Launching a career in banking and finance is one of the most strategic moves you can make today. With evolving tech, data-driven decision‑making & compliance demands, banks in India are on the hunt for talent that’s skilled, adaptable… and ready to hit the ground running.

If you’re seeking a banking course that offers job‑credit, practical exposure, and strong placement support—this guide will help you navigate your way to that first or next big opportunity.

Why Choose a Banking Course in India?

The banking sector remains one of the most stable arenas for ambitious professionals. Here’s why:

- High demand: With expanding retail banking, NBFCs, fintech apps & digital lending—all needing trained talent.

- Growth roles: Think PMOs, credit analysts, treasury executives, compliance leading to senior roles.

- Attractive compensation: Freshers with analytical and tech-ready skills can start at ₹4–6 LPA.

- Skill focus: Banks don’t just hire degrees—they hire practical thinkers with finance skills.

This is where a certification course in the banking sector holds value—it teaches you exactly what lenders need now.

Types of Banking Courses You Can Take

Here are several popular formats:

| Course Type | Best For | Duration |

| Banking diploma after graduation | Fresh graduates seeking job-ready skills | 3–6 months |

| Online banking course in India | Working professionals looking for flexibility | 4–8 months |

| Best banking course with placement | Anyone wanting direct access to hiring pipelines | 6 months |

| Certification course in banking sector | Those who want recognised credentials alongside practical learnings | 3–6 months |

For example, the Postgraduate Financial Analysis Program provides a robust structured curriculum, live instruction, and assured placement links. You can also get a preview in this video.

What Makes a Great Banking Course With Placement?

To rise above the rest, your training must come with placement pathways.

Here’s what to look for:

| Feature | Why It Matters |

| Guaranteed interview slots | Gives you multiple chances—not just hope |

| Employer collaborations | Ensures curriculum aligns with current industry needs |

| Mock interviews & resume support | Boosts your chances of success in real selection cycles |

| Strong alumni network | Offers insights & mentorship post‑training |

If you’re targeting public or private banks, choosing the best banking course with placement ensures you’re job‑ready from the first day.

Banking Diploma After Graduation — What to Expect

Completing a banking diploma after graduation helps you transition into the BFSI domain—quickly and effectively.

Typical topics include:

- Banking Operations

- Retail vs corporate credit

- Financial statement analysis

- Compliance (KYC/AML)

- Digital banking infrastructure

- Excel, Power BI & MIS dashboards

These courses often include internships or capstone projects to build your portfolio—crucial for the real world.

Advantages of an Online Banking Course in India

The shift toward remote learning has seen online banking course in India become extremely popular—and powerful.

Benefits include:

- Learn from any location—urban or small-town

- Recordings let you study anytime, anywhere

- Peer learning through virtual forums

- Same tools & case studies as offline programs

And if the course offers placement support, you get flexibility plus immediate value.

Choosing the Right Certification Course in Banking Sector

Certifications demonstrate you’ve mastered modern financial competencies. Top features include:

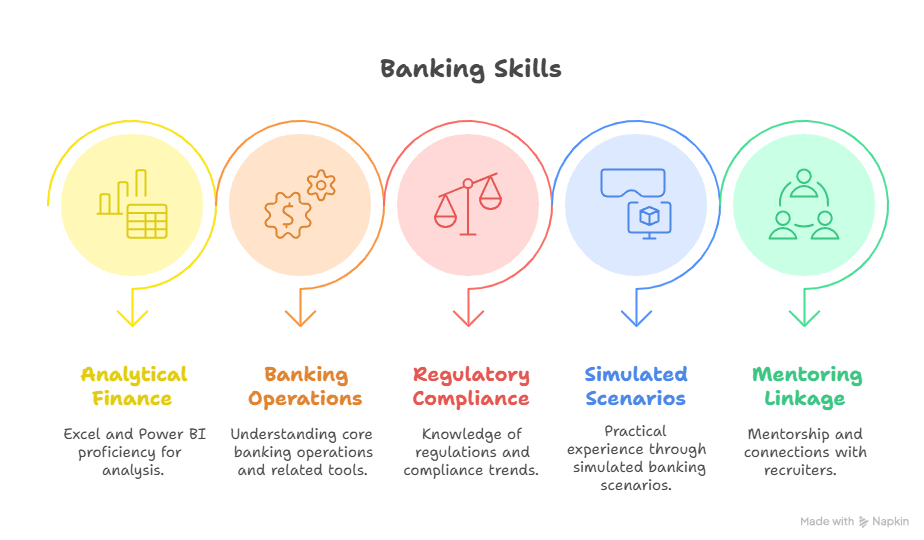

- Analytical finance skills (Excel + Power BI)

- Core banking operations and tools

- Regulatory know‑how & compliance trends

- Live simulated banking scenarios & real‑life cases

- Mentoring and recruiter linkages

Strong certification course in banking sector programs, like Imarticus, blend theory with tool‑based learning & placement prep.

Breakdown: Career in Banking And Finance — What Roles Await

Completing a bank‑focused training can open doors like:

| Role | Where You’d Work | Typical Starting LPA |

| Credit Analyst | NBFCs, Banks, Fintech | ₹5–7 LPA |

| Relationship Manager | Private banks, Retail branches | ₹4–6 LPA |

| Operations / Back‑Office | Core banking teams, BFSI operations | ₹4–5 LPA |

| Treasury Trainee/Analyst | Bank treasury, trading desks | ₹6–8 LPA |

| Compliance Officer | Compliance departments, risk teams | ₹5–7 LPA |

Many career in banking and finance paths also intersect with consulting & fintech—thanks to transferable skills.

How to Distinguish the Best Banking Course With Placement

Before choosing, evaluate on:

- Job guarantee or assured interviews?

- Industry‑led curriculum – is it updated?

- Project or internship components included?

- Mentorship & recruiter access?

- Alumni placed at top banks or fintechs?

When it comes tolanding a role fast, the best banking course with placement is vital for smooth onboarding.

Bonus: How a Banking Course Complements Finance Careers

If you’re aiming for roles beyond traditional banking—like FP&A, treasury, corporate strategy—a program in banking also equips you with:

- Financial statement modeling

- Risk & compliance frameworks

- Treasury operations & liquidity management

- Credit evaluations & debt issuance

These skills enhance career in banking and finance, making you adaptable to M&A, treasury analysis, or FP&A roles.

FAQs

1. What is the best banking course with placement right now?

The one with live training, real tools… & recruiter tie-ups.

2. Can I take an online banking course in India from home?

Yes… top ones are fully remote with mentor access.

3. Is a banking diploma after graduation enough for jobs?

Yes, if it’s practical & offers placement support.

4. What’s covered in a certification course in banking sector?

Mostly operations, KYC, credit, risk… & digital tools.

5. Can freshers start a career in banking and finance?

Absolutely—many entry-level roles need just right skills.

6. Is online banking course in India recognised by banks?

Yes, if it’s from a trusted institute with recruiter links.

7. Will a banking diploma after graduation help in fintech jobs?

Yes… especially in roles like ops, credit or sales.

8. Are certification course in banking sector useful for career switchers?

Very… they help build finance basics fast.

Final Thoughts

Choosing a banking course in India is not just a step—it’s a strategic leap toward a stable, dynamic, and high-paying finance career.

Whether it’s an online banking course in India, a certification course in banking sector, or the best banking course with placement, find a program that:

- Bridges education with employment

- Offers employer-relevant skills

- Supports your dream role in the BFSI domain

For a strong blend of practical skills, placement assurance & industry curriculum, consider exploring structured programs like Imarticus that mould you into a finance professional in 2025 and beyond.