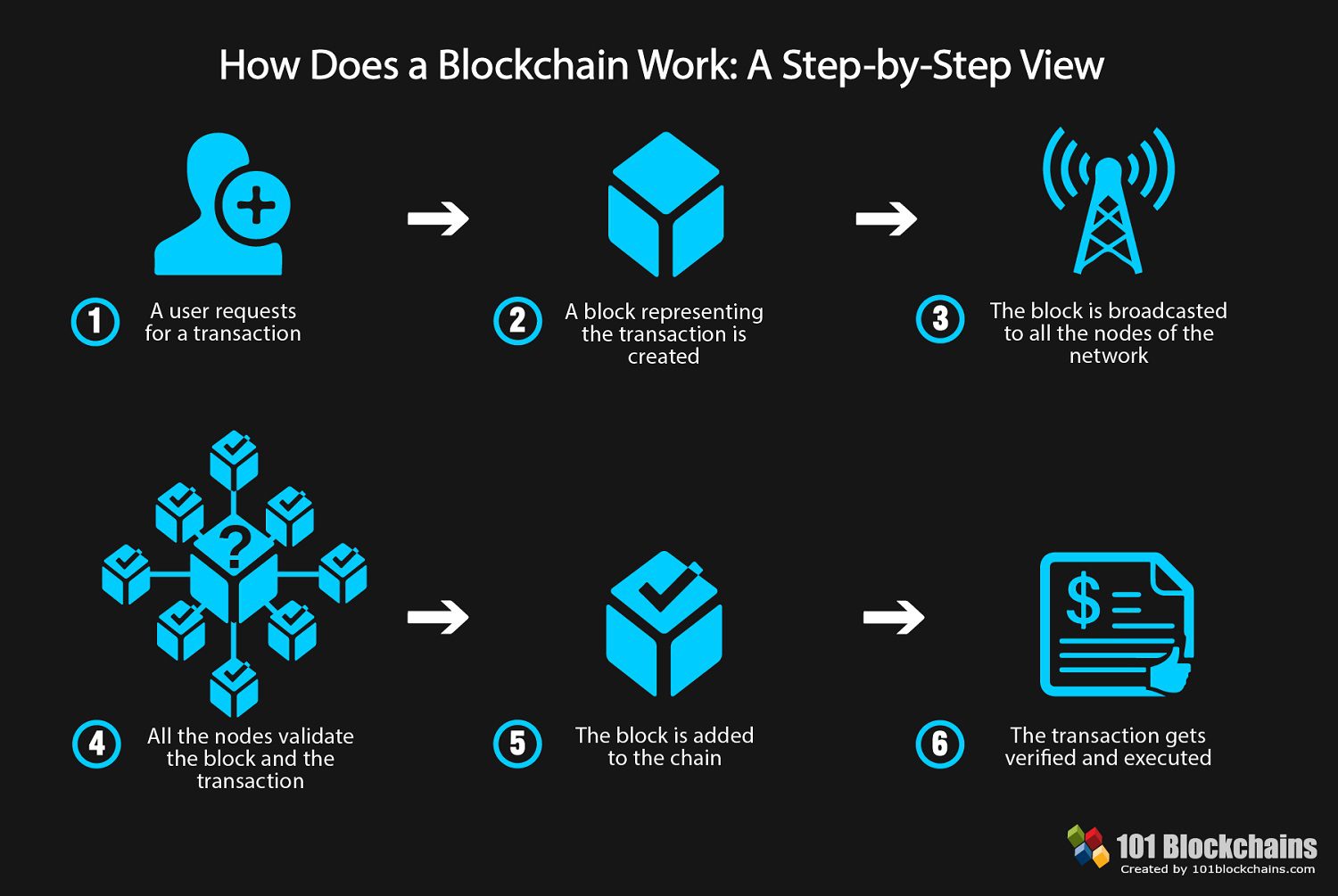

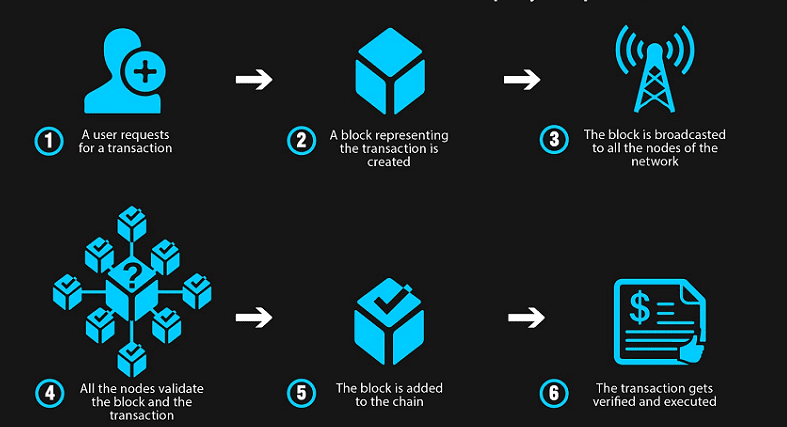

A blockchain is a public ledger which records and accounts for each and every bitcoin transaction that is made. Blockchain acts as an alternative to normal currency, centralized banking, and other transaction methods. It is changing the way we handle financial transactions. Blockchain maintains an ever-growing list of each and every transaction across every network, which is distributed over thousands of computers making it almost impossible to hack.

Our business uses the following applications to implement blockchain technology.

Smart Contracts

This term was first coined in 1993 – but it is only recently that Smart Contracts has gained fame due to the 2013 release of the Ethereum Project. Smart Contracts are run on this Ethereum Project which acts as a decentralized platform – these are applications that run exactly as programmed without a chance of downtime, fraud, censorship or any third party interference.

Smart Contracts are self-automated computer programs that can carry out all terms of a contract without any external assistance. It is financial security that is routed to different recipients held in escrow. Smart contracts are unbreakable, and it helps the business to bypass unnecessary regulations. Smart Contracts also helps in lowering the cost for a subset of our common financial transactions.

Cloud Storage

Our company is also beta testing the cloud storage application, that will help decrease dependency whilst offering secure cloud storage. Users can store on the normal cloud for more than 300 times simply by using excess hard drive space – this process is similar to someone renting their home on Airbnb. On average, the world is spending more than $22 billion on cloud storage, and this has the capacity to be a source of revenue for average users. Cloud storage also has the potential to reduce the cost to store data for personal users as well as companies.

Supply-Chain Communications & Proof-of-Provenance

Most of the things that we purchase are not made by one single entity, rather by a chain of suppliers who trade their components – for example, graphite or lead for pencils – to one company that gets everything together and makes the final product. The major issue with this system is that even if a single one of those components fails, the brand had to take the heat. We use blockchain technology, that provides the stakeholders with digitally permanent records that are can be audited with no concern. This also ables the stakeholders to see the site of the product at each value-added step.

Paying Employees

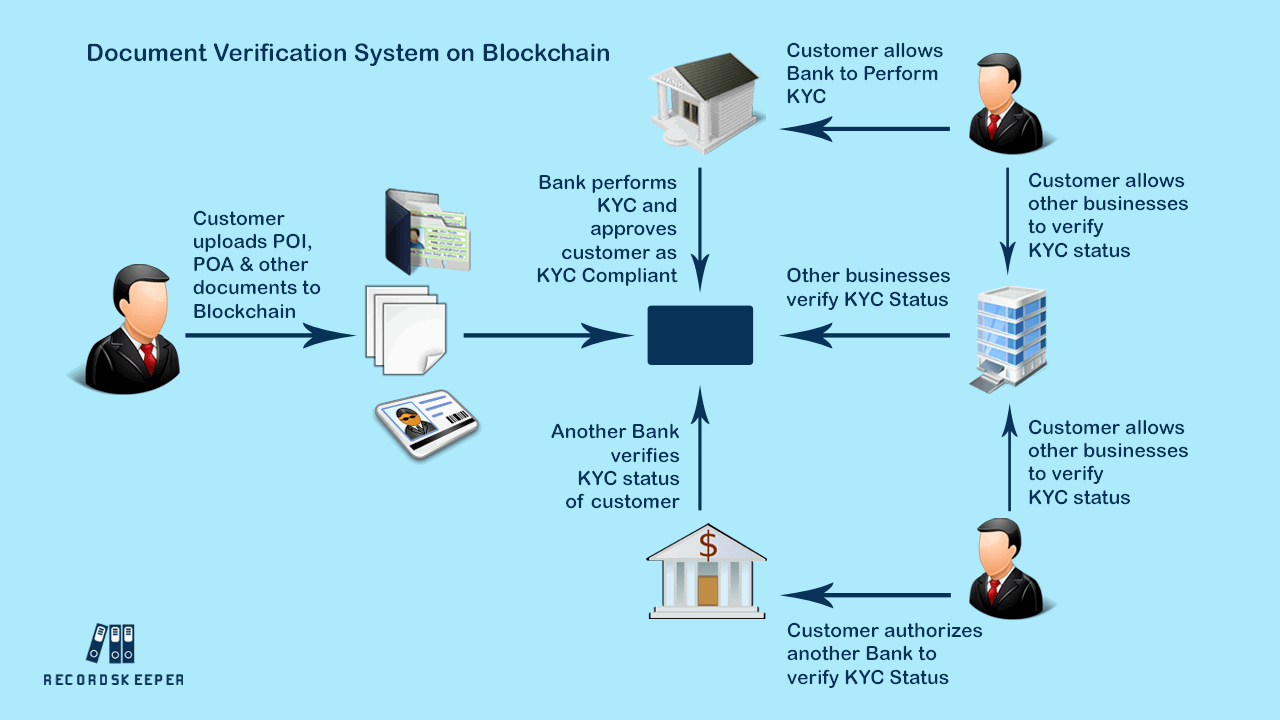

We thought and decided that blockchain Certification can be used as an application to compensate employees as it has its roots in cryptocurrency. Since our business has a vast network of international workers, we have also incorporated Bitcoin into the payroll which has turned out to be a major cost saver.

The world’s first Bitcoin-based payroll service, Bitwage has found a way around the high fee structure that is associated with international money transfer, at a much-reduced amount of time as such payments do not need to move from one bank to the other – this has been very effective for our business as it saves both time and money for our employers and us. Since we use a public ledger, one can actually see and keep track of all the money during the entire transfer process. This form of payments is something many other companies and banks are betting on this year, and it has become a very large part of our business.

Electronic Voting

According to BitShares, which is a globally distributed database, DPOS or Delegated Proof of Stake is the fastest, most decentralized, efficient and flexible consensus model that is available. BitShare also states that DPOS helps to resolve consensus issues in a fair and democratic way as it leverages the power of stakeholder approval voting. Elected delegates can be used to tune all network parameters from fee schedules to block intervals and transaction sizes. It takes as little as an average of just 1 second to confirm transactions by a deterministic selection of block producers. Most of all, this consensus protocol is designed to protect our business against unwarranted regulatory interference.

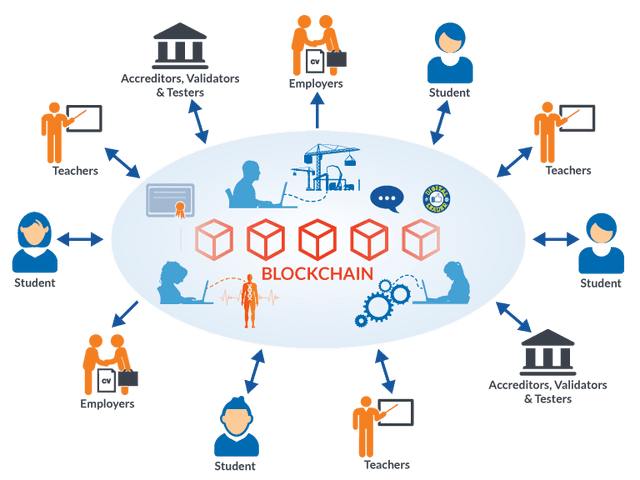

Fintech Course

Fintech is a new form of financial technology that applies and uses technology to improve financial actions. In our business, we have also included blockchain training that includes short fin-tech courses for our employees and stakeholders to understand better what kinds of applications best fit blockchain and other forms of distributed public ledger technology. Since incorporating blockchain in our business, it has become imperative for our employees to understand the design rationale, the basic technology, the underlying fundamentals of cryptography and its limitations.