Introduction

FRM Certification is the pinnacle of risk management qualifications, which enables finance experts to analyse and manage complex financial risks.

With increasing regulatory pressures and market volatility, international employers seek experts who know how to map credit, market and operational risk.

By obtaining an FRM Certification, you sharpen your analytical ability and signal to international employers that you possess the math and ethics capabilities necessary to manage assets and drive strategic decision-making.

What is FRM Certification?

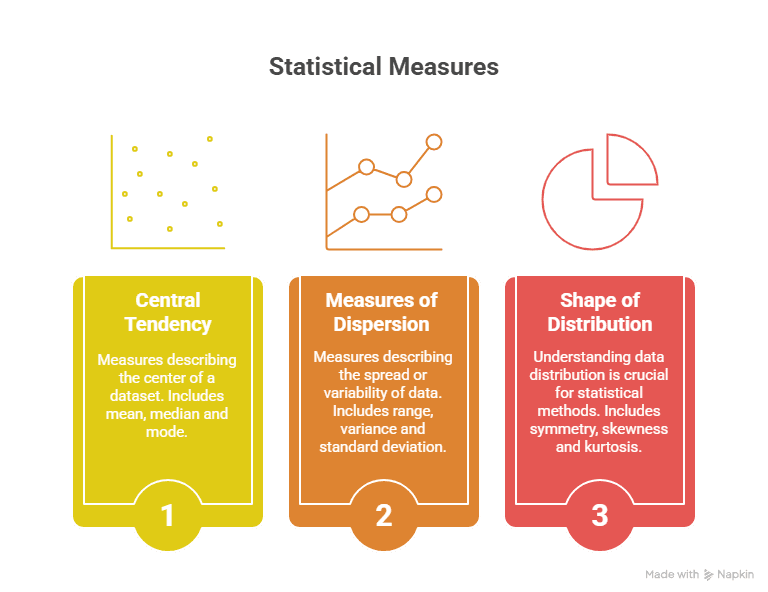

The FRM Certification, developed by the Global Association of Risk Professionals (GARP), tests candidates on:

- Foundations of risk management and quantitative analysis

- Valuation methods, derivatives and issues in today’s markets

- Credit risk measurement and credit risk management

- Operational risk frameworks and risk modelling

Part I consists of 100 multiple‑choice questions to be completed in four hours, and Part II consists of 80 multiple‑choice questions to be completed in another four-hour exam.

The candidates should pass both exams and acquire two years of relevant professional experience to be deemed eligible.

Until now, over 90,000 professionals have obtained the FRM charter, demonstrating its popularity and global reach.

Why a Financial Risk Manager Course in India

Enrolling in a Financial Risk Manager program in India ensures you will learn in a setting that combines local market forces with GARP’s global syllabus.

Leaders in the industry, like Imarticus Learning, offer:

- Live, interactive classes from industry experts

- Detailed mock exams with analytics-based feedback

- Active peer forums and mentorship support

These topics enable you to develop a deeper understanding of key concepts, such as Basel III capital requirements and stress testing, and to hone the skills applicable to real-world risk situations.

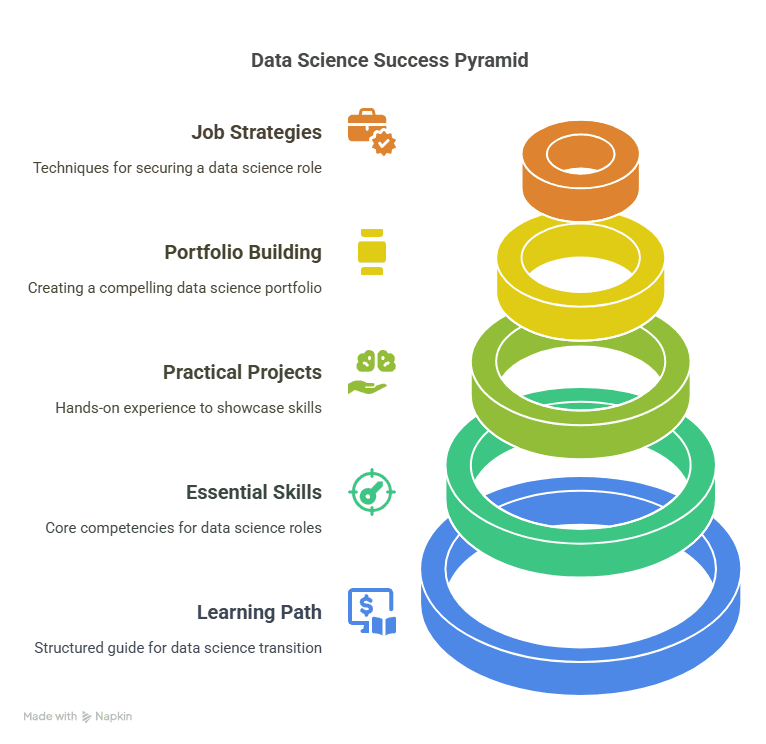

FRM Career Development Prospects

FRM career development prospects include some high-impact roles:

- Risk Analyst (Quantitative modelling, scenario analysis)

- Credit Risk Manager (Loan portfolio valuation, credit scoring)

- Operational Risk Specialist (Process audits, control framework design)

- Regulatory Compliance Officer (Policy implementation, reporting)

- Chief Risk Officer (CRO) (Board advisory, enterprise risk management)

- Climate Risk Analyst (Sustainability and environmental risks analysis)

- FinTech Risk Consultant (Cryptocurrency and cybersecurity risks analysis)

| Role | Average Salary (INR LPA) | Key Responsibilities |

| Risk Analyst | 6–10 | Quantitative models and stress-testing |

| Credit Risk Manager | 10–15 | Loan portfolio monitoring and credit scoring |

| Operational Risk Specialist | 8–12 | Control evaluations and loss analysis |

| Regulatory Compliance Officer | 12–18 | Compliance audits and regulatory reporting |

| Chief Risk Officer | 25+ | Strategic risk governance and leadership |

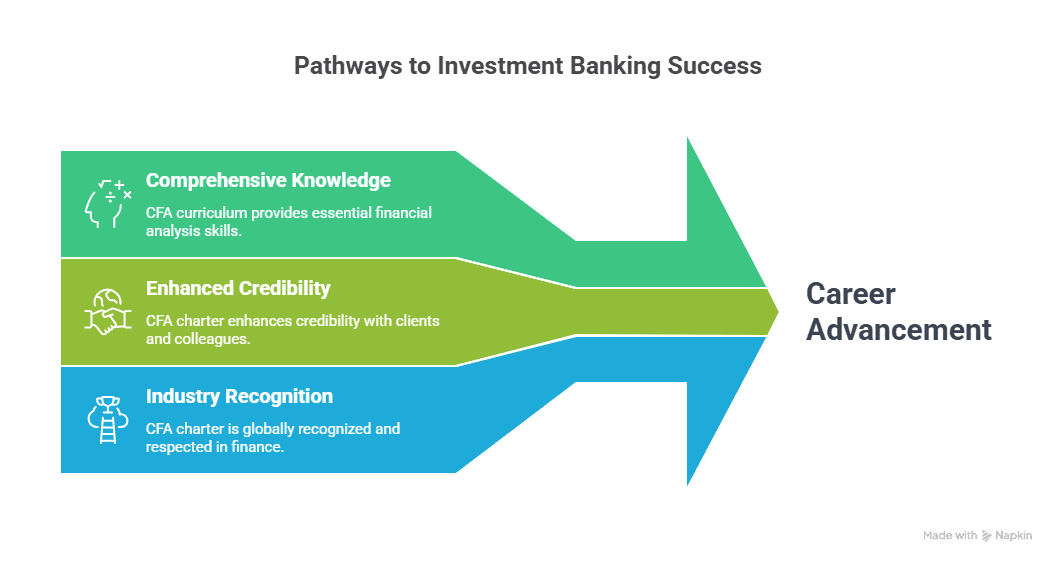

Advantages of FRM Certification

The benefits of FRM certification far outweigh a line on your resume:

- Global Acceptance: FRM-holders are accepted in 190+ countries.

- Compensation Boost: ₹9–12 LPA base pay for Indian FRM professionals

- Excellent Network: GARP alumni conference, webinars and thought-leadership access.

- Skill Enhancement: Proficiency in complex risk models, stress-testing techniques and regimes.

- Continuous Learning: GARP’s Risk Intelligence platform is updated monthly on new risks and best practices.

Global Risk Management Career

A Global risk management profession is concentrated in major financial centres like London, Singapore, and New York, where risk professionals with professional credentials hold key positions.

Financial managers’ occupations are forecasted to grow 17% between 2023 and 2033, contrasted with a 4% increase for all occupations over the same timeframe (Bureau of Labor Statistics).

Key trends driving demand are:

- More regulation, management, and capital levels

- Increasing demand for cryptocurrency and digital asset risk management

- Greater emphasis on reducing climate risk and sustainability

- Increased application of AI and data-driven risk analytics

FRM Course Eligibility and Scope

Understanding FRM course eligibility and scope makes your preparation easy:

Eligibility: Bachelor’s degree (any stream) or equivalent; final-year students can enrol.

Exam Schedule: Part I and Part II are both available every May, August, and November.

Curriculum Coverage: Areas covered in teaching are market risk, credit risk, operational risk, derivatives, quantitative analysis and new issues.

Fees: Standard Fee of USD 800 for Part I and Part II; USD 600 for Part I and Part II for early registration, and also one-time registration fee of USD 400 is to be paid.

FRM versus Other Risk Credentials

FRM is solely focused on risk management, while other credentials are broader or of a differing focus:

| Role | Average Salary (INR LPA) | Key Responsibilities |

| Risk Analyst | 6–10 | Quantitative models and stress-testing |

| Credit Risk Manager | 10–15 | Loan portfolio monitoring and credit scoring |

| Operational Risk Specialist | 8–12 | Control evaluations and loss analysis |

| Regulatory Compliance Officer | 12–18 | Compliance audits and regulatory reporting |

| Chief Risk Officer | 25+ | Strategic risk governance and leadership |

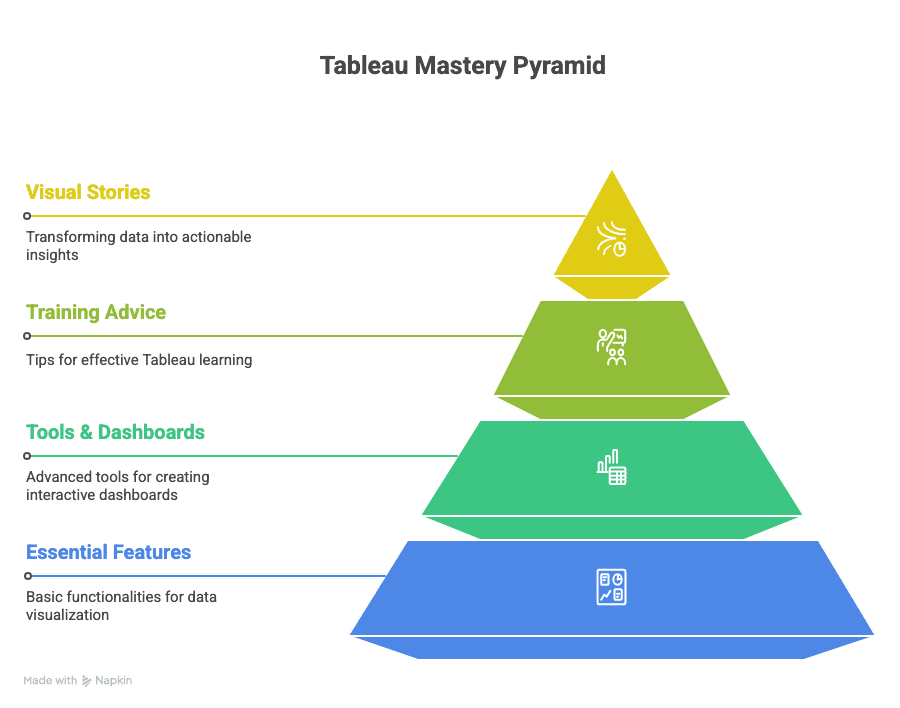

How to Effectively Prepare for FRM Certification

A thoughtful study calendar is the key:

- Plot the Syllabus: Allocate topics for each part and assign studying hours (200–250 hours per Part).

- Choose the Right Material: Utilise GARP’s authentic study materials, including Schweser Notes, AnalystPrep, and Imarticus Learning study packs.

- Peer Groups: Studying in groups enhances memory and introduces you to various problem-solving approaches.

- Mock Exams: Simulate practice tests to build exam stamina and improve time management.

- Weak Spots: Analyse study performance reports to reveal quantitative or conceptual knowledge deficiencies.

- Up-to-Date: Study GARP’s monthly Risk Intelligence bulletins for trends and exam question insights.

Industry Insight & Fresh Perspective

Updated GARP data indicate that 40% of job specifications for risk jobs now include FRM Certification as desired or needed, again solidifying its central role in hiring.

Banks and financial institutions are trying to keep up with emerging risks—like AI-tailed trading irregularities and climate-borne credit risk exposure—so demand for certified risk managers keeps increasing.

Watch the below video to know more

FRM Certification Explained

Frequently Asked Questions

What is the pass rate for the FRM?

Part I is around 55%; Part II is roughly 52%.

How much preparation time do I need?

Allow 200–250 study hours per exam.

Can I sign up before graduation?

Yes, final-year students are also eligible.

Is prior work experience necessary before exams?

No, two years’ work experience in the relevant field following the clearing of both parts.

What study material is recommended?

GARP study material, Kaplan Schweser, AnalystPrep and Imarticus study material.

Are there online and classroom classes?

Yes; Imarticus Learning and Kaplan offer both classroom and live-online classes.

How is FRM distinguished from CFA?

FRM deals with risk, whereas CFA focuses on broader portfolio management.

Conclusion

Apart from enhancing your quantitative and ethical abilities, FRM Certification provides the best career opportunities worldwide in the field of risk management, a skill deemed necessary in today’s modern age.

Key Takeaways:

- Highest Demand: 54% of companies plan to expand risk teams within the next 18 months.

- Competitive Compensation: From ₹9 LPA to ₹33 LPA maximum with experience.

- Global Mobility: Valid in over 190 countries, leading to opportunities in London, Singapore, New York, and other professional destinations.

Ready to begin your risk career now?

Enrol for the FRM Certification preparation program with Imarticus Learning.

Make use of expert guidance, in-depth mock tests and personalised placement support.