Entering the finance sector is no longer a limitless dream of freshers anymore. With systematic efforts and industry-focused mentoring, investment banking freshers’ careers today are an outstanding doorway to a successful career in finance. Not only as a career to earn a living, but even as a stepping-stone to create tomorrow’s leaders in the finance sector.

Why Investment Banking Jobs for Freshers Are in High Demand?

With a historically elitist and exclusive career, the wave of investment banking freshers’ lives brought roles to the ordinary citizen. Financial ecosystem globalisation, increasing digitalisation, and increasing demand for expert roles have opened new doors of entry.

These are not mere jobs — they are learning tasks that boost investment banking skills development as much as business skills. Organizations more and more proactively seek young freshers who can be shaped into strategic finance professionals.

Investment Banking Jobs for Freshers: Building a Foundation for Long-Term Success

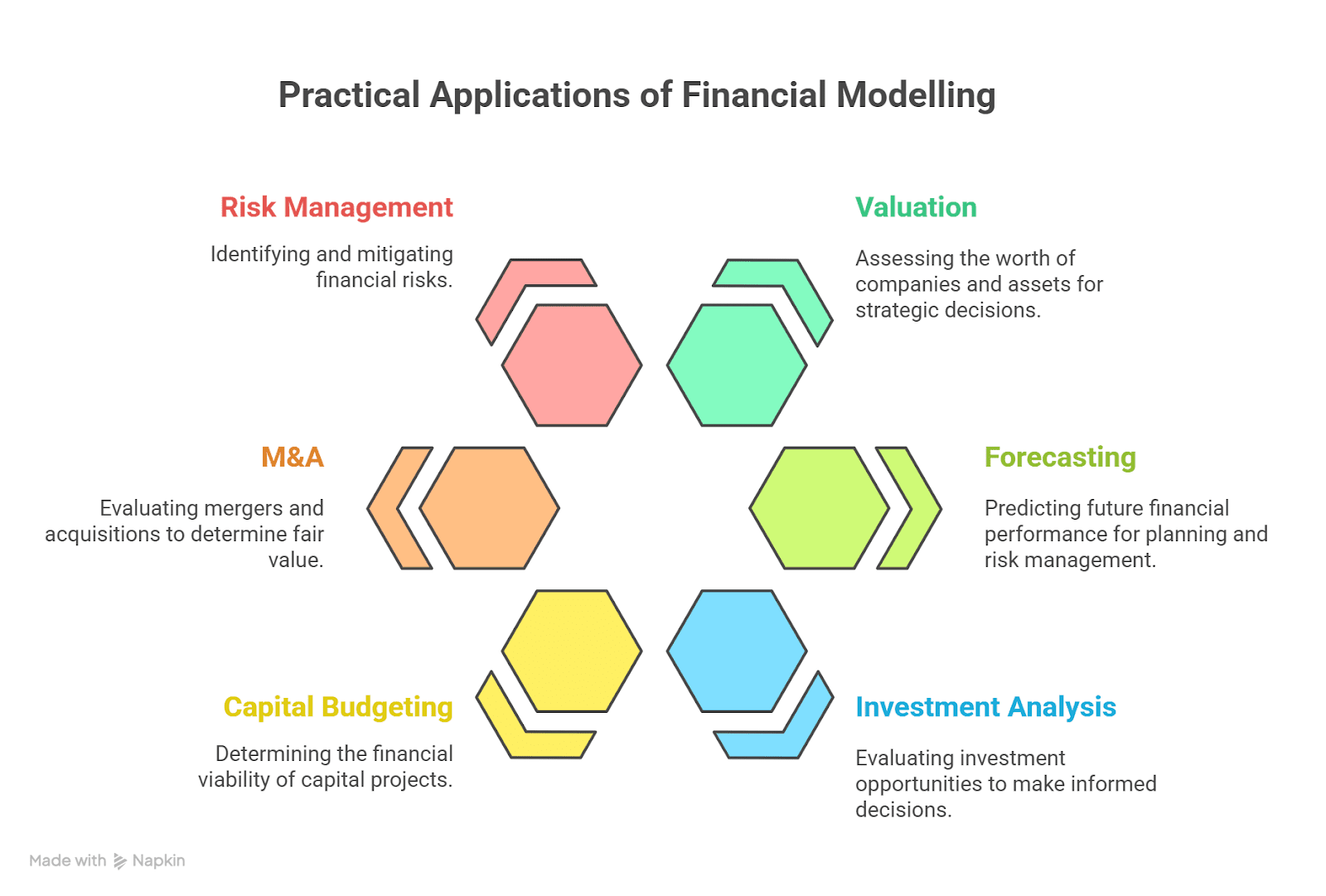

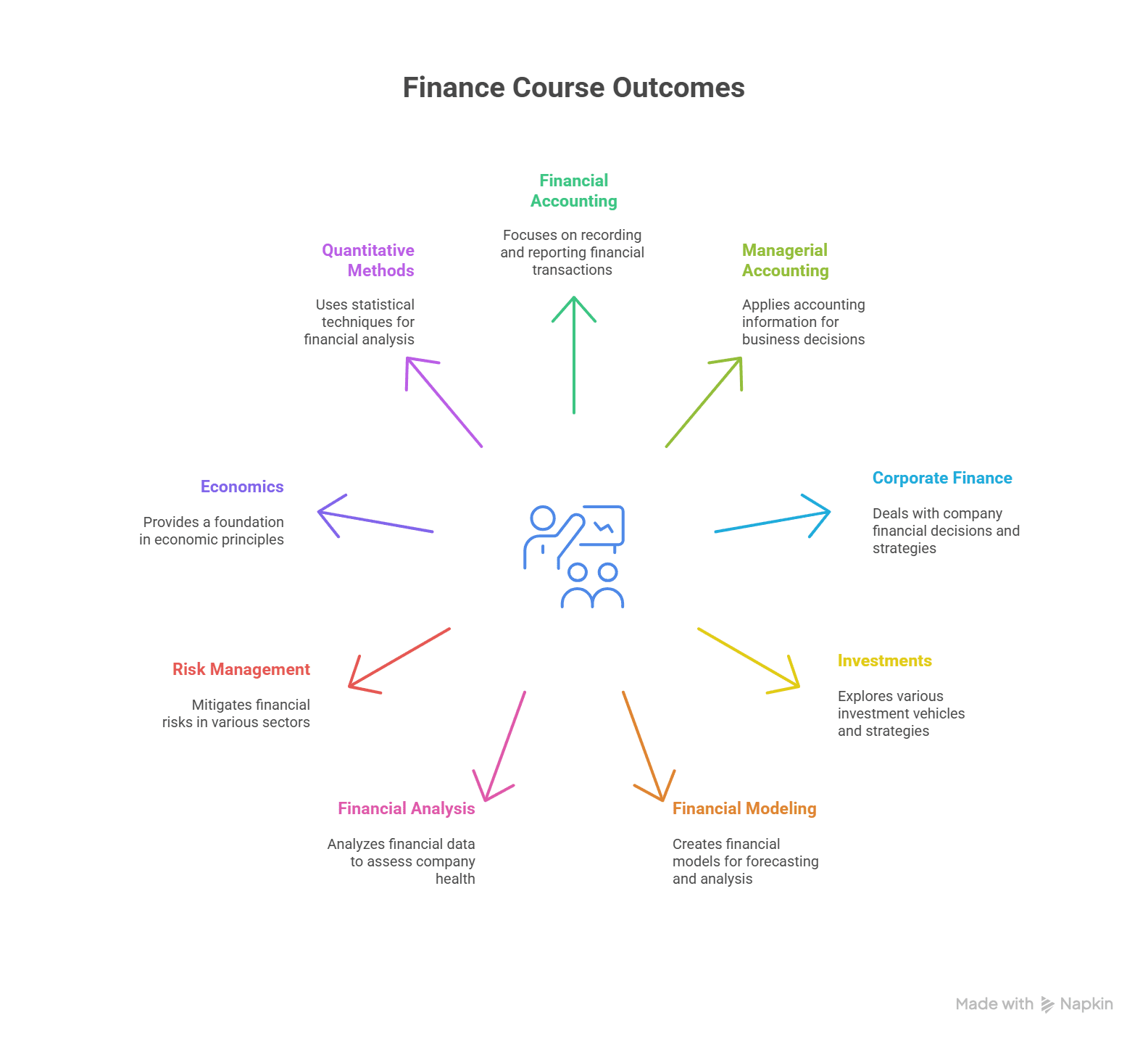

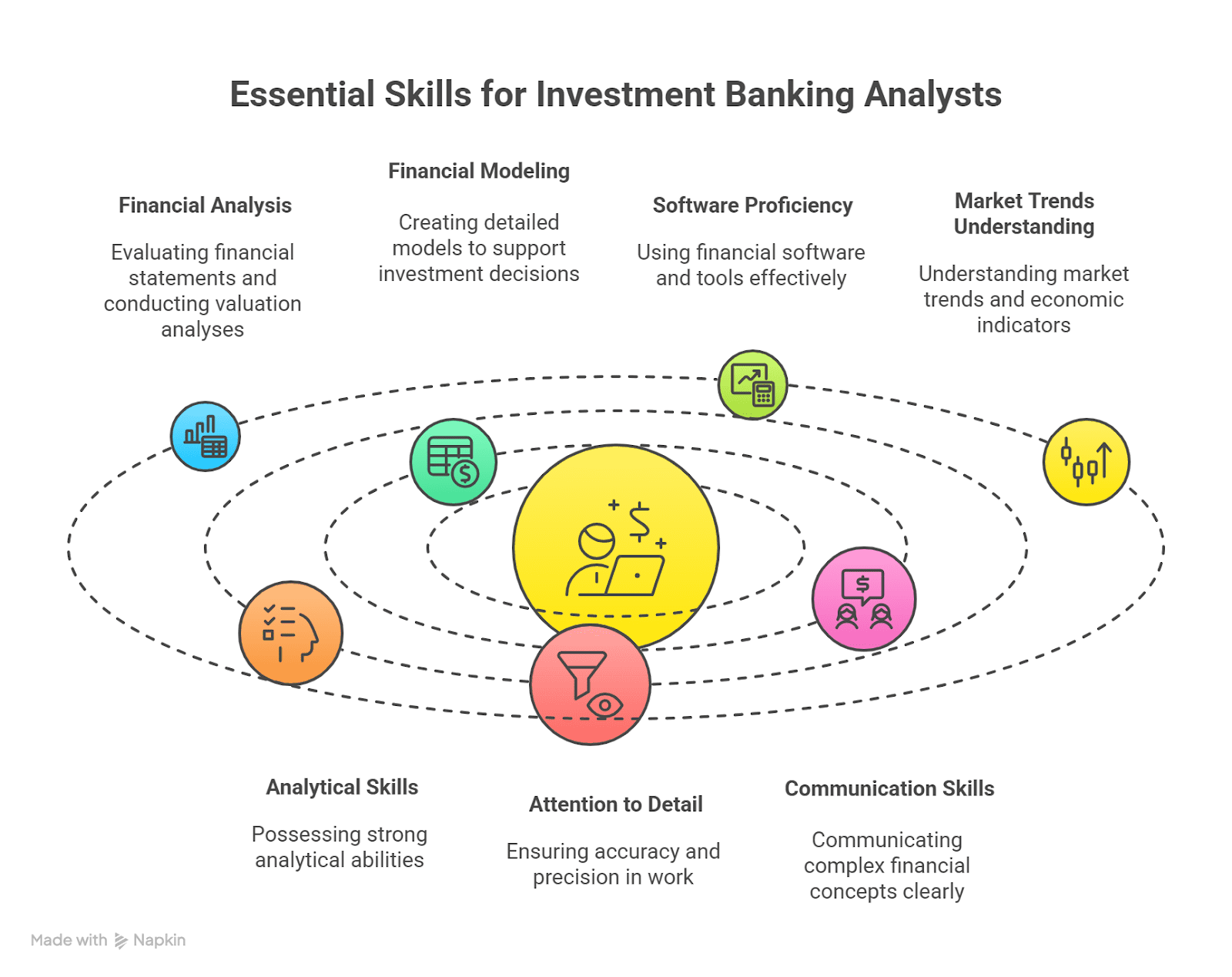

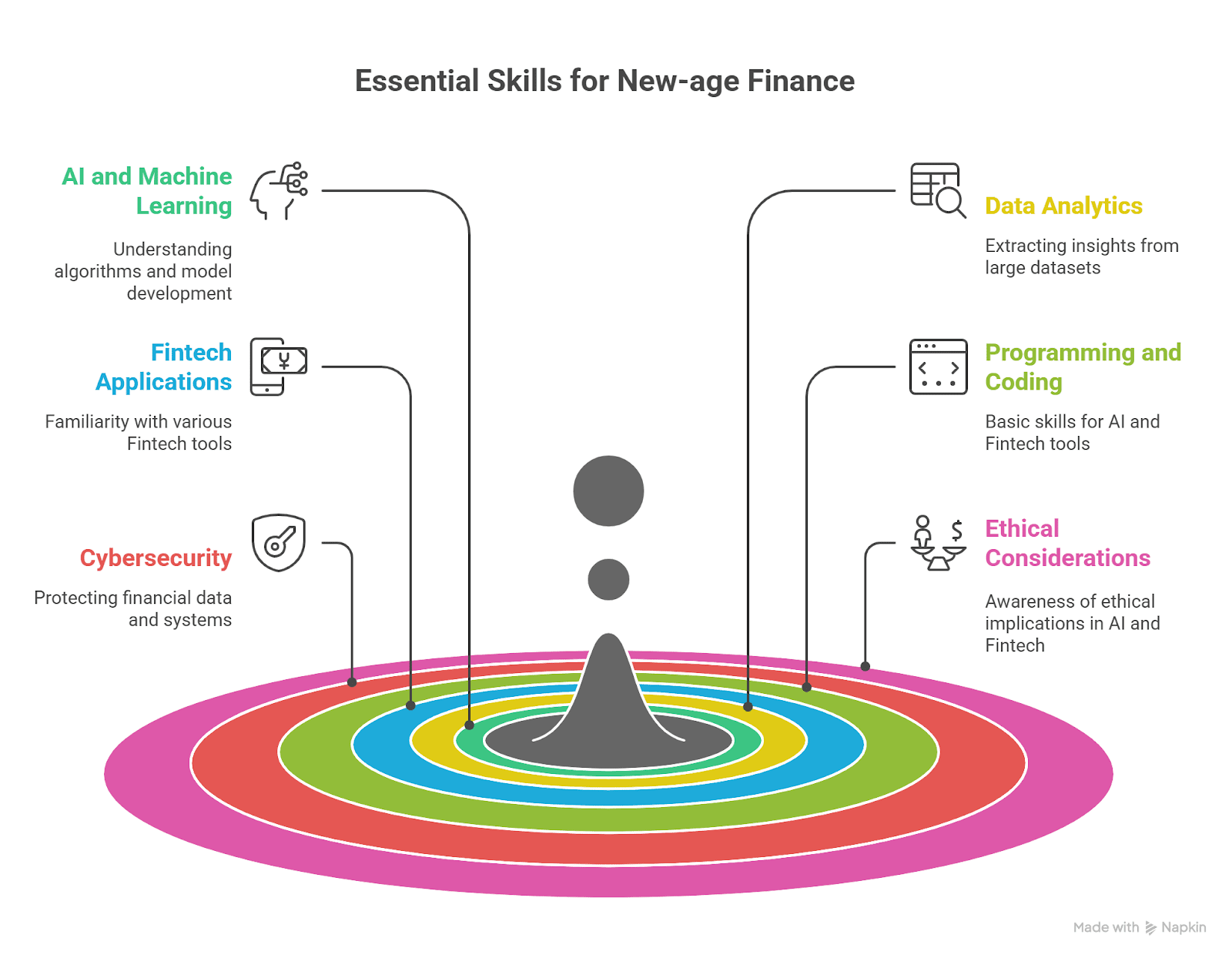

The most appealing to the freshers is the learning process. These are jobs that are designed to shape you from ground zero with a focus on foundation-level investment banking skill-building such as:

- Analytical thinking and financial modeling

- Equity, debt, and derivatives markets understanding

- Support to M&A planning and execution

- Building client relationships

- Regulatory compliance and risks

Apart from this, finance career training in India has also become a fast-rising phenomenon to fulfill this demand, where training centers are offering experiential learning through project-based learning and simulated market conditions.

What Makes Freshers the Perfect Fit for Investment Banking?

Newers do possess a unique combination of passion, adaptability, and learning desire. Proper job assurance banking course or counseling behind them, they smoothly change to stress cultures. These days, firms prefer hiring on potential and molding the skills.

This also illustrates the vision of most of the top investment banking schools that implement exposure learning and placement-focused finance program.

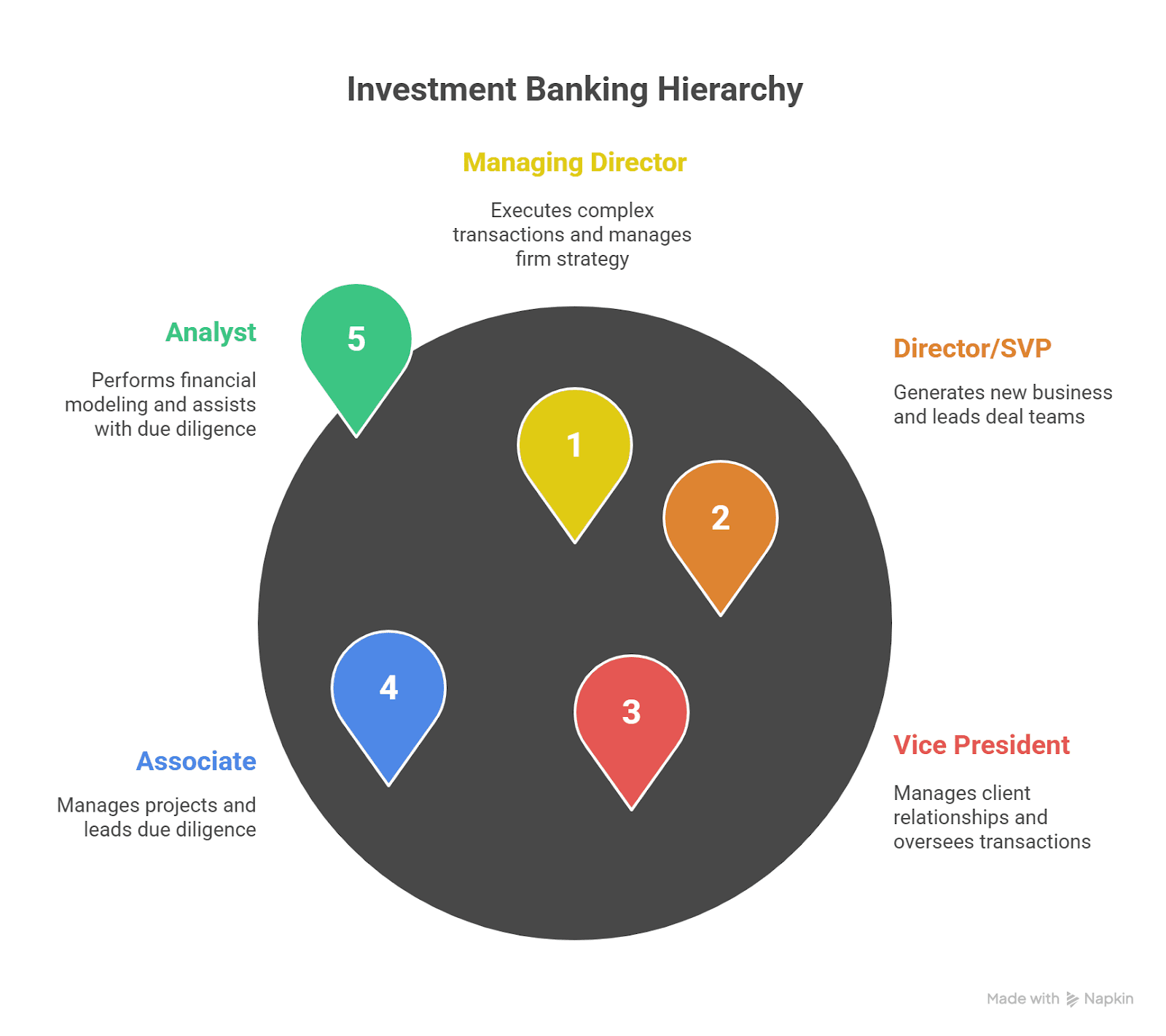

Career Progression: From Entry-Level to Leadership

The road from junior analyst to VP or senior associate in investment banking is narrow but highly rewarding. However, those who get in early enough discover that they see a lot quicker growth because of the well-checked investment banking career path left behind by industry legends.

Rookies’ jobs in investment banking introduce the applicants to deal-making, financial engineering, and advisory services from their very first day. All the initial hustle is worth it if it leads to a top-line job with multimillion-dollar portfolios.

Training and Courses Supporting Investment Banking Aspirants

It does not turn into a phenomenon of the overnight investment banking success. It is a result of a no-nonsense approach complemented by rigorous training and strict mentoring. The would-be candidates are opting more and more for:

- Placement-based finance courses to acquire hands-on experience

- Global financial regulation and compliance courses

- Soft skill training and client management

Theory and practice mix is the norm now, with career readiness for freshers being significantly enhanced.

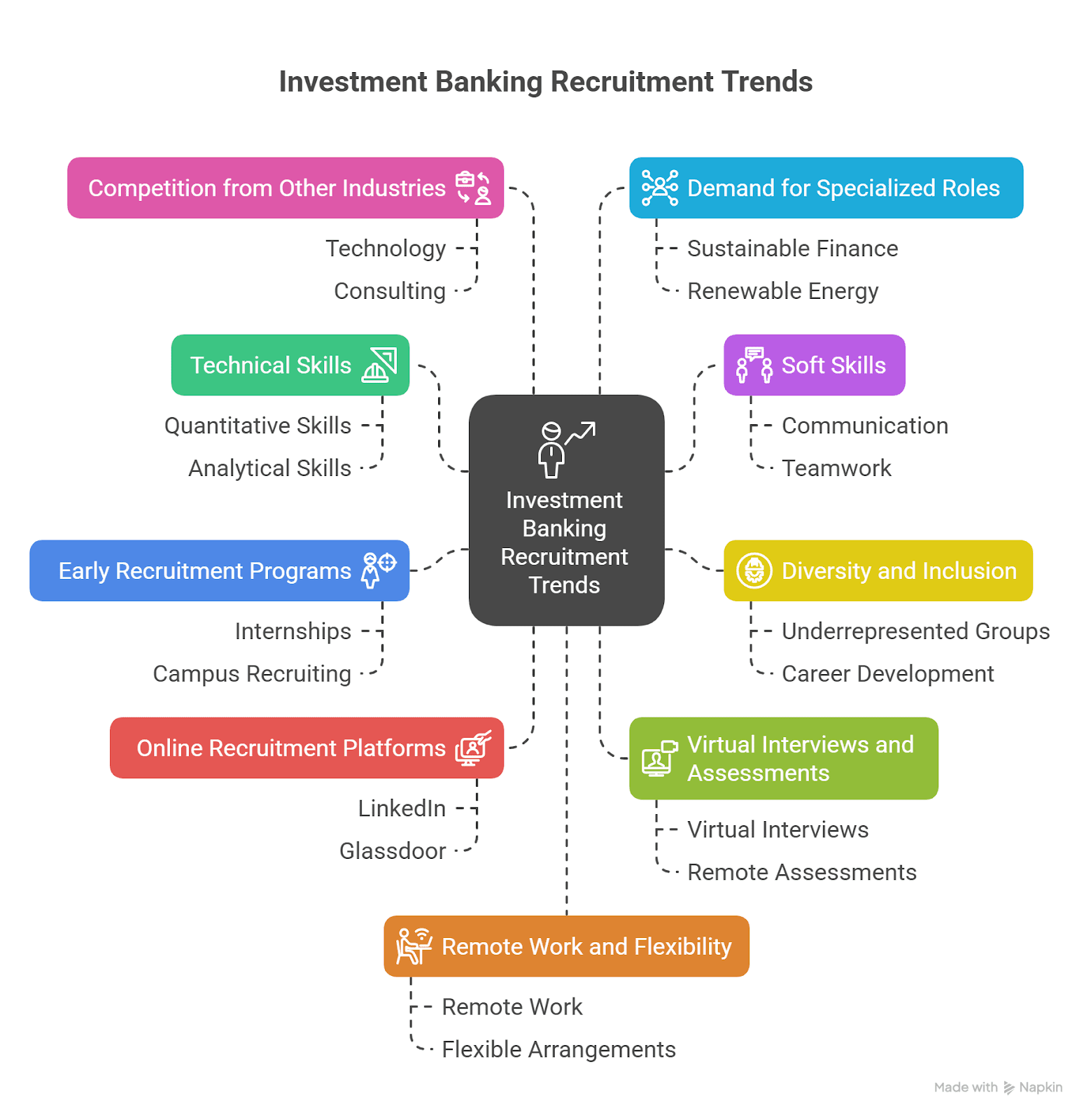

Industry Demand and Recruitment Trends

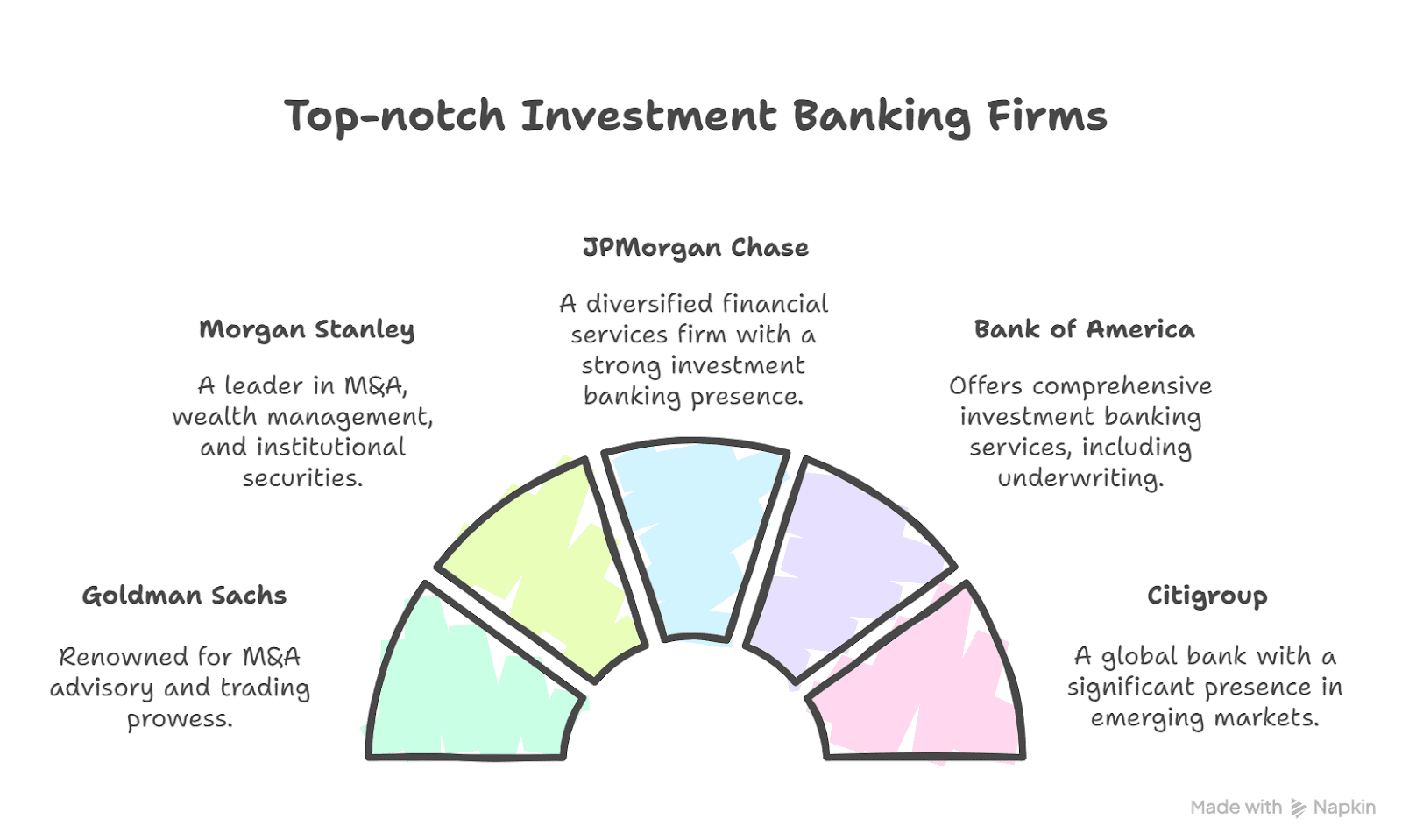

Indian and international investment banks are struggling with the increasing demand for talented analysts and associates. With increasing deal flows and growing capital markets, the need for new talent skilled in finance and technology never ends.

Some firms are going to specialized training schools and top investment banking institute to hire pre-screened talent. The organizations have strenuous learning patterns and rigorous boot camps that shape the students into professional working personalities.

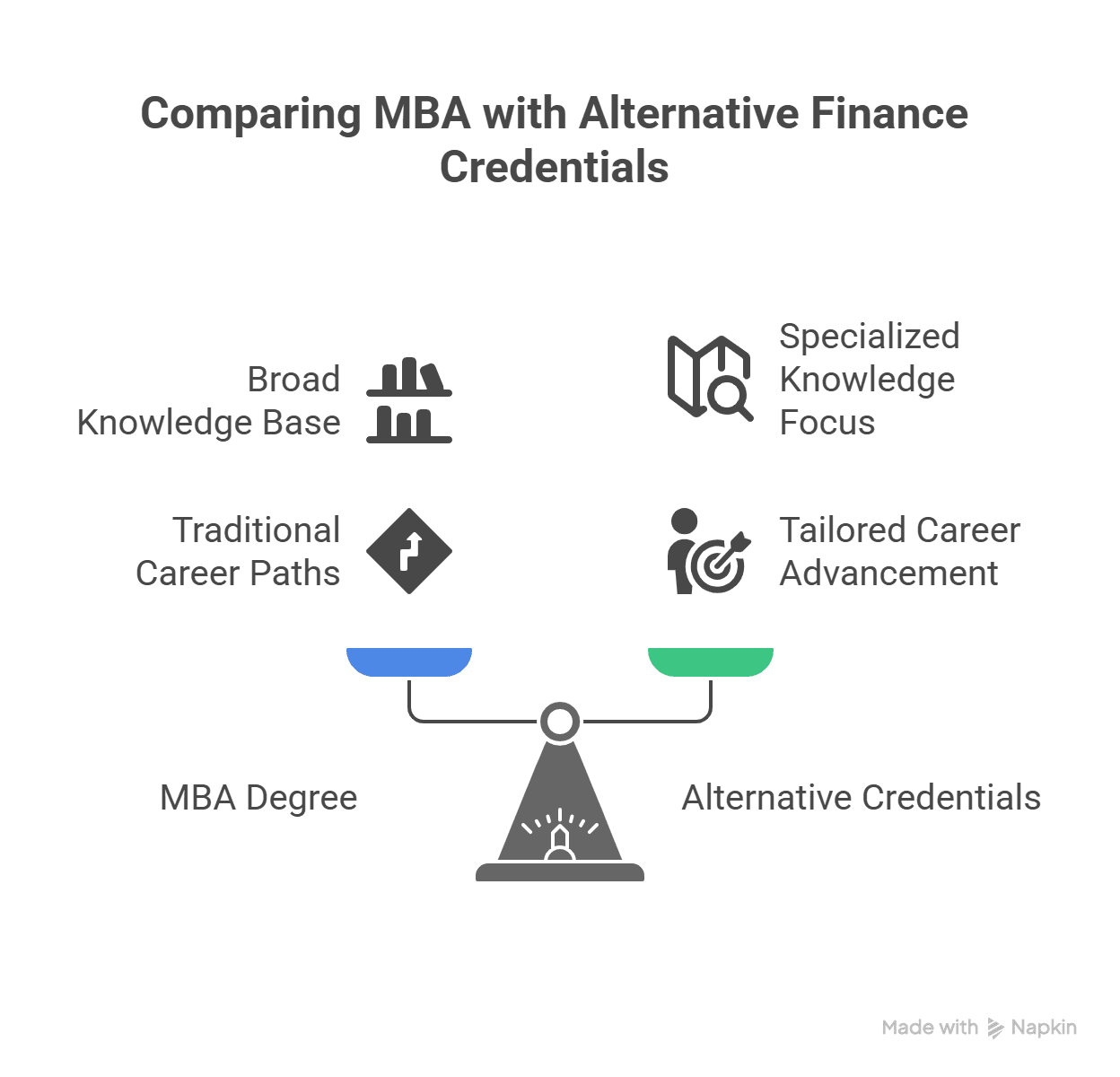

Role of Certifications in Accelerating Career Success

Such a popular certification lends credibility and suggests that the applicant wishes to be an expert in the subject. The hiring managers place more value on certified professionals, especially from organizations providing:

- Live exposure to equipment such as Bloomberg Terminal and Excel VBA

- M&A simulation and IPO model projects

- Compliance and ethics guidance

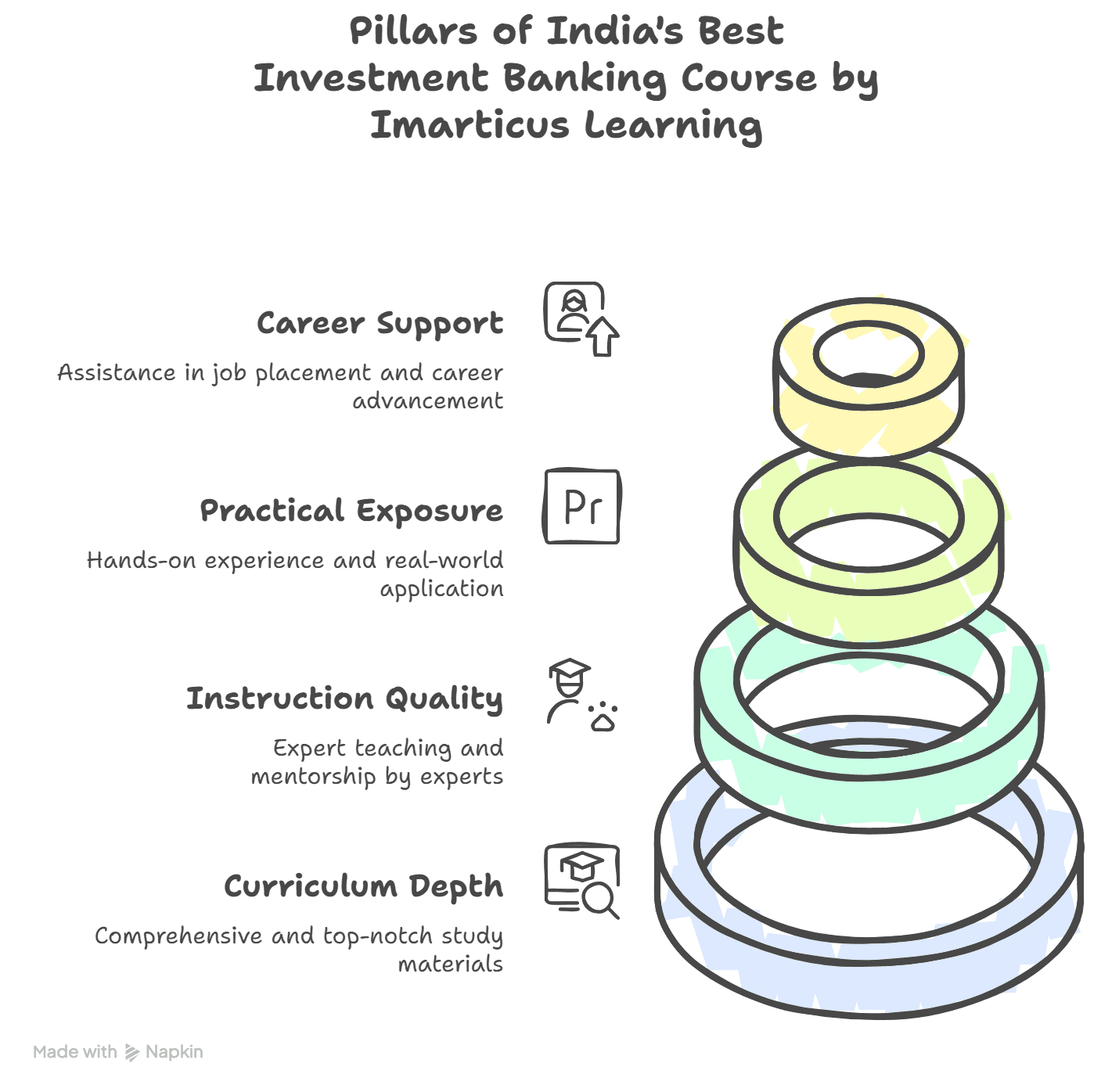

Such a high-impact program is Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP™).

What Sets CIBOP Apart?

- Job Assurance: 7 guaranteed interviews with top-tier employers

- High Placement Rate: 85% success rate with salaries up to ₹9 LPA

- Flexible Durations: 3-month and 6-month options available

- Prestigious Recognition: Winner of Best Education Provider in Finance at the 30th Elets World Education Summit 2024

With more than 1200+ batches completed and 50,000+ learners trained, CIBOP is a trusted name for those pursuing careers in investment banking.

What You’ll Learn?

The course offers a comprehensive study of investment banking activities with a glimpse into:

- Money Laundering Schemes

- Ethical Banking Practices

- Compliance Rules

- Trade-Based Money Laundering Methods

Career Opportunities Post CIBOP

The successful placements have been in roles such as:

- Investment Banking Associate

- Wealth Management Associate

- Trade Surveillance Analyst

- Collateral Management Analyst

- Regulatory Reporting Analyst

- KYC Analyst

- Client Onboarding Associate

Imarticus Learning’s project-first approach allows students not just to graduate proficient, but with quantifiable skills. Career growth rather than job placement is focused on.

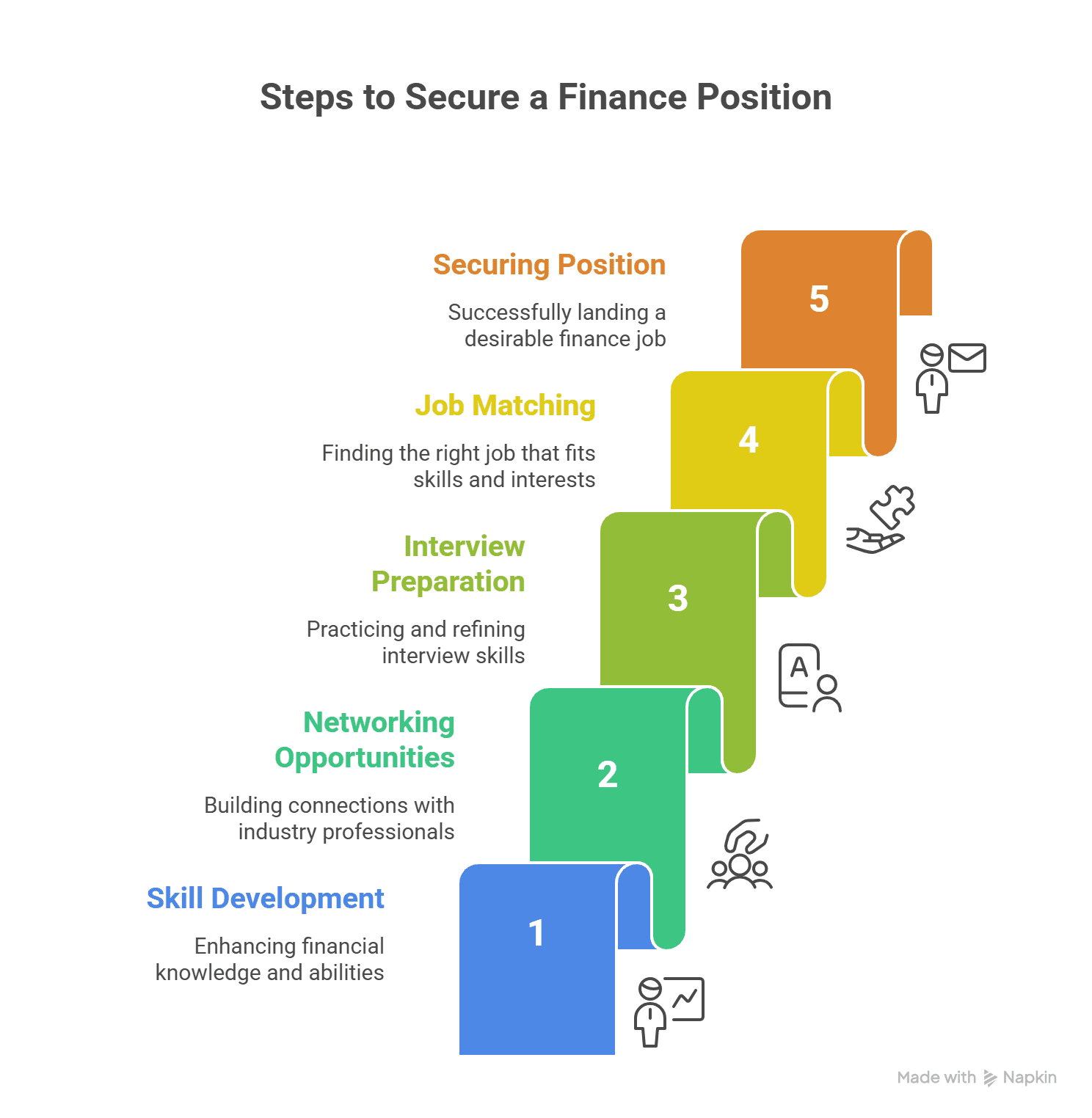

Added Value with Career Services

Your learning does not cease with certification. CIBOP takes you through:

- Aptitude Training to outperform recruiter tests

- Practice Interviews through mock interviews and professional guidance

- Creating Profiles to differentiate oneself in a competitive market

FAQs on Investment Banking Jobs for Freshers

1. What qualifications are required for investment banking jobs for freshers?

Most of the jobs require a background in finance, commerce, or economics. But having a well-established certification or training scheme can improve your chances significantly.

2. How can I start my investment banking career immediately after graduation?

You can begin by enrolling in a placement-oriented finance course like CIBOP and subsequently hone your skills prior to making applications with leading investment banks.

3. What are the starting roles available for freshers?

Fresher jobs are certain of the most renowned jobs like investment banking analyst, settlement associate, and risk management consultant.

4. How important are certifications in investment banking?

Certificates bridge the gap between practice and theory. Certificates improve career opportunities and confidence.

5. Which is the best investment banking certification for freshers?

Programs such as Imarticus Learning’s CIBOP offer intensive training, live projects, and placement assurance, which is best suited for freshers.

6. Can a non-finance graduate go for investment banking jobs?

Yes, provided you would need to go through a intense training or certification program to equip yourself with the skills investment banking requires.

7. What salary can I get as a fresher in investment banking?

Freshers receive a fresher’s salary of ₹3-6 LPA based on the institute, job, and your certification. Top-performers and institutions can negotiate and get good packages.

Conclusion

New investment banker career is a scary but real aspiration for brilliant graduates of this generation. With well-timed training, certification, and mindset, you can be a beginner-to-maestro finance leader. CIBOP courses by Imarticus Learning not only teach you the investment banking fundamentals required but also offer unparalleled career guidance, placement support, and live projects that facilitate your investment banking transition and make it a success.

Go ahead, invest in yourself and let your career as a financial professional in India flourish like never before.

Why Choose Imarticus Learning’s Course for Your Investment Banking Career?

If you’re a fresher looking to break into the world of investment banking, the Certified Investment Banking Operations Professional (CIBOP) programme by Imarticus Learning offers the perfect starting point. It is a 100% job-assured training course tailored for finance graduates with 0–3 years of experience.