Financial risk management is no longer a niche specialisation in finance. It has evolved as one of the most critical functions across banks, fintech companies, consulting firms, and global financial institutions. As markets grow more volatile and regulatory frameworks become stricter, the demand for certified risk professionals continues to rise.

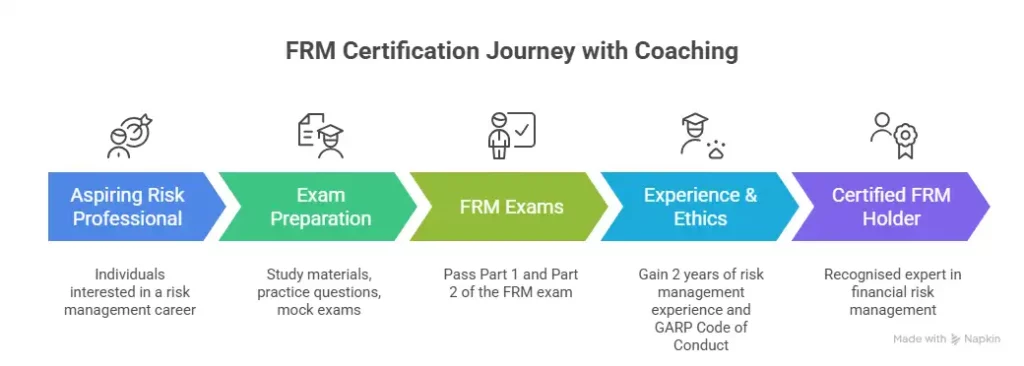

This is exactly why the FRM certification has gained massive traction over the past decade. But here’s the truth – clearing FRM is not easy. The syllabus is technical. The concepts are deep. And the exams test real understanding, not just memorisation.

Selecting the best FRM coaching in India is a crucial step for financial professionals seeking risk management excellence. The finest institute is not only there to address all aspects of the syllabus but also includes mentorship, practice tests and industry experience.

This comprehensive guide offers a step-by-step approach to selecting the ideal program, understanding FRM coaching formats and city options, online vs offline, fees, identifying leading providers providing tested FRM exam preparation tips, and outlining the steps to launch a fulfilling career in financial risk management.

FRM complements careers beyond banking

FRM isn’t limited to investment banking. It opens roles in fintech, consulting, asset management, corporate finance, and even tech-driven risk analytics.

Why FRM Certification Is Growing in Demand

If you’re new to risk management and wondering about: what is FRM? A FRM certification course in India prepares candidates with the expertise to measure, control and hedge financial risks. The FRM certification, awarded by GARP (Global Association of Risk Professionals), is globally recognised in risk management and financial analysis. It focuses on:

- Market Risk

- Credit Risk

- Operational Risk

- Quantitative Analysis

- Financial Markets & Products

- Risk Models

Financial institutions now prioritise professionals who understand how to assess and manage risk. Whether it’s an investment bank, an NBFC, or a fintech startup, risk management is central to decision-making.

This rising demand has also increased the need for quality FRM coaching in India, especially structured programs that combine exam prep with practical exposure. GARP identifies India as one of the fastest-growing markets for FRM candidates, with major cities like Mumbai, Delhi, and Bangalore emerging as key exam hubs.

Unlike general finance courses, FRM focuses purely on risk management – market risk, credit risk, liquidity risk, and operational risk. That’s why banks and consulting firms value it highly.

The video breaks down the full FRM course structure, exam levels, preparation strategy, and career scope in a simple, practical way.

Why Most Students Choose FRM Coaching

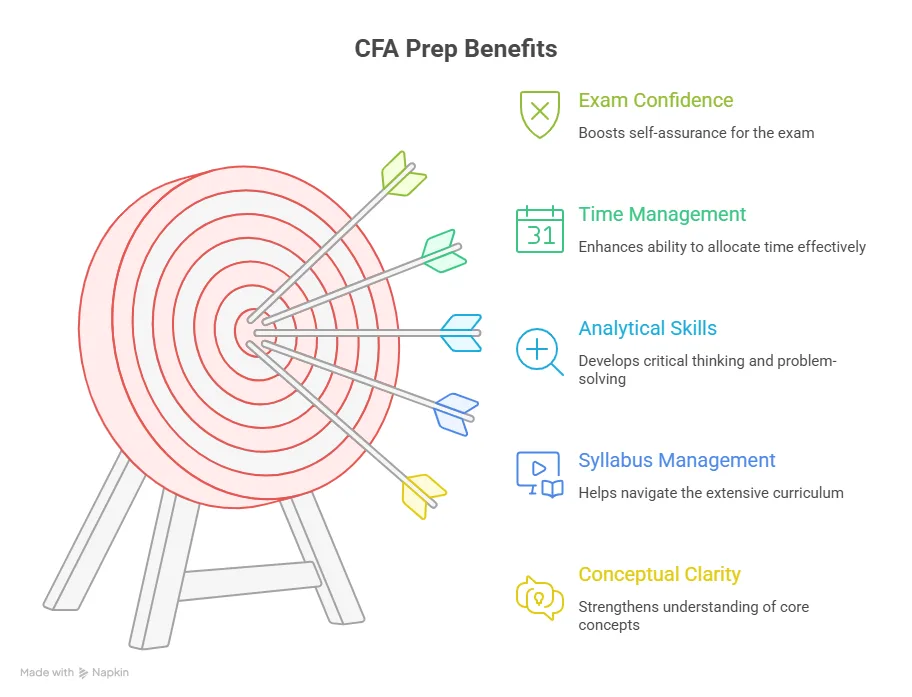

Technically, you can prepare for FRM through self-study. But most candidates eventually realise that structured guidance makes preparation far more efficient.

Here’s why FRM coaching classes make a difference:

- Structured study plan

- Faculty support for difficult topics

- Access to mock tests and practice questions

- Concept clarity in quantitative areas

- Peer learning environment

- Discipline and accountability

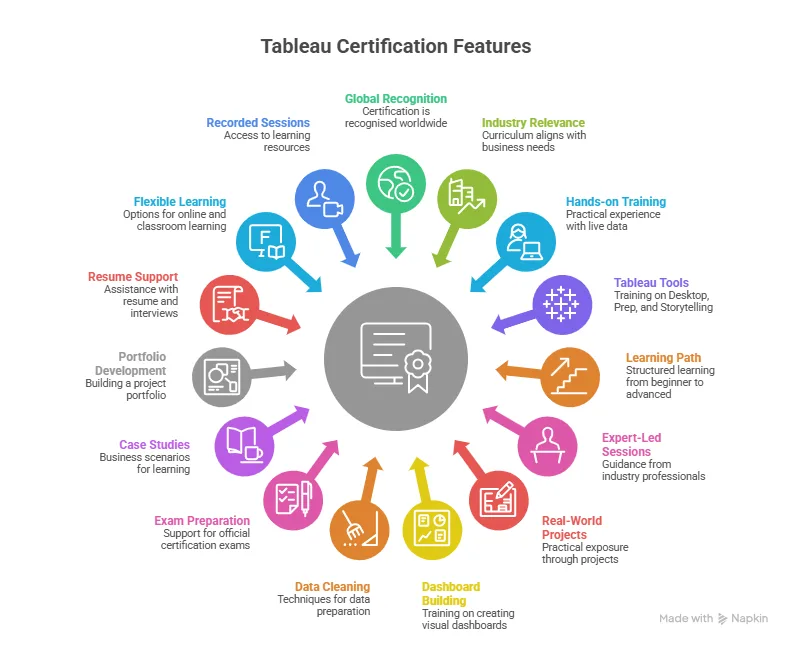

The FRM exam tests application-based understanding. Without guidance, many candidates struggle to connect theory with exam-level questions. That’s why choosing the best FRM coaching becomes an important career decision. Here are some main features of the FRM Certification:

| Feature | Details |

| Syllabus | GARP-aligned curriculum covering risk management, quantitative analysis, financial markets, and valuation models (Parts 1 & 2). |

| Exam Format | Two computer-based exams: Part 1 (100 questions) and Part 2 (80 questions), each 4 hours long. |

| Work Experience | 2 years of relevant work experience required for FRM certification (before or after exams). |

| Global Recognition | Recognised by banks, regulators, and corporates worldwide with 160,000+ FRM professionals globally. |

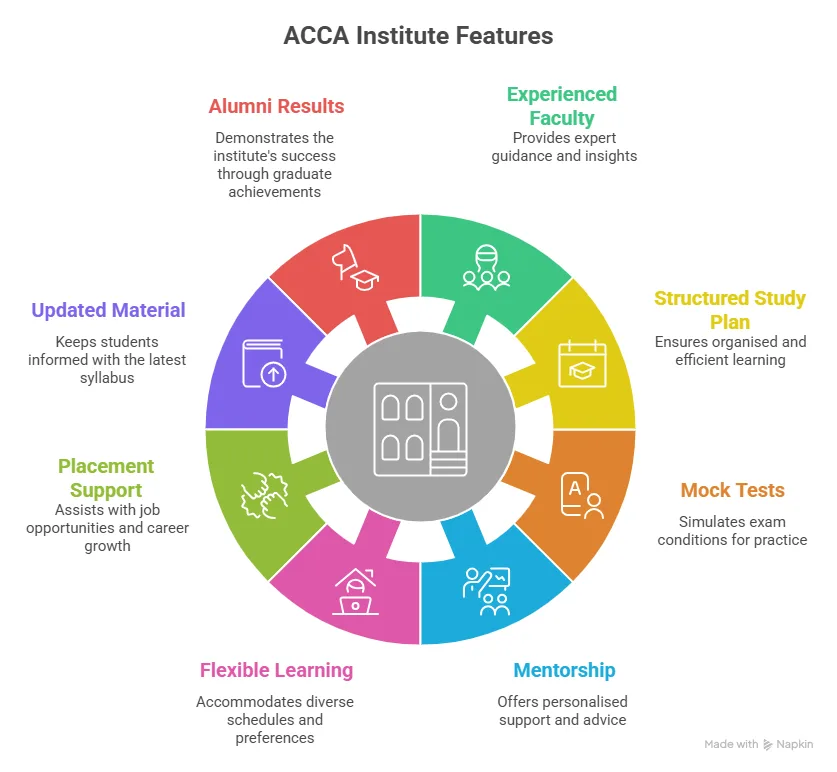

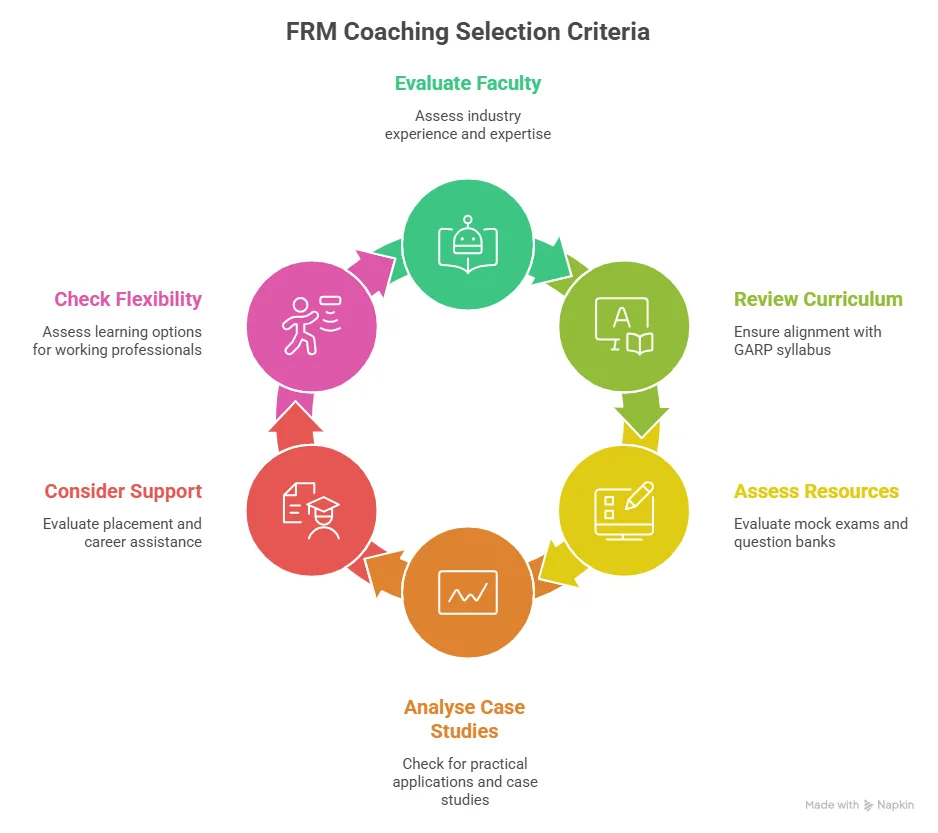

What to Look For in the Best FRM Coaching in India

Instead of asking “Which institute is the best?” ask this: What makes the best FRM coaching in India?

A strong program should offer:

- Experienced Faculty – Having faculty with real-world experience in banking, risk management, or financial markets can simplify complex topics effectively.

- Updated Curriculum – The FRM syllabus should align with the latest GARP guidelines.

- Practical Case Studies – Risk is best understood through real financial scenarios.

- Mock Exams & Question Banks – Practice is critical for FRM success.

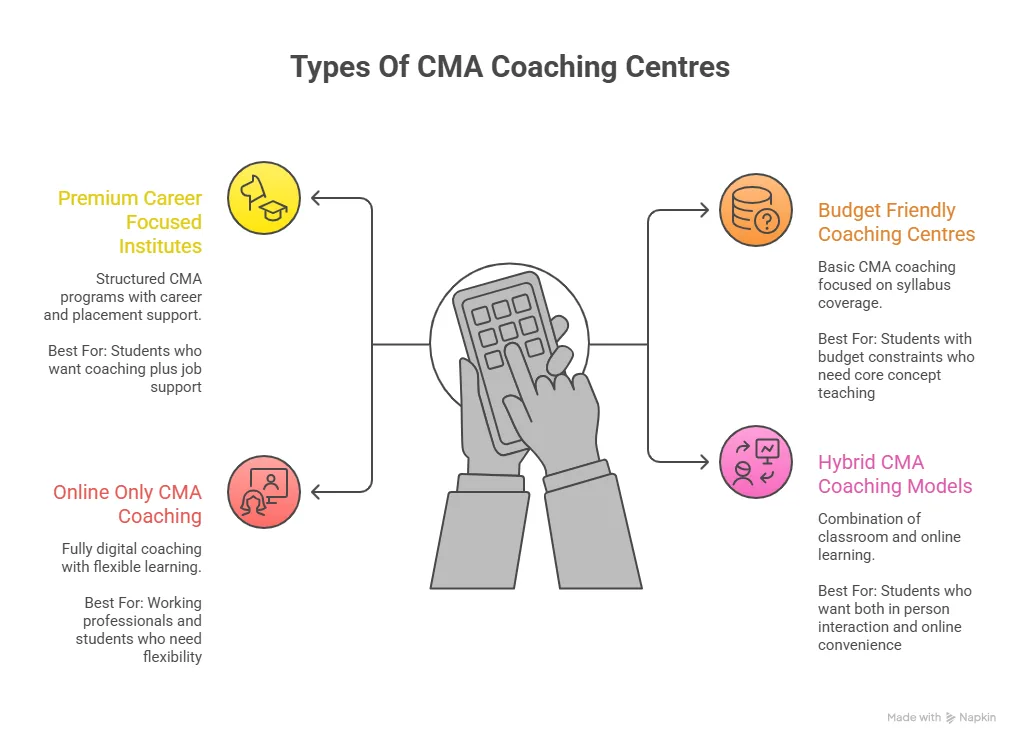

- Flexible Learning Options – Many candidates are working professionals, and at that stage, flexibility matters.

- Career Support – Guidance beyond exam prep with resume-building workshops, placement bootcamps, and internship and placement opportunities adds long-term value.

When evaluating FRM coaching in India, focus on learning depth, not just marketing claims.

Also Read: Understand the FRM course duration before you plan your studies.

Who Should Enrol in FRM Coaching?

You should consider FRM coaching if you are:

- A commerce or finance graduate

- An MBA finance student

- A banking or finance professional

- A risk or compliance professional

- Someone targeting global finance roles

Any professional from specialised finance, accounting, and management backgrounds is an ideal candidate for FRM.

| Qualification/Background | Can They Pursue FRM? | Why It Makes Sense |

| CA (Chartered Accountant) | ✅ | A strong foundation in finance, audit, and regulations helps in credit risk, market risk, and compliance roles. |

| CMA (Cost & Management Accountant) | ✅ | Knowledge of cost analysis, financial planning, and corporate finance aligns well with risk management. |

| CFA (Chartered Financial Analyst) | ✅ | CFA + FRM is a powerful combination for careers in investment banking, asset management, and risk consulting. |

| CPA (Certified Public Accountant) | ✅ | Useful for professionals moving into financial risk, regulatory risk, and global finance roles. |

| ACCA | ✅ | Global accounting and finance exposure complements risk management and compliance functions. |

| MBA (Finance/Banking) | ✅ | MBA graduates can specialise further in financial risk, treasury, consulting, and fintech through FRM. |

| Investment Banking Professionals | ✅ | FRM enhances expertise in market risk, derivatives, valuation risk, and regulatory frameworks. |

Did you know?

Even professionals in corporate finance or investment banking benefit from FRM’s risk-focused perspective.

City-Wise FRM Coaching in India

Many candidates search specifically for location-based options. Here’s an overview of major hubs offering FRM coaching in India.

| City | What does it offer |

| FRM Coaching in Bangalore | It’s a fintech and analytics hub. Many working professionals in finance and tech opt for weekend or hybrid classes. You get flexible formats due to demanding work schedules |

| FRM Coaching in Delhi | Being a major financial and corporate centre, Delhi NCR has a strong demand for risk and compliance professionals. Offline classroom coaching and hybrid models are common here. |

| FRM Coaching in Hyderabad | It’s an emerging financial services and tech hub. Structured weekend batches are popular here. |

| FRM Coaching in Mumbai | Mumbai is India’s financial capital. Naturally, FRM coaching in Mumbai sees high demand from banking and finance professionals. Structured coaching options are preferred here. |

| FRM Coaching in Pune | FRM coaching in Pune is popular among MBA and finance students. With its growing financial ecosystem, Pune offers both online and classroom learning options. |

FRM Coaching Fees

Let’s talk honestly about FRM coaching fees – because this is usually the first practical question that comes up. Preparing for FRM is a serious commitment. You’re investing your time, energy, and yes, your money. So it’s fair to ask: Is it worth it?

Here’s how it’s structured:

- Registration Fee: ₹10,000

- Remaining Course Fee: ₹80,000

- Payment Options: Full payment or zero-cost EMI options

Now here’s what you should really think about when comparing FRM coaching fees in India:

Are you paying only for classes or for proper guidance?

A lower fee may look attractive at first. But sometimes that price includes:

- Only one part (not both Part 1 and Part 2)

- Limited mock tests

- Outdated study material

- Minimal doubt-clearing support

- No access to recorded sessions

FRM isn’t an exam you can casually prepare for. So instead of asking, “What’s the cheapest option?”

Ask yourself, “Will this investment genuinely improve my chances of clearing FRM and building a strong risk career?”

Because at the end of the day, clearing the exam on time and moving forward in your career is what truly gives you returns – not just saving a few thousand rupees upfront.

Interesting Insight:

Many professionals combine FRM with CA, CFA, MBA, or other finance qualifications to strengthen their risk and finance expertise.

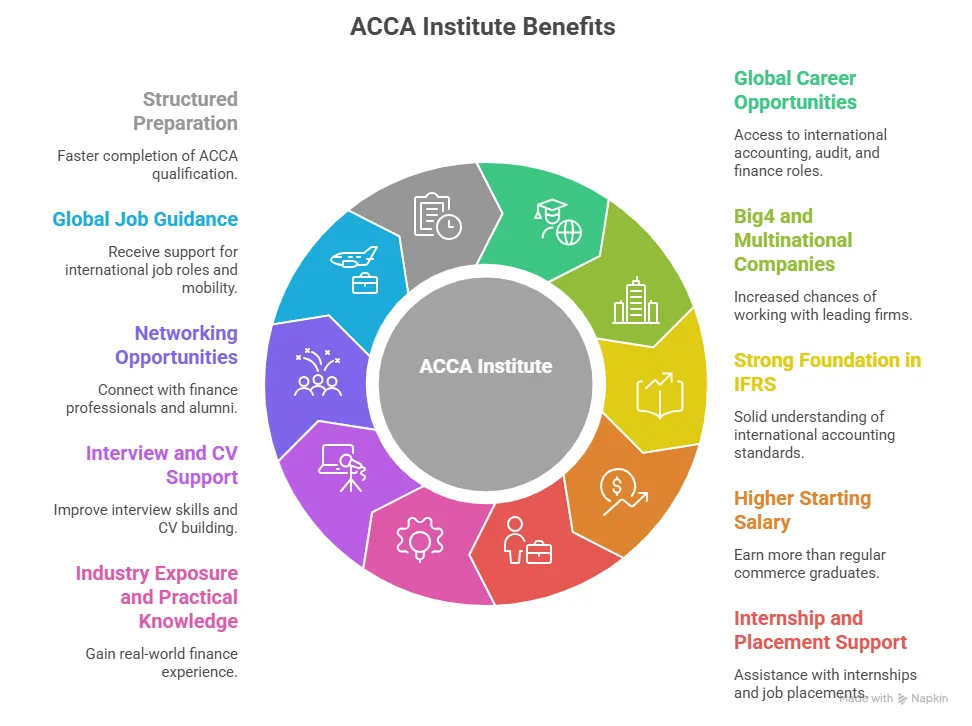

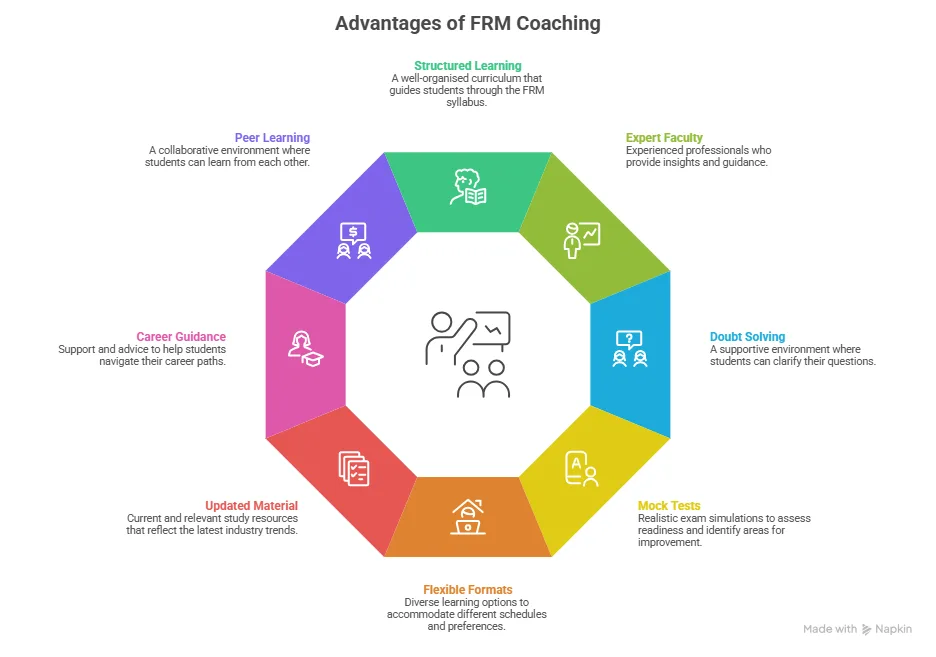

Advantages of FRM Coaching

The FRM certification is rigorous, which tests your understanding of financial risk management concepts, quantitative techniques, and real-world financial scenarios. Students can find the syllabus overwhelming, without a structured plan and expert guidance. This is where FRM coaching makes a clear difference. Let’s have a look at the advantages:

| Advantage | Why is it beneficial |

| Structured Learning | Complete coverage of all GARP topics with updated content on market risk and regulatory frameworks. |

| Expert Faculty | Learn from practising risk professionals with real-world case studies and practical insights. |

| Mock Tests & Performance Analysis | Regular mock exams with detailed report cards to identify strengths and weak areas. |

| Career Support | Resume building, mock interviews, and alumni networking to support finance and risk careers. |

| Higher Success Rate | Guided coaching candidates often score up to 20% higher in mock exams compared to self-study learners. |

Research suggests guided contenders outperform self-study rivals by 20% on mock-exam attempts.

Did you know?

The FRM exams are concept-heavy and quantitative. Students who follow structured coaching, mock tests, and doubt-solving sessions typically perform better than self-study candidates.

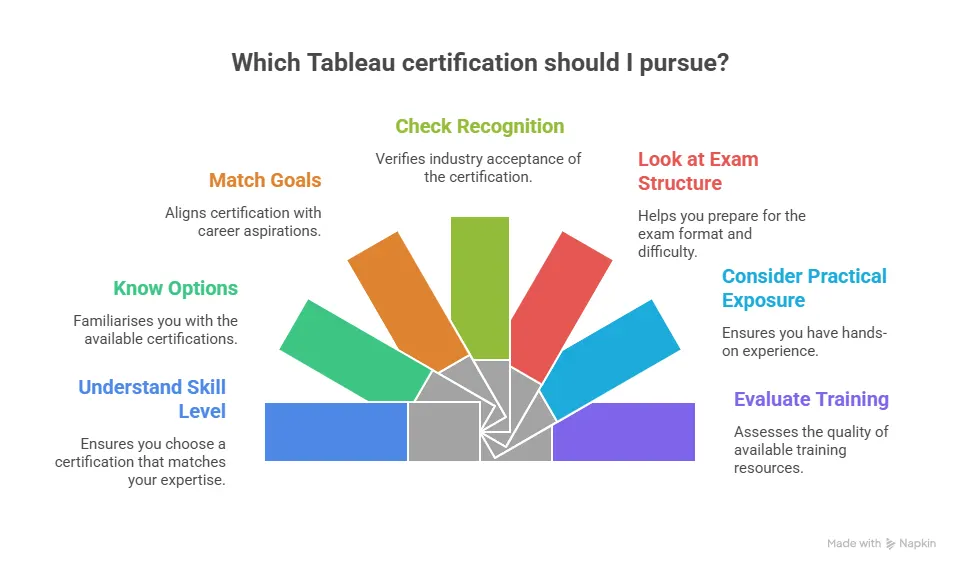

How to Choose the Best FRM Coaching in India

Many FRM coaching providers in India go beyond teaching – offering resume building, interview prep, and networking support with finance recruiters.

Before enrolling, ask yourself:

→Am I preparing while working full-time?

→Do I need structured discipline?

→Do I prefer classroom or online flexibility?

→Do I want career guidance beyond exams?

The best FRM coaching for one candidate may not be suitable for another. You should make your choice based on learning style, schedule, and career goals. Remember these points while comparing the best FRM coaching institute in India:

| Factor to Consider | What to Look For |

| Faculty Experience | Choose institutes with faculty having 10+ years of experience in risk management, banking, or financial markets. |

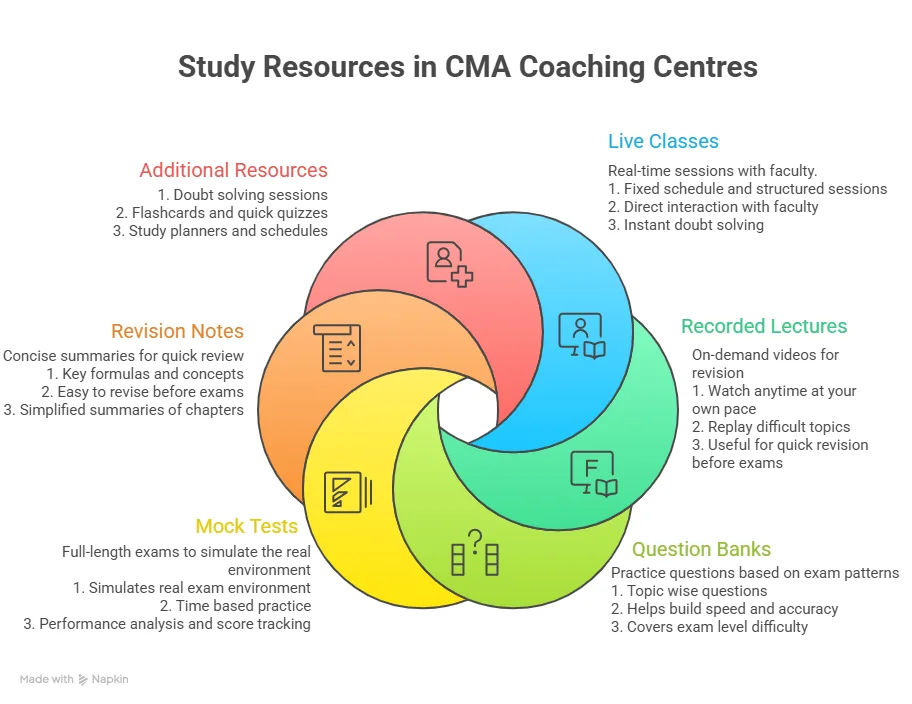

| Study Material Quality | Comprehensive notes, updated curriculum, practice quizzes, question banks, and concept-based video lectures. |

| Doubt-Clearing & Revision Support | Regular one-to-one mentoring or small group doubt-solving sessions, and availability of revision sessions for complex quantitative and risk topics. |

| Mode of Delivery | Flexible options, including live online, classroom, or hybrid learning, for students and working professionals. |

| Mock Tests & Analytics | Full-length mock exams with performance analytics, detailed solutions, and exam-oriented practice. |

| Curriculum Coverage | Complete GARP-aligned syllabus with focus on both Part 1 and Part 2, including updated risk frameworks. |

| Placement & Career Support | Resume building, interview preparation, internship assistance, and access to alumni or recruiter networks. |

| Student Reviews & Results | Check past student feedback, success rates, and the institute’s credibility before enrolling. |

Also Read: Everything you need to know about FRM Part 1 before starting your risk management journey.

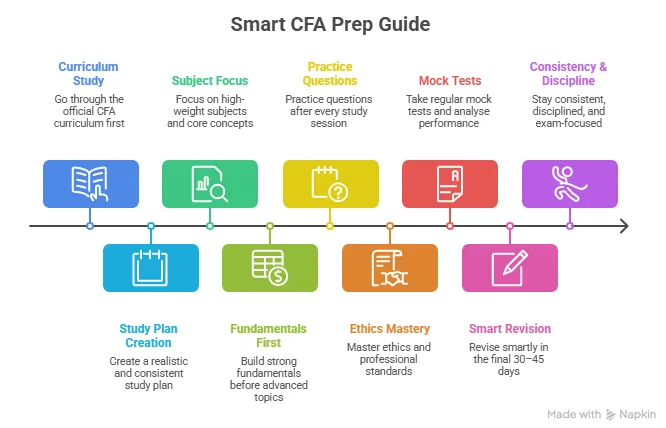

FRM Exam Prep Tips

FRM coaching in India is structured to support working professionals and students. Weekend batches, recorded sessions, and revision classes make it manageable with a full-time schedule. Take these FRM exam prep tips seriously to pass on your first attempt:

| FRM Study Strategy | What You Should Do |

| Develop a Solid Study Schedule | Dedicate 2-3 hours daily to theory, problem-solving practice, and revision to ensure consistent preparation. |

| Analyse Mock-Test Results | Review performance carefully and revisit topics where you score below 60% to strengthen weak areas. |

| Combine Quality Resources | Use official institute study material along with trusted prep providers like Bionic Turtle and Kaplan Schweser. |

| Join Study Groups | Participate in regular peer discussions to stay motivated and clarify complex risk concepts. |

| Practice Like the Real Exam | Take full-length timed mock exams monthly to build speed, accuracy, and exam-day endurance. |

A strong strategy includes:

- Consistent weekly study

- Concept clarity

- Regular practice questions

- Full-length mock exams

- Focus on weak areas

Exam Difficulty & Pass Rates

- The Part 1 pass rate of 44% indicates the difficulty of the quantitative content.

- 56% pass rate for Part 2, centred on case studies and practical principles.

- With 300+ study hours, students achieve a 30% improvement in passing rates, according to international surveys.

Distinct Practical Approach: ESG & AI Risk Modules

A distinct feature is the integration of ESG risk and AI-risk frameworks:

- ESG risk workshops – Gain insights on climate, social‑impact and governance‑failure case studies.

- AI risk labs – Practical training in algorithmic bias, model‑validation and real‑time monitoring.

- Regulatory updates – Get ahead of new standards such as Basel III and SFDR.

This ensures you are positioned at the forefront of both past and emerging risk areas, thereby future-proofing your knowledge.

Interesting Insight:

The Financial Risk Manager certification is globally recognised and respected across financial markets, banks, consulting firms, and multinational organisations.

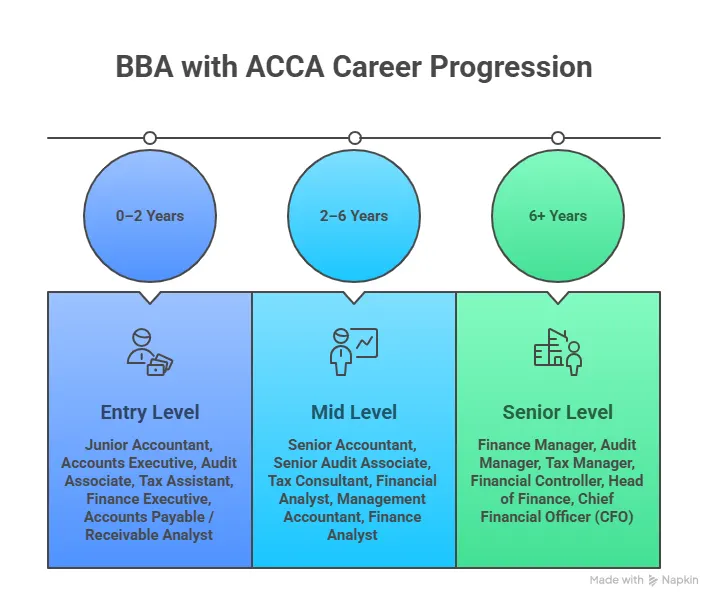

FRM Salary in India

According to the Global Association of Risk Professionals (GARP), with stricter regulations and global financial integration, companies need professionals who understand risk modelling, compliance, and financial stability, creating strong demand for FRM-certified talent. Here’s what the FRM Salary looks like:

| Experience Level | Average Salary Range |

| Entry-level (0-2 yrs) | ₹6-10 LPA |

| Mid-level (3-6 yrs) | ₹12-22 LPA |

| Senior (7+ yrs) | ₹25-50 LPA+ |

Professionals working in global banks or consulting firms often earn significantly higher packages as they gain experience.

If you’re looking to enrol in a FRM coaching or certification and wondering whether pursuing FRM makes sense for your career in the coming years, this video breaks down the scope, salary potential, and industry demand for risk professionals in 2026 and beyond.

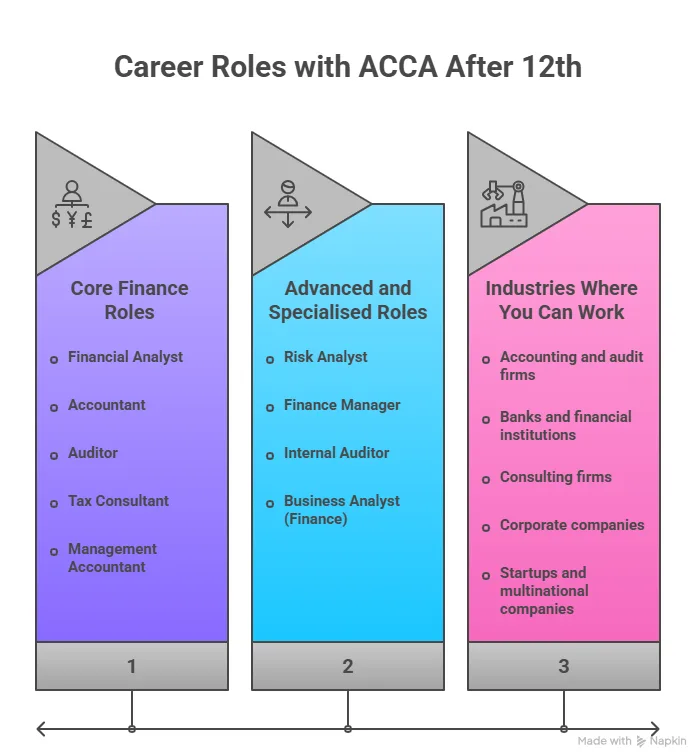

Career Opportunities After FRM Certification

FRM certification prepares you for specialised roles in financial risk and analytics. As global finance becomes more risk-focused, certified professionals are in demand across industries. Popular roles after FRM include:

- Risk Analyst

- Credit Risk Analyst

- Market Risk Analyst

- Operational Risk Manager

- Financial Risk Consultant

- Treasury Risk Analyst

Top hiring sectors:

- Investment banks

- Commercial banks

- NBFCs

- FinTech companies

- Consulting firms

- Global financial institutions

Why FRM Is Worth It in 2026 and Beyond

Risk management is no longer optional for financial institutions. Regulatory pressure, global uncertainty, and digital transformation have made risk expertise essential.

Professionals with FRM certification demonstrate:

- Strong quantitative foundation

- Deep understanding of financial markets

- Risk evaluation capability

- Strategic thinking

This makes FRM one of the most future-proof certifications in finance.

Developing Your Career in Financial Risk Management

A promising career in financial risk management is a combination of certification and practical experience:

- Networking – Attend GARP chapters, webinars and risk forums.

- Continuous learning – Study journals such as the Journal of Risk Model Validation (JRMI).

- Hands-on activities – Finish capstones in VaR modelling or credit-risk simulations.

- Diversify credentials – Use FRM with CFA or CAIA to diversify career opportunities.

- Mentorship – Take guidance from experienced FRM professionals on LinkedIn and at industry conferences.

Why Choose Imarticus for FRM Coaching?

When you’re preparing for a global certification like the FRM program, the coaching institute you choose can make a real difference. It’s not just about covering the syllabus – it’s about how well you understand risk concepts, apply them, and stay consistent through months of preparation.

Here’s what makes Imarticus a strong choice for FRM aspirants:

- Industry-experienced faculty – Learn from trainers who bring real risk management and finance industry experience, not just theoretical teaching. This helps you connect FRM concepts with real-world scenarios.

- Structured curriculum aligned with GARP – The program follows the official FRM syllabus closely, ensuring complete coverage of both Part 1 and Part 2 topics with a logical learning flow.

- Comprehensive study material – Students get detailed notes, concept explainers, practice questions, and revision tools designed specifically for FRM preparation.

- Live + recorded learning flexibility – Attend live interactive classes and revisit recorded sessions anytime. This is especially useful for working professionals balancing jobs and exam prep.

- Regular mock tests and practice exams – Topic-wise quizzes and full-length mock exams help you track progress and improve exam-day confidence.

- Doubt-clearing and mentoring support – Dedicated doubt-solving sessions ensure you don’t get stuck on complex topics like derivatives, risk models, or valuation.

- Exam-focused preparation strategy – Beyond theory, the program emphasises exam strategy, time management, and question-solving techniques.

- Updated content for current exam patterns – FRM exam patterns and risk trends evolve. Updated content ensures your preparation stays relevant.

- Career-oriented learning approach – The focus goes beyond passing the exam – helping you build practical knowledge for roles in risk, banking, and finance.

FAQs About FRM Coaching in India

If you’re considering the FRM certification, most aspirants want clarity before committing months of effort. Here are answers to some of the most frequently asked questions aspirants ask before starting their FRM journey.

Do I really need coaching for FRM?

Not everyone does, but most candidates benefit from structured coaching like Imarticus Learning. FRM covers complex topics like quantitative analysis, derivatives, and risk models. Coaching helps simplify these and keeps you consistent.

Can working professionals prepare for FRM with coaching?

Yes. Many FRM aspirants are working professionals in finance, banking, consulting, or analytics. Flexible class schedules and recorded sessions make it manageable alongside a job.

How long does it take to prepare for FRM Part 1 with coaching?

On average, students spend 4 to 6 months preparing for Part 1. This can vary depending on your background in finance, maths, or risk management.

Is FRM harder than CFA?

They are different. CFA covers broader investment topics across three levels, while FRM focuses deeply on risk management across two parts. Many find the FRM quantitative sections challenging but manageable with practice.

Who should take FRM coaching?

FRM coaching is essential for professionals who want to enter Risk management, Banking and financial services, Investment banking, treasury, analytics, and consulting. It also suits students aiming for careers in finance.

Can non-finance students pursue FRM?

Yes. While a finance background helps, even engineers, maths graduates, MBAs, or commerce students can pursue FRM with proper preparation.

How important are mock tests in FRM preparation?

It is very important to have mock tests in FRM Coaching. Mock tests help you understand exam patterns, improve speed and accuracy, identify weak areas, and build exam confidence.

What career opportunities open after FRM?

After FRM, common roles include Risk analyst, Market risk manager, Credit risk analyst, Operational risk manager, and Treasury or investment risk roles. FRM is valued globally across banks and financial institutions.

Build a Strong Risk Career with Expert FRM Coaching

FRM is globally recognised and can strengthen your profile for risk and finance roles in international markets, especially with relevant experience. With the right preparation strategy and guidance, FRM is absolutely achievable – whether you’re a student exploring finance careers or a working professional looking to move into risk management.

Preparing for the FRM certification is a serious commitment, but it’s also a powerful career investment. In a financial world where managing risk is more important than ever, professionals who understand market, credit, and operational risk are in high demand across banks, fintech firms, consulting companies, and global financial institutions.

If your goal is to build a strong career in risk management and stand out in a competitive finance industry, starting your FRM course with the right support system can make all the difference. Focus on learning deeply, stay consistent with your preparation, and you’ll be well on your way to becoming a confident global risk professional.