Marketing has changed. If you are a student or working professional looking to pursue a digital marketing career, you’re probably asking yourself what will you even learn? What tools will you use? What strategies will you examine? How will the course content align with industry standards? In this blog, we will explore the digital marketing course syllabus so that you have an immersive perspective on what you will have to look forward to in the digital classroom.

In the current job sector, it is not sufficient for candidates to have theoretical experience. Capabilities, certification, and work experience are criteria for selection of candidates in the eyes of the employer. So it is imperative that before admission, one understands the Digital Marketing Course Syllabus in detail. We will now tackle each component in the syllabus, pen down current trends in digital marketing, and explore the modules that give power to these courses.

Table of Contents

- Marketing Syllabus Breakdown

- Overview of a Digital Marketing Course

- Course Modules in Detail

- Key Digital Marketing Topics Covered

- Comprehensive Course Curriculum Structure

- Must-Know Marketing Course Subjects

- Practical Tools & Skills in Marketing Course

- Updated Syllabus for Marketing Trends (2025)

- Career Outcomes from the Course

- FAQs

- Key Takeaways

- Conclusion

Overview of a Digital Marketing Course

Before we dig into components, let’s first discuss what you should expect from a digital marketing course. Most solid programs include a mixture of foundational knowledge, platform knowledge, analytics, and strategy.

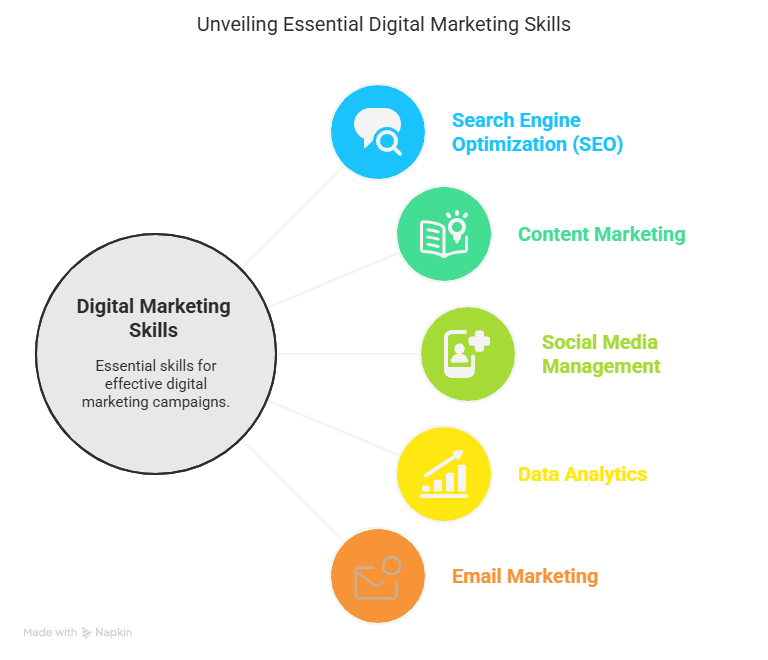

Most online digital marketing courses offer foundational knowledge, platform knowledge, analytics, and strategy. Online digital marketing courses help learners understand the creative side of marketing, but also the analytical side too. The Digital Marketing Course Syllabus has a lot of competencies from SEO and SEM to influencer marketing and automation.

Marketing Syllabus Breakdown

Comprehensiveness and relevance are the components of the marketing syllabus. The syllabus is constructed to mirror the market trend and hiring needs, and the syllabus is revised almost annually when reasons necessitate.

In 2025, look for a heavy focus on personalisation, automation, influencer marketing, and, AI powered customer journeys, in the digital marketing course syllabus.

Sample Marketing Syllabus Structure:

| Module | Topic | Key Learning Outcome |

| Module 1 | Fundamentals of Marketing | Understand core marketing principles |

| Module 2 | SEO and SEM | Learn to optimize content and run ads |

| Module 3 | Social Media Marketing | Build brand presence across platforms |

| Module 4 | Analytics | Track campaign performance |

| Module 5 | Email & Automation | Build and run campaigns that convert |

| Module 6 | Capstone Project | Apply learnings to a real-world scenario |

Course Modules in Detail

Each module within the Digital Marketing Course Syllabus is designed to build on the previous one. Starting from the basics, learners gradually move into complex tools and campaign strategies.

Let’s take a closer look at some essential course modules:

- Marketing Fundamentals – Consumer behaviour, branding, and 4Ps

- Website Building – WordPress or Wix site setup and management

- Search Engine Optimization (SEO) – On-page, off-page, and technical SEO

- Paid Advertising (SEM/PPC) – Google Ads, keyword bidding, retargeting

- Email Marketing – List segmentation, A/B testing, open rates

- Content Marketing – Storytelling, blogs, video scripts

- Influencer & Affiliate Marketing – Platforms, outreach, contract basics

These digital marketing topics provide a balanced mix of theoretical knowledge and hands-on practice.

Key Digital Marketing Topics Covered

The dynamic nature of digital marketing means that the syllabus must stay responsive to industry evolution. In 2025, the following digital marketing topics are receiving a lot of focus:

- Voice Search Optimization

- YouTube SEO

- Conversational Marketing

- Instagram Reels & Shorts Strategy

- AI in Email Personalization

Trending External Reads:

Forbes on Digital Marketing Trends

These resources show how the Digital Marketing Course Syllabus adapts to real-time trends.

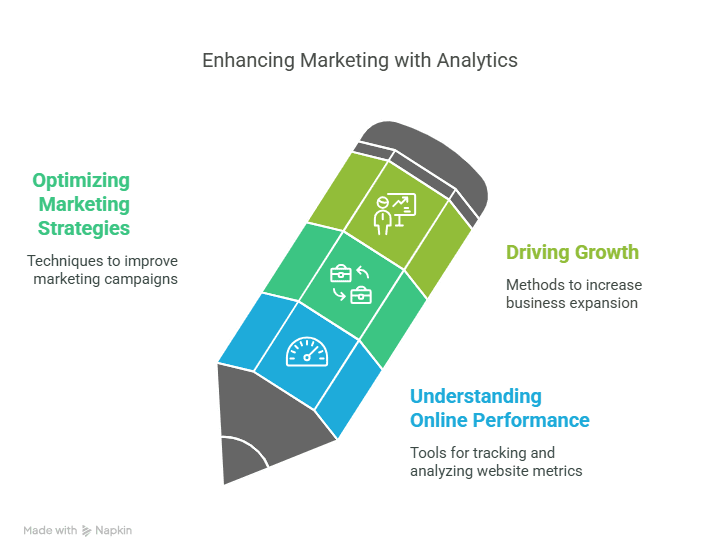

Comprehensive Course Curriculum Structure

A robust course curriculum is more than a list of subjects; it’s a guided journey from novice to job-ready professional. The 2025 curriculum integrates theory with tools, industry case studies, and live projects.

You’ll experience:

- Live simulations with ad platforms

- Real-time analytics dashboards

- Peer-to-peer reviews and teamwork assignments

- Portfolio-building projects

- Industry mentoring sessions

| Phase | Learning Path |

| Phase 1 | Foundation & Basics |

| Phase 2 | Platform-Specific Skills |

| Phase 3 | Campaign Execution |

| Phase 4 | Strategy & Optimization |

| Phase 5 | Capstone and Job Support |

Must-Know Marketing Course Subjects

These marketing course subjects form the skeleton of any digital marketing program. While the platforms and tools may evolve, the concepts are universal.

You will deep dive into:

- Consumer Behavior and Market Research

- Brand Management Principles

- Communication and Persuasion Strategies

- Media Buying & Planning

- Performance Metrics & ROI Calculations

Understanding these subjects will give you the strategic lens needed to make smart marketing decisions.

Practical Tools & Skills in Marketing Course

Modern marketing demands mastery over tools. The skills in marketing course modules train you in both hard skills (platforms, analytics) and soft skills (creativity, communication).

Tools You’ll Master:

- Google Analytics & Google Ads

- SEMrush or Ahrefs

- HubSpot or Mailchimp

- Meta Business Suite

- Canva & Adobe Express

Soft Skills You’ll Cultivate:

- Strategic thinking

- Data interpretation

- Customer empathy

- Content creation

- Collaboration and presentation

Having both tool-specific and strategic skills boosts your marketability across industries.

Updated Syllabus for Marketing Trends (2025)

With every passing year, the syllabus for marketing undergoes key changes. AI, automation, and short-form content are leading the charge in 2025.

What’s new this year:

- AI-based campaign targeting strategies

- Generative content using ChatGPT or Jasper

- Gamification in lead generation

- Integration of AR/VR in user journeys

- Emphasis on sustainability branding

The Digital Marketing Course Syllabus now ensures learners are equipped to lead digital innovation.

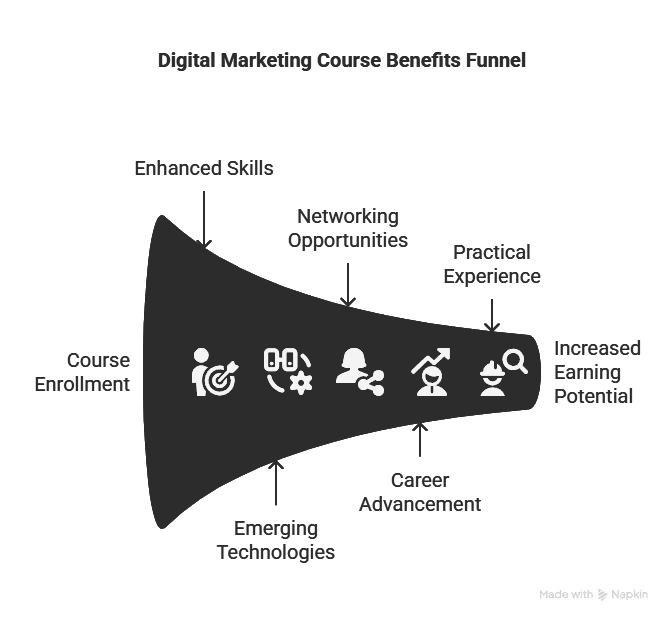

Career Outcomes from the Course

A well-rounded digital marketing course opens doors to roles such as:

- Digital Marketing Manager

- SEO/SEM Specialist

- Content Strategist

- Social Media Manager

- Performance Marketing Analyst

With companies across every sector looking for skilled digital marketers, job opportunities are abundant.

FAQs

Q1. How long is a digital marketing course?

Typically, programs last between 3 and 6 months, depending on content and delivery, either online or in-person.

Q2. Do I need a background in marketing to take this course?

No, there are no prerequisites in terms of background, digital marketing is suited to students with an interest in creativity, data or communication.

Q3. Is certification important after completing the course?

Absolutely. Certifications from Google, HubSpot, or Meta increase your job prospects significantly.

Q4. Will I work on real campaigns during the course?

Yes. Most programs include real-time projects, ad budgets, and performance reports to simulate live campaigns.

Q5. What is the salary range after completing a digital marketing course?

Entry-level salaries are typically between- ₹3.5 to ₹5 LPA. Experienced individuals can earn ₹12 – 15 LPA.

Q6. What industries in India hire digital marketers?

Almost every industry..including e-commerce, technology, finance, media, education, and healthcare.

Q7. How often is the syllabus updated?

Good programs update the Digital Marketing Course Syllabus – yearly or bi-annually based on industry trends.

Q8. Can I take this course while having a full-time job?

Yes.. most institutes offer flexible scheduling, weekend classes, or self-paced modules.

Q9. Are tools and platforms taught hands-on?

Definitely. Courses include practical assignments using Google Ads, Analytics, SEO tools, and email platforms.

Q10. Is a digital marketing career future-proof?

Yes. With increasing digital adoption, marketing roles will continue evolving but remain in high demand.

Key Takeaways

- A well-structured digital marketing course syllabus includes foundational theory, platform mastery, and real-world projects.

- Emerging digital marketing topics such as AI, AR/VR, and gamification are now standard components.

- Soft and hard skills in marketing course curricula make learners job-ready.

- Students can expect global job relevance with up-to-date course curriculum and tools.

Conclusion

Examining the digital marketing course syllabus gives you a clearer picture of what to expect, which ultimately helps you select the most appropriate course/project for your goals! Are you transitioning careers? Earning some upskilling? Or simply starting? If the course or program has an innovative and future facing marketing syllabus, then it can be your launching pad into this exciting career field. Remember, the right course isn’t just about teaching you how to market — it is teaching you how to think like a marketer.

Are you ready to embark on the exciting journey of digital marketing?