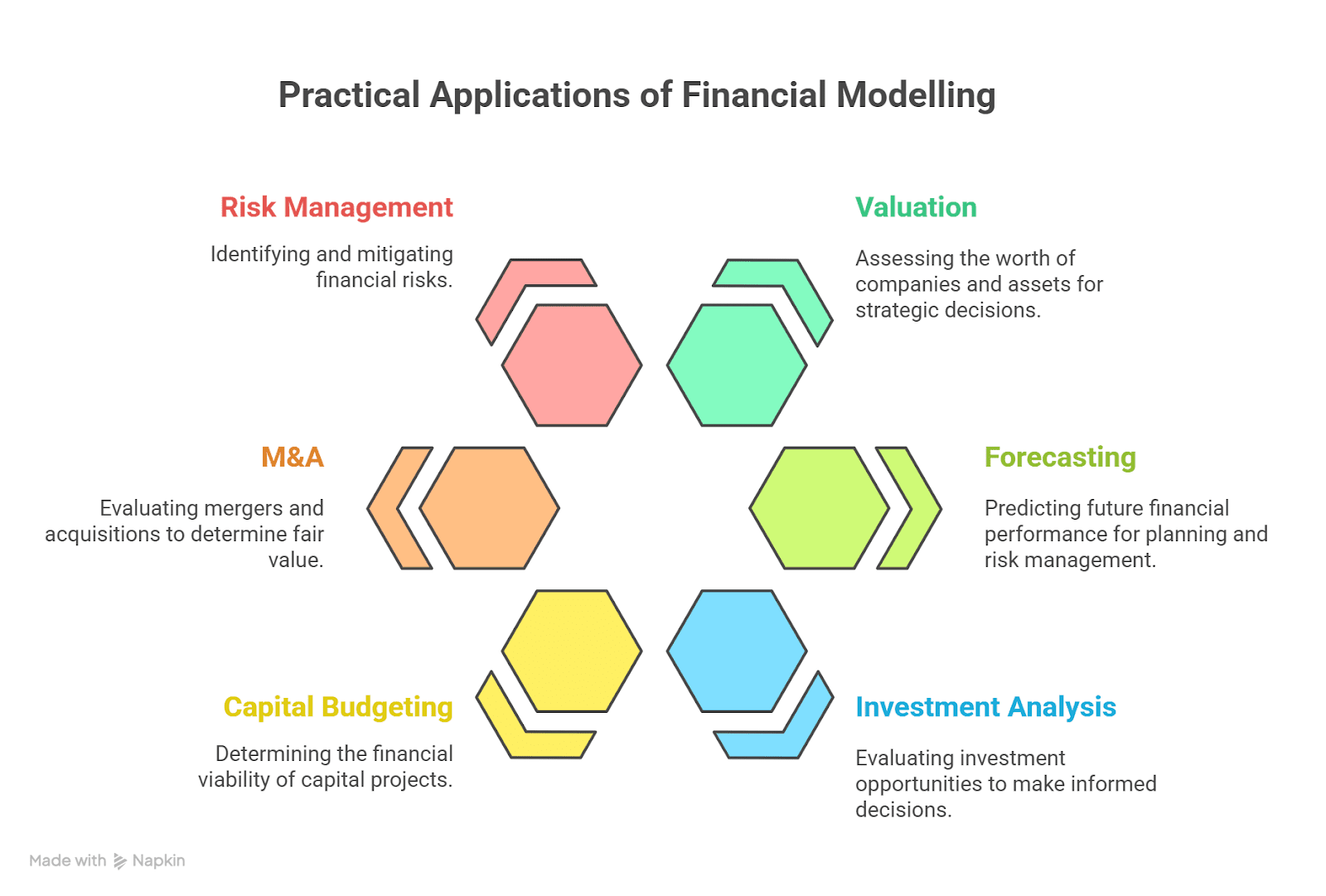

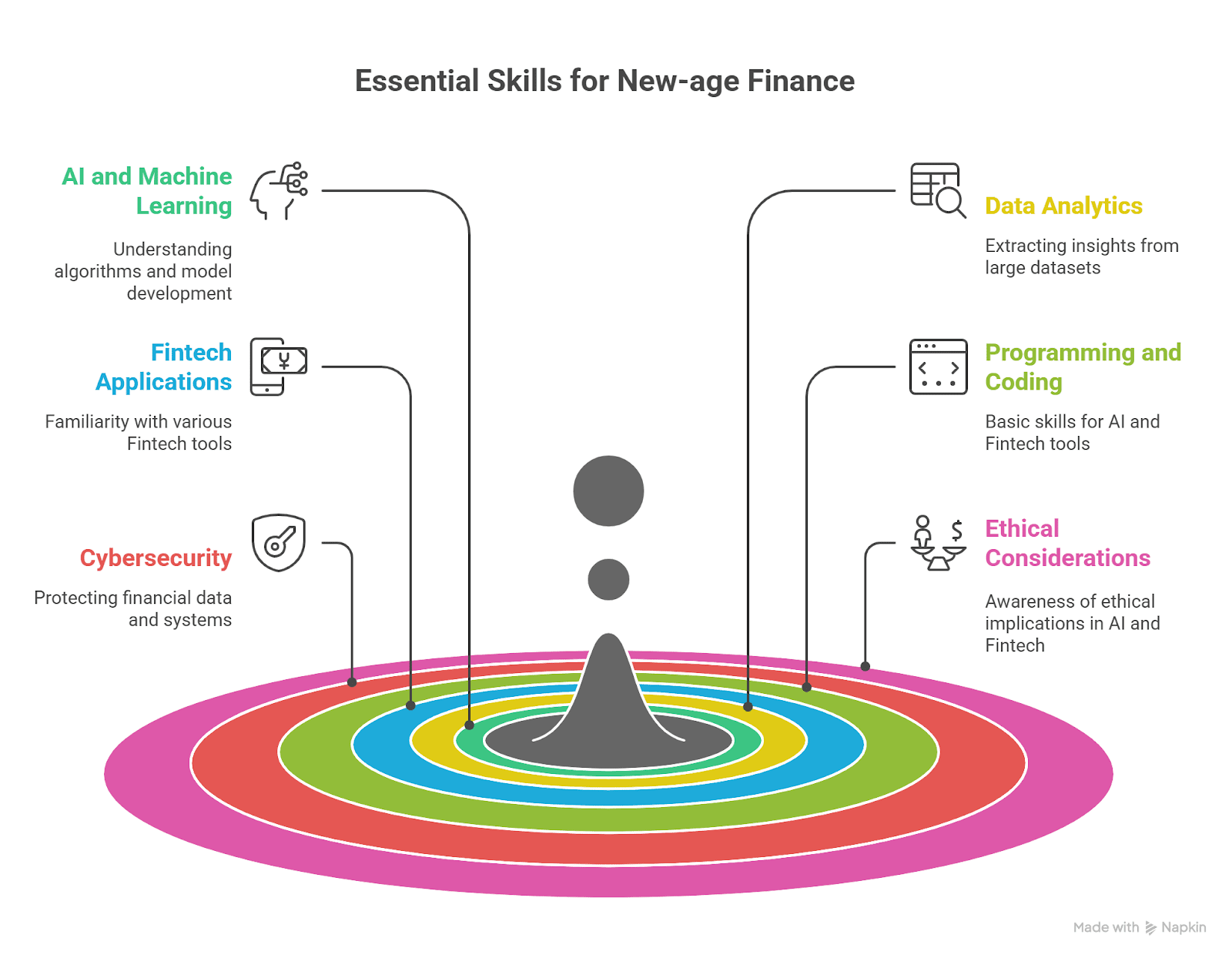

- Depth and Breadth of Curriculum: A diverse course must include comprehensive coverage of the significant investment banking activities like M&A analysis, DCF modeling, risk analysis, regulatory frameworks, and securities valuation.

- Training from Expert Practitioners: Practitioner-conducted courses can provide access to unparalled industry know-how to students.

- Project-Based: Live projects and experiential simulations replicating industry environments allow students to implement ideas into real-world environments.

- Placement Support: Courses providing interview assurance opportunities and strong placement support are good options.

What to Expect from the Best Investment Banking Course in India?

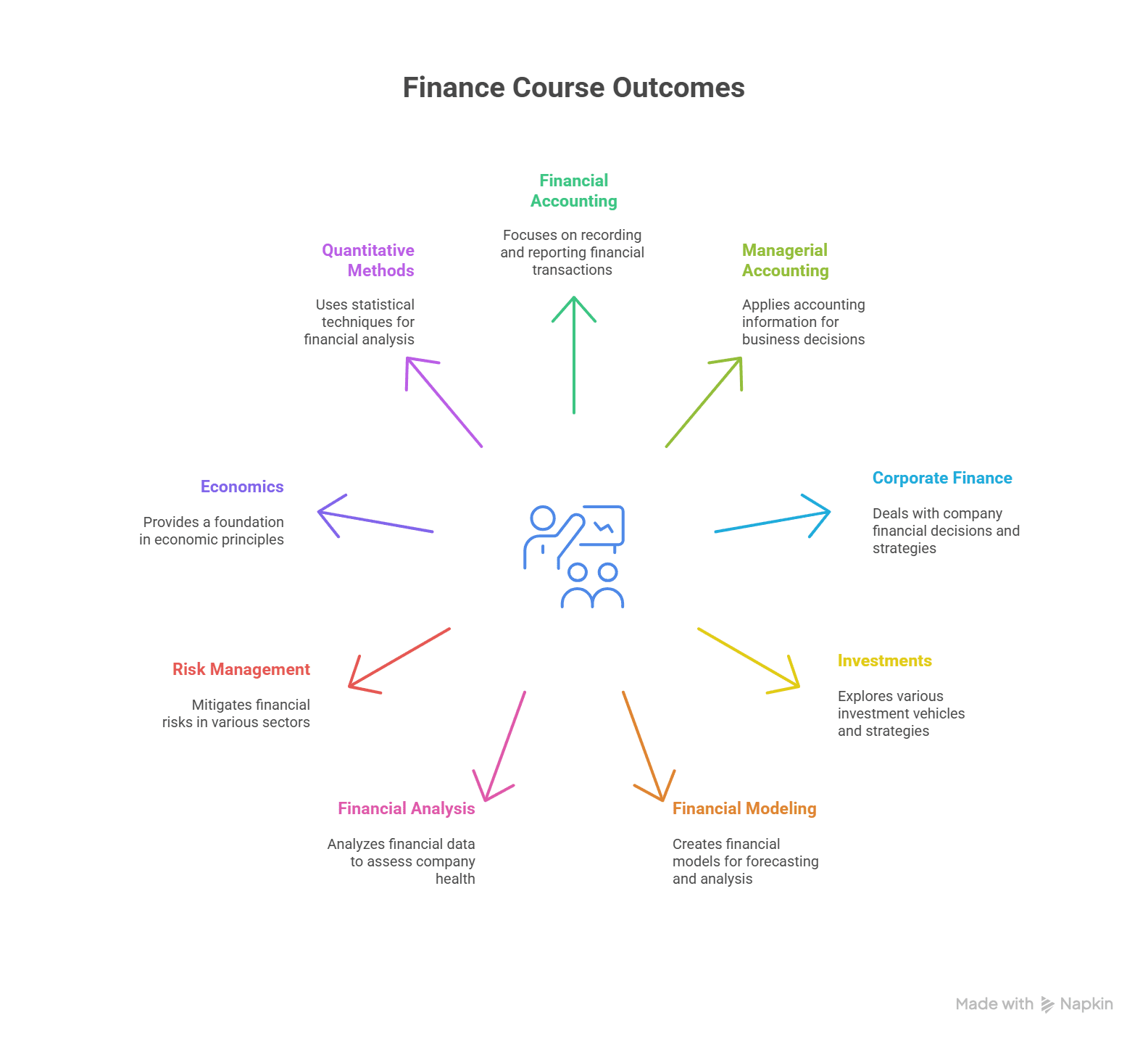

A high-impact investment banking course must teach something beyond just theoretical concepts. It must include:

- Live examples of international capital markets through case studies

- Equity and debt financing modules

- Excel training and financial modeling for finance professionals

- Exposure to regulatory compliance and anti-money laundering measures

These modules provide a solid grounding, teaching students hard as well as soft skills needed in order to excel in sophisticated financial situations.

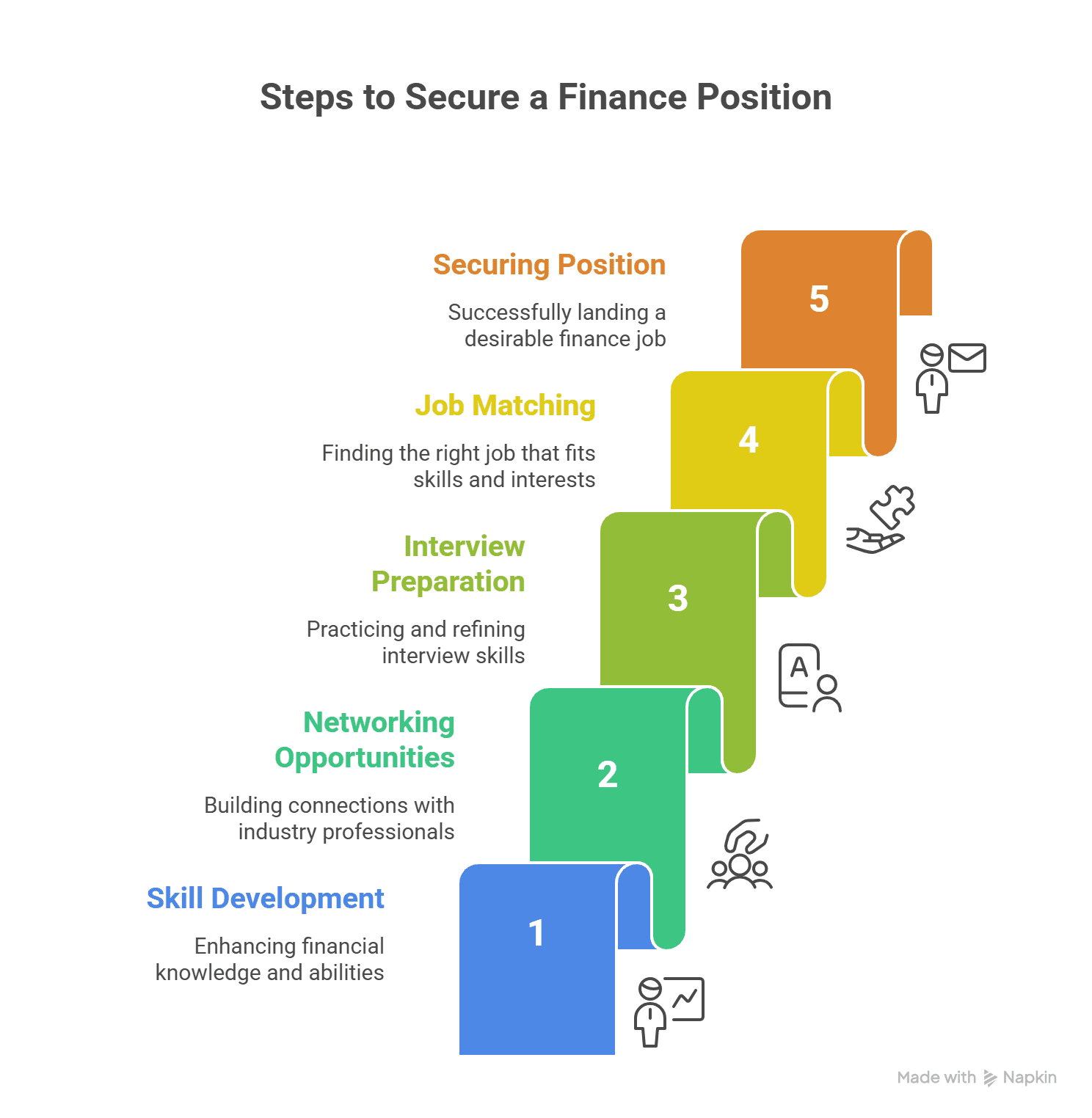

Career Outcomes: From Learner to Global Finance Professional

Students of the top investment banking course in India possess a variety of various career opportunities lying ahead of them, including:

- M&A Analyst

- Equity Research Associate

- Investment Banking Associate

- Capital Markets Analyst

- Financial Modelling Specialist

The skills learned from the course correspond to the requirements of leading Indian investment banks, private equity players, and asset management companies worldwide.

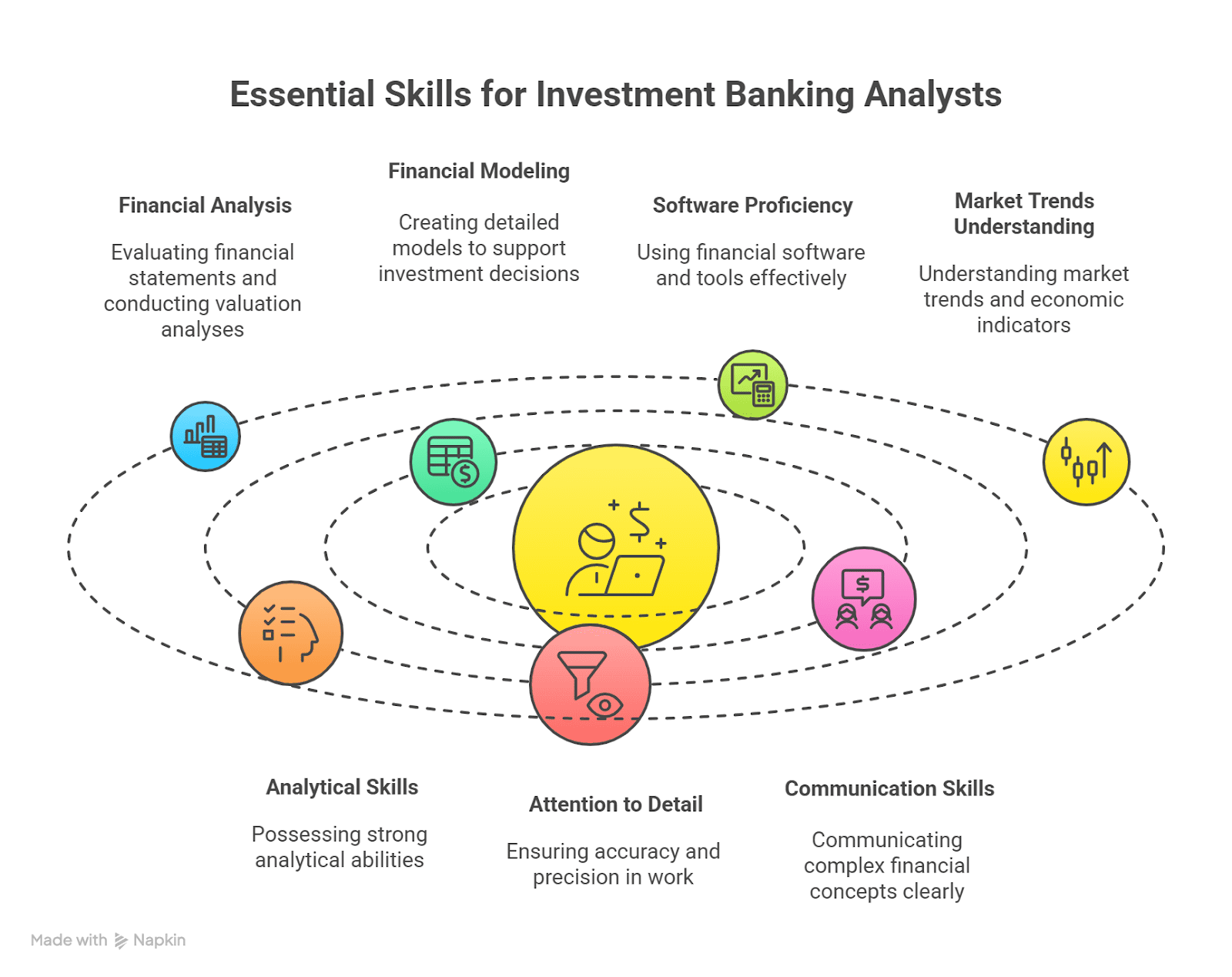

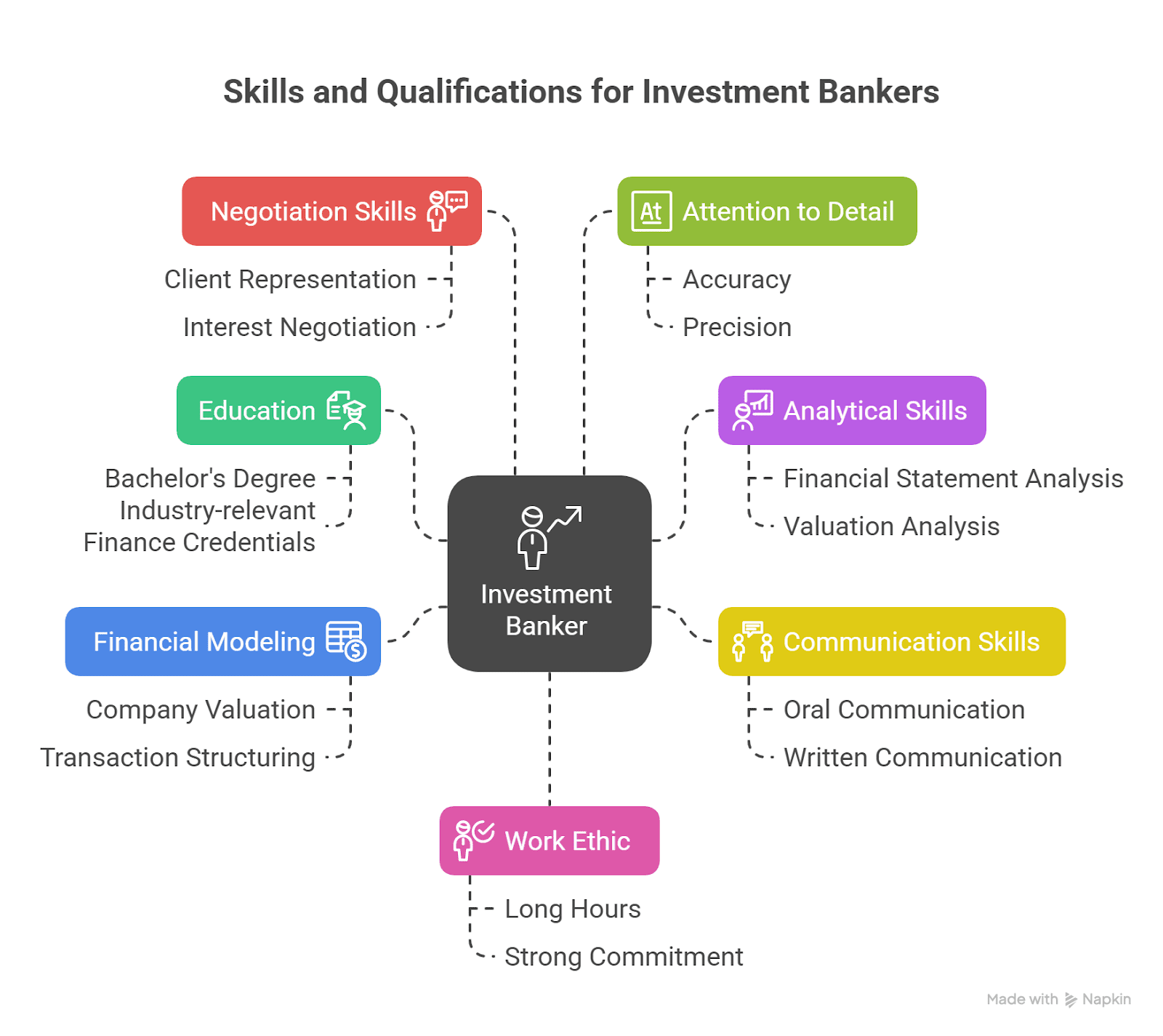

Building Core Skills for Investment Bankers

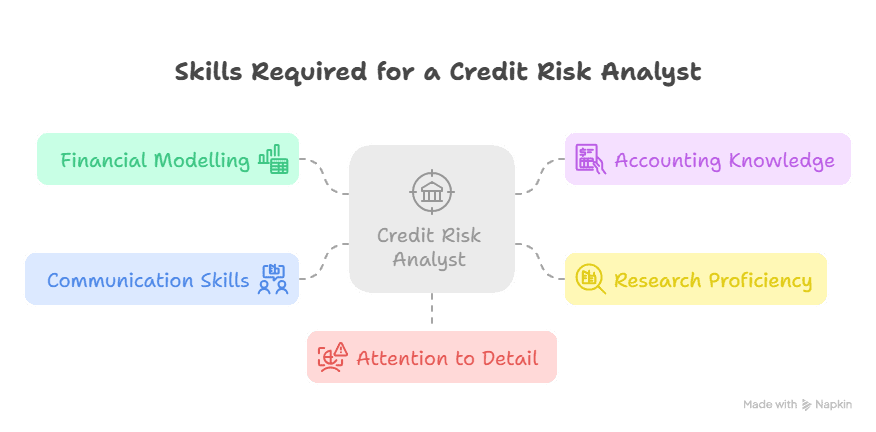

Any individual aspiring to make a career in this field must learn and cultivate a specific set of skills. These are:

- Advanced Financial Analysis: Acquiring the skill of analyzing the financial health of a company to ascertain its feasibility for investment.

- Valuation and Modelling Training: Experiential skills in building and interpreting financial models.

- Excel for Finance Professionals: Excel functions and shortcuts required in day-to-day banking activities.

- Understanding M&A Dynamics: Advanced understanding of structuring deals, due diligence, and strategic impact analysis.

- Soft Skills: Stakeholder management, negotiation, and communication skills play a role of significance in high-value transactions.

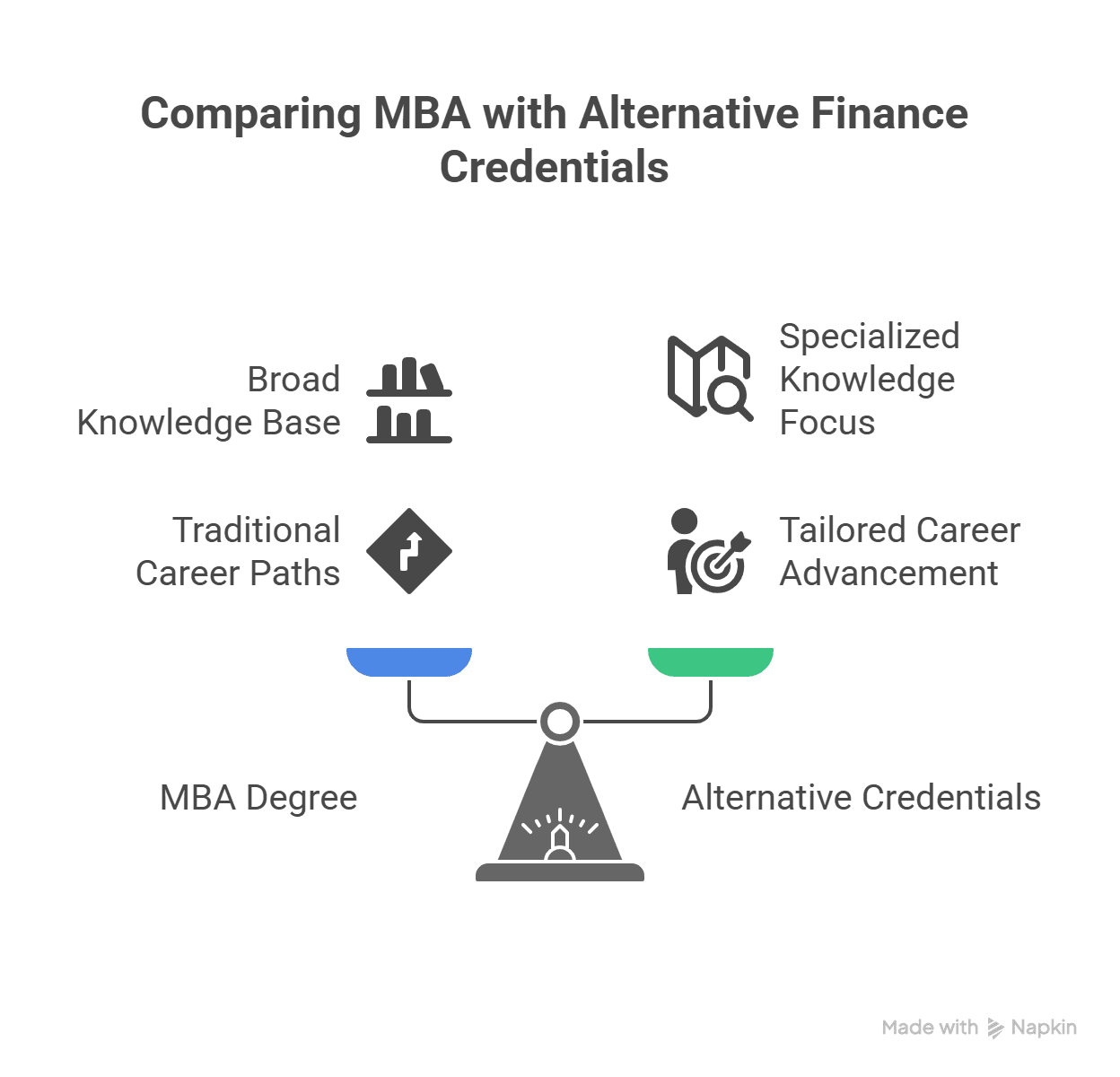

A Look at the Best Investment Banking Certification India Has to Offer

India’s educational scene is witnessing an increasing number of professional upskilling courses among finance students and early career professionals. Among this group, there is one whose standing is tall based on its all-around and industry-focused offering: the Certified Investment Banking Operations Professional (CIBOP) course presented by Imarticus Learning.

Why CIBOP is Among the Best Investment Banking Courses in India?

With more than a decade of successful record, the CIBOP course is for finance graduates with 0-3 years of experience and is aimed at establishing a career in investment banking operations. That’s why it’s a suitable choice:

- 100% Job Guarantee: Assured placement support for deserving candidates, and thus a perfect choice for career beginn ers.

- Strong Curriculum: It includes securities operations, anti-money laundering, risk management, and wealth & asset management.

- Practical Training: Project-based modules on ethical banking, compliance, and money laundering conspires are conducted by students.

- Industry Validation: Recipient of the Best Education Provider in Finance in the 30th Elets World Education Summit 2024.

What Roles Can You Pursue After CIBOP?

The investment banking operations training program prepares candidates for high-growth roles such as:

- Investment Banking Associate

- Settlement Associate

- Risk Management Consultant

- Hedge Fund Associate

- Regulatory Reporting Analyst

- KYC Analyst

85% placement rate and compensation packages as high as 9 LPA is little surprise considering that this course ranks among the best finance courses in India.

Tailored for Success: Skills for Investment Bankers

CIBOP does not only teach, it transforms. You are given aptitude training to ace employer tests, profile boost support to excel, and rigorous interview practice by professionals. It is the ideal combination of technology savvy and employability development.

How the CIBOP Course Boosts Your Career in Global Finance

An international finance career is within reach in the current globalized era of finances with the suitable qualification. CIBOP equips students with subject-specific skills and worldwide exposure with:

- A world-class banking and financial services launching platform

- Positive industry associations via Imarticus’ 1000+ recruitment clients

- 50,000+ alumni network

FAQs

1. What is the best investment banking course in India for freshers?

For freshers, Imarticus Learning’s CIBOP™ is unrivalled in its job guarantee, trainer-instruction, and well-rounded syllabus designed for newcomers.

2. What qualifications do I need to enrol in an investment banking certification India offers?

You would mostly require a finance, commerce, or economics background. Other stream graduates with a solid financial background would be accepted by some courses.

3. How long does it take to complete an investment banking operations course?

Professional courses such as CIBOP™ take 3 to 6 months, striking a balance between intensive learning and convenience for working professionals.

4. What are the key skills for investment bankers developed in these courses?

Key skills are financial modeling, equity research, risk management, and communication skills. Ethical behavior and compliance with regulations are also emphasized in the classes.

5. Is a career in global finance achievable after completing an Indian course?

Yes, certainly. Due to education globalization as well as industry-specific curriculum, students who graduate from good Indian courses are prepared to guide clients of multinational companies.

6. Are online investment banking certifications in India as effective as in-person classes?

Yes, if they also have interactive elements like live sessions, case studies, projects, and mentorship. Imarticus Learning has a blended style that increases accessibility and effectiveness.

7. What salary can I expect after completing a top finance course in India?

Salaries will depend on the experience, but after coursing like CIBOP, one can expect packages of 4 LPA to 9 LPA, depending on their profile and placement.

Conclusion

Selecting the right investment banking course in India is a crucial step towards becoming a high-flyer in the fluctuating world of finance. Whether you want to specialize in M&A, equity markets, or operations, the appropriate training can prove to be a long way in expanding your professional horizon.

The Imarticus Learning Certified Investment Banking Operations Professional (CIBOP™) course is the financial education gold standard, with theoretical depth complemented by real-world application and excellent placement assistance. If you’re serious about boosting your investment banking career, then this is a journey you should take.

Start your global finance journey here—confidently, clearly, and with a course that delivers.