Last updated on September 18th, 2025 at 08:48 am

Thinking of building a global career in accounting or finance? If you’ve been exploring international certifications, you’ve probably come across the ACCA certificate. But here’s the question that pops up in every aspiring finance professional’s mind — Is the ACCA certificate valid worldwide? Let’s unpack the answer to this, along with everything else you need to know if you’re planning to pursue ACCA.

Table of Contents

- Introduction to the ACCA Certificate

- ACCA Certification Benefits: Why it’s Worth It

- How to Get an ACCA Certificate: Steps for Students

- ACCA Qualification Process: A Global Journey

- ACCA vs Other Accounting Certifications: The Big Comparison

- ACCA Course Requirements: What You Need to Know

- Career Opportunities with ACCA: Jobs Across Borders

- ACCA Exam and Certification: What to Expect

- Global Recognition of ACCA: Is it Truly Valid Everywhere?

- Key Takeaways

- FAQs

- Conclusion

Introduction to the ACCA Certificate

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

Among the globally recognised certifications in accounting, the ACCA (Association of Chartered Certified Accountants) is the one on a pedestal. Based in the UK, the ACCA runs in over 180 countries and thus becomes one of the most favourable options for students interested in pursuing international exposure. Students are increasingly turning towards this globally accepted credential to open up opportunities across borders and industries.

ACCA Certificate equips professionals with the financial acumen and ethical framework needed for high-level decision-making roles. With flexible exam schedules, global recognition, and competitive career advantages, the ACCA qualification continues to be a powerful tool in the finance world.

ACCA Certification Benefits: Why It’s Worth It

The benefits of the ACCA certificate go beyond the resume — it transforms how professionals approach finance, ethics, and strategy. Whether you plan to work in India or abroad, the advantages are substantial.

Here’s why ACCA is considered a smart choice:

- Recognised in 180+ countries including the UK, Canada, Singapore, and UAE.

- Offers job-ready skills in taxation, audit, and strategic business reporting.

- ACCA members often earn 25-40% higher salaries than their peers.

- Open doors to multinational roles across consulting firms, banks, and fintech companies.

External Resource: ACCA Global – Member Benefits

How to Get an ACCA Certificate: Steps for Students

Getting the ACCA certificate is a structured process that accommodates both students and working professionals. ACCA has simplified the process, making it highly accessible.

Here’s a quick guide for aspirants:

- Enrol with ACCA directly or via an accredited learning partner.

- Submit necessary educational documents.

- Start with the Knowledge Level papers.

- Proceed to Skill and Professional Level papers.

- Complete the Ethics and Professional Skills module.

- Gain a minimum of 3 years relevant work experience.

| Step | Description |

| Enrolment | Register with ACCA UK online or through an approved provider |

| Exams | 13 exams divided into 3 levels |

| Experience | 3 years practical experience required |

| Final Step | Ethics and Professional Skills Module |

ACCA Qualification Process: A Global Journey

The qualification process is designed to produce highly capable professionals who can take on leadership roles in finance anywhere in the world. Unlike many domestic certifications, ACCA takes a holistic view.

The qualification structure includes:

- Three tiers of examinations (Applied Knowledge, Applied Skills, and Strategic Professional)

- Ethics and Professional Skills training

- Practical Experience Requirement (PER) to apply learning in real-world situations

This global journey ensures ACCA-qualified professionals are ready for international assignments from day one.

ACCA vs Other Accounting Certifications: The Big Comparison

Wondering how ACCA compares to other global certifications like CPA, CA, or CMA? Each has its pros, but ACCA holds a unique edge when global mobility is your goal.

| Certification | Global Recognition | Duration | Flexibility | Work Experience Required |

| ACCA | 180+ countries | 2-3 years | High | 3 years |

| CA (India) | Mostly India | 4-5 years | Moderate | Articleship required |

| CPA (US) | USA & select | 1-2 years | Moderate | 1-2 years |

| CMA (US) | Global | 1-2 years | High | 2 years |

External Resource: Global Accounting Certifications Comparison

ACCA Course Requirements: What You Need to Know

Before you register for the ACCA certification– it’s important to understand the eligibility and course structure. ACCA welcomes candidates from diverse academic backgrounds.

General Requirements:

- Completion of 10+2 with a minimum of 65% in Accounts/Maths and English

- Graduate students can directly enter the Skills Level

- Professionals with work experience can also apply for exemptions

Documents Needed:

- Educational transcripts

- Passport-size photo

- Valid government ID

Career Opportunities with ACCA: Jobs Across Borders

One of the standout features of the ACCA Certificate is the vast career landscape it opens up. Whether you aim to work in audit, taxation, FP&A, or strategic advisory, ACCA equips you with the credibility to do so.

Popular Job Roles:

- Financial Analyst

- Audit Manager

- Tax Consultant

- Risk Manager

- CFO (with experience)

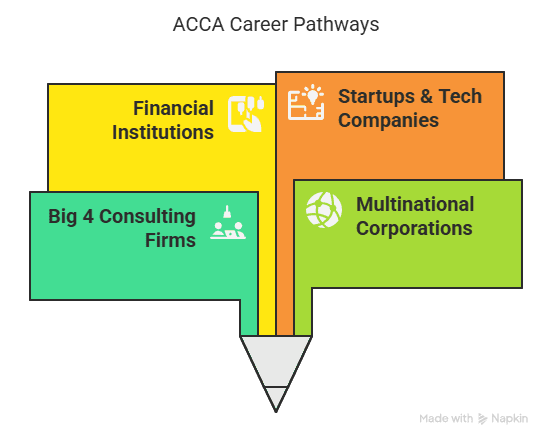

Industries Hiring ACCAs:

- Big 4 Consulting Firms

- Multinational Corporations (MNCs)

- Financial Institutions

- Startups & Tech Companies

ACCA Exam and Certification: What to Expect

The exam structure of ACCA is both rigorous and flexible, allowing candidates to appear for exams on their schedule. Exams are held quarterly, and students can attempt up to 4 papers per session.

Exam Breakdown:

- 13 papers across three levels

- Computer-based exams for initial papers

- Scenario-based and analytical assessments at Professional Level

Certification Timeline: Most students complete ACCA in 2.5 to 3 years, depending on exemptions and exam pace.

Global Recognition of ACCA: Is it Truly Valid Everywhere?

So, let’s get back to the core question — Is the ACCA Certificate valid worldwide? Absolutely. ACCA has MOUs with 100+ countries and is recognised by top employers globally.

Key Facts:

- ACCA is accepted by major finance institutions across the UK, EU, Middle East, and parts of Asia.

- It is legally recognised in Singapore, UAE, Canada, and Australia for regulatory and advisory roles.

- Indian companies with international operations prefer ACCA-qualified professionals for global finance roles.

This means that with an ACCA certificate, you are never restricted by geography.

Key Takeaways

- The ACCA Certificate is recognised in over 180 countries.

- Offers flexible, modular learning suitable for working professionals and students.

- Opens career doors in diverse sectors from finance to consulting.

- Globally respected and legally acknowledged in several countries.

- Helps professionals transition into international finance roles with ease.

FAQs

1. Is the ACCA certificate valid in India?

Yes ACCA is highly regarded by the multinational companies and startups having global operations.

2. How long is the ACCA program?

Typically, most students complete the program in 2.5 to 3 years, this will depend on prior qualifications and study/exam strategy.

3. Can I get exemptions on the ACCA qualification based on my prior qualifications?

Yes. Generally, if you are a commerce graduate/postgraduate you may receive exemptions on up to 9 papers, which will depend on the university and ACCA course you completed.

4. What jobs can I get with the ACCA certificate?

You can become a financial analyst, auditor, tax consultant, or even become the CFO of a company provided you have the required experience.

5. Is ACCA harder than CA?

It’s not necessarily harder; ACCA focuses more on practical, global applications while CA is focused on Indian laws and practices.

6. Is there any age limit to apply for ACCA?

No, there’s no official age limit. Anyone above 18 with the required academic background can apply.

7. Can I study ACCA online?

Yes, several accredited learning partners offer online and hybrid formats for students.

8. Is ACCA worth it without experience?

While experience strengthens your profile, even freshers with ACCA are hired for entry-level

roles in MNCs.

9. What is the cost of pursuing ACCA?

The total cost may range from INR 2.5–3.5 lakhs, depending on the number of exams and study materials used.

10. Do employers value ACCA?

Yes, especially in MNCs, consulting firms, and startups where global accounting standards are followed.

Conclusion

The ACCA Certificate is one’s passport to a worldwide career in finance. So, it is not only an asset; it is extra leverage for students and professionals to enter international markets confidently. If you are planning a career that crosses boundaries with a slightly glamorised aura for your financial skills, then the ACCA qualification is your ticket. Now that you know it is recognised worldwide, are you ready to step into it?